-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How Do I Get My IRS Identity Protection PIN: Actionable Tips

.png)

Dmytro Serhiiev

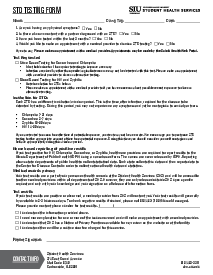

If you are wondering “how do I get my Identity Protection PIN from the IRS?” you first need to learn what it is. Identity Protection PIN is released by the IRS six-digit number that protects your information from fraudsters. You can hide your SSN or taxpayer ID number with it.

What Is an IRS Identity Protection PIN?

The IRS Identity Protection PIN is the code that helps you to secure your personal data from thieves. The number of digital crimes is growing with the development of new technologies and global digitalization. Nowadays, it is better to have an IRS identity theft protection PIN that hides your Social Security number and ID taxpayer’s number.

The IRS created this option for anyone who uses online forms. Only the IRS and you know this PIN. It also eases work for the IRS since they can easily verify the identity of the person behind the six-letter password, no matter whether you file a paper or electronic tax return.

Why Is It Essential to Get an IRS Identity Protection PIN?

You might want to get an Identity Protection PIN from the IRS to protect your personal data from fraudsters who can use it for their benefit. However, this is not the only reason why you might need a PIN. Think about the advantages that IRS offers via the PIN:

- The IRS can easily verify your identity using this password. It simplifies their work. In case someone steals your data and uses it, the IRS can stop the procedure right away;

- You lower the chances to become a victim of your personal data theft;

- You protect your personal account on the IRS official website and may send a wide range of forms from there.

How to Get an IRS Identity Protection PIN

To be able to answer “How do I get my IRS Identity Protection PIN?” read this section. Here we offer a step-by-step guide to your service. The procedure is simple, and you don’t need any extra preparations for it. Yet, you have to go through simple identity verification so that the IRS can identify you.

If your spouse wants to use your PIN, they have to go through the same process of verification. Dependents that use your account need to do the same. Follow the next instructions to get your IP PIN:

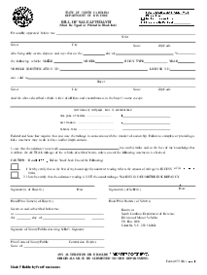

1. Visit the official IRS website. Check out the section “File.” There is a sub-section called “Individuals.” There, you will find a detailed description of the process. Check the button “Get an IP PIN” in the paragraph “How to get an IP PIN”. You will quickly notice it since it is big and blue. Press it and go to the next stage.

.png)

2. Submit an IP PIN Request. Enter the page via your own account beforehand. You can sign the way you prefer. You may use ID.me and the IRS name that already exists. If you don’t have an account, create it from the very beginning. Press the button “Create an account.” Fill out the section with your email and password. Read the rules and press “Continue”. Choose the best MFA option you trust.

.png)

3. Provide the Required Information. Here you have several options. Before you send a request Identity Protection PIN to the IRS, decide whether you want to use the code generator app, security key, text message, push notification, passkey on your device, or NFC mobile security key. Based on your choice, provide the required information. It can be either your phone or email address. You need to confirm that you are the owner of the phone by answering it or by going through the registration procedure in your email. It takes a few seconds. You might need to wait sometime till the address or phone is checked and confirmed.

4. Receive Your IP PIN. Once you are there, you will receive the PIN from the IRS. You can significantly ease your life by installing the app offered by the IRS. It works on both mobile platforms, and you can download it on App Store as well as on Google Play. The app is lightweight but you need to provide access to your location and some data you want to share based on the type of identification you prefer. You can create a password there; make sure it is totally secure. This PIN is intended for your own use. Consider it as a key to your personal data that you can hide from other parties except for you and the IRS. Don’t share the password with other users.

Benefits of Having an IRS Identity Protection PIN

There are numerous benefits of PIN Identity Protection created by the IRS. Here are some major thoughts about them. Before you generate your own IRS new Identity Protection PIN, learn the pros it provides:

- Your PIN is unique, and thieves can’t copy it without a long procedure of verification and proof. Thus you are aware that someone wants to get your code;

- This PIN is valid only for one year, so you cut the possibility for thieves to steal it by creating a new password for your personal information each year;

- The IRS trusts the documents protected by such PIN considering them as those that pass verification and belong to you;

- The IRS accepts paper or electronic files with a PIN as trustable and rarely rejects them, unlike those documents that are not secured.

FAQ

Read these most popular questions on IRS PIN that were found online. The answers might be helpful for you. Check out the information before you create your password.

How else can you protect yourself from tax identity theft?

If you are worried about your personal information getting revealed to third parties, you have to make sure that it is totally secure. There are several ways to protect the data apart from the IRS IP PIN. You can also use only trustable sources that provide encryption while you are filling out tax forms. For example, PDFLiner is an online editor that offers several levels of encryption and even a time stamp for your documents.

What if I lost my PIN?

If you lose your PIN, don’t worry. You have to follow the steps provided by the IRS. Don’t try to fill out 15227 forms to receive the new one. You can retrieve the lost information online via your account on the IRS website. You will need to confirm your identity there.

How to use an identity protection PIN?

You have to use a PIN while filing the tax return forms to the IRS. You don’t have to use it with all the forms. You will need it for the tax report of the 1040 family, including 1040-SR, 1040-PR, 1040-NR, and 1040-SS. Enter the code on your e-file or write it down manually.

Fill Out Tax Forms At No Time with PDFLiner

Start doing your taxes electronically and save loads of time!