-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

State Identification Number in 1099 Explained

.png)

Dmytro Serhiiev

Wise men say that understanding taxes is one of the best ways to save money. Saving your money by getting the gist of taxes is exactly what we’ll be assisting you within this article. When you receive a 1099 form, you'll often see a State Identification Number (SIN) listed. This notion identifies the state where the income was earned and helps make sure that taxes are correctly attributed.

Below, you’ll find the basic details about the 1099 payer state number:

- Unique Identifier. The SIN is basically your SSN for tax purposes.

- Area-Specific. Different for each state, which guarantees accurate tax tracking.

- Not Always Present. Not all 1099s have a SIN. Whether you have it or not depends on the specifics of your earnings.

- Useful for Filing. Helps when filing taxes, so keep an eye out for it.

To cut a long story short, the SIN is how your local authorities keep track of their part of the tax money. Now, let’s talk about the differences between the SIN and Federal EIN.

Payer’s State Number vs. Federal EIN

“Taxes, after all, are dues that we pay for the privileges of membership in an organized society,” said Franklin D. Roosevelt. Understanding the SIN and the Federal Employer Identification Number (EIN) can feel quite disorganized. But it’s actually simpler than it seems. Below, we’ve laid out the difference in simple terms.

SIN

- It’s unique to each state.

- It’s used for tax identification.

- It makes sure that local tax obligations are met.

Federal EIN

- It is issued by the IRS.

- It identifies businesses for federal tax purposes.

- It’s basically an SSN for businesses.

With all that said, the Payer’s State Number 1099 is all about state taxes. Each state issues its own, so it varies depending on your current location. As for the Federal EIN, it is used nationwide, assigned by the IRS, and is crucial for federal tax filings. Figuratively speaking, the SIN is your area’s ID card and the Federal EIN is your business’s federal passport. Both are important but serve different tax purposes.

Specifics of the SIN

Taxes are unavoidable, that’s a well-understood fact. Form 1099-wise, the State Payer’s State Number is of great importance. We’ve shared further details for your better understanding of this aspect below:

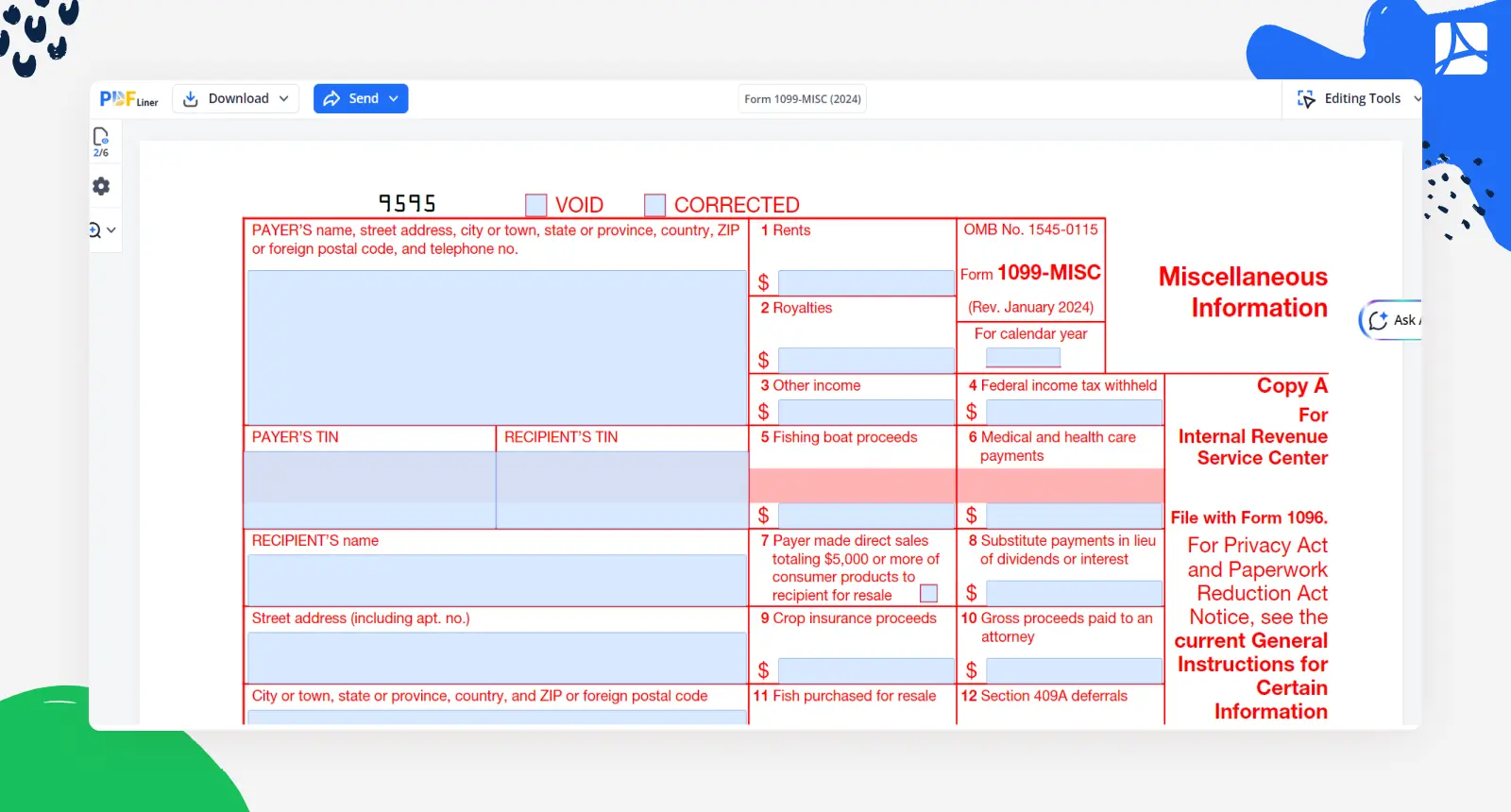

- Let's say you've earned some extra cash from renting out your property or winning a certain prize. You will need to report it on a 1099-MISC form. The SIN comes into play here, making sure your local authorities get their rightful portion of these earnings.

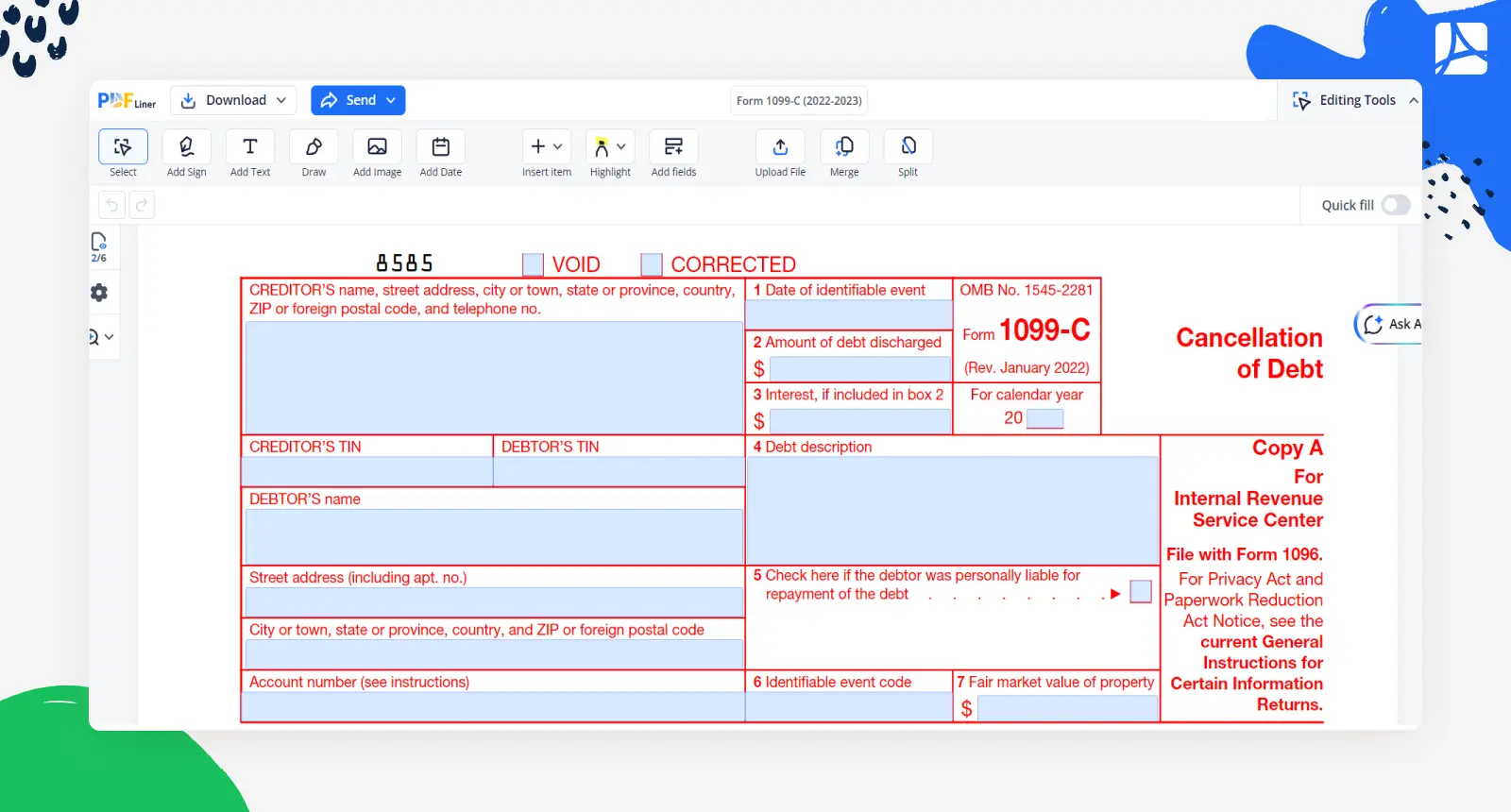

- Now, if you've received interest income from your bank, you'll get a 1099-INT form. The SIN makes sure that the tax from this income is directed to the correct state.

- Are your investments paying off? You'll receive a 1099-DIV for dividends then. Here, the SIN helps your local authorities collect taxes on these profits.

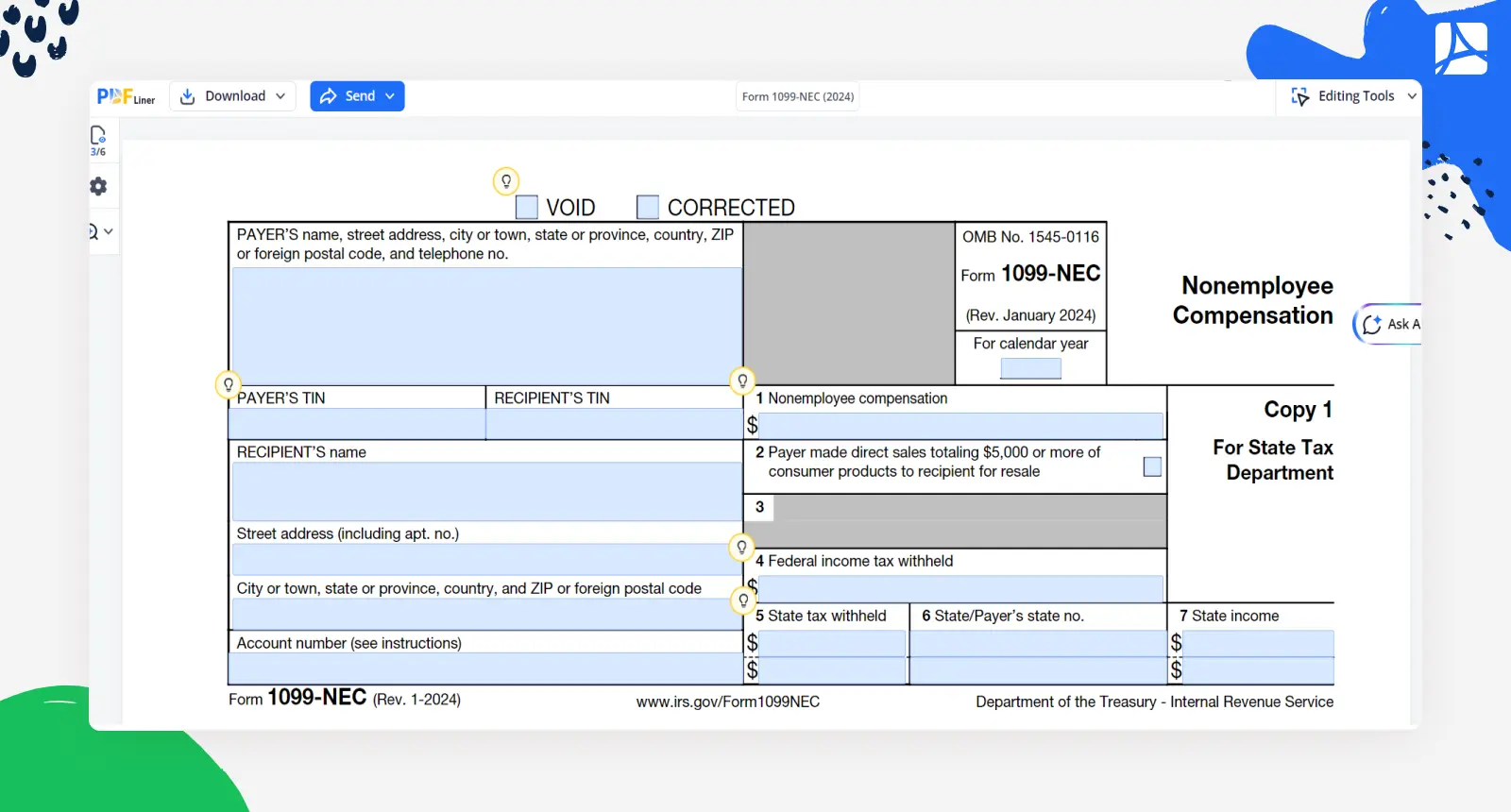

- If you're a freelancer or independent contractor, a 1099-NEC form is utilized for reporting your income. The SIN ensures that even these non-employee compensations are taxed by your state.

All in all, each type of 1099 covers different incomes, but the SIN consistently makes sure your local government gets its cut.

Payer’s State Identification Number 1099: Alternative Names & Purposes

The SIN comes with many names and formats, depending on your whereabouts in the US:

- In California, for instance, it is often referred to as the “State Employer Identification Number” (SEIN). It has 8 digits and is used for businesses that operate in the area.

- In New York, they use the term "New York Employer Registration Number" (NYERN). This one is a bit longer, with 9 digits. It’s how the Big Apple’s tax authorities monitor businesses and make sure they’re contributing their share, too.

- Meanwhile, they have a slightly different approach in Texas. They call it the "Texas Workforce Commission (TWC) Number." This one is also 9 digits long, but it's specifically used for unemployment tax purposes.

- Florida has the “Reemployment Tax Account Number” (RTAN) — a 7-digit figure that businesses use when paying unemployment taxes. Florida's got lots of sunshine and a no-nonsense approach to their tax ID numbers.

- In Illinois, the SIN is the “Illinois Unemployment Insurance (UI) Account Number.” It has 10 digits and is used primarily for unemployment insurance taxes.

Cutting to the chase, the State Taxpayer Identification Number isn't just a series of digits. It's how your state stays on top of taxes, ensuring everyone pitches in their part.

Fill Out and Submit 1099 Forms Online

Complete, validate TIN, and file the form to the IRS in a few minutes.