-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Difference Between Forms 1040 and 1040 NR: Comprehensive Guide

.png)

Dmytro Serhiiev

Forms 1040 and 1040 NR are the two most commonly used documents in the US. They represent tax returns for different categories of people. In this article, we will compare 1040 vs 1040NR and tell you in detail how to understand which one is right for you and how to use them.

Fillable Forms 1040 656f2839815ba38085013bdd

1040 vs 1040-NR

Let’s first understand the features of each form and who they are issued for.

What is a 1040-NR?

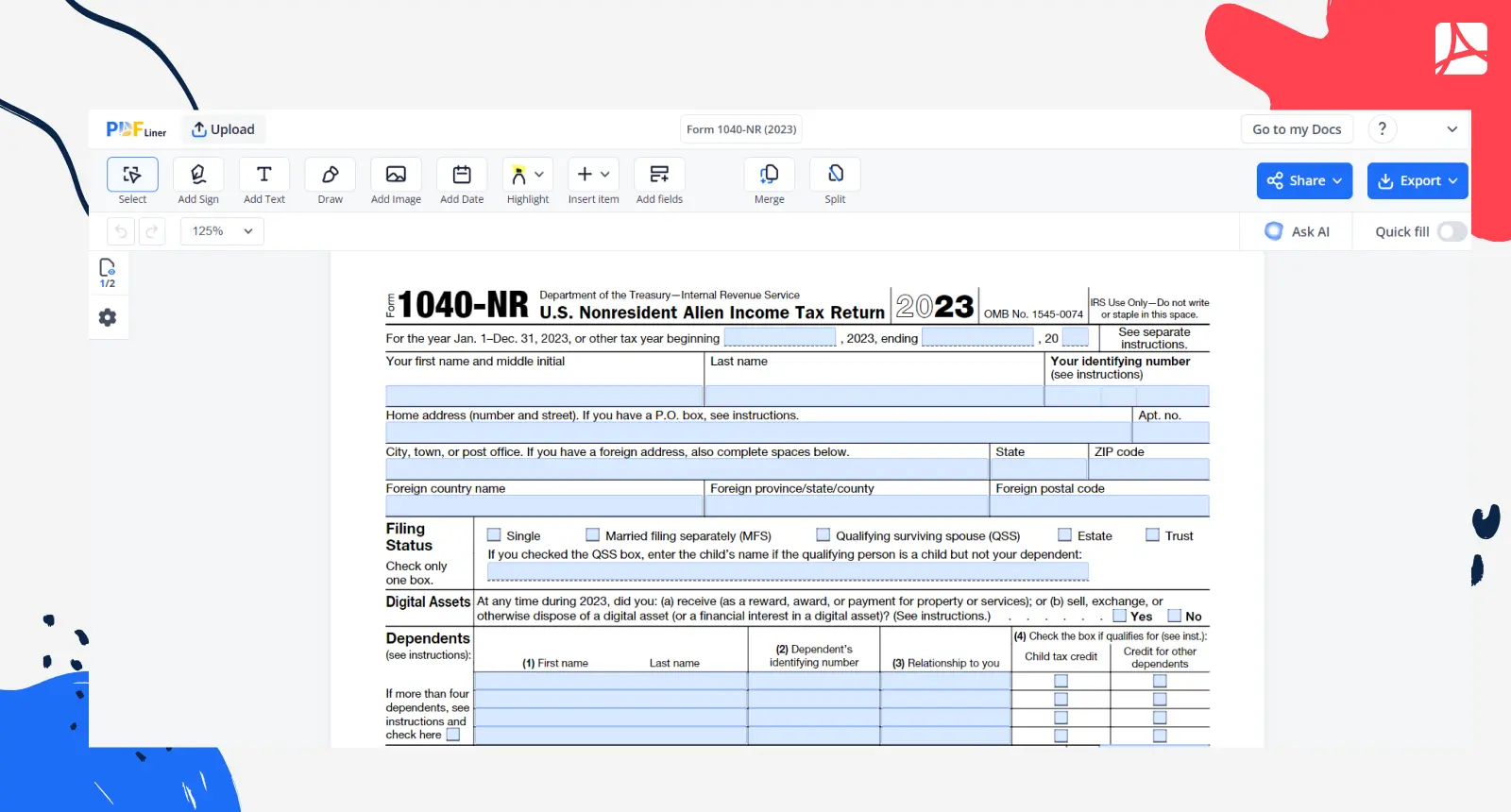

Form 1040-NR is a two-page document with the alternative name “US Non-Resident Tax Return” (hence the acronym NR). As the name implies, it is used by a category of people considered by the tax service non-residents. These include those non-citizens who have an active or passive income in the United States, have not passed the substantial presence test (SPT) or green card test (GDT), and do not have permanent resident status.

This form is used to document Fixed, Determinable, Annual, and Periodic (FDAP) payments and Effectively Connected Income. Like American citizens, such taxpayers may qualify for deductions and exceptions. If foreigners do not have income from businesses or property in the United States, they should not complete this document (in most cases).

What is Form 1040?

Form 1040 is also a two-page document with an alternative name, “Individual Tax Return.” With it, taxpayers report to the tax office on their income for the past year and calculate deductions, credits, and total tax. It is intended to be completed primarily by US citizens. However, it should also be used by permanent residents and foreigners who meet SPT requirements. From the point of view of taxation, these categories are equated to the country’s citizens.

Let’s compare 1040 NR vs 1040

As you can imagine, the main difference in these forms is the status of a placeholder for tax purposes. If you are a resident in this regard, you need to provide Form 1040. If you are a non-resident, then file 1040NR. The tax service in its manuals clearly defines both statuses, so there should be no difficulties with the identification.

In terms of content, there is a difference between 1040 and 1040 NR, but it is not so significant that placeholders cannot understand the details. Both documents have the same sections and ask for similar personal information. If you know how to complete the first one, you won’t have any problems with the second one.

Please note that US law also uses the term “dual-status alien.” It applies to those people who, in one year, can be both residents and non-residents in terms of taxation. If you are in the expatriation process, you will need to complete both Form 1040 and Form 1040 NR. It usually happens in the first or last year of your stay as a country resident.

Who Files Form 1040-NR?

The abbreviation “NR” indicates that this tax return is designed for non-residents of the country. To determine your status, the IRS has a fairly simple recommendation. If you are not a citizen of the US and have not passed the SPT or GDT, but are eligible to claim tax benefits as a citizen, then you have the status of a non-resident. In this case, you need to fill out this variation of the form and pay the tax 1040NR.

If you are a non-citizen and have no income in the United States, you do not need to fill in this document.

Fill Out Form 1040 656f2839815ba38085013bdd

Determining an Individual’s Tax Residency Status

The simplest tax status is a citizen: everything is pretty clear with it. All people who have US citizenship are treated as citizens for the purposes of the tax system. Residents are those people who, during a calendar year, not a tax year, met GDT and/or SPT.

Non-residents are those who are not citizens of the country and have not passed the specified tests but have income from work or business in the US. However, there are situations in which you can choose your status (the so-called First-Year Choice). To do it, you need to meet certain IRS requirements.

How to File Forms 1040 and 1040NR?

Whether you choose Form 1040 or 1040 NR, the IRS provides you with two main options for filing completed paperwork. First of all, it motivates taxpayers to submit forms electronically, as information is processed faster this way. You can do it on the official IRS website or use specialized tax software.

All accompanying Schedules can also be submitted electronically. Completing tax forms online, such as with the PDFLiner, also has advantages as it minimizes the chance of errors and speeds up the process.

However, you can still send completed documents by mail. If you choose this method, the details are different for the forms described. So, to submit Form 1040 to the IRS, you need to get an address that matches your state.

Find the complete list of addresses on the IRS website; please note that the locations differ depending on whether you enclose the payment or not. To submit Form 1040 NR, send documents to the:

Department of the Treasury,

IRS,

Austin, TX 73301-0215 (without payment)

or

IRS, PO Box 1303,

Charlotte, NC 28201-1303 (with payment).

Fill Out Form 1040 NR 65a2731e9817d58d7701c9d5

FAQ

Here you will find even more information about the difference between 1040 and 1040-NR forms.

What happens if I file 1040 instead of 1040NR?

Any such mistake can be corrected if you notice it in time. Use Form 1040X to amend a document already submitted to the IRS and attach the correct tax return. If you don’t do it, you will face penalties because, from the IRS’s point of view, you are trying to claim deductions and credits you are not entitled to.

What is the difference between residents and non-residents?

Different status implies different rights and obligations, in particular when paying taxes. For tax purposes, residents are considered to be people living in the country who meet the GDT and/or SPT requirements. Non-residents are foreigners who have not passed these tests but have income in the United States.

When are these forms due?

The deadline for submitting both forms is the same. It is the middle of the fourth month of the calendar year. In 2024, it’s April 15.

Can I e-file a tax return?

Yes, regardless of your status for tax purposes and filing status, you can submit both documents to the tax office electronically. The same applies to Schedules that may be required in your situation.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!