-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

W-4 vs. W-9: Main Differences

.png)

Dmytro Serhiiev

Knowledgeability makes you powerful — they say it for a solid reason. When it comes to taxes, knowing the ins and outs of the W-4 and W-9 forms can save you headaches down the road. In this article, we’ll explore the main differences between these two paramount tax documents.

Here’s what you can expect:

- Definitions. What are the W-4 and W-9 forms, and why do they matter?

- W-4 Form Explained. How employees use it to determine how much tax should be withheld from their paycheck.

- W-9 Form Explained. How freelancers and contractors use it to provide their taxpayer information to companies.

- Main Differences. A clear comparison of the purposes and use cases of each form.

- Tips for Success. Practical tips for filling out both files accurately and effectively.

What Is the Difference Between a W-9 and a W-4

Are you dealing with taxes in the United States? Then, knowing the difference between a W-9 and a W-4 is of great importance. Both forms are crucial, but they serve different purposes for employers and contractors.

So, what's the main difference?

- W-9. This doc is for independent contractors and freelancers. When a company hires you for a project, they’ll ask for a W-9. It helps them get your Taxpayer Identification Number (TIN) so they can report your earnings to the IRS.

- W-4. This one is for employees. When you get a new job going, your employer will ask you to fill out a W-4. It will tell them how much federal income tax to take out of your paycheck based on your allowances and exemptions.

With that said, here are some useful tips to emphasize the W-9 vs W-4 specifics for you:

- If you're a freelancer, keep your W-9 info handy, because you'll need it often.

- As an employee, update your W-4 whenever your financial situation changes to avoid surprises at tax time.

All in all, if you want to keep your tax life simple, we recommend that you get to grips with the form W-4 and W-9 comparison. It’s going to be very useful for you irrespective of whether you're on a company’s payroll or working for yourself. Now, let’s cover each of these documents in more detail.

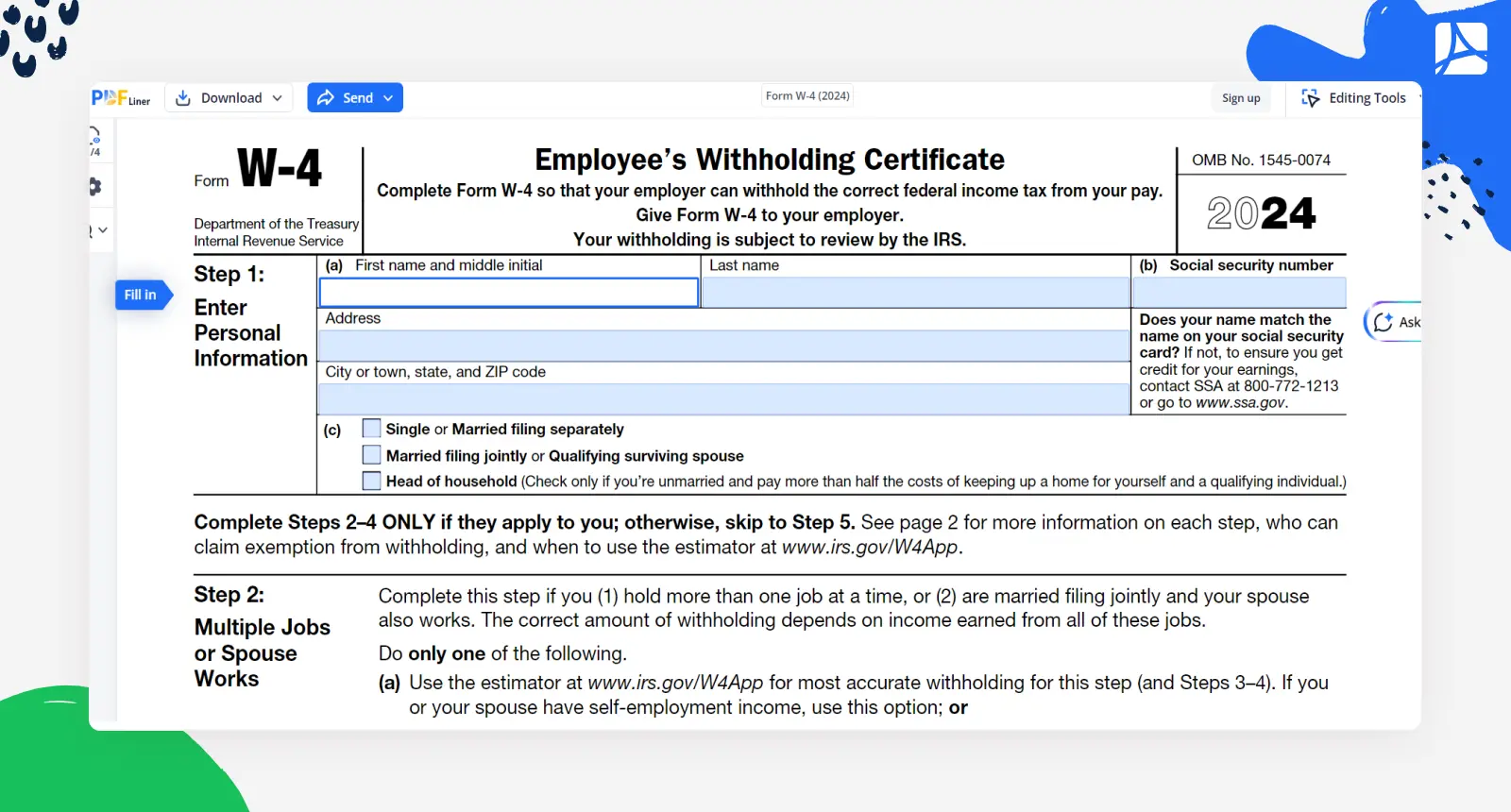

What Is a W-4 Form?

When you start a new job, one of the first forms you’ll come across is the W-4. This document is vital, as it serves to pinpoint how much federal income tax your employer should withhold from what you’ve earned with them.

So, what’s a W-4 all about?

The W-4 form helps your employer figure out the right amount of tax to take out of your earnings, making sure you don’t end up owing a big chunk at tax time — or getting a surprise refund. It’s all about balancing the scales!

Below, we’ve shared the main points to include on your W-4:

- Personal Info. Your full name, address, and SSN.

- Multiple Jobs or Spouse Works. If you have more than one job or a working spouse, this section helps adjust your withholdings.

- Dependents. If you have kids or other dependents, you can claim credits here.

- Other Adjustments. Extra earnings, deductions, and additional withholding amounts.

In simple terms, the W-4 form is a way for you to tell your employer how much tax to hold back from each paycheck. Filling it out correctly can make tax time less of a headache. So, take a few minutes to get it right — you’ll thank yourself later!

Fillable W-4 Forms 65c09d3b9580e4a026001f42

What Is a W-9 Form?

.webp)

If you’re a freelancer or contractor, the W-9 form is what you’ve probably come across. But what exactly is it, and why is it paramount? As a matter of fact, this document is a way for companies to collect your TIN so that they can report how much they’ve paid you to the IRS.

Below, we’ve shared a quick look at the main points of a W-9:

- Personal Info. Your name, business name (if possible), and contact details.

- Taxpayer Identification Number. That implies your SSN or EIN (Employer Identification Number).

- Certification. Your signature, confirming that all the info is correct and that you’re not subject to backup withholding.

Simply put, the W-9 form is your way of telling a company, "Here’s my tax info, so you can report what you pay me." It’s the main piece of the puzzle in the relationship between contractors and the companies they work with. So, fill it out accurately and keep it handy — you'll need it more often than you think!

Fillable W-9 Forms 65f013686d1834a70e07c82d

Detailed Comparison: W-4 Form vs W-9 Form

Below, we’ve shared an easy-to-understand criteria-specific W-9 vs W-4 comparison:

Criterion 1. Purpose:

- W-4. Employees use it to determine tax withholdings.

- W-9. Independent contractors use it to report earnings.

Criterion 2. Who uses it

W-4

- Who Uses It. Employees.

- When It Is Used. At the start of a new job or when financial situations change.

- Why It Is Used. To tell employers how much tax to withhold from paychecks.

W-9:

- Who Uses It. Freelancers and independent contractors.

- When It Is Used. Whenever a company hires you for a project.

- Why It Is Used. To provide tax information so that companies can report payments to the IRS.

Criterion 3. Legal & tax implications

The W-4 and W-9 are distant cousins — related, but with very different lives. Below, we’ve covered their legal and tax implications:

W-4 (For Employees)

- Implications. This form affects how much tax your employer withholds from your paycheck. If you get it wrong, chances are you’ll owe more when tax season comes knocking.

- Legal Stuff. You certify that your info is correct and that you’re eligible for the allowances you claim.

- Tax Drama. Adjusting it can prevent a big tax bill or a sad refund.

W-9 (For Contractors)

- Implications. It gives your taxpayer info to companies you work with. They use it to report what they pay you to the IRS.

- Legal Stuff. You promise that the info is accurate and that you’re not subject to backup withholding.

- Tax Drama. Forgetting this can lead to a mess, so fill it out pronto.

Filling out your W-4 or W-9 can make your head spin. But don’t worry! Here are some useful expert tips to breeze through them:

If you’re an employee dealing with a W-4:

- Be Accurate. Double-check your personal info and dependents.

- Use the Worksheets. They can help calculate allowances more accurately.

- Update as Needed. Life changes? Update your W-4 to avoid underpaying.

If you’re a freelancer or contractor dealing with W-9:

- Keep It Handy. Have your Taxpayer Identification Number ready.

- Fill It Out Fully. Avoid leaving fields blank — be thorough.

- Submit Promptly. Send it in as soon as you start a new job to avoid delays.

Here are some more recommendations from our tax experts:

- Understand the Purpose. Know why each form is required.

- Seek Help If Needed. Asking for professional assistance if you’re confused is a must.

- Stay Organized. Hold onto copies, just in case.

At the end of the day, a W-4 is all about how much tax to take out of your paycheck, while a W-9 is about reporting what a company pays you. Your ultimate goal should be to fill out both docs correctly and keep the tax man happy (read as enjoy peace of mind!). Don’t forget that you can always make the most of PDFLiner to cope with both tasks like a champ!