-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out a 2290 Form

.png)

Dmytro Serhiiev

Are you planning to register a heavy highway vehicle in your name? Then today’s post is definitely worth reading. In this piece, we’ll go over the 2290 tax form instructions, its essence, and specificities, who must file it and who, along with the basics of how to properly prepare the file. Keep reading for details and tips.

Fillable Form 2290 649997b58345c96f70032495

What Is a 2290 Form?

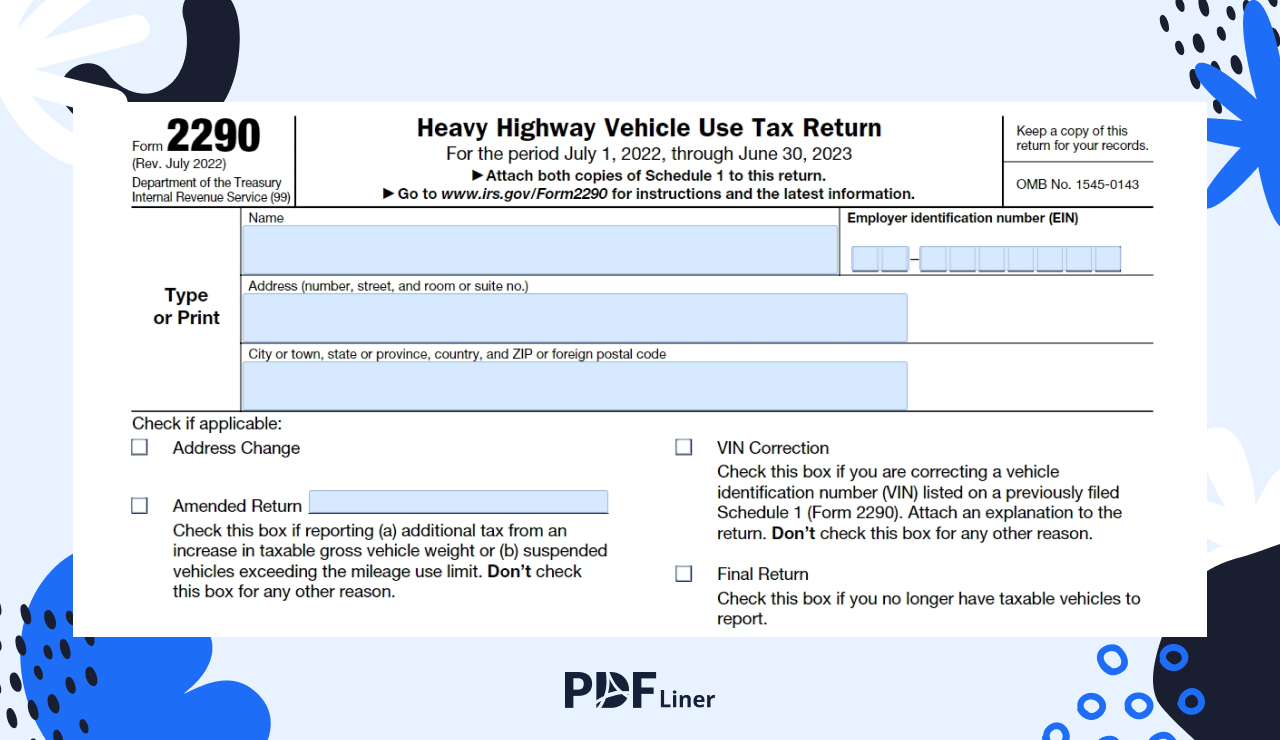

Paying the heavy vehicle use tax (shortened to HVUT) to the IRS is inevitable, alas. And that’s where the named form kicks in. It’s a must-prepare document if you’re a truck driver who intends to drive on public highways and whose truck weighs over 55,000 lbs.

Upon filing this return, you receive a doc that serves as a receipt for the tax form, also known as Schedule 1. You’ll need this to renew your truck registration on a yearly basis. Whether you’re on the prowl for this particular form or need any other document template, PDFLiner has got you covered.

How to Get Form 2290: Two Solid Ways

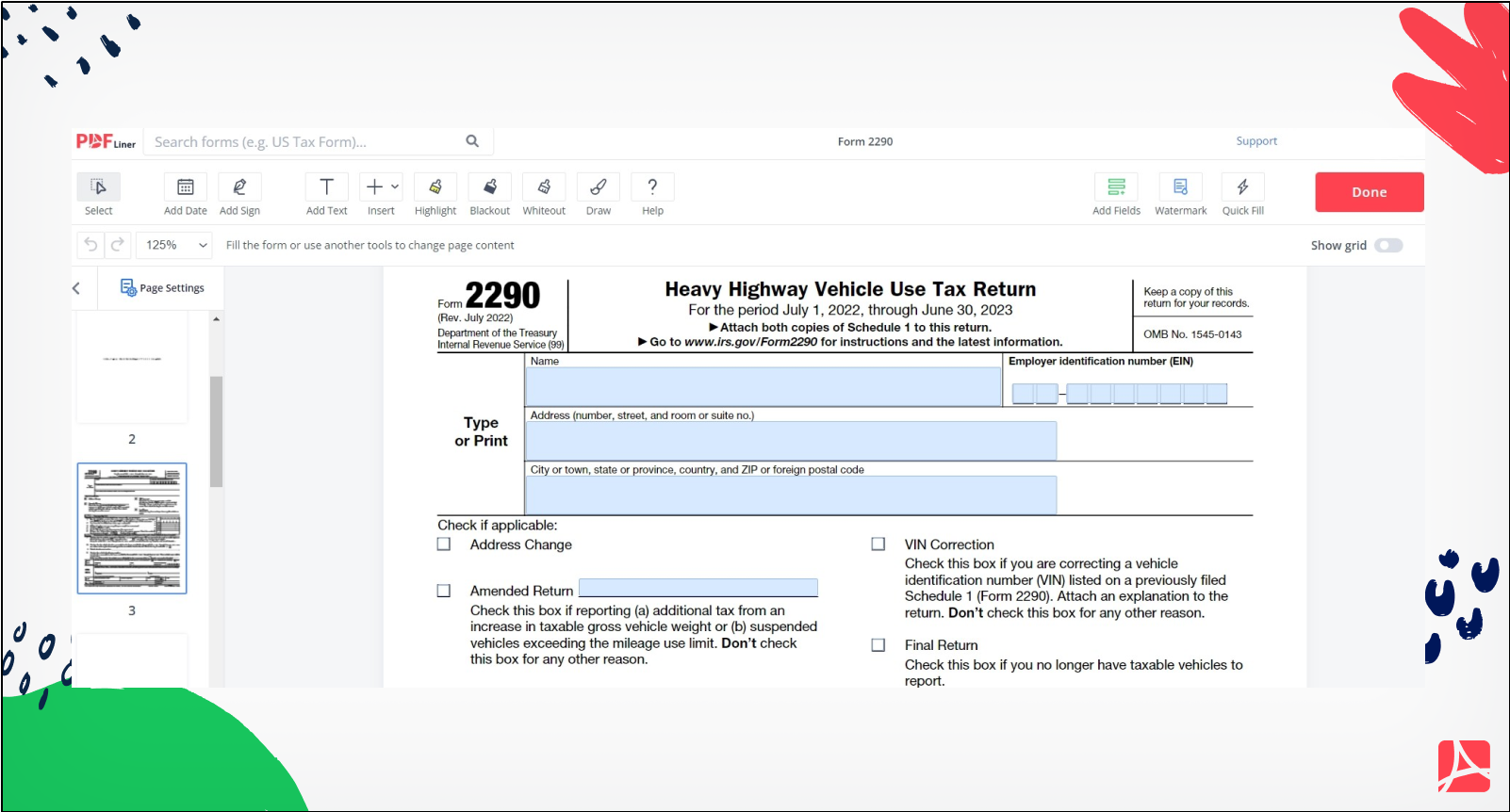

There are two methods of laying your fingertips on this form. The first one is to find it on the official IRS website. The second one is to launch it and fill it out right here and right now on PDFLiner.

Of course, opting for the second method is your best bet because it offers you a treasure trove of editing features, along with the possibility to e-sign, share, and file your docs via our secure system. Keep reading to explore the basic instructions for IRS Form 2290.

Fill Out 2290 Form 649997b58345c96f70032495

How to Fill Out a 2290 Form: the Fundamentals

Basically, filing this return is a must for any individual, LLC, cooperation, or any other type of entity with heavy vehicles registered. The form is a whopping 10 pages, with a few of them being non-fillable.

Here’s the information you’ll need to prepare in advance prior to completing this form:

- Business name and contacts.

- EIN and VIN.

- Vehicle Taxable Gross Weight.

- Vehicle First Used Month.

Here’s a step-by-step guide on how to fill out the doc:

- Indicate your full name, contacts, and EIN.

- Fill out the Figuring the Tax section.

- Proceed by filling out the Statement in Support of Suspension.

- Switch to the Tax Computation table.

- Complete the Schedule of Heavy Highway Vehicles.

- Specify the current date.

- Indicate your signature.

PDFLiner is your best bet if you’re on the hunt for a top-notch solution for under-your-own-steam digital document management. These perks of filling out the form with PDFLiner cannot be underestimated:

- we offer an all-in-one 2290 e-file solution that includes all the supporting docs;

- with us, you can get your Schedule 1 in a multitude of ways;

- enjoy instant error check and typo prevention;

- we provide a safe and secure environment for submitting the form;

- store all your tax docs in one place;

- have instant access to the 2290 filing instructions and useful tips.

And that’s pretty much it when it comes to the vital and intricate topic of how to fill out form 2290. Yes, the form may seem challenging to cope with. Under these circumstances, you are more than welcome to turn to professional help. It’s associated with certain financial investments, but they are sure to pay off in the long run because they’ll bring you blissful peace of mind.

How to Sign Form 2290

The third and the ninth page of this form should contain your signature. Don’t forget that PDFLiner grants you the possibility to digitally sign any form that’s on your current agenda. Need to send someone a document for signature? Boy, oh boy, with our service, you can do it in a matter of mere instants! With regard to the signing process, it’s easy to get to grips with. Here are the must-follow steps:

- Upload the needed doc to the system or find the required template in our catalog.

- Hit the ‘Add Sign’ button in the upper menu bar.

- Choose how you want to add your signature: draw, upload, or capture.

- Find the signature fields in your doc and get the procedure going.

- Don’t forget to save it when you’re through. Yes, it’s as easy as it sounds.

Remember that digital signatures within PDFLiner are legally binding and secure. This fantastic tool saves heaps of your valuable time and automates your administrative affairs in the most efficient way possible.

And it’s available to our platform users right here and right now, irrespective of their current whereabouts. That’s what we call the ultimate convenience and the possibility to work on your docs on the go.

How to File Heavy Use Tax Form 2290

The option of filing the form via the IRS site is unavailable. With that said, you can utilize a reliable commercial software provider for this purpose. Bear in mind that the third-party service you’ll opt for when filing this form does not charge the tax you owe.

Follow the service’s instructions as you progress through submitting the form, and enjoy filing your return in a digital (read as the most convenient) way. Yes, in many ways, with e-filing, it’s your way or the highway. Totally liberating and time-saving, for sure.

FAQ

Who should file Form 2290?

Any individual or organization with heavy vehicle(s) registered must file this form and pay the return. That’s a given.

May I file one Form 2290 for two vehicles?

Yes. As a matter of fact, you can file one document for all the trucks that you’ll drive for the twelve months of the upcoming tax year. That’s convenient, for sure.

Can I claim a refund electronically for a vehicle that was sold?

The answer is yes, you can. Use the next 2290 Form you file for this purpose. Have further questions on the topic? You’re welcome to get in touch with us to ask them or contact your local expert for equally prompt and professional answers.

Fill Out Forms At No Time with PDFLiner

Start filing your forms electronically today and save loads of time!

Form 2290 Online 649997b58345c96f70032495