-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Everything You Need to Know When Buying a House

Liza Zdrazhevska

Buying a house is a significant milestone in your life, but it can also be an overwhelming process if you're not properly prepared. In this article, we'll guide you through the essential requirements for buying a house in the United States, focusing on the necessary documents and guidelines that come with them.

Understanding the required paperwork is crucial to ensure a smooth transaction, and we'll discuss the documents needed for buying a house in the US. Stay tuned for expert advice and tips to make your home-buying journey a successful one.

List of Documents Needed to Buy a House With Guidelines

When embarking on the journey of purchasing a house, it's crucial to be equipped with the necessary documents to ensure a smooth and successful transaction. In this comprehensive guide, we present the essential paperwork to buy a house. Whether you're a first-time homebuyer or a seasoned investor, understanding and preparing these documents in advance will save you time and bolster the buying process.

So, what documents do you need to buy a house? Read on to find out.

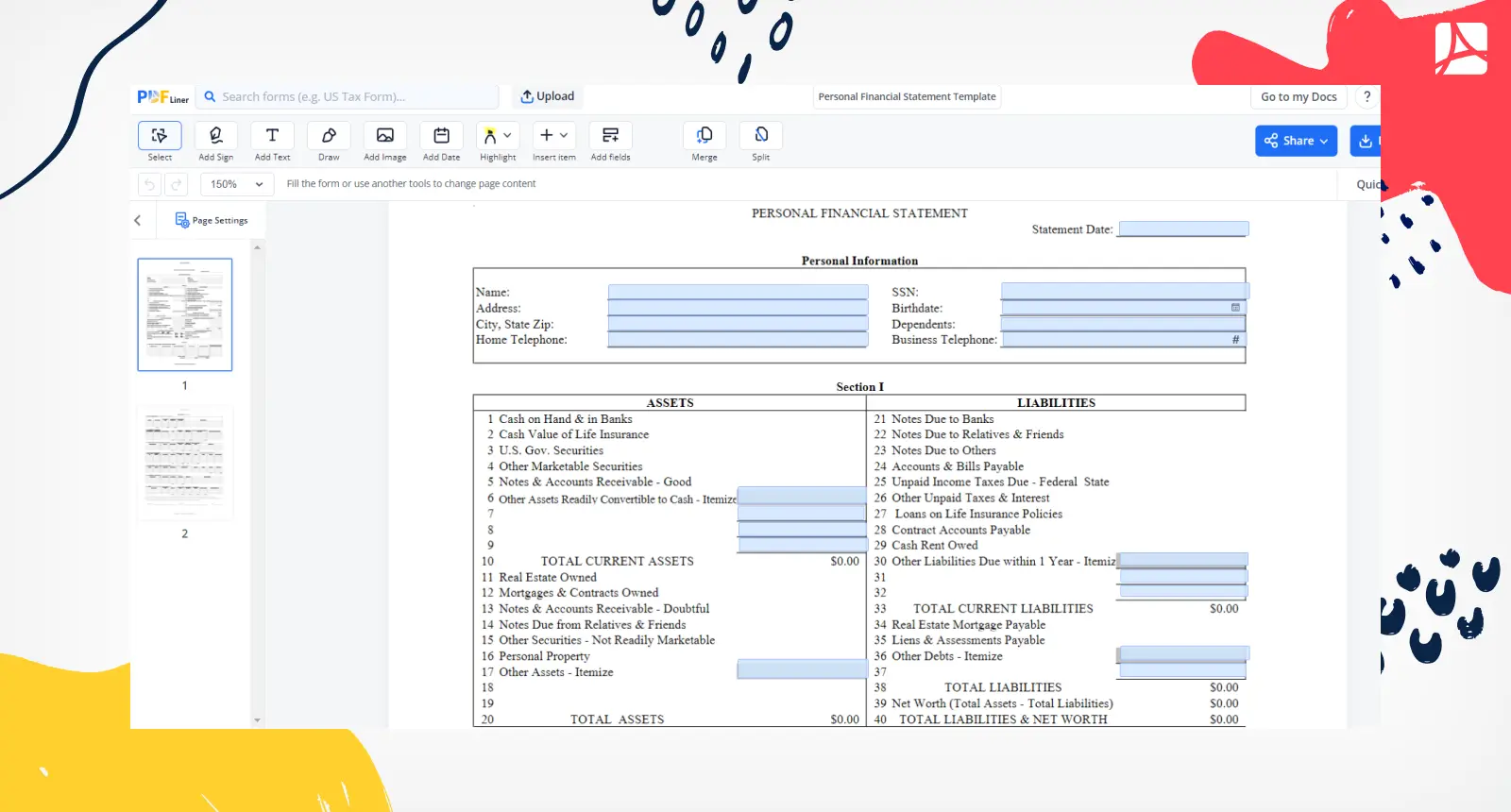

Proof of income and assets

When buying a house, providing proof of income and assets is essential for lenders to assess your financial stability. In this section, we'll explore the necessary docs that demonstrate your income and assets, helping you meet the requirements for a house loan.

- Pay Stubs or Other Proof of Constant Income. This document provides evidence of your regular income, including details such as salary, bonuses, and deductions, validating your ability to make mortgage payments.

- Bank Statements. Bank statements help verify your savings, checking, and investment account balances, offering a comprehensive picture of your financial health.

- Retirement Account Statements. Statements from your retirement accounts, like 401(k) or IRA, show your long-term savings and financial stability.

- Tax Returns. Tax returns offer a thorough record of your income, deductions, and tax liabilities, giving lenders insight into your financial history.

- Gift Letters. If you receive a financial gift from a family member or friend to assist with the down payment, a gift letter explains the source of the funds and confirms that it is not a loan.

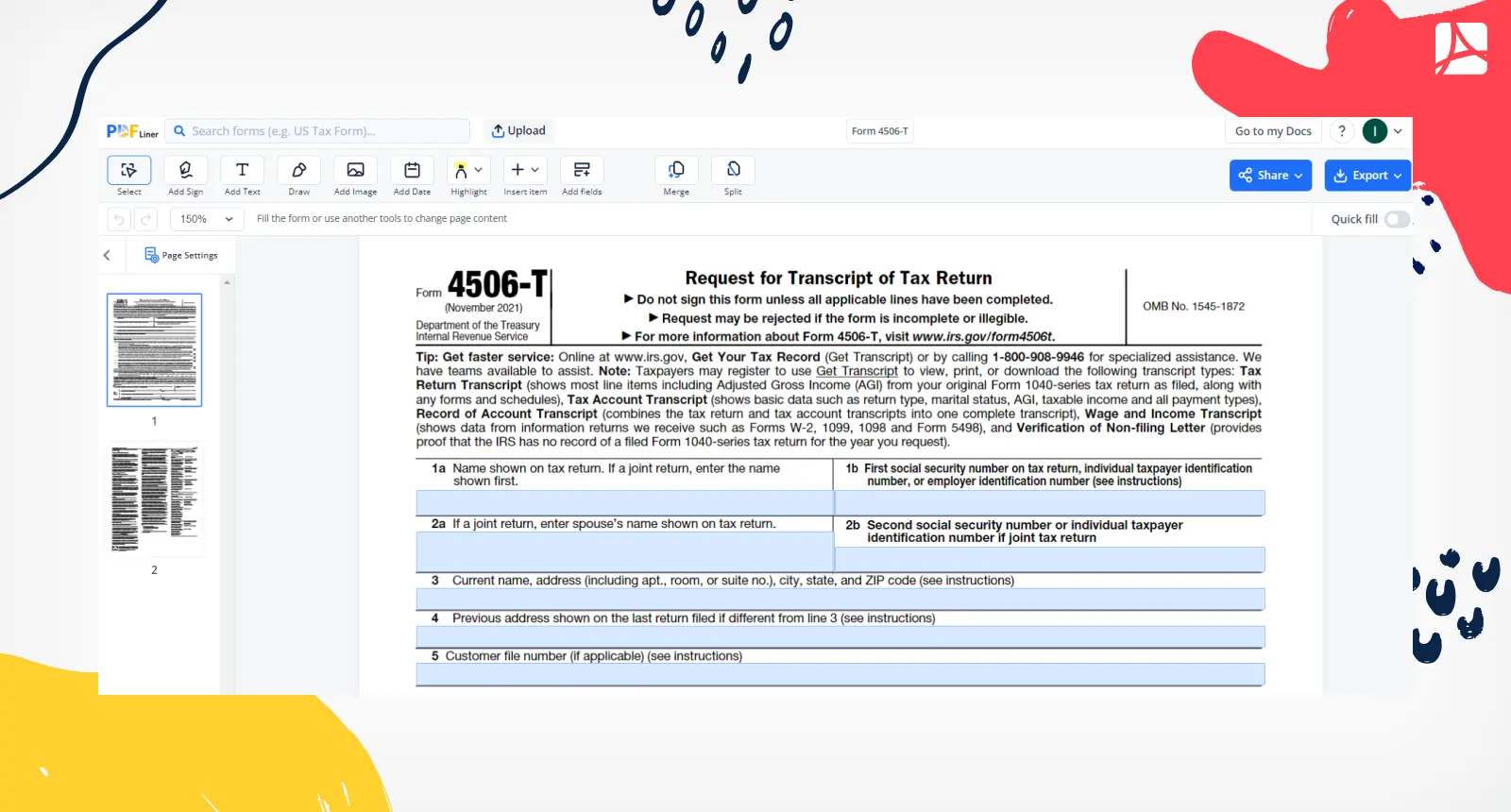

- Form 4506-T. This form grants your lender permission to access your tax records directly from the IRS, ensuring the accuracy of the information provided in your tax returns.

By preparing these documents, you'll enhance your credibility as a borrower and increase your chances of meeting the needed criteria for buying a house.

Proof of employment

When buying a house in the US, proving your employment is crucial for lenders to assess your financial stability and ability to make mortgage payments. To validate your income, several documents are typically required.

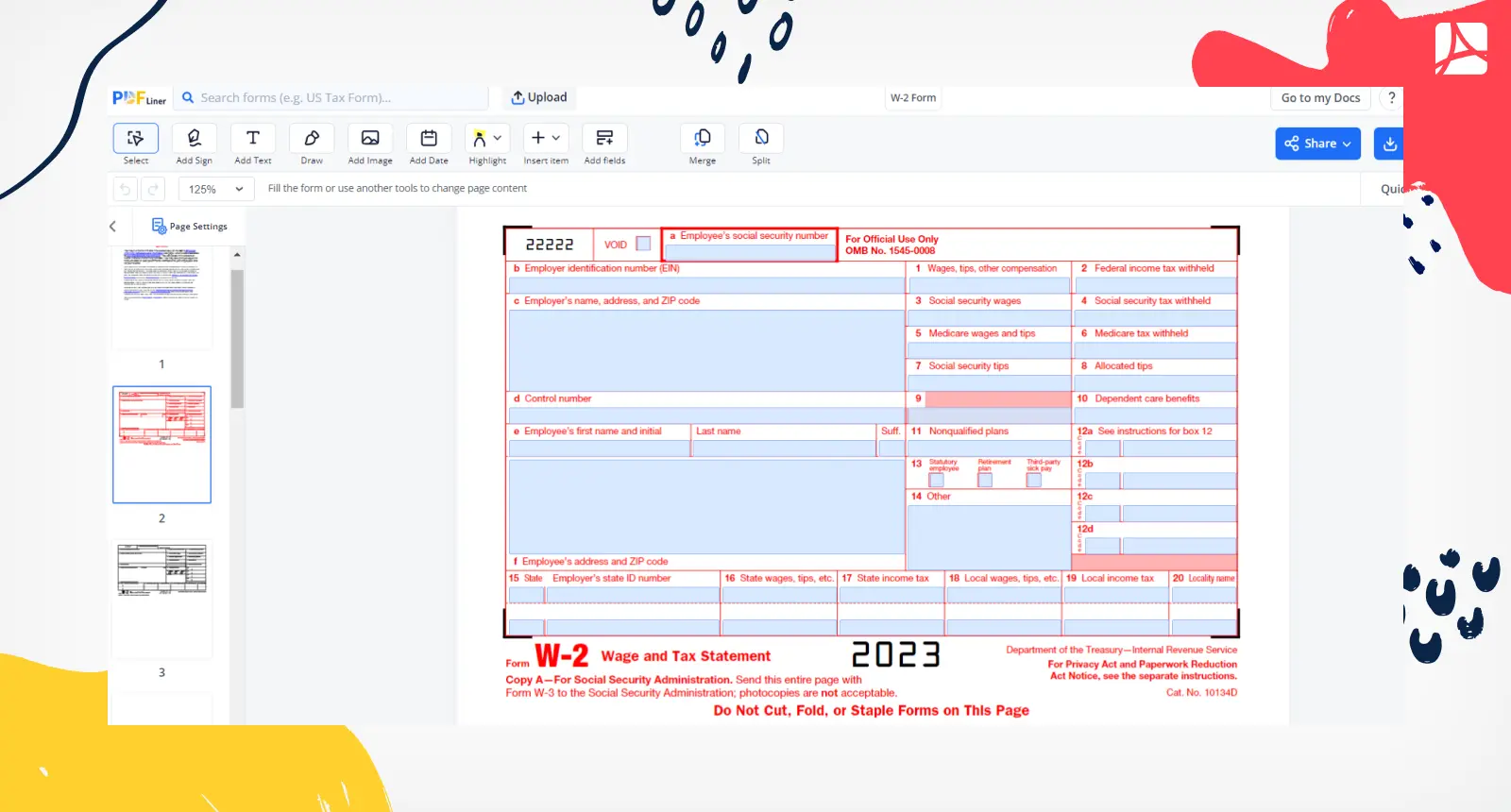

Pay stubs serve as immediate proof of employment and detail your salary, bonuses, and deductions. Employment verification letters from your employer provide an official confirmation of your position, salary, and length of employment. Additionally, lenders may request W-2 forms or 1099 forms to verify your income reported to the IRS. Collecting and organizing these documents will help establish your employment history and strengthen your mortgage application. Keep reading for more information on what is needed to buy a house.

Info on debts

When considering the things you need to buy a house in the US, providing information on your debts is crucial. Lenders assess your debt-to-income ratio to determine your ability to manage additional mortgage payments.

By disclosing your existing debts, such as credit card balances, student loans, or car loans, lenders can evaluate your financial obligations and determine an appropriate loan amount. This information helps them assess your overall financial health and make informed decisions regarding your mortgage application. Being transparent about your debts is essential for a smooth and successful home-buying process.

Credit report

One of the things you need when buying a house in the US is a credit report, which provides a comprehensive overview of your credit history. A credit report includes information about your credit accounts, payment history, and outstanding debts. It also includes your credit score, which represents your creditworthiness.

Lenders use your credit report and score to assess your ability to manage debt and make timely payments. A good credit score increases your chances of securing favorable loan terms and interest rates, making it an essential document in the home-buying process.

Pre-approval letter

A pre-approval letter is an essential component of what you need when buying a house. It is a document issued by a lender after assessing your financial information, credit history, employment details, and debt data. This letter signifies that the lender has reviewed your financial standing and is willing to provide you with a specific loan amount.

Having a pre-approval letter in hand offers numerous advantages. It helps you understand your purchasing power, strengthens your position as a serious buyer, and gives sellers confidence in your ability to secure financing. With a pre-approval letter, you can confidently pursue your dream home and boost the overall home-buying process.

Loan estimate

A loan estimate is a crucial document you need when buying a house, as it provides vital information about the mortgage loan you are considering. It is typically provided by the lender after you apply for a loan. The loan estimate serves multiple purposes, including helping you compare loan offers from different lenders, evaluating the costs associated with the loan, and ensuring transparency in the loan process. Its main components include:

- Loan Terms. Details about the loan amount, interest rate, and loan duration.

- Projected Monthly Payments. Estimated principal and interest payments, along with potential mortgage insurance and escrow amounts.

- Closing Costs. Estimated fees and expenses associated with the loan closing.

- Cash-to-Close. An estimate of the total amount you will need to bring to the closing, including down payment and other costs.

- Loan Features. Information on whether the loan has any special features, like prepayment penalties or adjustable interest rates.

By carefully reviewing the loan estimate, you can choose the mortgage loan that best suits your needs and get all the right answers to your ‘What do you need to buy a house?’ question.

Offer letter

An offer letter is a document submitted by a buyer to the seller expressing their intent to purchase a property. It includes important details such as the offered purchase price, proposed terms and conditions, and any contingencies. Here are some reasons why you need an offer letter when buying a house:

- Demonstrates Seriousness. An offer letter shows the seller that you are a committed and motivated buyer.

- Negotiation Tool. It serves as a starting point for negotiations, allowing you to outline your desired terms and conditions.

- Sets Expectations. The offer letter clarifies the proposed purchase price and other crucial aspects, ensuring both parties are on the same page.

- Competitive Advantage. A well-crafted offer letter can give you an edge in a competitive market, especially when there are multiple offers on the property.

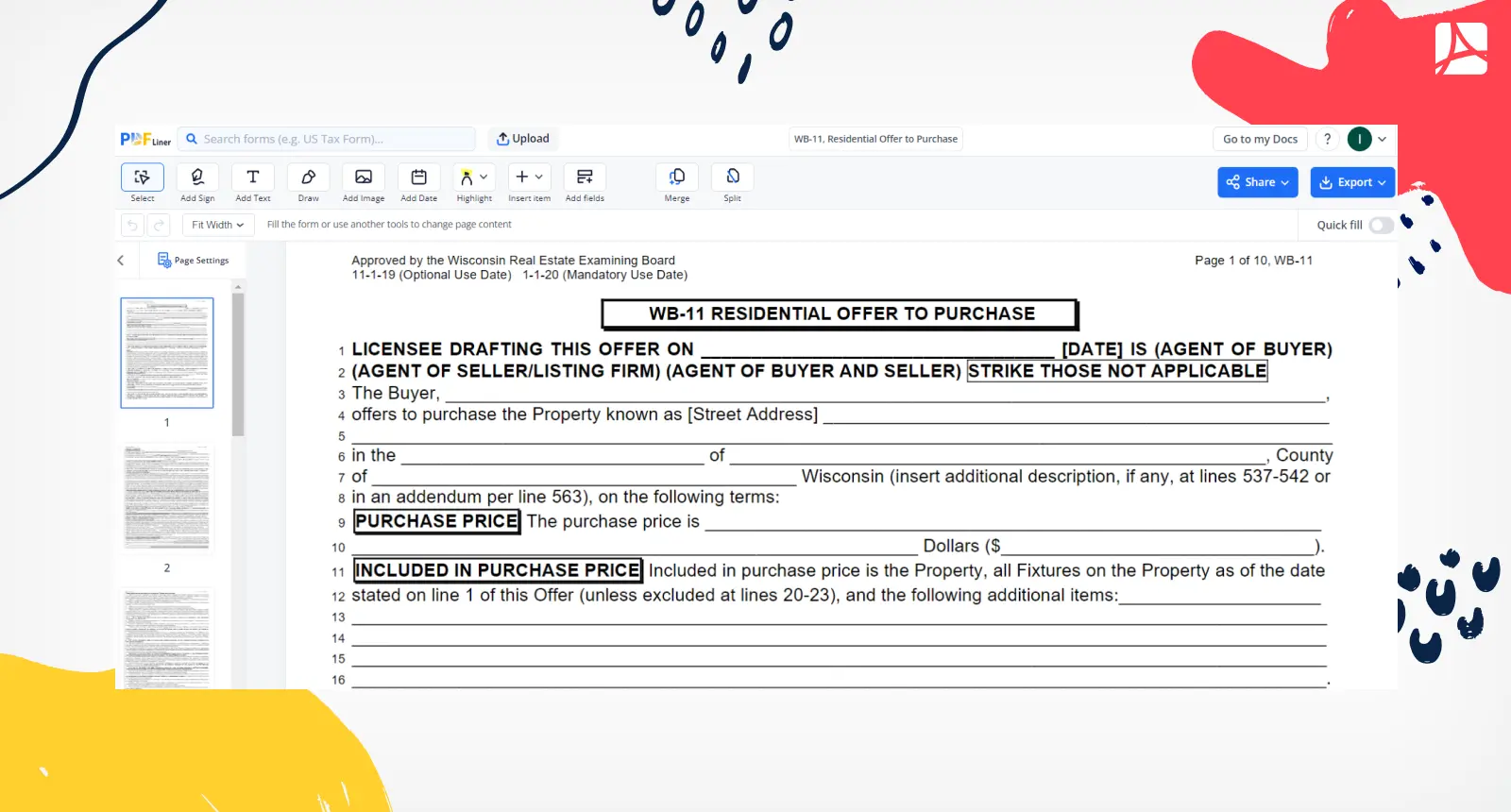

Purchase agreement

A purchase agreement is a legally binding document that outlines the terms and conditions of a real estate transaction. It serves as the formal agreement between the buyer and seller when buying a house. Here are the main elements typically included in a purchase agreement:

- Property Details. The portrayal of the property being sold, including its address, legal description, and any included fixtures or appliances.

- Purchase Price. The agreed-upon amount the buyer will pay for the property.

- Contingencies. Conditions must be met for the sale to proceed, such as home inspection or financing contingencies.

- Closing Date. Date when the transaction will be finalized and ownership transfers to the buyer.

- Earnest Money. Initial deposit made by the buyer to show their commitment to the purchase.

- Disclosures. Any required disclosures by the seller regarding the property's condition or known issues.

Seller’s disclosures

Seller disclosures are a vital component in the process of buying a house. These disclosures are homeowner documents provided by the seller that contain important information about the property's condition, known issues, and any material defects.

The significance of seller disclosures lies in their ability to provide transparency and protect buyers from potential surprises or undisclosed problems. They enable buyers to make informed decisions, evaluate the property's condition, and assess any necessary repairs or maintenance. Reviewing seller disclosures is crucial to understanding the property's history, potential risks and ensuring a fair and transparent home-buying process.

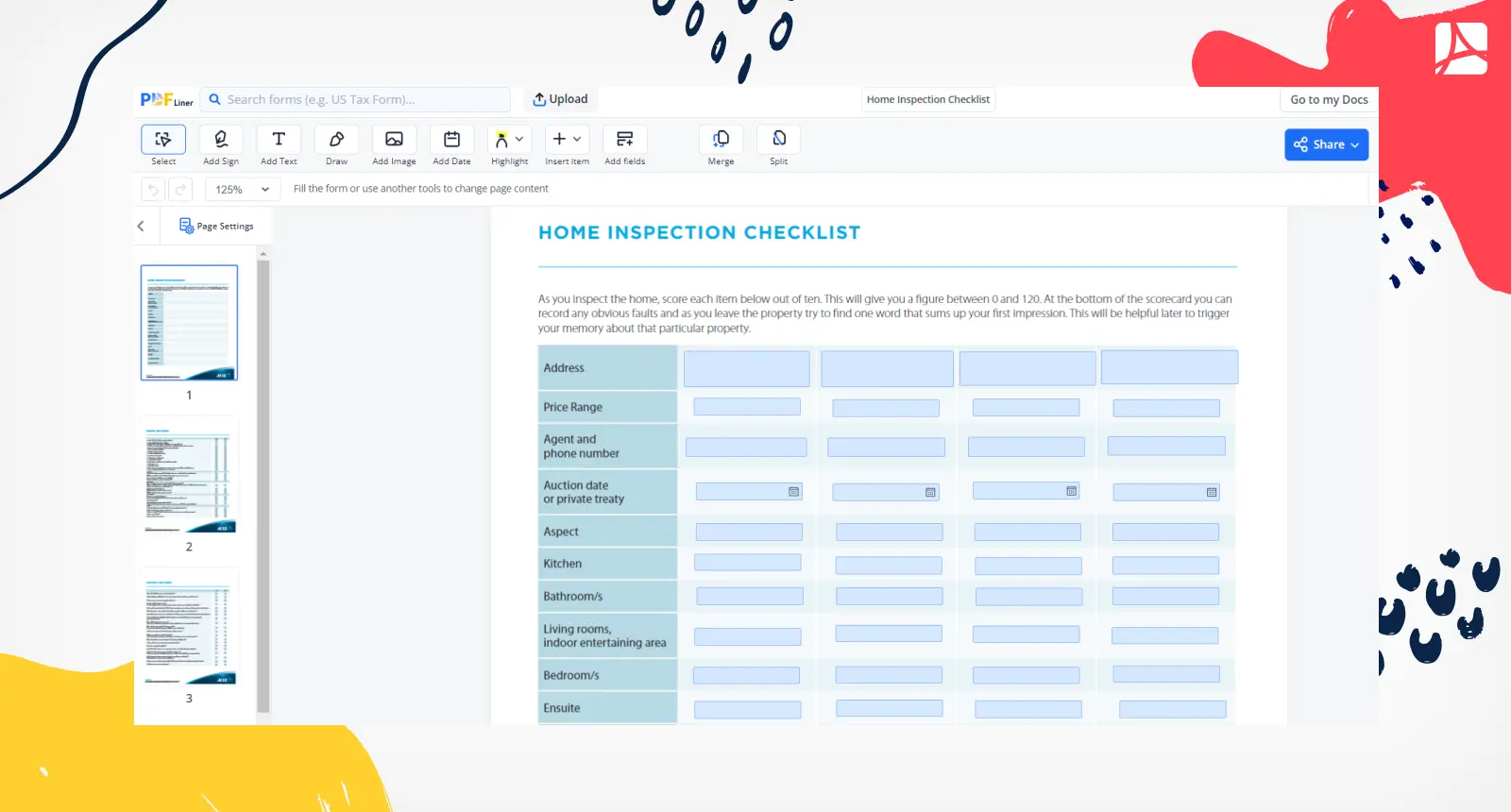

Home inspection report

A home inspection report is a detailed assessment of a property's condition conducted by a professional home inspector. It holds significant importance in the process of buying a house as it provides valuable insights into the property's structural integrity, systems, and potential issues. The report typically consists of:

- Exterior Evaluation. Inspection of the roof, siding, foundation, and drainage systems.

- Interior Assessment. Examination of walls, ceilings, floors, windows, and doors.

- Mechanical Systems. Evaluation of electrical, plumbing, heating, and cooling systems.

- Appliance Inspection. Assessment of the functionality of included appliances.

- Structural Analysis. Identification of any structural issues or concerns.

Home appraisal

A home appraisal is a professional assessment of a property's value conducted by a licensed appraiser. It holds crucial importance in the process of buying a house for several reasons:

- Determining Fair Market Value. An appraisal provides an unbiased evaluation of the property's worth, ensuring you pay a fair price.

- Mortgage Approval. Lenders require an appraisal to assess the property's value and ensure it aligns with the loan amount.

- Investment Protection. An appraisal helps protect your investment by ensuring you're not overpaying for the property.

- Negotiating Power. Appraisal results can be used as a negotiation tool if the appraised value differs from the agreed purchase price.

- Lender Protection. Appraisals help lenders assess the property's value as collateral for the loan, reducing risk.

Closing disclosure

A closing disclosure is a document provided to the borrower by the mortgage lender before closing on a house. It outlines the final terms, costs, and details of the mortgage loan. While similar to the loan estimate, the closing disclosure includes the actual costs incurred during the loan process, providing a more accurate representation of the financial aspects of the transaction.

The closing disclosure is vital in the process of buying a house for the following reasons:

- Ensures Transparency. It provides a comprehensive breakdown of the closing costs and loan terms, promoting transparency in the transaction.

- Verifies Accuracy. By comparing the closing disclosure with the loan estimate, borrowers can ensure that the final terms resonate with what was initially presented.

- Allows for Review. Buyers can thoroughly review the document before closing to identify any discrepancies or errors that may need to be addressed.

- Facilitates Budgeting. The closing disclosure allows buyers to anticipate and prepare for the total costs involved in the transaction.

- Compliance Requirement. The closing disclosure is mandated by the Consumer Financial Protection Bureau (CFPB) to protect borrowers' rights and ensure they have the necessary information before finalizing the deal.

Cashier’s check

A cashier's check is typically needed during the closing stage of the house-buying process. Buyers may be required to obtain a cashier's check to cover the down payment, closing costs, or any other fees associated with the purchase. It provides assurance to the seller that the funds are guaranteed, facilitating a secure transaction.

Proof of homeowners insurance

Proof of homeowners insurance is an essential requirement in everything you need to buy a house. It is a document that demonstrates you have obtained insurance coverage for the property you are purchasing. Lenders typically mandate homeowners insurance to protect their investment in case of unforeseen events like fire, natural disasters, or liability claims. Having proof of homeowners insurance provides peace of mind to both lenders and buyers, ensuring that the property is adequately protected and minimizing financial risks associated with potential damages.

Property survey

A property survey is an important component of the guidelines to buying a house. It is a professional assessment of the property's boundaries, structures, and any encroachments. A survey helps ensure that the property lines are accurately defined, and there are no boundary disputes or discrepancies. It provides valuable information about the land, potential easements and helps buyers make informed decisions regarding the property's use, potential improvements, and compliance with local regulations.

Final Thoughts

Cutting to the chase, buying a house involves a series of important steps and considerations. From gathering necessary documents such as proof of income and assets, credit reports, and pre-approval letters to reviewing seller disclosures and conducting home inspections, each stage is crucial in ensuring a successful transaction.

The process further encompasses obtaining a loan estimate, submitting an offer letter, and finalizing a purchase agreement. Additionally, acquiring a property survey, securing homeowners insurance, and preparing a cashier's check for closing are essential elements. By following these steps meticulously, buyers can navigate the complex journey of purchasing a house with confidence and peace of mind.

FAQ

What is the most important thing when buying a house?

Naturally, it’s financial preparedness. Ensuring you have a strong credit score, a stable income, and a sufficient down payment are crucial factors. Additionally, obtaining a pre-approval letter from a lender demonstrates your financial credibility to sellers. It's essential to have a clear understanding of your budget and solid answers to your ‘What are the requirements to buy a house?’ question.

How long does it take to buy a house?

On average, the process takes about 30 to 45 days from the time an offer is accepted to the closing. However, it can be shorter or longer depending on factors such as the complexity of the transaction, market conditions, and the speed of completing necessary tasks like inspections and loan approvals. Working closely with your real estate agent, lender, and other professionals involved can help speed up the process and ensure a timely purchase.

Save Your Time with PDFLiner

Fill out, edit, sign, and share Real Estate documents online!