-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Sign 1040 for Quick and Effortless Submission

.png)

Dmytro Serhiiev

The IRS 1040 form is the main tax reporting form for individuals who reside in the US. In case you’ve been wondering about how to get a 1040 form, we offer a PDF version of the form and a comprehensive guide on how to do it. But how do you sign your 1040 form if you are filing it electronically? Read below to find out how and where to sign 1040 forms to make sure they are eligible for submission.

Sign 1040 Online 656f2839815ba38085013bdd

How to Sign 1040 Online

In order to go online and sign a 1040 form as a self-preparer or attach your signature to a report prepared by your tax professional, you will need to use a PDF document version of this form that contains fillable fields. This also applies if your question is how to sign 1040 for deceased taxpayers — this can be done by a spouse or legal representative of the person who passed away.

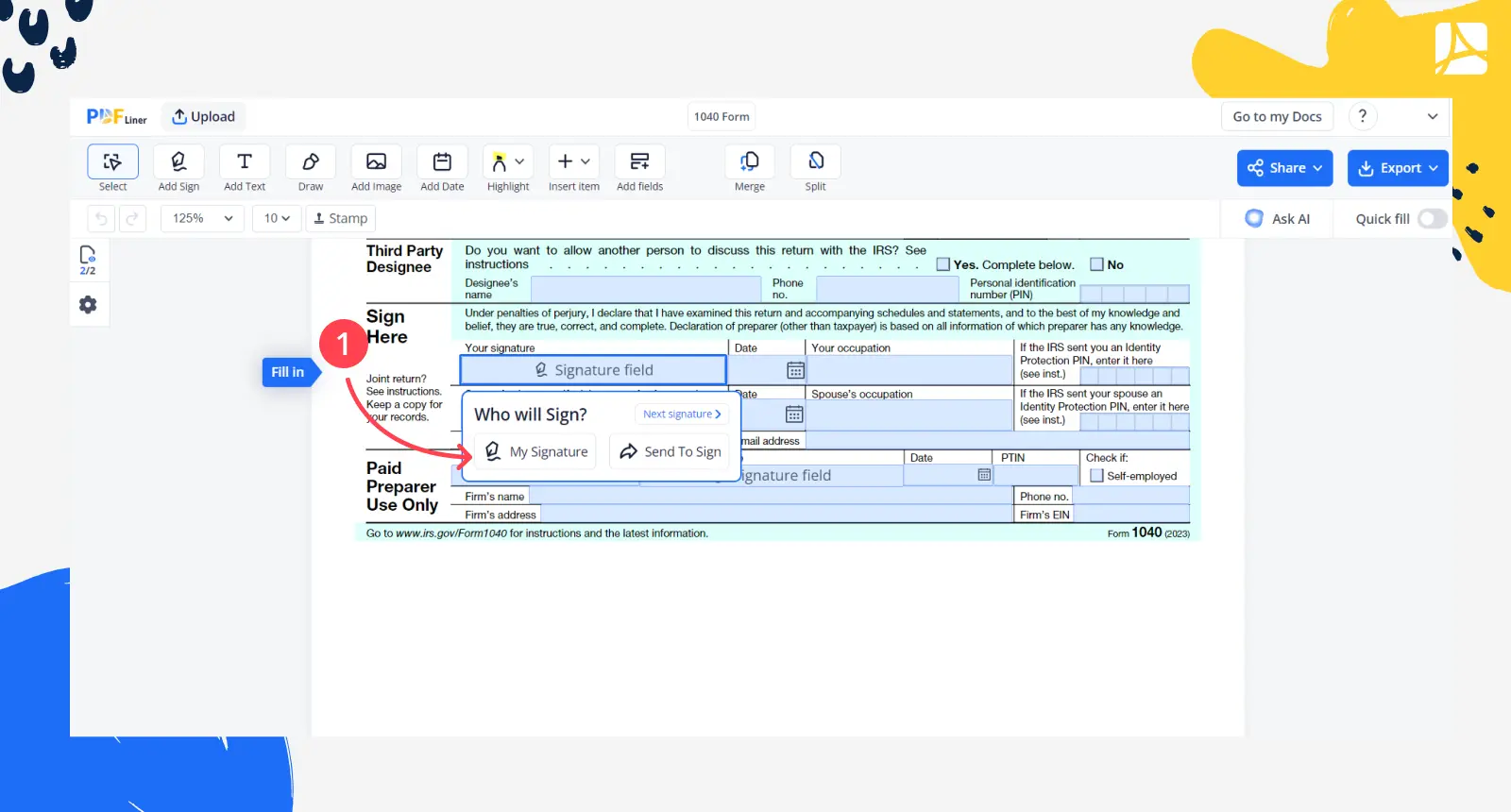

After completing the blank PDF online or uploading one with all the data filled in, proceed to sign the tax return form. PDFLiner offers extensive Sign PDF Online functionality that’s highly intuitive to navigate. When you go to the respective section of the website, you’ll see the platform’s PDF editor with a toolbar on the top of the page.

Step 1: Scroll to the end of the second page, click on the Sign Field and select My Signature. Also, you can select Send for Signature so that the other party can receive the document and sign it.

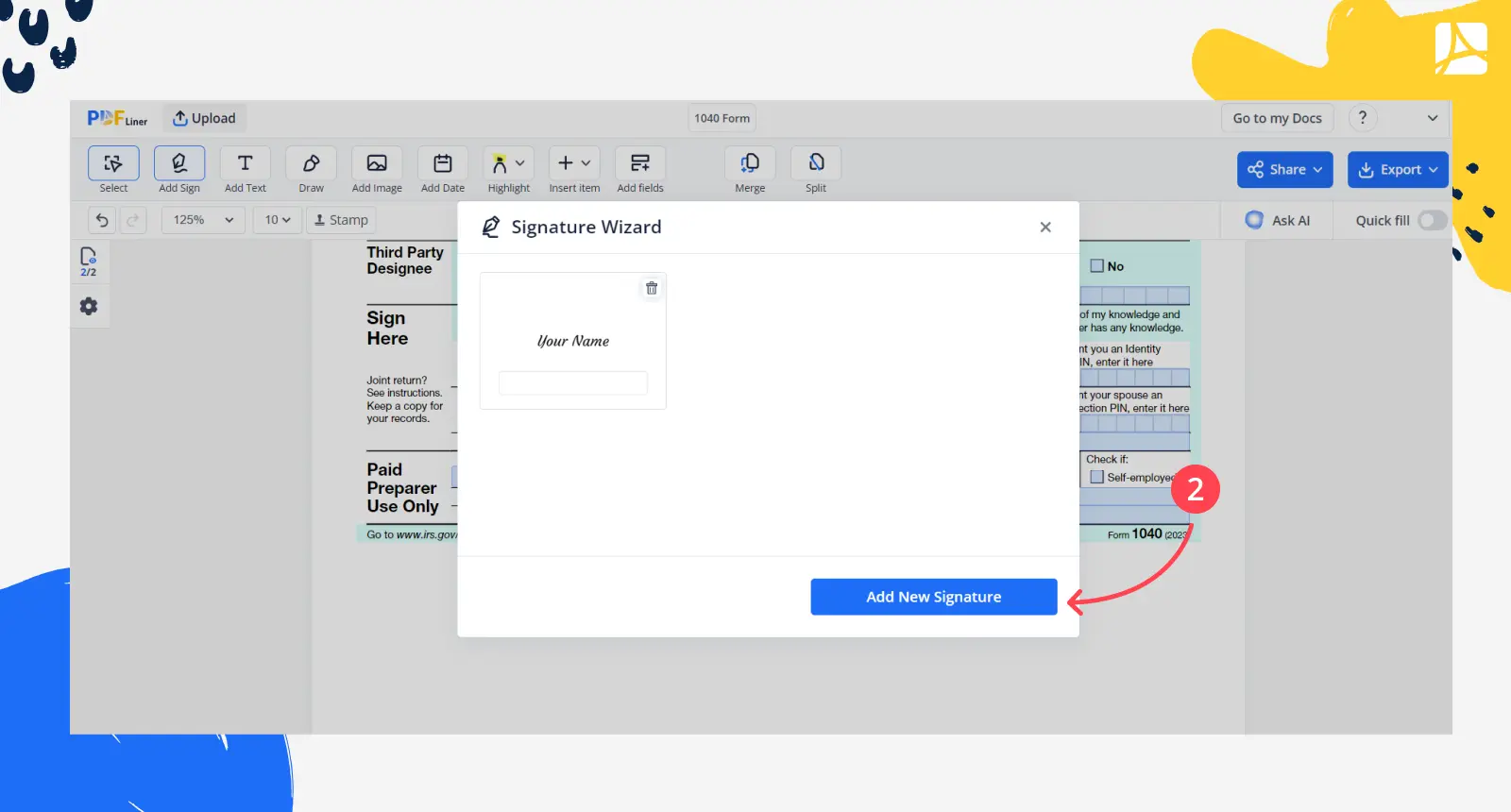

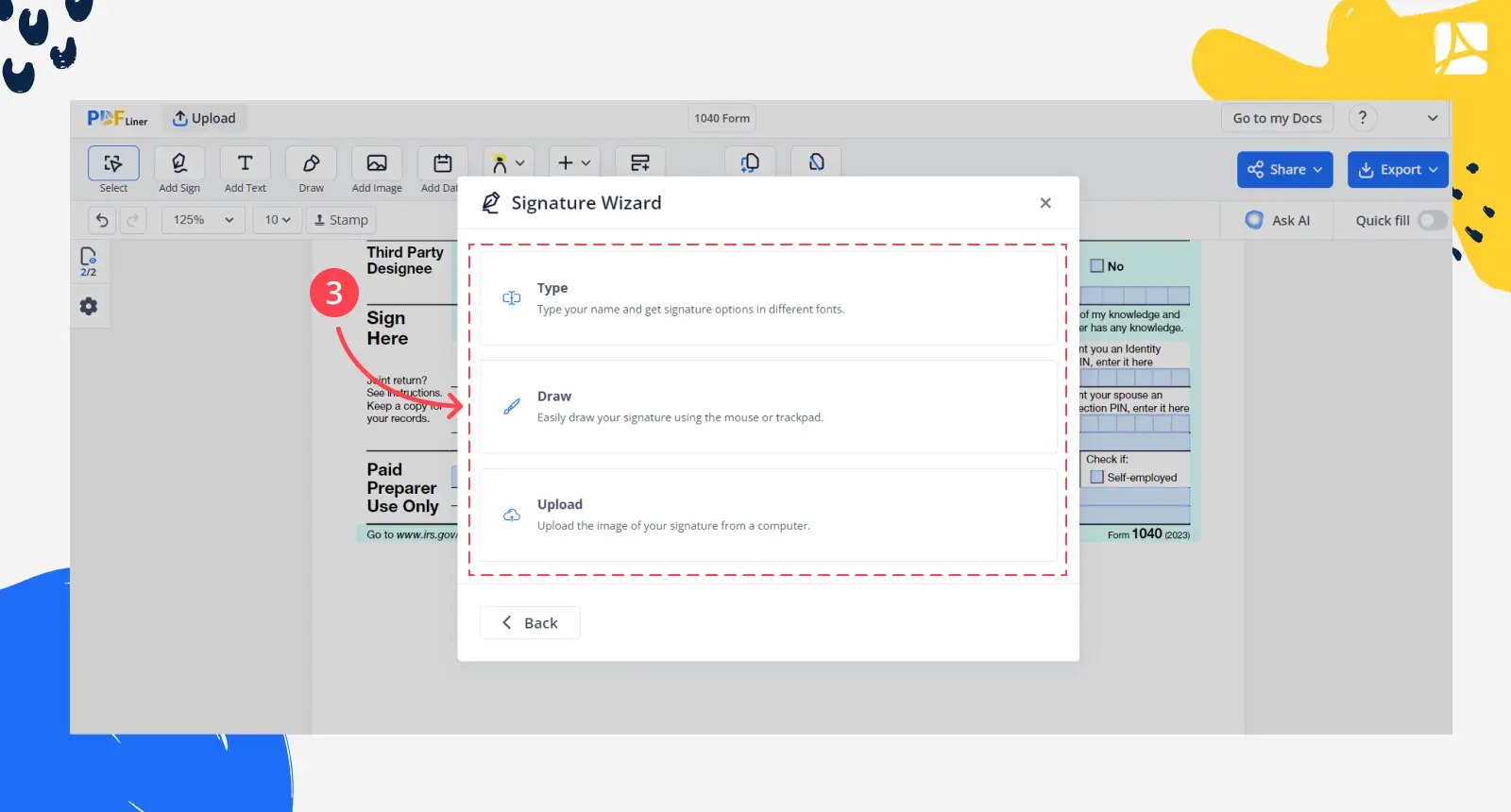

Step 2. You’ll see the so-called Signature Wizard. This section stores any previous signatures that you may have used if you are a returning user. Alternatively, you can use it to quickly create a new electronic signature. In order to do it, click the "Add New Signature" button.

Fillable 1040 656f2839815ba38085013bdd

Step 3: In the latter case, you’ll have four options. You can either type in your name to have it transformed into a handwritten style text, draw a signature with your mouse, or use an image. The image can be uploaded or taken with your camera, which you can trigger directly from the Signature Wizard.

Please note that the instrument is not specific to 1040; you can use it to sign any document.

Signable Form 1040 656f2839815ba38085013bdd

Frequently Asked Questions

This section answers some common 1040 questions.

Do I need to sign 1040?

Yes, you do. You can e-sign 1040 if you choose to submit it electronically.

Does the IRS accept electronic signatures on Form 1040?

It does. E-signs are accepted on 1040 forms.

Can taxes be filed without a signature?

Not in the context of 1040.

Can my accountant sign my tax return?

You are only allowed to submit a tax return signed by an agent in case you are ill/absent from the US or for any other reasons as approved by the IRS.

Sign Your Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Form 1040 656f2839815ba38085013bdd