-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out a W-9 for an LLC: Quick Guide

.png)

Dmytro Serhiiev

Last Update: Dec 30, 2024

“Change is the only constant in life,” said the Greek philosopher Heraclitus, and so is the inevitable encounter with tax paperwork when you're in business. If your Limited Liability Company (LLC) is rubbing elbows with other businesses (highly likely!), you might find yourself face-to-face with the W-9 form. Why, you wonder? Well, it's Uncle Sam's way of keeping tabs on your tax issues. In this post, we'll offer you a step-by-step guide on how to fill out a W-9 for an LLC, as well as provide the basics about this document. Keep reading.

Fillable W-9 Form 65f013686d1834a70e07c82d

Key Takeaways

- Used to provide the IRS with essential information about your company, such as official name, address, and identification number.

- Select the correct tax classification for your LLC on the form, including options like Single-Member LLC, Partnership, S Corporation, or C Corporation.

- Provide accurate business information, choose the tax classification, include your EIN or SSN, sign the form, and send it to your client; no need to send it to the IRS.

- Refusing to provide a W-9 can result in a 24% withholding fee from your payments, so consult a tax expert to avoid issues.

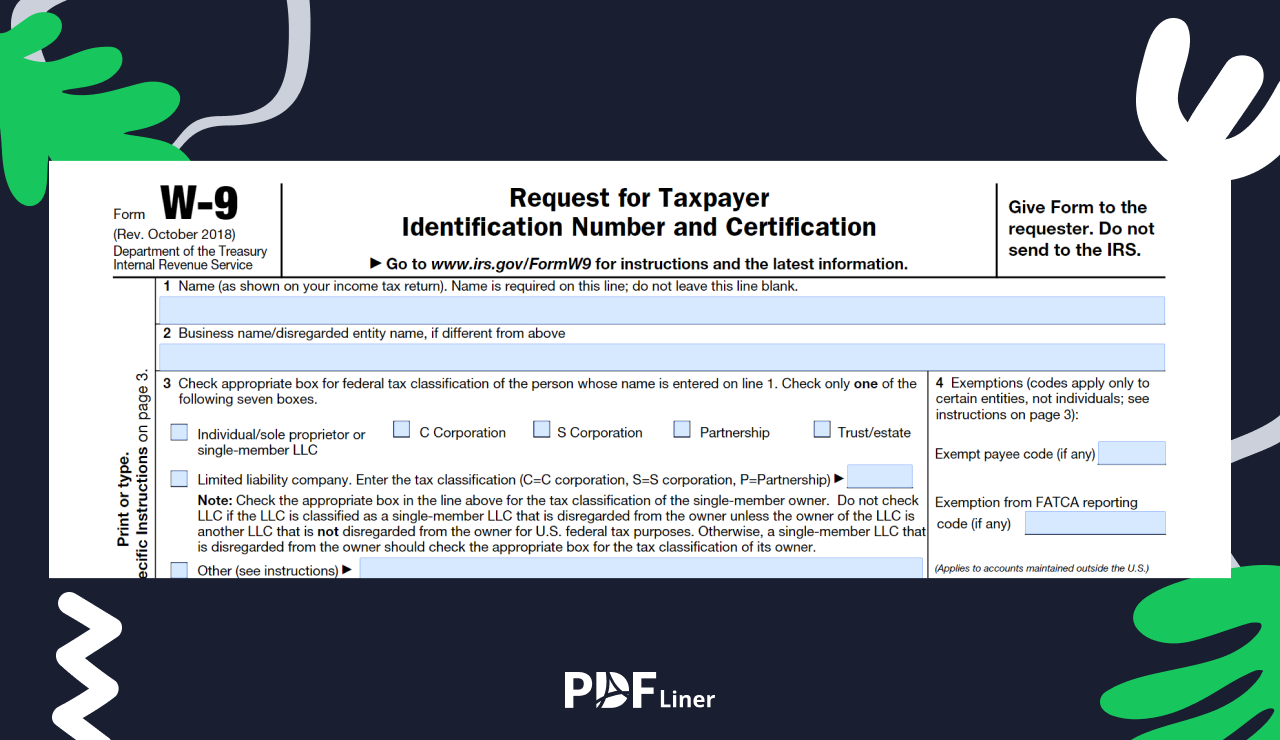

What Are the Specifics of W-9 for LLC

The W-9 form acts as an identification card for your business, tax-wise. Its purpose is to provide the IRS with important details about your firm: its official name, address, and unique identification number (in this case, Employer Identification Number).

We’ve provided some specifics of filling out W-9 for LLC below.

1. Why fill it out

- The IRS uses it to track your business's income and make sure everyone's playing by the tax rules.

- If you work with other businesses or freelancers, they may ask for your W-9 to keep their own tax records straight.

2. What's inside

- Business ID. Your company’s official name, address, and employer identification number.

- Certification. To certify that you agree to pass your data to your client you need to sign the form.

Long story short, W-9 is a necessary step for businesses (that includes Limited Liability Companies). By taking this step, you provide tax authorities with transparent information and demonstrate your commitment to adhering to their guidelines.

W-9 Tax Classification for LLC

In the wise words of Albert Einstein, “The only source of knowledge is experience.” Understanding the tax classification for your Limited Liability Company on the W-9 form is all about practical experience. Consider sorting your business into tax categories on the W-9 form. It's not complicated — just a straightforward guide to help your Limited Liability Company determine its tax identity.

Below, we've provided a concise guide to the LLC tax classification W-9 for you to steer clear of any confusion.

- Single Member LLC. A Single Member LLC on the W-9 means you are the one and only owner of your business. It's straightforward: the income and deductions get reported on your personal tax return. You handle the tax affairs solo, without needing a tax partner. It's a clear and simple tax process involving just you and your firm.

- Limited Liability Company. An LLC on the W-9 means your business is recognized separately from you. Your company files its tax return, and you, as the owner, report your share of profits on your personal taxes. It's a forthright process, dividing business and personal tax responsibilities.

- S Corporation. Choosing S Corporation for your LLC on the W-9 means your business gets special tax treatment. It's like blending the benefits of a corporation and a partnership. Your company’s profits pass through to your personal tax return, and you avoid paying corporate income tax. It means tax efficiency for your business.

- C Corporation. C Corporation on the W-9 gives your entity a distinct tax status. With this option, your business has a separate tax identity — it's got its own tax rhythm. Profits are taxed at the corporate level, and if you get dividends, they're taxed on your personal return.

- Partnership. Partnership on the W-9 means your firm teams up for taxes. Your business isn't taxed on its own. Instead, profits and losses are shared among the owners. It's a joint effort, and everyone reports their portion on personal tax returns.

W-9 Instructions for LLC: How to Fill It Out

According to Mark Twain, “The secret of getting ahead is getting started.” Filling out your first W-9 might seem like decoding ancient hieroglyphs, but fear not! Upon studying our guide provided below, you'll be breezing through it on mental cruise control. So, whether you’re wondering how to fill out a W-9 as a single-member LLC or just starting your tax path, follow these detailed steps to embrace clarity.

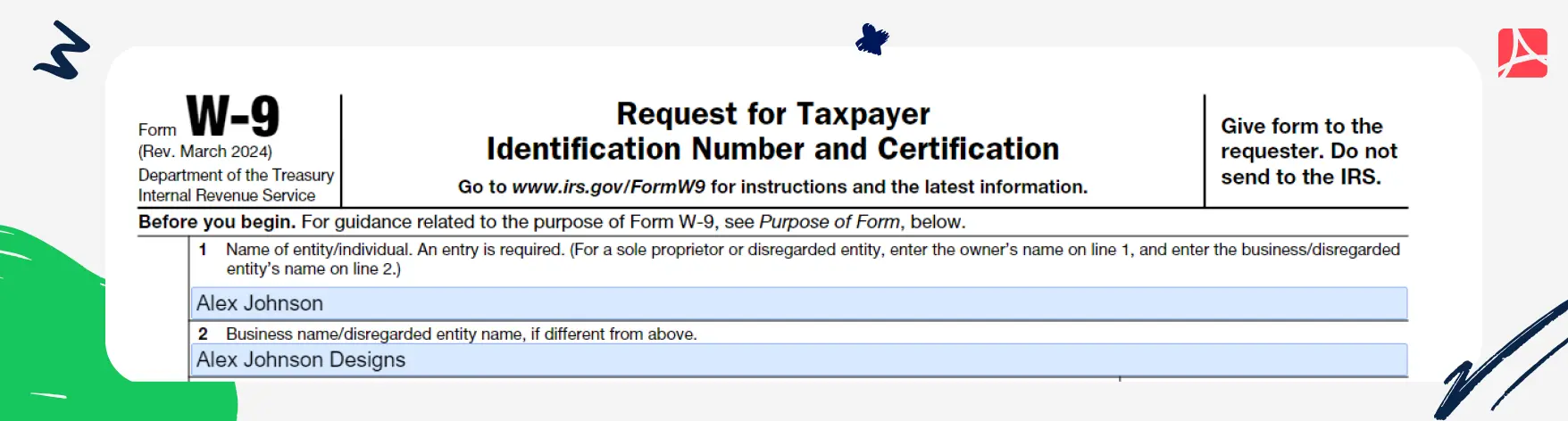

1. Provide your company details

On Form W-9, you'll share some basic info about your company. Start with your name. If you own a single-member Limited Liability Company, use Line 1 for your personal name and Line 2 for your LLC or DBA name. For example, if you're Bryan Smith of Bryan Smith Builders LLC, Line 1 gets your full name, and Line 2 gets your business name.

If you're in a multi-member Limited Liability Company filing as a partnership, S-corp, or C-corp, just put your business name on Line 1.

Lines 5 and 6 are for your business address — city, state, and zip code go there. It's as easy as ABC.

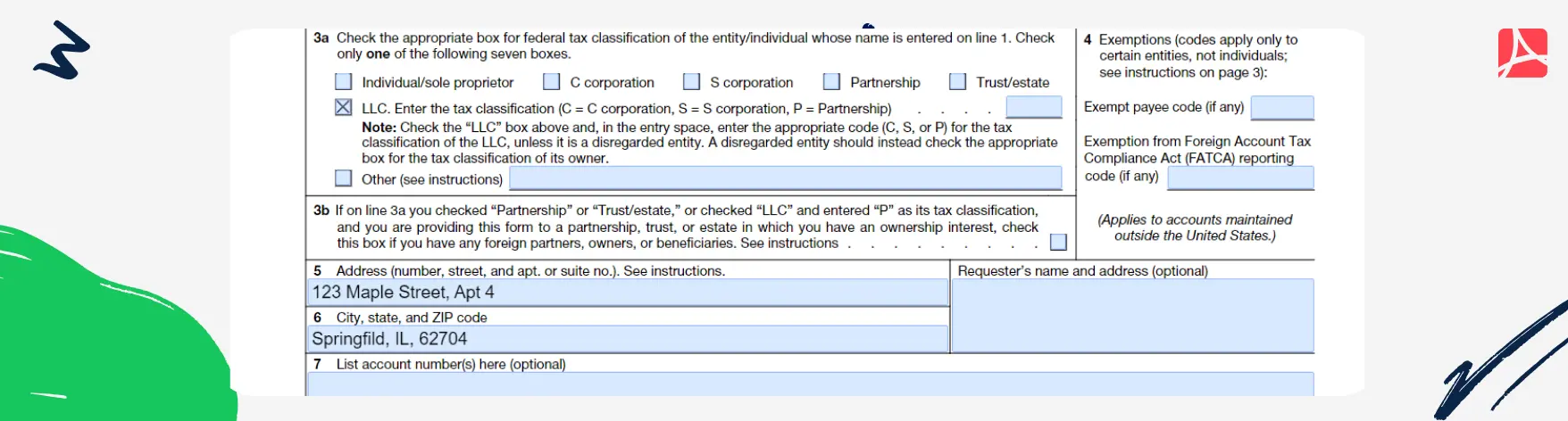

2. Pick the right tax classification

Line 3 is about your tax classification. Selecting the right box here is vital, so let’s break it down simply:

- Single-Member LLC: Mark the first box if you don’t have a S-Corp status.

- Multi-Member LLC: Mark the LLC box and specify the correct type with a letter (S, C, or P).

Examples for Line 3:

- Sole Proprietorships choose “Individual/sole proprietor” or “single-member LLC.”

- Single-member LLCs without S-Corp status choose “Individual/sole proprietorship or single-member LLC.”

- Single-Member LLCs with S-Corp status choose “Limited Liability Company” and write “S.”

- Partnership LLCs choose “Limited Liability Company” and write “P” letter.

- C-Corp LLC pick the 5th box as well and write a letter “C”.

For Line 4, only fill it if your business is a particular type, e.g., a government entity or Real Estate Investment Trust. Check page 3 of the document instructions for the full list.

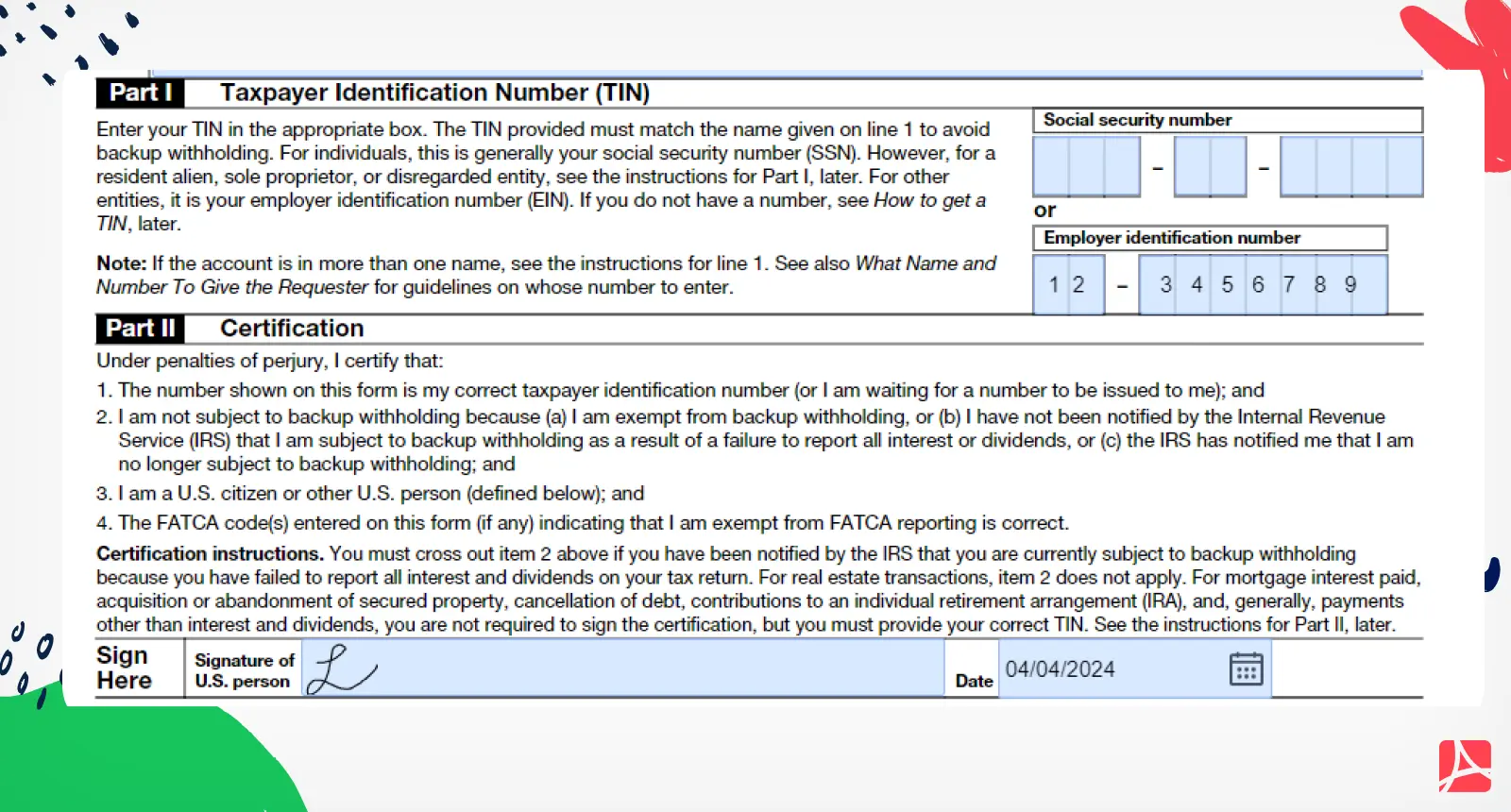

3. Indicate your EIN

When you’re through with the intro, proceed by completing Part 1, which requires your Taxpayer Identification Number (TIN).

Your TIN can be either your:

- Social Security Number (SSN);

- Employer Identification Number (EIN).

If you're a Limited Liability Company without S-Corp or C-Corp status, use your EIN.

If you are a solo LLC, you can choose whether to use EIN or SSN. We recommend applying for EIN even if you don’t have employees because this way you will have a separate tax ID for your business.

If you're a resident alien, not a US citizen, you should not use the W-9 form, but instead use Form W-8 BEN for individuals, or Form W-8BEN-E for businesses.

Finish Part I, then put your signature on the doc.

Once done, send the W-9 to your client — no need to mail it to the IRS. We hope we’ve answered your “How to complete W-9 for LLC?” question. It's actually fairly easy, so go ahead and make the most of our instructions to cope with the task. By the way, if you use PDFLiner for this, you won’t even have to create a W-9 for LLC every time you are required to send it. Instead, you can make it once, store it here, and use it as a template. The only thing you’ll need to change is the date of signature.

W-9 Examples for LLC

Filling out a W-9 form for your Limited Liability Company doesn't have to feel like climbing Mount Everest. Let's explore the following real-life examples that will (hopefully) keep it simple and practically useful for you. Study each W-9 LLC example provided below for better understanding.

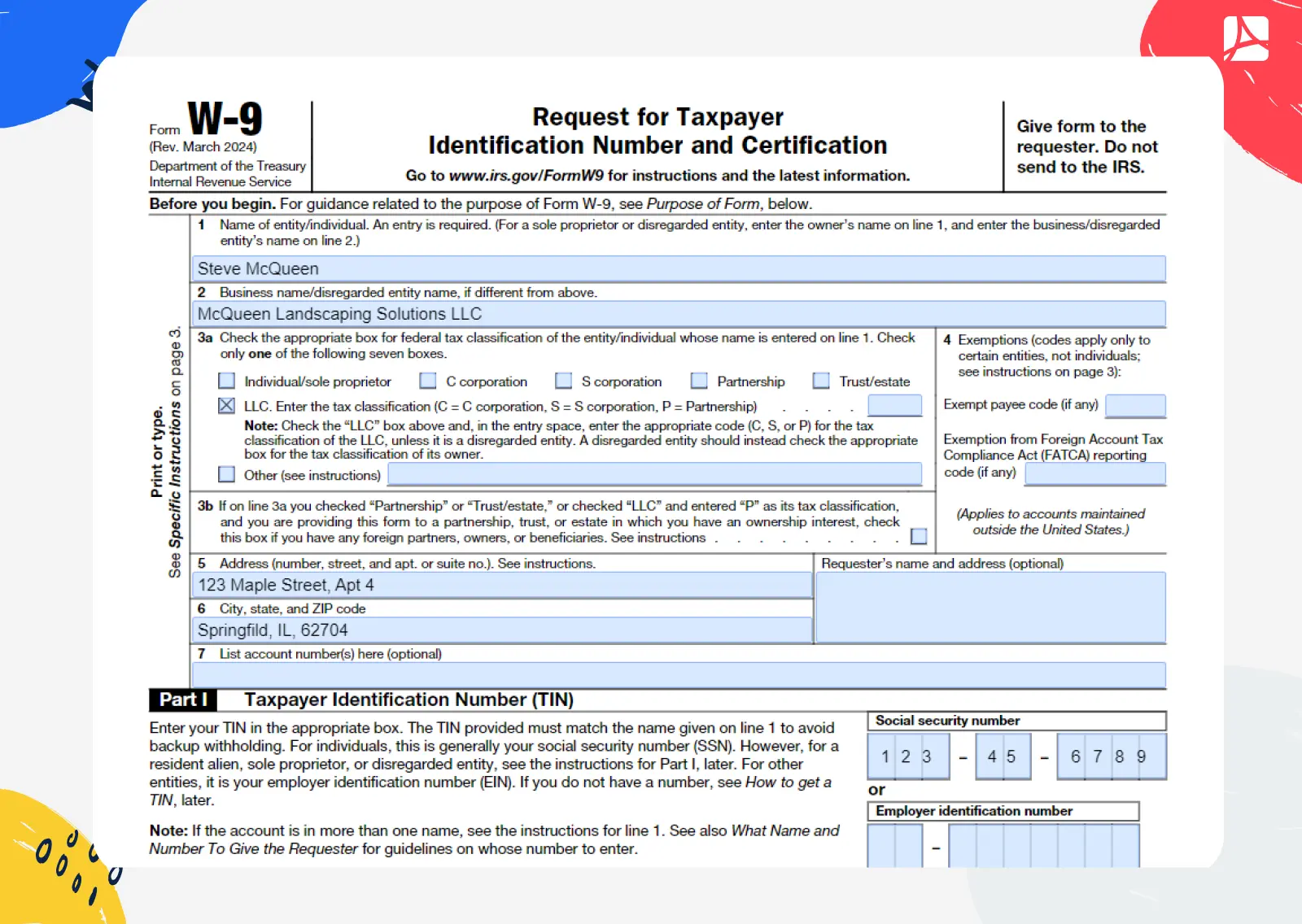

1. Single-Member LLC. Steve McQueen is the owner of McQueen Landscaping Solutions LLC. Here's how he fills in the W-9:

- Steve writes his full name on Line 1.

- For Line 2, he puts down the name of his business, “McQueen Landscaping Solutions LLC.”

- On Line 3, he checks the box for “Individual/sole proprietor or single-member LLC.”

- Steve adds the business address on Lines 5 and 6.

- Writes his SSN in Part 1.

- Signes and dates the form in Part 2.

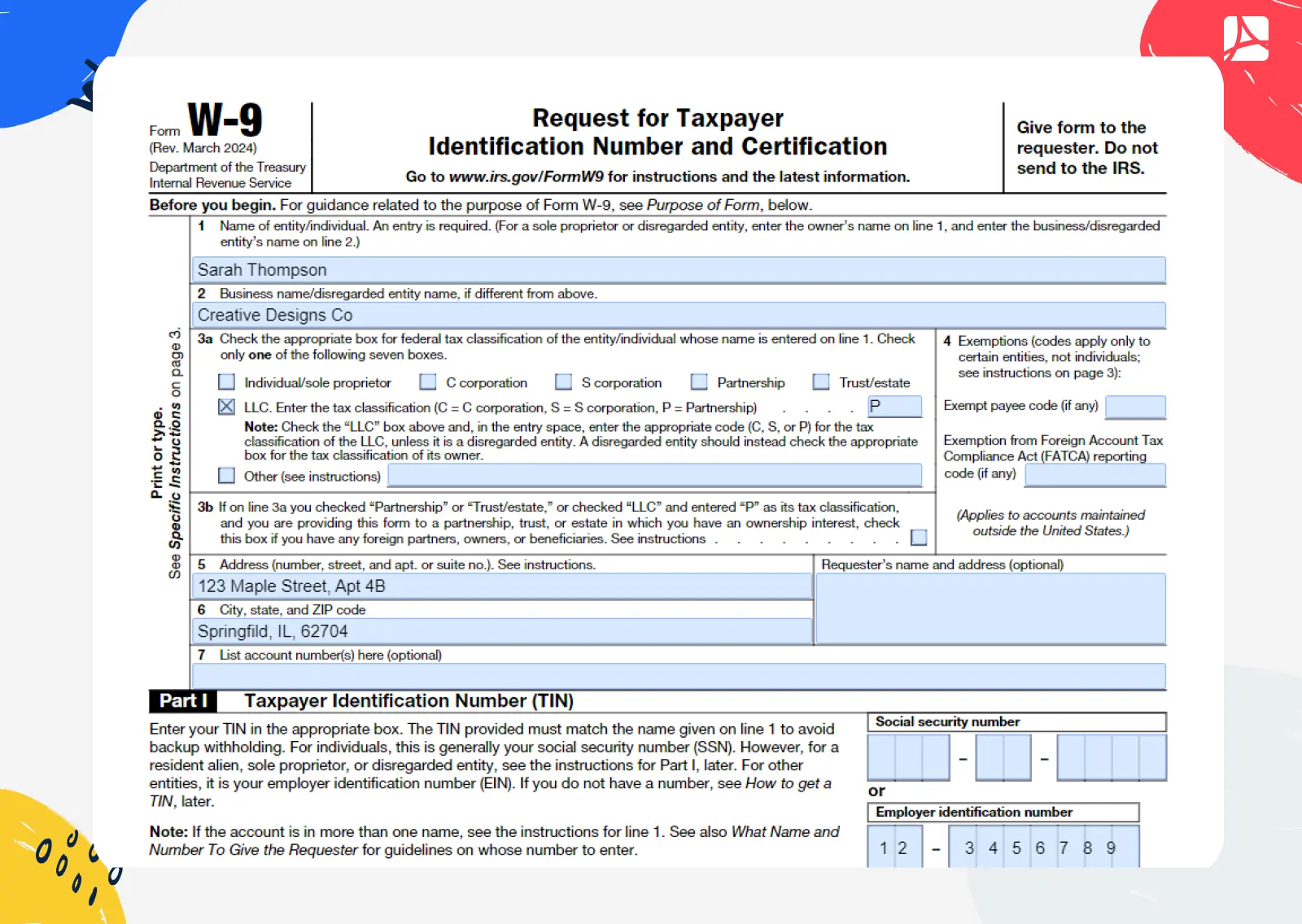

2. Multi-Member LLC. Sarah Thompson and Alex Miller are owners of Creative Designs Co. They fill out their W-9 like this:

- They write “Creative Designs Co.” as their business name on Line 1.

- On Line 3, they check the box for “Limited Liability Company.”

- To specify their tax status as a partnership, they add a “P.”

- Lines 5 and 6 are filled with the business address.

- Write the EIN in Part 1.

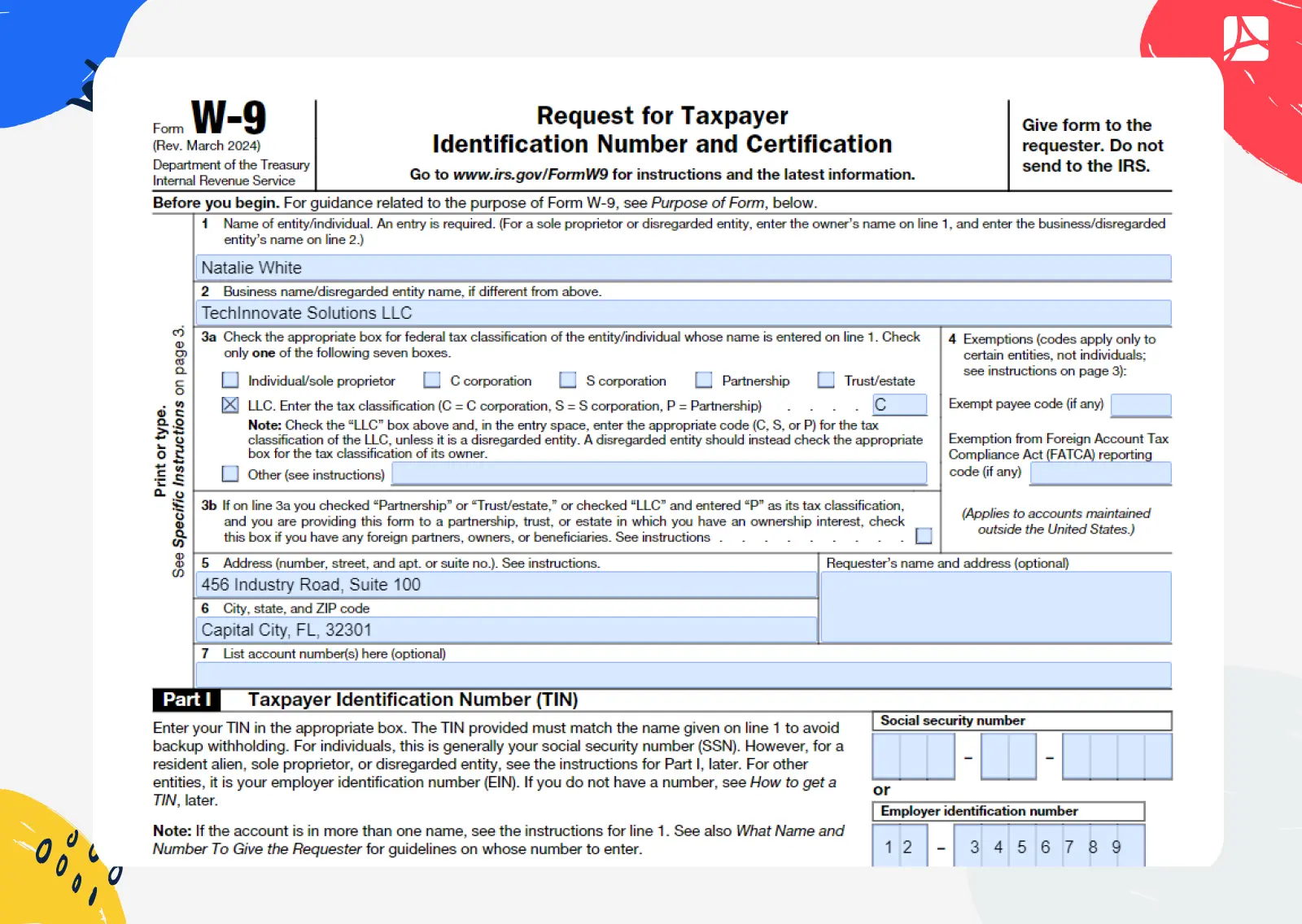

3. LLC as C-Corporation. Natalie White owns TechInnovate Solutions LLC and treats it like a C Corporation. Here's how she completes her W-9:

- Natalie puts down “TechInnovate Solutions LLC” on Line 1.

- For Line 3, she checks the “Limited Liability Company” box and writes a letter “C”.

- Business address goes on Lines 5 and 6.

- Specifies the company’s EIN in Part 1.

Quick tips for all examples

- Keep It Real. Stick to the names your company goes by in official documents.

- Classify With Confidence. Go the extra mile to pick the right tax category on Line 3. Individual, partnership, or corporation — choose correctly.

- Address Accuracy. Your business address is like its home address in the tax world. Be sure to provide the right coordinates on Lines 5 and 6.

- Extra Check for Partnerships. If your firm is doing partnership, don't forget to add that friendly “P” on the tax class line.

- Spell It Out for Corporations. Make it clear if your Limited Liability Company is a corporation by adding a “C” to the tax classification line.

Can I Refuse to Fill Out a W-9?

Not feeling comfortable providing your sensitive information to someone? You can refuse to fill out your W-9. However, if you skip this vital step, brace yourself — there will be a 24% backup withholding fee on your payments. It's like a charge for not providing the needed tax info when required. As a result, your client might give you the side-eye, and your payment amount might be seriously affected. Before you make the final decision, ring up a reliable tax expert for advice. At the end of the day, when it comes to tax issues, a little chat with a professional can save you from big financial problems.

Fill Out Tax Forms Online and Save Your Time

File forms in no time using PDFLiner and concentrate on your business.

Get W-9 Online 65f013686d1834a70e07c82d