-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out PPP Loan Application & Apply Online

.png)

Dmytro Serhiiev

If your team is the heart and soul of your business, and the thought of having to fire people due to the global crisis sends shivers down your spine, you can enter the Paycheck Protection Program (PPP), a loan from the U.S. Small Business Administration that was rolled out to assist companies in keeping their employees on payroll and shoring up against layoffs. In this post, we’ll cover the topic of how to fill out a PPP loan application online.

What Is a PPP Loan Application

The pandemic crisis has influenced companies throughout the world. Small businesses are at the highest risk of bankruptcy and shutting down for good. Fortunately, the U.S. Small Business Administration has taken a variety of measures to help small business owners and self-employed individuals survive through these unprecedented times. SBA loans are among those measures.

Though this financial aid is clearly a loan (meaning it should be returned), SBA claims that it’s fully forgivable. However, it refers only to the case if business owners whose applications have been approved keep their entire staff on payroll and use the government’s finances to cover their companies' most vital needs (e.g. salaries, rent, employee protection, etc.).

In this guide, we’ll walk you through the completion process and pretty much answer your ‘How to fill out a PPP loan forgiveness application?' Filling out a PPP loan application is not exactly a walk in the park. So, keep reading for more information on how to fill out and where to send a PPP loan forgiveness application. Don’t hesitate to hire a professional to help you sort out the form whenever you feel that it’s necessary.

Who Should Fill Out a PPP Loan Application

Wondering if you’re eligible to apply for a PPP loan? That’s a pretty common question. Below, you will find the list of common criteria your business should meet to qualify for your PPP loan:

- your company operated before Feb 15th, 2020;

- your company still operates to serve others;

- you have no more than 500 staff members;

- your organization has several offices, and you have no more than 500 staff members per location.

We’ve mentioned some fundamental PPP loan eligibility parameters, but you should bear in mind that every situation comes with its unique set of circumstances. Therefore, we recommend that you drill down on the issue with your financial and legal teams prior to submitting your PPP loan application online.

How to Fill Out Your PPP Loan Application: Quick Guide

Prior to switching to our payroll protection program application form guidelines, make sure you’re aware of the following aspects. As of today, there are three forgiveness forms:

- 3508 is for any borrower. Basically, the two forms below are the simpler versions of this major file. If you’re self-employed, you can use the simplified version to make the application process easier;

- 3508EZ: you can use this form to apply for forgiveness if your loan amount is over $ 150,000;

- 3508S: you can use this form to apply for forgiveness if your loan amount is $ 150,000 or less;

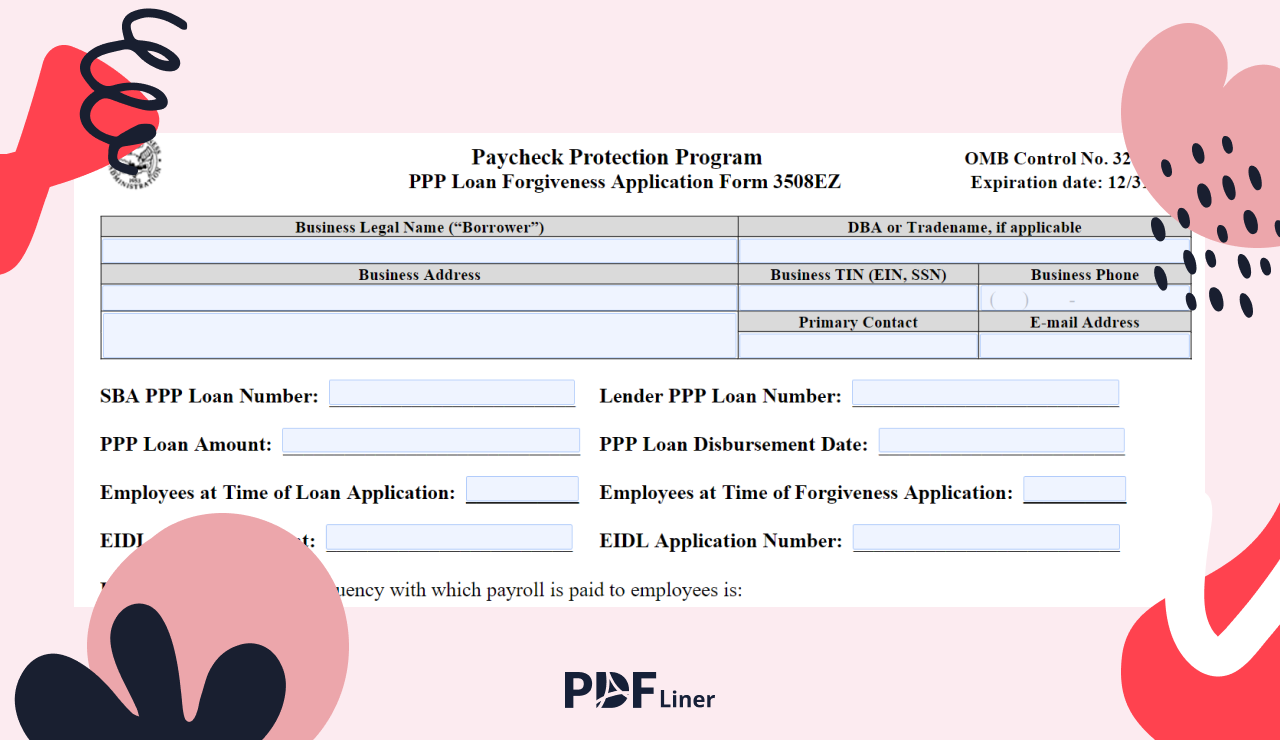

Now, when it comes to the process of completing your PPP loan application form, you should know that all PP loan forgiveness application forms consist of two parts that require your company and loan details, as well as your forgiveness amount request. Find our PPP loan forgiveness application instructions and a quick step-by-step how-to-fill-out guide below.

.png)

1. Indicate your company name.

2. Enter your company address and detailed contact information.

3. Specify if this forgiveness application is your first or second PPP loan.

4. Type your SBA PPP loan number. Get in touch with your lender if you’re not sure how and where to get this number. The same goes for the lender PPP loan number field.

5. Indicate the full loan amount you received (PPP loan amount).

6. Enter the date when the money arrived in your bank account. In case the money came in stages, just point out the first date.

7. Indicate the number of your staff members.

8. Don’t forget to sign the form.

Keep in mind that even though our team does its best to constantly monitor and update all our forms as soon as the new details go online, this information might change almost in the blink of an eye. Therefore, make sure you use our blog for informational purposes and only rely on your lawyers when it comes to monitoring your PPP loan application deadline and generally making any financial decisions.

How to Sign a PPP Loan Application Form

If the idea of managing your files in just a few taps and saving your time immensely sounds good to you, then you should definitely try signing your PPP loan application form (as well as other files) via the PDFLiner e-signature tool. With this tool, you get to enjoy a streamlined, paperless workflow, while cutting down on document-related costs and tremendously speeding up your document processing.

Here’s a quick guide on e-signing your PPP loan application form via PDFLiner:

1. Press the ‘Sign Field' button.

2. Choose how you want your signature generated: Type, Draw, or Upload.

3. Save the changes you’ve just made, and that’s about it.

.png)

Sign a PPP Loan Application Form

How to File a PPP Loan Application

Wondering where to apply for a PPP loan? First and foremost, you should know that applications for loan forgiveness are processed by your lender. So, fill out the form and send it to your lender. Your lender, in turn, is required by law to respond to the application within two months. Bear in mind that in case you’ve received two PPP loans, you are to submit two separate PPP loan application forms.

Feel free to submit your application through the SBA direct forgiveness portal or via any existing SBA lender. When your application is finalized with the SBA representative, they will place it into their lender marketplace where a PPP lender gets to accept it and offer you a PPP loan. After that, you will get a confirmation email from the SBA representative. Read the instructions in that email carefully in order to get the loan.

FAQ

How do I fill out a self-employed PPP application?

Generally speaking, the procedure is pretty standard. You fill out all the necessary fields, add a signature, and submit the form. The details of the fill-out process depend on the unique circumstances of your case and i.e. the variation of the form you’ll need to choose out of the three ones we’ve mentioned above. To identify which form variation is right for you, take your loan amount into consideration. If it’s $ 150,000 or less, use Form 3508S. If the loan amount is over $ 150,000, use Form 3508EZ.

What should I submit with the PPP application?

The paperwork you’re going to deal with when preparing what’s necessary for submitting your PPP application is going to be intense (especially if your PPP loan is for an amount larger than $ 150,000). For example, you’ll need to provide the documents verifying how the loan funds were spent, e.g. mortgage statements, list of all employees on your payroll, utility bills, etc.

Which documentation do I need for my PPP loan?

The exact number of documents needed depends on how you used your PPP financial aid. Still, the standard list invariably includes your bank account statements, photo ID (e.g. driver’s license), as well as your SBA loan number.

How do I fill out a second PPP loan?

First, make sure you’re eligible for a second-draw PPP loan. To qualify, you’ll need to make sure you’ve used or allocated the full amount of your first-draw PPP loan. Furthermore, you need to have less than 300 employees and provide facts to prove that your profits have dropped by at least 25%.

Can I fill out a PPP loan application online?

Yes, you can easily complete your PPP loan application online via PDFLiner. To do that, you need to register with the service, find the necessary form template via our extensive catalog or upload your own template, and then make the most of all the tool’s features to fill out the form and save lots of time along the way.

I have questions left on the topic. Where can I find more answers?

Consult with an accounting specialist that has vast experience with the forms you need under their belt. Many experts have unlimited access to professional guidance that might come in handy. This approach can be a very good investment in saving your business during these turbulent times.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!