-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

1098-T vs 1098-E: Everything You Need to Know

.png)

Dmytro Serhiiev

Last Update: Dec 6, 2024

a0fe6562be3260403a8

These IRS tax forms collect important tax data from taxpayers and establishments with tax-exempt status. If you are still wondering what is the difference between 1098-T and E forms, you are not the only one. While both documents are dedicated to student loans and tuition fees, you might not need them until the time comes. Therefore, it is important to learn everything about the difference between 1098-E and 1098-T in advance.

Form 1098-E67a23a0fe6562be3260403a8 67a23a0fe6562be3260403a8

Key Takeaways

- Form 1098-T reports tuition and related fees for students, along with grants and scholarships.

- Form 1098-E reports student loan interest paid over the year.

- 1098-E is issued by lenders to borrowers who paid at least $600 in student loan interest.

- Both forms must be sent by January 31.

Difference Between 1098-T and 1098-E

Before you understand the difference between 1098-T vs E, you have to find out what these forms are. Though they are both informational and might seem similar, these documents can’t replace each other. They are different versions of the 1098 form, which is the Mortgage Interest Statement. Here is what you need to know about them:

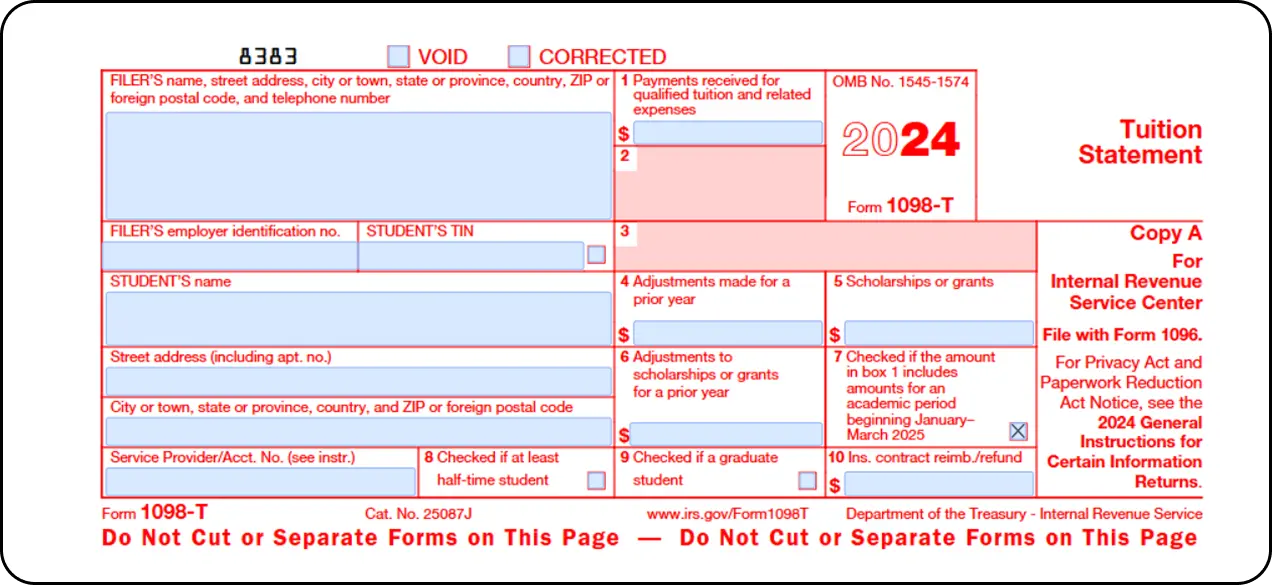

What is a 1098-T?

The 1098-T form is explained by the IRS officials as a Tuition Statement. It contains information about the possible tuition and other related fees throughout the academic year. Students also get data about the grants and scholarships that cut total expenses and credits received during the education process. Normally, it covers the period from January to December. The document is filed to the IRS by insurers and students who received the remuneration for the tuition and other successive expenses.

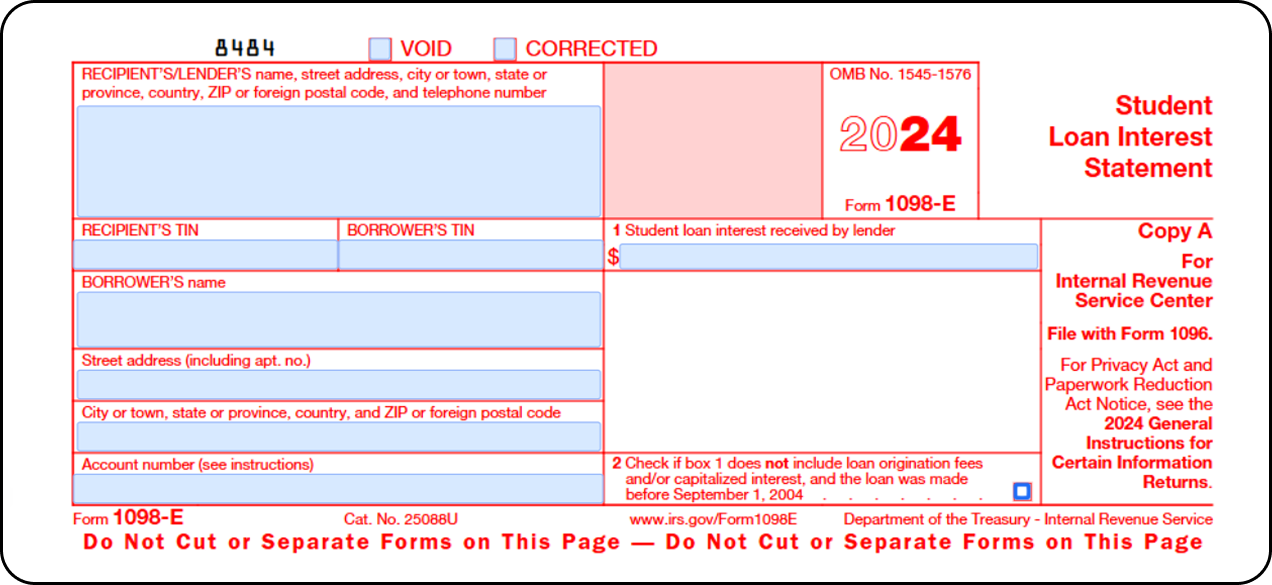

What is form 1098-E?

Form 1098-E is explained by the IRS as Student Loan Interest Statement, and it reports the amount of money that was paid by the taxpayer for the student loan. The document is based on the paid interest for the whole year, and it must be sent both to the IRS and the borrower. If you receive this form, you have to check whether you may take a presumption based on your case or not.

In some cases, the interest might be deductible during the tax returns period. The form indicates the interest that you have paid on the loan during the calendar year, so make sure that you send it to the IRS on time. You will not receive the form if the amount of money was less than $600.

Let’s compare 1098-T vs E

There are some basic differences between the two forms you can’t ignore. Apart from revealing specific information on education expenditures, these documents help you to calculate total expenses for the tax year. You can learn their major differences in advance:

- The 1098-E form specifies the student loan amount that was paid for the last year, while the 1098-T contains information on the tuition paid for the post-secondary school;

- Your insurance company or any other organization that is responsible for transmitting student loans sends the 1098-E copy by January 31. You will receive the form only if you paid $600 per year, rarely if the sum was smaller. Meanwhile, form 1098-T is provided to any student who paid tuition. The deadline is also January 31;

- Compared to the 1098-E, the 1098-T form offers wider opportunities for arrangement;

- If you file more than one form 1098-T, you need to have an account number. It is vital when you use different accounts for beneficiaries. It is also required in case you file the 1098-E form.

Fill Out 1099-T67a326242f714c67ff091f9663eb6b1fac3cad6fe40d82c3

Who Files the Forms?

Since we’ve answered the question “Is 1098-E the same as 1098-T?”, let’s find out who must file these documents. As a taxpayer, you don’t have to file any of them. Instead, you should wait till you receive the form and check the information before you use it in your tax return.

1098-T

The form is sent by an insurer who runs the business of making refunds. You can be a representative of a financial institution or government unit. You can also act on behalf of a public educational institution. Only eligible organizations qualified as a unit of the governmental program can send the form. You have to be an employee or designated officer to do this job.

1098-E

The form is filled out by a loan servicer or a representative of an educational institution that receives over $600 or a student loan interest from a person per year. If you don’t receive it by January 31, you have to contact the company in charge. 1098-E is sent as a letter via the postal service or electronically to your email.

Form 1098-E67a23a0fe6562be3260403a8 63eb6d597667f19fab071d13

How to File Forms 1098-T and 1098-E?

The difference between 1098-E vs T becomes less when it comes to filing the forms to the recipients. The procedure is similar, but you still need to learn who and when files these documents. The deadline is the same, which is January 31. As for the recipients:

- Form 1098-E is filed to the IRS service center, borrower, and recipient. Ensure that you mention the student loan interest, the TINs of the borrower and the recipient, and an account number if it is required. You’d better check the instruction for a specific year since they might differ;

- You have to file the 1098-T form to the IRS together with Form 1096. Send Copy B to the student. Keep Copy C in your archive. It contains the same information as other copies, and you have to check if the year on the form is appropriate. The IRS provided brief instructions on the form. You can find a detailed description and step-by-step instructions on the platform PDFLiner.

FAQ

Here are the most popular questions on both forms. Read our answers to learn more about these documents.

Where can I get my 1098-E form?

You may easily download the form from the IRS's official website. If you don’t want to spend much time and search for specific documents among numerous forms, use PDFLiner. It will quickly lead you to both 1098-E and 1098-T. If you are a taxpayer who has to receive the form, simply wait till it appears in your post box.

What if I don’t receive Form 1098-E?

If you don’t receive Form 1098-E by the deadline, which is January 31, make sure that your case suits this specific document. If you know that you have to get the form, it is better to contact the insurance company that must file it. You can also contact IRS representatives directly via their official website.

When do 1098-T forms become available?

Since the form must be sent by January 31, you need to wait for some time. Based on the chosen way of filing it, you can receive the document by email or by regular mail. Regular mail delivery takes more time, but not later than a week after the deadline.

How to amend a 1098-T form?

If you need to modify the form, you should initially address the filler. Using PDF editors like PDFLiner enables you to correct the problem and change the data. You have to submit the form to the IRS. Remember to attach the tax return form for the specific year as well.

Fill Out Tax Forms Easely Using PDFLiner

Try the electronic form filling solution and save loads of time!