-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

W-9 vs. W-8 Forms: Which One Do You Need and Why It Matters

Dmytro Serhiiev

Last Update: May 6, 2025

Whether you’re a business working with contractors or a freelancer providing services to U.S. clients, choosing the right IRS tax form is crucial.

Get Started

Get Started

W-9 vs. W-8BEN:

Quick Comparison

Form W-9 and Form W-8BEN are both used to provide taxpayer information, but they serve different purposes depending on whether the individual is a U.S. resident or a non-U.S. resident.

Definition

Who Receives One?

Example

Filing Deadline

W-9

Collects taxpayer information from U.S. persons (citizens or residents)

U.S. businesses collecting info from U.S. contractors or freelancers

U.S.-based freelancer hired by a company for services

No IRS submission—submit to the requester before payment is made

W-8BEN

Reports other types of payments, like rent or prizes

Copies go to the IRS (Copy A), the State Department (Copy 1), and the recipient (Copy B)

Payments of $600 or more, such as office rent, equipment rentals, or other miscellaneous payments.

No IRS submission—submit to the requester before payment is made

Start with W-96741158300573dd00e00c67f6741158300573dd00e00c676741158300573dd00e00c67f65bb657f5447959694021119

Start with W-8BEN61b082ccce61ef11782913b2 65bb60ced1918f924e00be1b

1099-NEC

Definition

Reports payments to non-employees (e.g., freelancers and contractors)

Who Receives One?

Copies go to the IRS (Copy A), the State Department (Copy 1), and the recipient (Copy B)

Example

Paying $600 or more to anyone who performs services for your business and is not an employee

Filing Deadline

January 31 (both paper and e-filings)

Start with 1099-NEC 65bb657f5447959694021119

1099-MISC

Definition

Reports other types of payments, like rent or prizes

Who Receives One?

Copies go to the IRS (Copy A), the State Department (Copy 1), and the recipient (Copy B)

Example

Payments of $600 or more, such as office rent, equipment rentals, or other miscellaneous payments

Filing Deadline

February 28 (paper) or March 31 (electronic)

Start with 1099-MIISC 65bb60ced1918f924e00be1b

Tax Forms W-8 and W-9: Key Differences

In the U.S., the Internal Revenue Service (IRS) is responsible for determining how much income tax individuals and entities owe. As a business operating in the United States, it’s your duty to report to the IRS who you’re paying, how much, and for what purpose.

You're also responsible for calculating and withholding the correct amount of taxes and submitting them to the IRS. This system ensures that the IRS receives the taxes it’s owed — and non-compliance can lead to significant penalties for your business.

Forms W-8 and W-9 are tools used to collect this important tax information. Both are IRS tax forms that help determine a payee’s tax status. The key difference between W-8 and W-9 lies in whether the payee is a U.S. person (citizen or resident) or a non-U.S. individual or entity.

By collecting W-9 vs W-8 from the people or companies you pay, you clarify how they should be taxed under U.S. law. This information is later used to prepare Form 1099, which you file at the end of the tax year.

Filing the wrong form — or failing to collect them altogether — can expose your business to unexpected tax liabilities, so it’s essential to get it right from the start.

What Is Form W-9 in USA?

Form W-9 is used by U.S. persons and entities to provide their Taxpayer Identification Number (TIN) to clients or payers. It’s typically used by U.S. citizens, residents, and businesses that are receiving payments reported on a 1099 form.

You’ll need to file a W-9 if you are:

- U.S. citizen or resident

- U.S.-registered business

- A freelancer or independent contractor based in the U.S.

- Providing services or goods to another U.S. business or client

W-9

Watch how it works

Use Form W-9 to provide your taxpayer identification if you are a U.S. person, and use Form W-8BEN if you are a non-U.S. individual claiming foreign status and possible tax treaty benefits.

Start Filing W-96741158300573dd00e00c67f 65bb60ced1918f924e00be1b

What Are W-8 Forms?

W-8 forms are for non-U.S. individuals and foreign entities who receive income from U.S. sources but are not subject to the same tax requirements as U.S. taxpayers. These forms help establish non-resident status and determine if you're eligible for reduced withholding rates under a tax treaty between your country and the U.S.

Which W-8 Form Do You Need?

Here’s a breakdown of the main W-8 taxs forms:

W-8BEN – For Foreign Individuals

The W-8BEN, officially titled Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting, is the most commonly used W-8 form. It’s intended for non-U.S. individuals — including international employees and independent contractors — to certify their foreign status for tax purposes.

Filing the W-8BEN does not exempt a foreign employee from U.S. tax liability. In most cases, U.S. employers are required to withhold 30% in federal income tax from payments to foreign workers. However, this rate may be reduced if the worker’s country has a tax treaty with the U.S. If the individual qualifies for a reduced or exempt rate, they may need to file a different W-8 form.

For foreign independent contractors, the rules are different. If the contractor is not a U.S. citizen and performs their work outside the U.S., they generally are not subject to U.S. tax. However, your business must collect a valid and complete W-8BEN to document their tax status. If you fail to do so, you may be required to withhold 30% of the payment anyway.

W-8BEN-E – For Foreign Entities

The W-8BEN-E is the entity version of the W-8BEN and is used by foreign businesses and organizations, such as corporations, partnerships, and trusts. Like the W-8BEN, it certifies foreign status and can be used to claim benefits under a tax treaty.

This form is appropriate for foreign entities earning passive income from U.S. sources, such as:

- Interest

- Dividends

- Royalties

- Rent

- Annuities

These payments may be subject to a 30% withholding tax, unless a treaty exemption or reduction applies. Filing the W-8BEN-E ensures the correct tax treatment for these entities.

W-8ECI – For Effectively Connected Income

The W-8ECI, or Certificate of Foreign Person’s Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States, is used when foreign individuals or entities are earning income that is actively connected to a U.S. business.

This form is meant for payees who are not just passive recipients of income, but are engaged in a trade or business within the U.S. Unlike passive income reported under W-8BEN-E, income covered under W-8ECI is usually not subject to withholding, because it's taxed similarly to income earned by a U.S. business.

In short:

- W-8BEN-E = passive income (like dividends or royalties)

- W-8ECI = active business income (like direct services or operations)

So, Which Form Do You Need?

Here’s a quick guide to help you decide:

- You are a U.S. citizen or resident, or your business is U.S.-based: ➤ File Form W-9

- You are an individual outside the U.S. receiving passive income from U.S. sources: ➤ File Form W-8BEN

- You are a non-U.S. company doing business with U.S. clients: ➤ File Form W-8BEN-E

- You are a non-U.S. entity with active business income connected to the U.S.: ➤ File Form W-8ECI

Why It Matters

Filing the correct form ensures:

- Compliance with IRS regulations

- Avoidance of unnecessary tax withholding

- Smooth payment processing between you and your client

Submitting the wrong form — or not submitting one at all — can lead to delays, incorrect tax treatment, or even penalties.

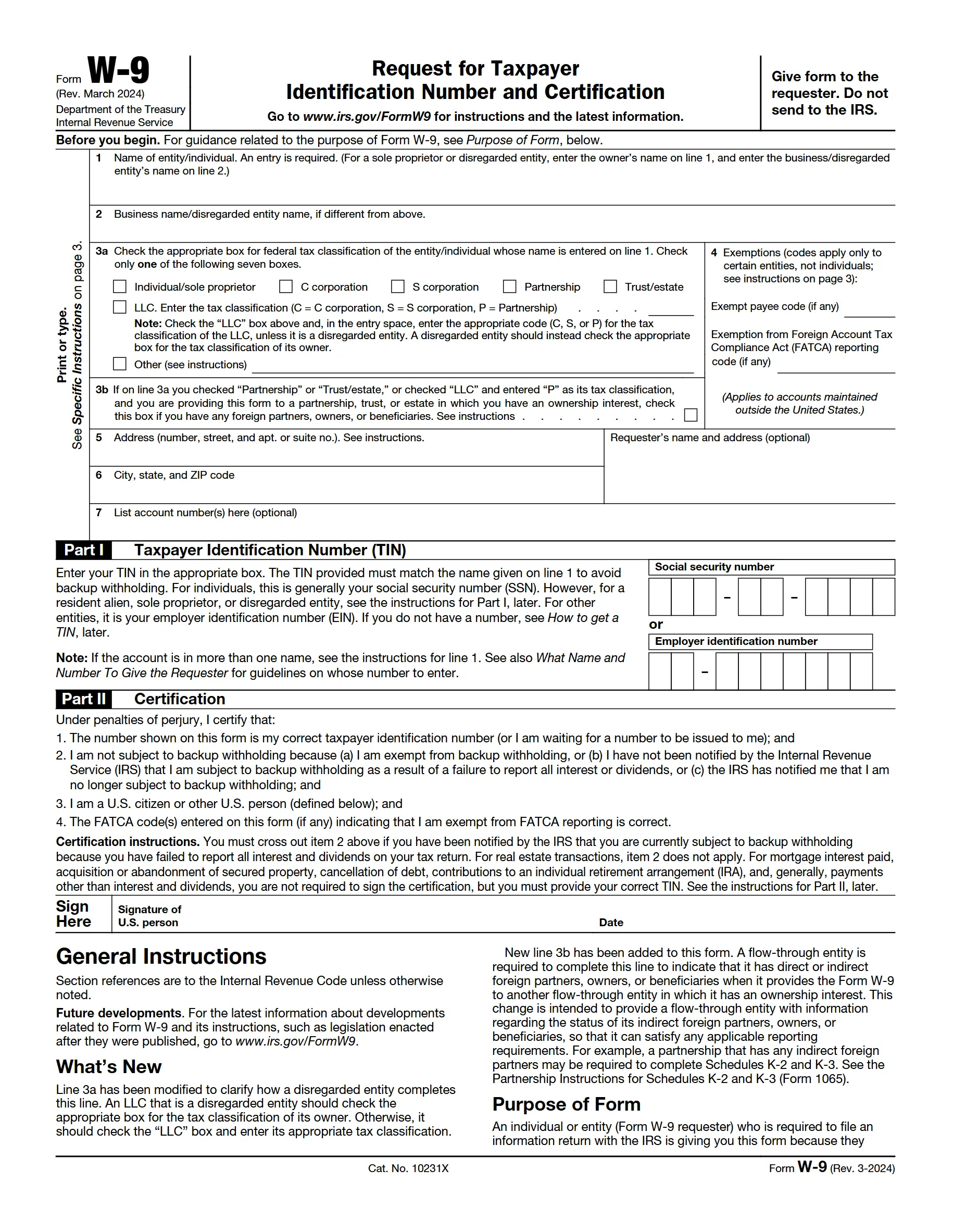

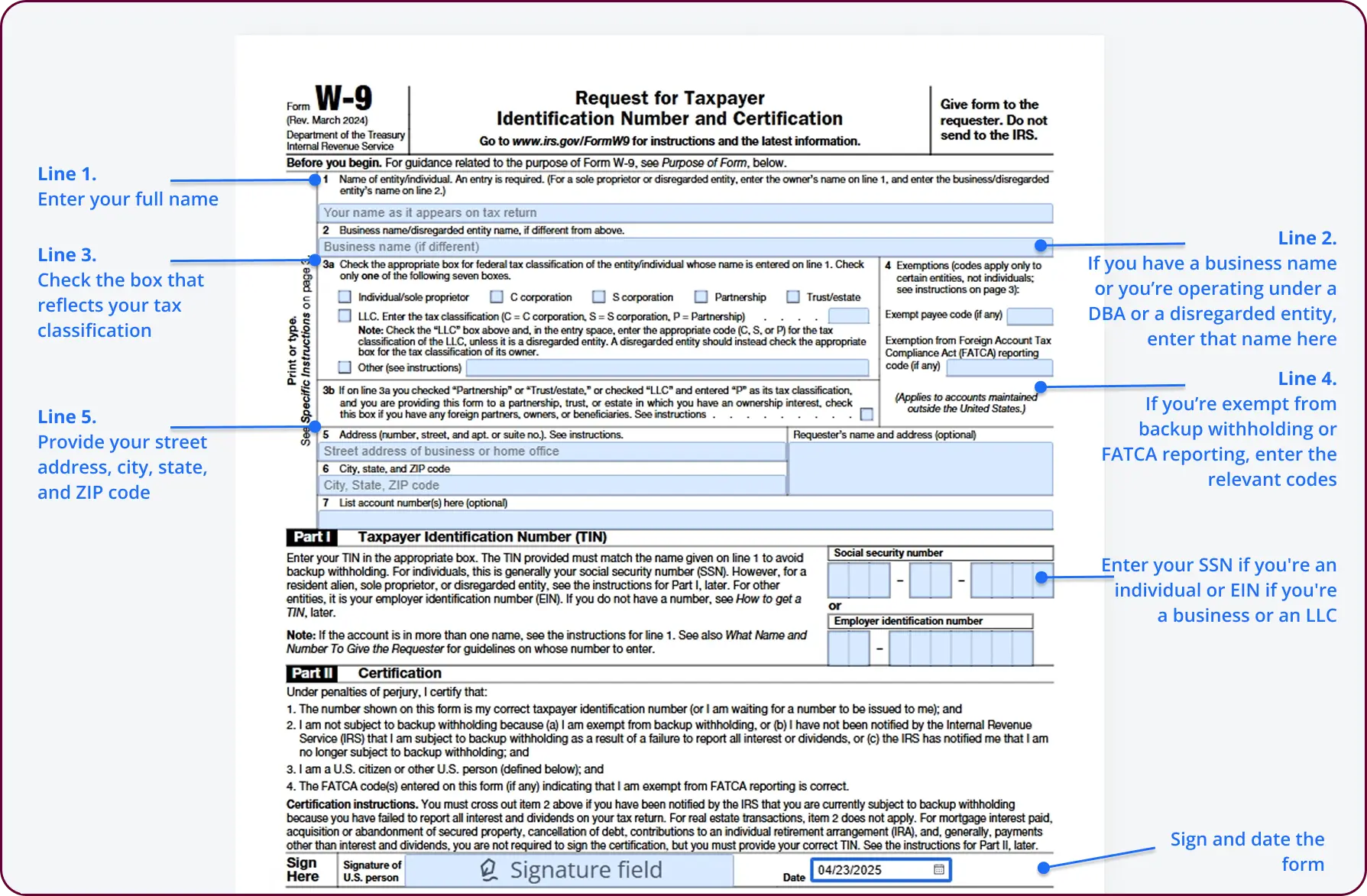

Filling Out Form W-9

Here’s how it should be completed:

- Provide the contractor’s full legal name, business name (if applicable), federal tax classification (e.g., Individual, Sole Proprietor, LLC, Corporation), and current address, including city, state, and ZIP code.

- Part I: Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Part II: Signature and date, confirming the accuracy of the information

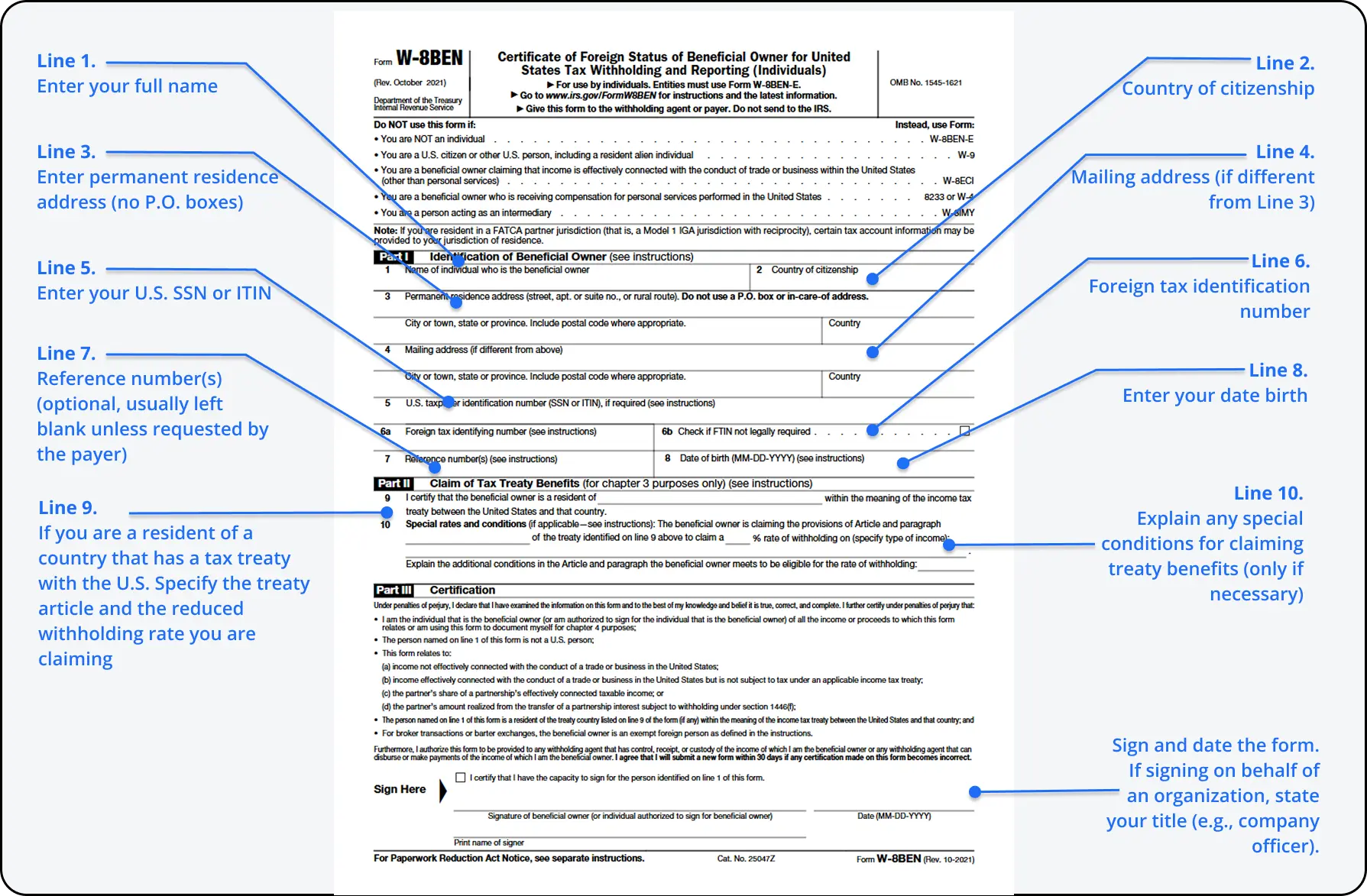

Filling Out Form W-8BEN

There are three parts to complete:

- Part I: Enter the contractor’s full name, country of citizenship, permanent residence address, and tax identification number (ITIN or foreign TIN).

- Part II: If eligible, the contractor may claim tax treaty benefits, based on the country they live in and whether that country has a tax treaty with the U.S.

- Part III: Signature and date to certify the information. Electronic or handwritten signatures are accepted.

When Should You Collect W-9 and W-8BEN Forms?

- W-9 tax forms should be collected during contractor onboarding and before any payments are made.

- W-8BEN forms should also be collected before the first payment. If not, you may be legally required to withhold 30% of the payment for U.S. tax purposes.

Frequently Asked Questions

What is a W-8 form used for?

W-8 forms are used to confirm that an individual or business is a non-U.S. resident or foreign entity. These forms allow the filer to claim tax treaty benefits, which can reduce or eliminate the standard 30% withholding tax on income from U.S. sources. Since tax treaties differ by country, the applicable rate will vary depending on the filer’s country of residence.

What is a W-9 form used for?

Form W-9 is used by U.S. persons, including independent contractors and freelancers, to provide their Taxpayer Identification Number (TIN) to businesses that hire them. The information from the W-9 is used by companies to prepare Form 1099, which reports the contractor’s income to the IRS.

How do I confirm my tax status with a W-9 W-8 form?

You can confirm your tax status by completing a W-8 or W-9 form. The process includes providing your individual or business name, TIN, and address, and signing the form to certify your tax status. Platforms may require this information either during onboarding or once you reach a specific payment threshold.

Why am I being asked to submit a W-9 or W-8 form now?

The client you work with needs your W-9 or W-8 form to correctly report your income to the IRS and determine whether they need to withhold any taxes.

If you are a U.S. person, you must submit Form W-9 to confirm your taxpayer status and provide your Taxpayer Identification Number (TIN).

If you are a non-U.S. individual, you must submit Form W-8BEN to certify your foreign status and potentially claim a reduced tax rate under an applicable tax treaty.

What happens if you don't submit the form?

If you fail to provide the correct form, the platform may be legally required to withhold up to 30% of your payments for tax purposes. In some cases, they might also suspend your payouts until your tax status is properly documented.

Tax season is coming — don’t wait until the last minute!

Quickly submit your W-9 or W-8BEN forms with PDFLiner’s easy-to-use tools and stay compliant before the deadlines catch up

Get Started

Secure Payments

IRS eFiling Provider

Data Encryption