-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Everything You Must Know on How to Correct a 1099 Form

.png)

Dmytro Serhiiev

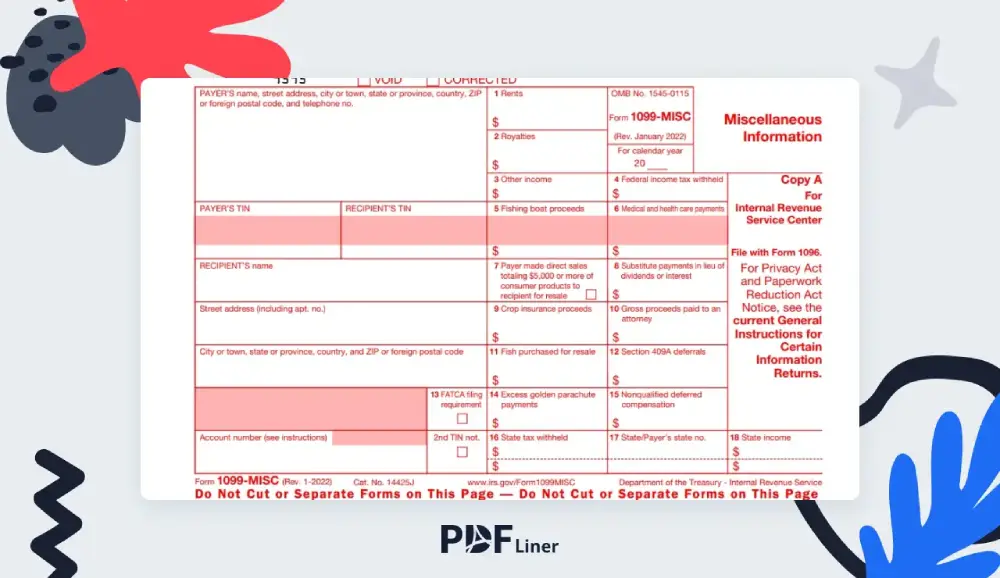

Many taxpayers began to wonder how to correct a 1099 MISC form after the IRS released the 1099 NEC document. The form is also known as Miscellaneous Income and is reported by business owners who provided payments for nonemployees during the year. It covers numerous cases, including rents and awards, so many business owners start 1099 correction mainly because they can’t keep up with a wide range of services.

1099-MISC Form 65bb60ced1918f924e00be1b

.webp)

What are 1099-MISC and 1099-NEC

Correct a 1099 Form

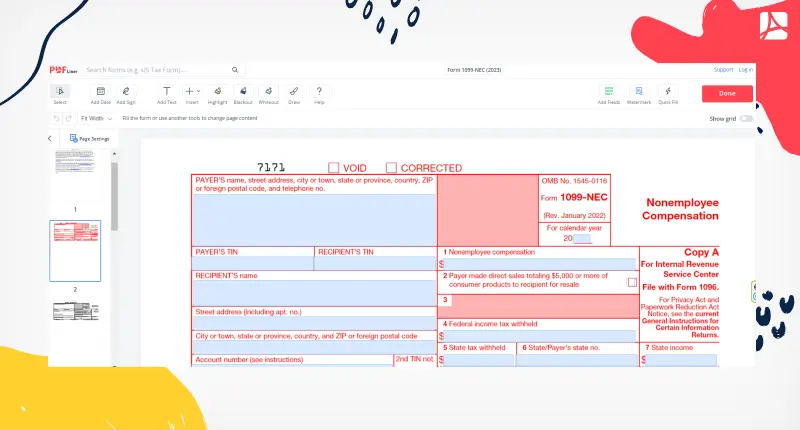

Business owners send 1099 NEC to the IRS to inform about their nonemployees who received at least $600 per year or more who filled out the requesed W9. It is also sent to the nonemployees. To get this procedure done, you should have the corrected 1099 NEC form. Before 2020 it was a 1099-MISC form that performed the same tasks as 1099-NEC. In 2020, the IRS decided to separate forms. If you still don’t know which file is a corrected 1099, you need to check out their features:

1099 Correction Types

The IRS accepts the 1099 amendment form, but you can avoid making mistakes in the first place. Usually, there are simple corrections that are required. Most of them are made because of inattention. If you don’t want to start correcting a 1099 MISC right after you complete it, you can pay attention to the next popular types of mistakes:

- You used the wrong form. You have to use NEC instead of MISC, for example;

- You provided the wrong numbers at the boxes of money amounts in your incorrect 1099-MISC form;

- You put the tick in the wrong box;

- You did not have to file the return;

- You’ve made a mistake in the TIN or the name of the payee;

- You’ve made a mistake in the address.

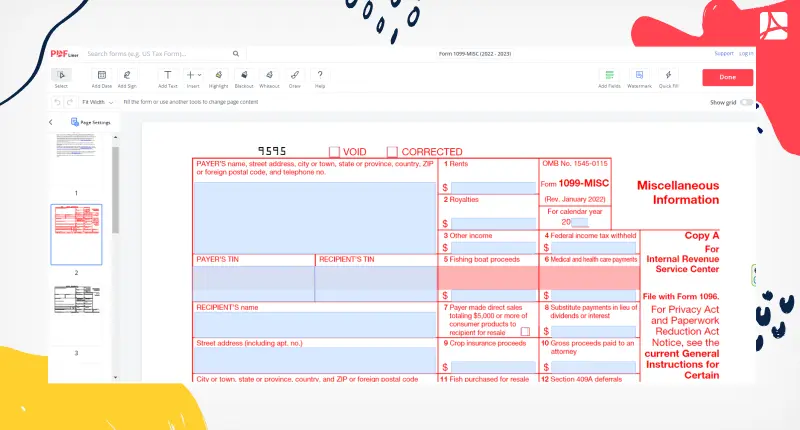

How to Correct 1099-MISC and 1099-NEC

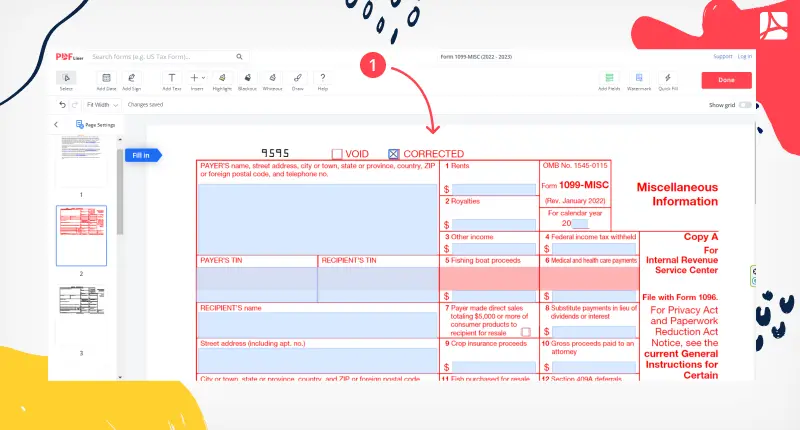

You may not amend 1099 MISC and NEC forms because the IRS doesn’t insist on that. But if you have not filed the document to officials yet, you can edit it via the PDFLiner online editor. It does not take a long time. But, if you have already sent the form with the wrong TIN, name of the payee, or mistake in number, here is how to amend 1099 MISC and NEC:

- Write a letter to the IRS with the name and your address;

- Describe the type of error you’ve made in the document;

- Underline the tax year you’ve calculated the payments;

- Include the correct TIN;

- Provide the transmitter control code inside;

- Describe the type of return;

- Write down the information about your filling method;

- Indicate the number of payees involved in the procedure;

- If the federal income tax was already withheld, you have to highlight this in the letter.

Pay attention that the wrong address may cause trouble since you will not receive the check. Anyway, if you filled in the wrong address, you can note the correct one in other documents or you have to file the letter to the Information Returns Branch. The form will be the same you’ve used to file the original document. You can’t use the 1099 correction letter template since there is no any. So, in case you don’t understand something, just talk to the staff of the IRS and explain the specific situation.

1099-NEC Form 65bb657f5447959694021119

How to File Corrected 1099 Forms

You will not find the correction form for 1099. Use the original one as a correction form. Make sure you explain to officials that you are sending the amended one. So, after you complete the new corrected form, follow the next steps:

- Put a tick in the box “Corrected” at the top of the page;

- Send the new form to the IRS;

- Send the corrected form to the vendor or contractor with whom you worked;

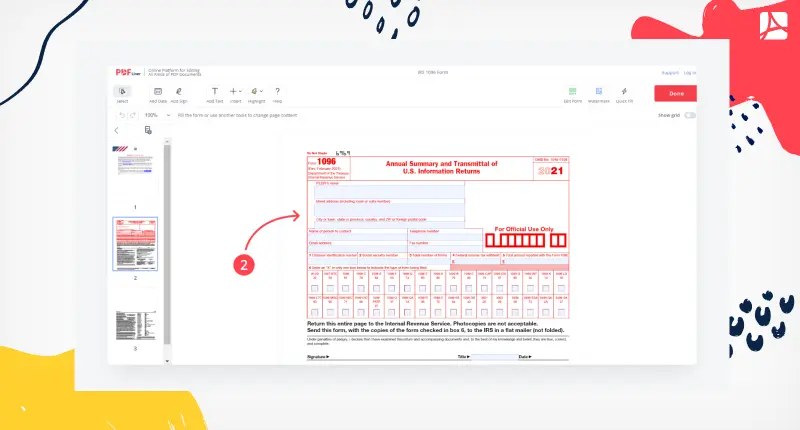

- If you need, file form 1096 with the corrected return;

- Don’t include incorrect form anywhere;

- Send the correction to the Information Returns Branch of the IRS.

FAQ

Check out the most popular questions on 1099-MISC and 1099-NEC forms. This information may help you to file the forms without mistakes or easily correct them.

What is the difference between 1099-MISC and 1099-NEC?

The 1099-NEC form was part of the 1099-MISC form until 2020. In 2021, the IRS decided to separate them. The 1099-NEC form was made for business owners who use the services of nonemployees and paid them $600 or more per year. The 1099-MISC form is for a wide range of miscellaneous income.

When should I file a corrected 1099 form?

You should file the corrected form after you had sent it incorrectly. The IRS usually expects corrected forms by April 2 or the end of March. Yet, since this form must be attached to the nonemployee's tax report, it must be corrected as soon as possible.

How do I void 1099?

You can void the incorrect 1099 form by using the correct one. Send the correct version to the IRS. You have to place the “X” in the box “Corrected” at the top of the form.

Does the address on 1099 matter?

Usually, it does not. If you have made a mistake in the address, don’t worry, the IRS will not use it. Yet, you still need to use the correct one in the other forms.

Is there a penalty for filing a corrected 1099?

It depends on the circumstances. If you file the correct form within the 30 days due date, you will be charged $50. The maximum penalty reaches $197,500.

Go Paperless with PDFLiner

Fill out, edit, sign and share any document online and save the planet