-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Backup Withholding Tax Explained

.png)

Dmytro Serhiiev

Oliver Wendell Holmes Jr. once wisely remarked, “Taxes are what we pay for a civilized society.” With this perspective in mind, in this post, we’ll be covering backup withholding tax. What does backup tax withholding mean? We have answers to your questions. We will clarify the meaning behind this notion, unveil its specificity, and the situations that may lead individuals or entities to be subject to backup tax withholding.

What Is Backup Withholding Tax?

It is like the emergency brake in the world of taxes. Just when you think you're cruising smoothly on the tax highway, this little surprise pops up to slow you down. In simpler terms, it's a precautionary measure taken by the IRS to make sure that taxes are collected, especially from those who might “forget” to report income.

Now, what makes backup withholding tax so special? Well, it’s not your ordinary tax. Instead of taxing your entire income, it targets specific types of income: interest, dividends, and even some government payments. The idea is to withhold a flat percentage (usually 24%) from these payments as a sort of “down payment” on your tax bill.

So, who gets the pleasure of dealing with US backup withholding tax? Generally speaking, if you fail to provide your taxpayer identification number (TIN) or give an incorrect one, the taxman might slap you by withholding your income. Similarly, if the IRS sends you a notice saying there’s an issue with your return and you don’t correct it, you could find yourself in risky territory.

Long story short, tax backup withholding works as a safeguard for the IRS, guaranteeing that all taxes are collected even when there are discrepancies or omissions in taxpayer info.

Criteria for Backup Withholding

It’s not just the IRS playing hard to get. There are specific criteria that trigger this tax safety net. Here's what usually lands you in backup withholding territory:

- Missing or Incorrect TIN. Forget your TIN or scribble it down wrong, and you're on the IRS's radar.

- Discrepancies with IRS Records. If the TIN you provide doesn't match what the IRS has on file, consider yourself flagged.

- Failure to Address IRS Notices. Ignore that letter from the IRS about your return? Be ready that a portion of your certain types of income may be held back by the IRS.

With all that said, backup withholding makes sure that taxes get collected even when the paperwork gets a bit, let's say, creative. So, whether it's a slip of the pen or a case of selective reading, these criteria are the IRS's way of saying, “We're watching you, but we're also here to help... ourselves to a bit of your income.”

Fill Out 1099-NEC 65bb657f5447959694021119

The Impact of Backup Withholding

Backup withholding has real financial consequences for both the payer and the recipient. Let's examine what this means.

For Payers:

- Administrative Burden. Managing backup withholding adds to paperwork and can be a real headache.

- Reconciliation Hassles. Tracking and reconciling withheld amounts can complicate accounting processes.

For Receivers:

- Immediate Cash Flow Hit. A portion of their income is held back, affecting available funds.

- Tax Complications. It might lead to more complex tax filing scenarios.

Now, the burning question: how much are we talking about? According to the IRS guidelines, the typical backup withholding tax rate is 24%. So, if you're earning interest or receiving dividends, expect a chunk to be withheld before it lands in your pocket.

Basically, backup withholding is an unexpected tax event in your money story. It's not a major crisis, but it's definitely not a good turn of events.

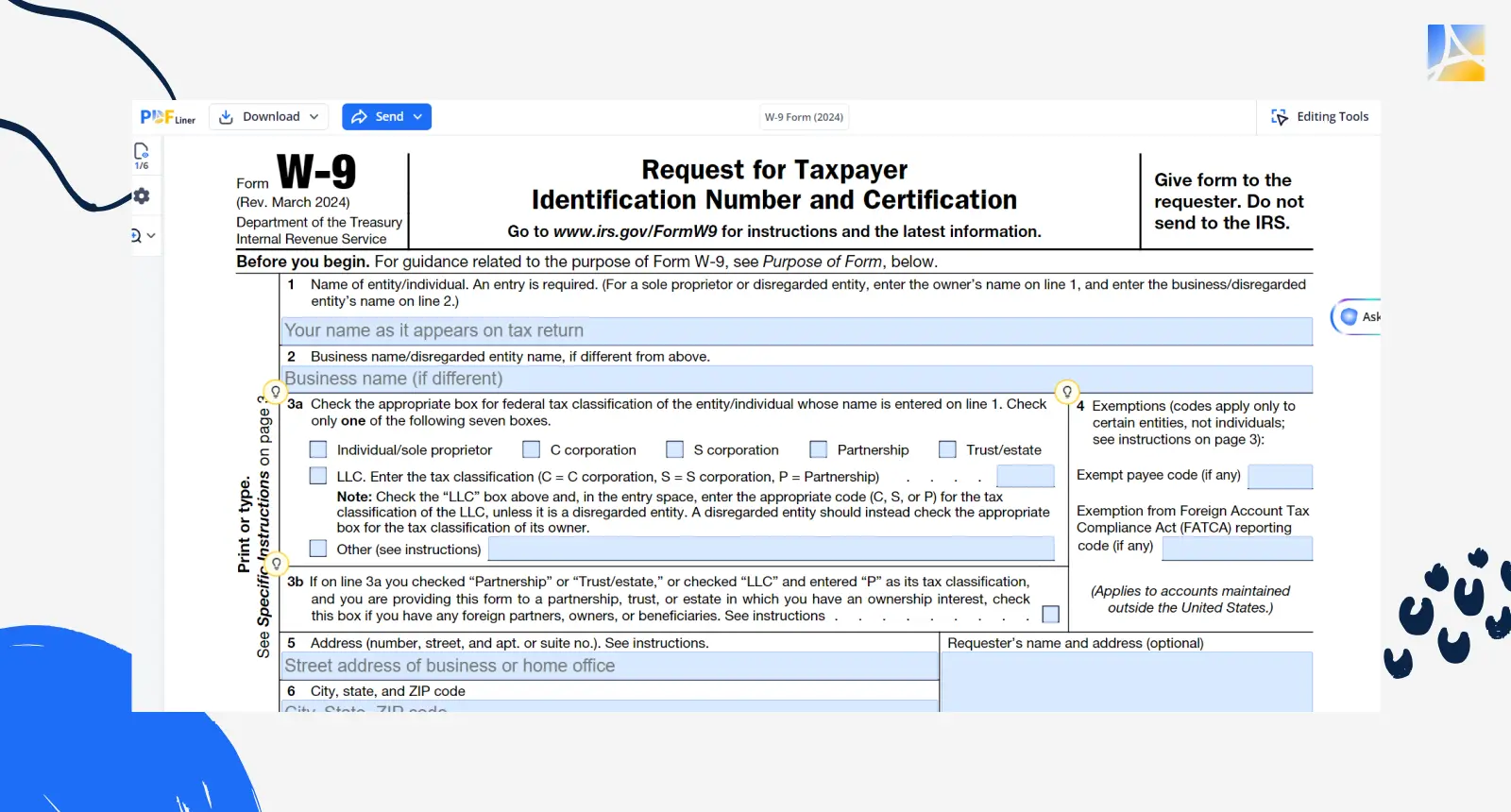

Filling Out Form W-9 & Its Role in Managing Backup Withholding

The 44th President of the United States, Barack Obama, once wisely said, “What people really want is fairness. They want people paying their fair share of taxes.” That's where Form W-9 comes into play. It's a crucial tool in guaranteeing that everyone plays by the general rules and helps manage backup withholding.

- Identification. It provides your Taxpayer Identification Number or Social Security Number, focusing on accurate taxpayer identification.

- Conformance. Filling out a W-9 correctly helps you adhere to IRS regulations, reducing the risk of money being withheld.

Below, we’ve shared a quick guide for properly filling out Form W-9:

- Name. Indicate your full legal name as shown in official papers.

- Business Name. If you have a business, specify its legal name.

- Address. Enter your current address where you get mail.

- TIN. Provide your TIN or SSN correctly.

- Certification. Sign and date the form to confirm that all the info is right.

Remember, accuracy is your best friend when filling out Form W-9. Any discrepancies or omissions may put you in a backup withholding position faster than you can say “refund.” So, think of Form W-9 as your way to make tax payments fair and square. When asked to fill one out, see it as your part in making the system work better for everyone.

Fill Out 1099-MISC 65f013686d1834a70e07c82d

How PDFLiner Helps Prevent Backup Withholding

IRS forms may resemble a bunch of Christmas lights — they’re so frustrating to untangle! But this time, don’t worry. PDFLiner is guaranteed to simplify the process for you, which, in turn, will prevent backup withholding of the tax W-9 Form.

Here's how PDFLiner makes a difference:

- User-Friendly. With PDFLiner, filling out your W-9 is as simple as pie, so no more headaches!

- Helping Hand. Stuck on a tricky part? PDFLiner gives you helpful hints and tips to easily cope with the task.

- Fort Knox Security. Rest easy knowing PDFLiner's super-secure platform keeps your sensitive info under lock and key and guarantees your W-9 forms are safe and sound.

- Crystal Clear Forms. No more messy handwriting. From now on, you’ll only deal with polished, pro-quality W-9 forms (thanks to PDFLiner).

Summing it all up, backup withholding taxes are definitely worth getting to grips with. This will help you avoid surprising financial problems. With PDFLiner, filling out important forms like the W-9 becomes stress-free. So, when that very season comes around, get ready with the right knowledge and tools to keep things simple and smooth.

Avoid Backup Withholding with PDFLiner

Fill out your tax forms and send them online at no time

Fillable W-9 65f013686d1834a70e07c82d

.png)