-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

![Picture of Legal Aid Queensland Application]() Legal Aid Queensland Application

Legal Aid Queensland Application

![Picture of Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors]() Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

![Picture of Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment]() Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

![Picture of Trustee Resignation Form]() Trustee Resignation Form

Trustee Resignation Form

![Picture of Pennsylvania Last Will and Testament Form]() Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

![Picture of AU Mod(JY), Parent(s), Guardian(s) details]() AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

![Picture of Wisconsin Last Will and Testament Form]() Wisconsin Last Will and Testament Form

Wisconsin Last Will and Testament Form

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How To Import 1099 Form Details From CSV/Excel File: A Step-by-Step Guide

.png)

Dmytro Serhiiev

Last update: Jan 24, 2025

Managing 1099 forms can be time-consuming, especially when filing for multiple contractors. With PDFLiner's bulk upload feature, you can save hours compared to manual entry. This guide explains how to streamline the process using free 1099 CSV templates for 2024, ensuring accuracy and ease of use.

Key Takeaways

- Download the free templates: Use the 1099-NEC template or 1099-MISC template to simplify data entry.

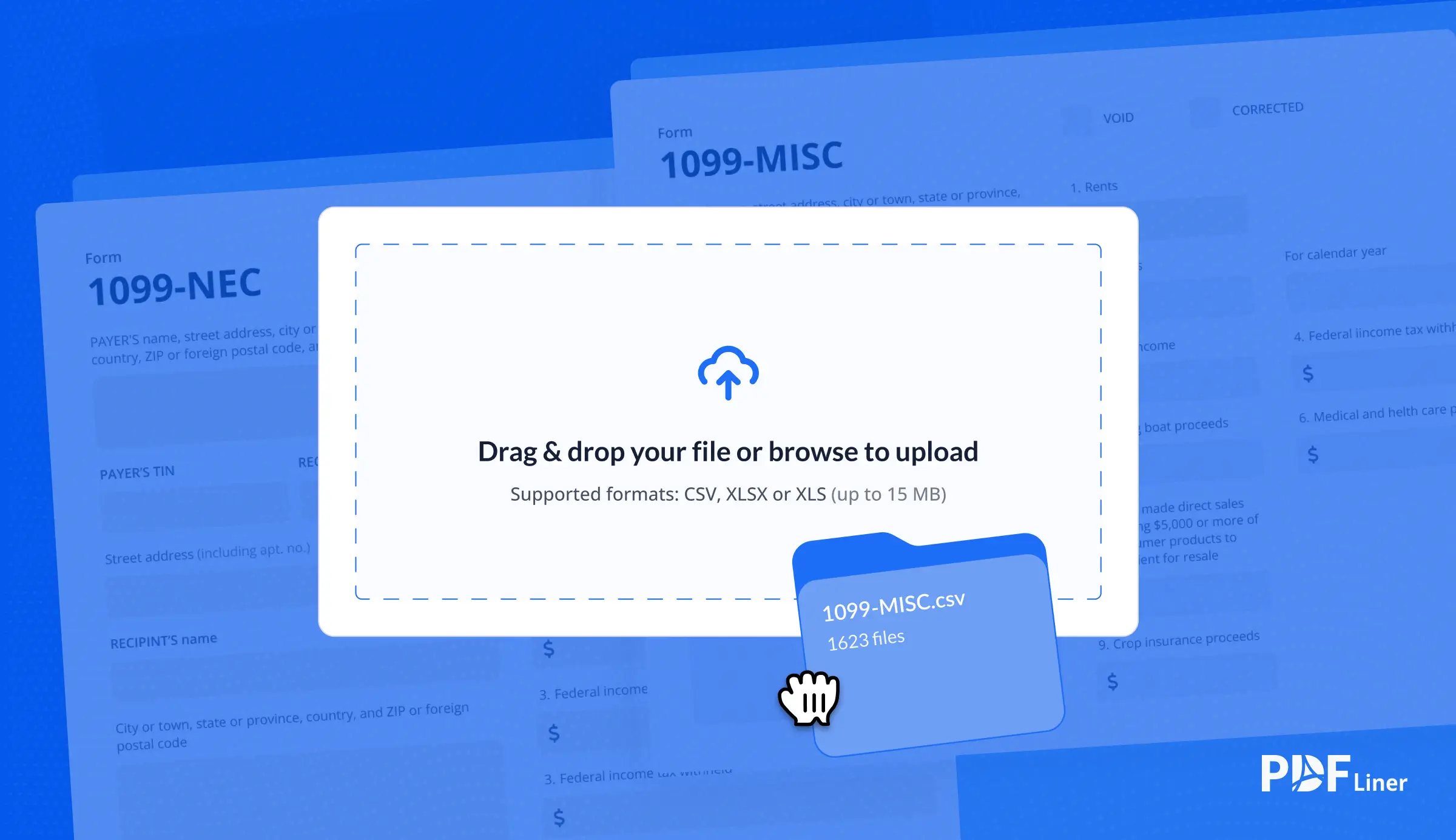

- Upload and validate: Drag and drop your completed file for instant validation.

- Save time: Reduce manual effort and complete bulk filings in minutes.

- Error management: Easily identify and correct errors with the downloadable report

Step-by-Step Guide to Importing 1099 Form Details

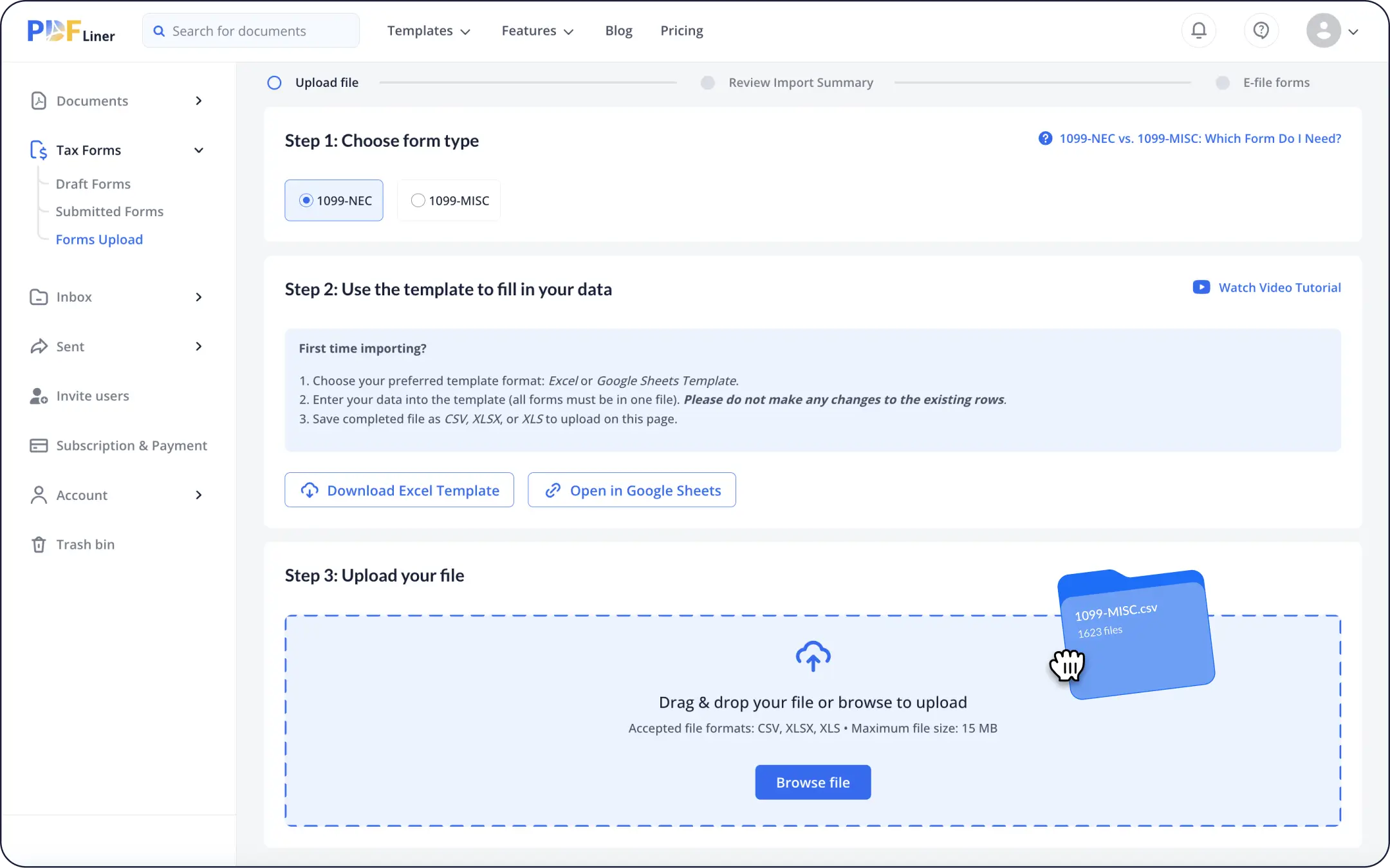

PDFLiner provides free 1099 Excel templates that come with clear instructions, making data entry straightforward. You can choose between the Excel format or the Google Sheets version, depending on your preference. These templates are designed to simplify the process, ensuring that you enter the correct information in the right fields.

Step 1: Log in or create an account

Visit PDFLiner and log in to your account. If you’re new, sign up for free to access the bulk upload feature.

Step 2: Access bulk forms upload

Navigate to the bulk forms upload page in your dashboard. Select your desired 1099 form type:

- 1099-NEC: For non-employee compensation over $600 (e.g., freelancers, contractors).

- 1099-MISC: For other payments like rent, prizes, or awards.

Step 3: Download and prepare the template

Download your preferred template in Excel or Google Sheets format. The templates include detailed instructions for each field:

- Payer section: Enter your Taxpayer Identification Number (TIN), business name, and address.

- Recipient section: Add the recipient's TIN, name, and address.

- Payment section: Enter the income amounts, including any federal income tax withheld and state filing details, based on the type of payment and the specific 1099.

Save the file as CSV, XLS, or XLSX after filling it out.

Step 4: Upload the completed file

- Drag and drop your file into the upload area or click `Browse File` to select it from your computer.

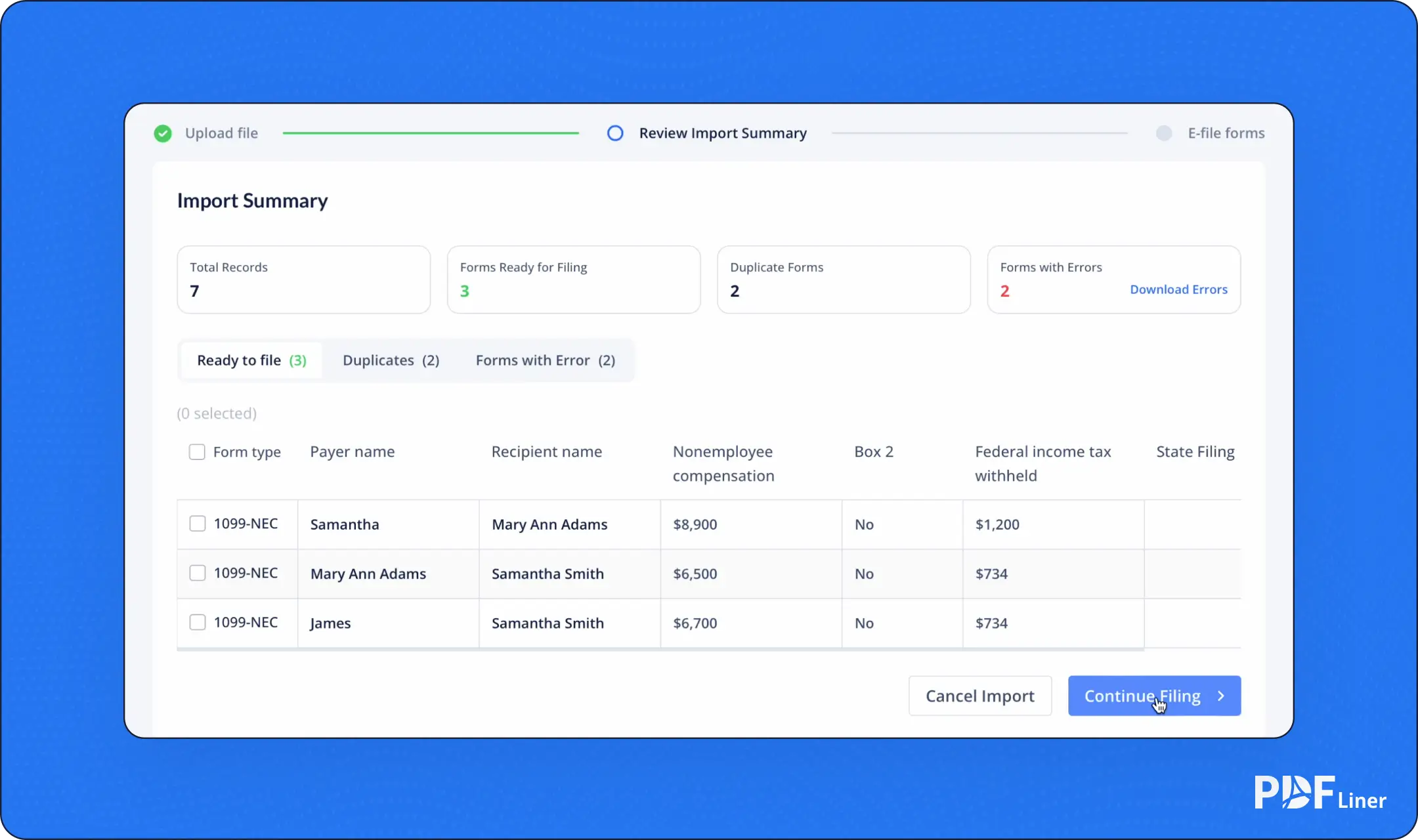

- PDFLiner will automatically validate the data and show a summary of:

- Forms ready for filing

- Duplicate entries

- Errors requiring attention

Step 5: Correct errors (if any)

- Download the error report to fix issues in your original file.

- Re-upload the corrected version or proceed with valid forms while addressing errors later.

Step 6: Finalize and file

Once the forms are validated, click `Continue Filing` to move them to the draft page for review. From there, you can e-file directly with the IRS.

Exporting Data from Accounting Software

Use our templates to transfer form data from your accounting software easily. If you’re using accounting software such as QuickBooks, Xero, FreshBooks, Bill.com, Zoho Books, Sage, or Gusto, exporting data for 1099 forms has never been easier. These platforms allow you to generate detailed reports with the necessary information, such as payer and recipient details, payment amounts, and tax details.

Benefits of templates:

- Predefined fields tailored for 1099-NEC and 1099-MISC.

- Seamless integration with exported data from accounting software.

Using our preformatted templates ensures compatibility and streamlines the process of preparing multiple forms for e-filing. Visit the bulk upload page to download the templates and get started.

Ready to Simplify Your 1099 Excel/CSV Templates for 2024?

Start today by visiting PDFLiner’s bulk upload page. Watch our video guide for a visual walkthrough.

Streamline your 1099 form filing process and ensure accuracy with PDFLiner’s user-friendly templates and tools.

Can I use any file format to upload my 1099 form details?

No, you need to use a supported file format such as CSV, XLS, or XLSX. You can download free templates for 1099-NEC and 1099-MISC from PDFLiner to ensure compatibility.

Do I need to create an account to use the bulk upload feature?

Yes, you need to either login or create a free account on PDFLiner to access the bulk forms upload feature and other tools.

How does PDFLiner validate the uploaded forms?

PDFLiner automatically checks your uploaded file for duplicates, missing information, and formatting errors and validates it according to IRS business rules to ensure compliance. It then generates a detailed summary and an error report, if necessary, so you can quickly resolve any issues.

Can I edit individual forms after uploading them?

Yes, once the forms are uploaded and validated, you can review and edit individual forms on the draft page before submitting them for e-filing.