-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get Funding for Real Estate Business

Are you passionate about learning how to start a real estate business? Want to know how to finance your venture? We’ve got you covered! In this post, we will explore the best ways to get funding for real estate operations. From traditional loans to alternative financing options, we will delve into the strategies and documents you need to secure the capital required to start your realty journey. Get ready to unlock valuable insights and pave the way to success in the dynamic world of real estate entrepreneurship. Read on to learn more about successful real estate financing.

5 Ways to Get Financing for Your Real Estate Business

Before we switch to the main topic, take a look through the following basic list of document templates typically needed when seeking financing for real estate business:

- Lean Business Plan Template for Startups;

- Seller Financing Agreement;

- Loan Agreement;

- Small Business Loan Agreement Template;

- Real Estate Business Plan.

Make the most of these templates when preparing your docs. This will save heaps of your precious time. Now, we will let you in on the effective ways of how to start a real estate business. If you would like to know how to start a business and what you need to know in general read other articles from our blog.

1. SBA Loans for Real Estate Financing: Pros & Cons

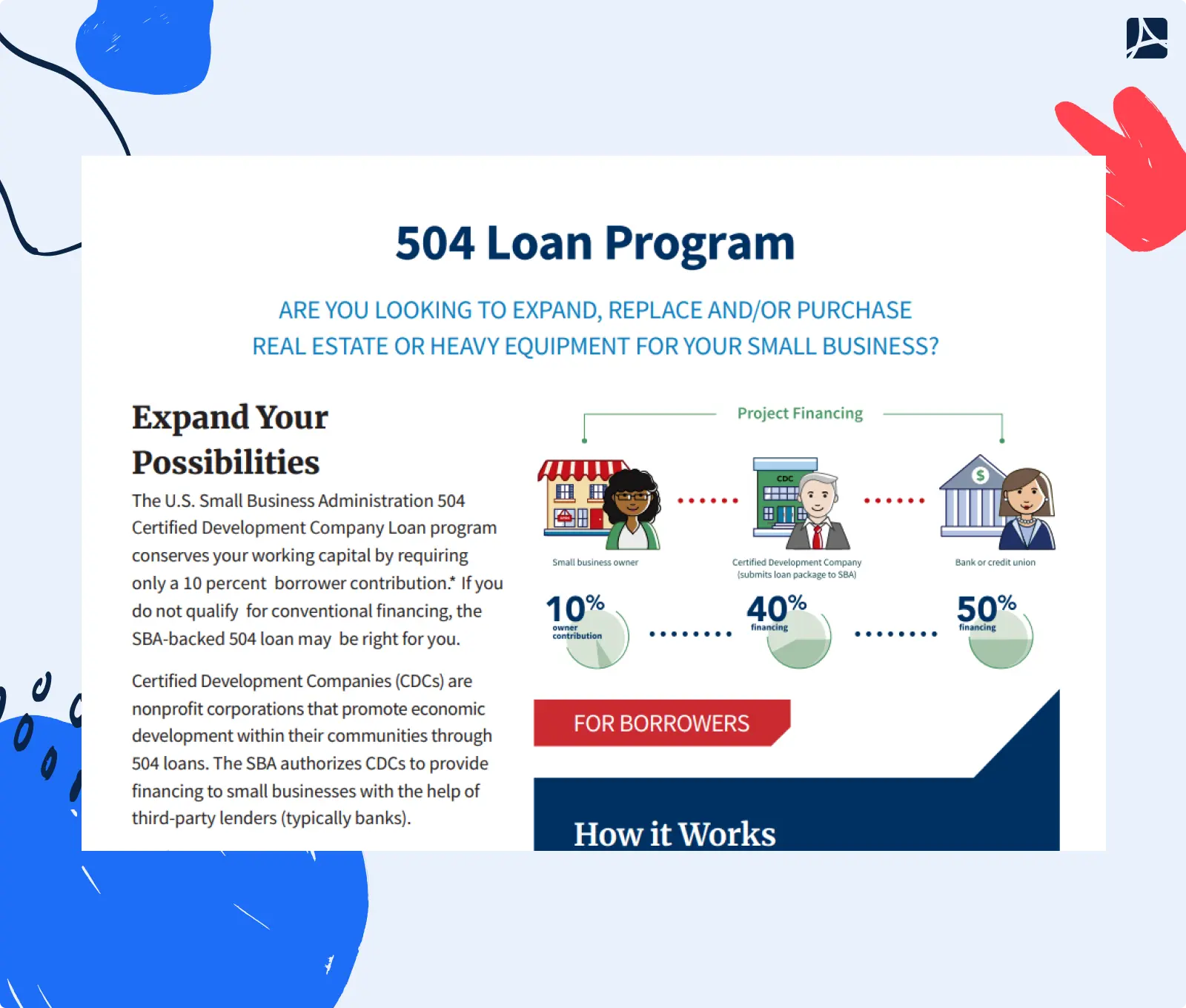

SBA loans, such as the SBA 7(a) Loan Program and SBA 504 Loan Program, can be advantageous financing options for real estate businesses.

Here are some perks of SBA loans to consider:

- Favorable Terms. SBA loans often offer longer repayment terms, lower down payment requirements, and competitive interest rates compared to traditional commercial loans.

- Accessible to Small Businesses. SBA loans are specifically designed to support small businesses, making them more accessible for entrepreneurs entering the real estate industry.

- Diverse Use of Funds. SBA loans can be used for various real estate purposes, including property acquisition, construction, renovations, or refinancing existing debt.

- Boosted Cash Flow. Longer repayment terms on a loan for real estate business can result in lower monthly payments, which can enhance your cash flow.

The drawbacks of SBA loans are as follows:

- Lengthy Application Process. These loans involve a comprehensive application process, including detailed financial documentation, business plans, and personal guarantees. This can result in longer processing times.

- Strict Eligibility Criteria. SBA loans have specific eligibility requirements, such as demonstrating good credit history, sufficient cash flow, and collateral. Startups and businesses with weak financial profiles might face challenges in qualifying.

- Limited Loan Amounts. SBA loans have maximum loan limits, which might not be sufficient for larger real estate projects or high-cost markets.

The following documents are usually needed for SBA loans for real estate investors:

- Business Plan. An in-depth business plan outlining the real estate venture's details, market analysis, financial projections, and management team.

- Personal and Business Financial Statements. Detailed statements reflecting personal and business assets, liabilities, income, and expenses.

- Income Tax Returns. Personal and business tax returns for the last few financial periods.

- Bank Statements. Recent bank statements for your accounts.

- Property Documents. Documentation related to the real estate project, such as purchase agreements, leases, or construction plans.

2. Private Investors / Angel Investors: Pros & Cons

Private investors, also known as angel investors, can be a valuable source of funding for real estate businesses.

Here are some perks of engaging private investors:

- Flexible Financing. Private investors offer flexibility in terms of loan terms, repayment schedules, and potential equity partnerships, allowing for customized financing arrangements.

- Industry Expertise. Private investors often possess valuable industry knowledge and experience that can benefit real estate businesses beyond just financial support. They may offer guidance, mentorship, and connections within the real estate market.

- Quick Decision-Making. Compared to traditional lending institutions, private investors typically have a faster decision-making process, enabling expedited funding for real estate projects.

- Access to Capital. Private investors can provide significant capital injection, enabling real estate businesses to fund property acquisitions, renovations, or expansions that might be challenging to finance through traditional avenues.

Now, here are the drawbacks of engaging private investors for financing real estate business:

- Equity Stake. Private investors may require an equity stake in the real estate business in exchange for their investment, potentially diluting the ownership and control of the entrepreneur.

- Potential Loss of Autonomy. Depending on the agreement, private investors may have a say in major business decisions, reducing the entrepreneur's independence.

- Higher Costs. Private investors typically expect higher returns on their investments compared to traditional loans, resulting in potentially higher interest rates.

- Finding Compatible Investors. Identifying and securing the right private investor for a realty business can be a time-consuming process, requiring thorough due diligence and alignment of goals and values.

Here are the documents needed for engaging private investors:

- Business Plan. A comprehensive business plan pinpointing the realty business's goals, financial projections, market assessment, and growth strategies.

- Financial Statements. Detailed financial statements, including balance sheets, income statements, and cash flow statements, showcasing the business's financial health and potential for growth.

- Legal Documentation. Contracts or agreements defining the terms of the investment, including equity ownership, profit-sharing, or repayment schedules.

3. Real Estate Crowdfunding: Pros & Cons

Crowdfunding has emerged as an innovative way to get finance for real estate development projects.

Here are some crowdfunding perks to consider:

- Access to a Large Pool of Investors. Crowdfunding platforms allow real estate businesses to reach a wide network of potential investors, increasing the chances of obtaining funding.

- Diverse Funding Sources. This method attracts individual investors from various backgrounds, allowing for a diversified funding base and potentially reducing reliance on traditional lenders.

- Lower Barrier to Entry. Crowdfunding opens doors for real estate entrepreneurs who might struggle to access conventional financing due to limited credit history.

- Investor Engagement. Crowdfunding often allows for direct communication between real estate entrepreneurs and investors, fostering engagement, feedback, and potential long-term partnerships.

As for the drawbacks of crowdfunding, they are as follows:

- Regulatory Compliance. Crowdfunding activities are subject to regulatory frameworks, requiring compliance with securities laws, disclosure requirements, and investor protection measures.

- Campaign Management. Running a successful crowdfunding campaign requires effective marketing, communication, and transparency to attract and retain investors.

- Uncertain Funding Outcome. While crowdfunding presents opportunities, there is no guarantee of reaching the funding goal. It requires an appealing project, a well-crafted campaign, and investor interest to secure the desired funding.

The following documents are typically needed for crowdfunding:

- Detailed Project Description. A comprehensive overview of the real estate project, including location, purpose, financial projections, and potential returns for investors.

- Financial Projections. Clear and realistic financial forecasts, outlining anticipated costs, revenue streams, and potential risks.

- Marketing Materials. Engaging visuals, videos, and presentations that highlight the real estate project's unique selling points, value proposition, and market potential.

- Legal Documentation. Compliance documents, such as offering memorandums or disclosure statements, to ensure regulatory compliance and protect the interests of investors.

4. Bank Loans: Pros & Cons

Bank loans, including small business loans, are a common avenue for real estate investors to secure financing. Here are some perks to consider:

- Competitive Interest Rates. Bank loans often offer competitive interest rates, allowing investors to secure financing at more favorable terms.

- Various Loan Options. Banks offer a range of loan programs specifically tailored for real estate investors, providing flexibility and options to meet their specific needs.

- Access to Large Loan Amounts. Banks can provide substantial funding to support real estate projects, enabling investors to pursue larger-scale ventures.

Bank loans come with certain drawbacks, too. Here are some of the cons:

- Stringent Eligibility Criteria. Banks have strict eligibility requirements, including creditworthiness, sufficient collateral, and financial stability, which can be challenging for some real estate investors to meet.

- Lengthy Approval Process. Bank loans often involve a lengthy application and approval process, which can cause delays in securing funding for time-sensitive investment opportunities.

- Personal Liability. In some cases, personal guarantees or collateral may be required, putting personal assets at risk in the event of loan default.

The following documents are typically needed for small business loans real estate investors:

- Business Plan. A comprehensive business plan covering the real estate investment strategy, financial projections, and market overview.

- Financial Statements. Detailed financial statements to demonstrate financial stability and viability.

- Property Documentation. Documentation about the property, such as purchase agreements, appraisals, and surveys, to provide information on the investment opportunity.

- Personal and Business Tax Returns. Personal and business tax returns for the past few years to assess income stability and financial health.

5. Seller Financing: Pros & Cons

Seller financing, also known as owner financing, offers a unique avenue for real estate businesses to obtain financing.

Here are some perks to consider:

- Increased Access to Financing. Seller financing provides an alternative option for real estate businesses that might face challenges securing traditional loans from banks or lenders.

- Flexible Terms. Sellers can offer more flexible terms such as lower down payments, extended repayment periods, and customizable interest rates, allowing for tailored financing arrangements.

- Streamlined Process. Seller financing often involves a simplified application and approval process, bypassing some of the stringent requirements of traditional lenders.

- Potentially Lower Closing Costs. Seller financing can result in lower closing costs as it eliminates the need for certain fees associated with conventional loans.

You can find potential disadvantages of this method below:

- Limited Pool of Properties. Not all sellers are open to providing financing options, limiting the availability of properties that can be acquired through seller financing.

- Potential Higher Purchase Price. Sellers may include the cost of financing within the purchase price, resulting in a higher overall cost compared to traditional financing methods.

- Risk of Default. Sellers bear the risk of default if the buyer fails to make timely payments, potentially leading to legal complications and property repossessions.

These documents are typically needed for seller financing:

- Purchase Agreement. A detailed agreement with the terms of the sale, including the purchase price, down payment, interest rate, repayment schedule, and any other specific terms negotiated between the two sides of the deal.

- Promissory Note. A legal document that establishes the borrower's obligation to repay the loan, including the loan amount, interest rate, and repayment terms.

- Deed of Trust or Mortgage. The document that secures the property as collateral for the loan, providing the seller with a legal claim if the buyer defaults on payments.

Final Thoughts

All in all, securing funding for your real estate business is a critical step toward success. By exploring the five afore-described ways to obtain financing — SBA loans, private investors, crowdfunding, seller financing, and bank loans — you have a diverse range of options to choose from. Each method presents unique perks and drawbacks, so careful consideration and thorough preparation are essential.

Remember to gather the necessary documents or to use document managment system for real estate. And always weigh the benefits and potential risks before making your financing decision. With the right funding in place, you'll be able to follow your dreams and unlock opportunities for growth and profitability.

FAQ

How do I find investors?

Finding investors for your real estate business requires a proactive approach. Start by networking within the industry, attending real estate events, and joining professional organizations. Utilize online platforms and crowdfunding websites to connect with potential investors. Additionally, consider partnering with a mentor or seeking the guidance of a financial advisor who can provide valuable insights and introductions to potential investors in the realty sector.

How much money is needed to start a real estate business?

The amount of money needed to start a real estate business can significantly vary, depending on such factors as location, scope of projects, and market conditions. It can range from a few thousand dollars for smaller-scale investments to millions for larger ventures. Conducting thorough market research, creating a detailed business plan, and assessing your specific goals and objectives will help determine the initial capital requirements. It's advisable to consult with financial advisors or industry professionals to get a more accurate estimation for your specific real estate business.

Is real estate a good business to go?

Real estate can be a lucrative and rewarding business to pursue. It offers the potential for long-term growth, passive income, and wealth accumulation. However, success requires thorough market research, financial planning, and a solid understanding of the industry. Assess your resources, risk tolerance, and commitment before venturing into the real estate business.

Save Your Time with PDFLiner

Fill out, edit, sign, and share Real Estate documents online!

.png)