-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

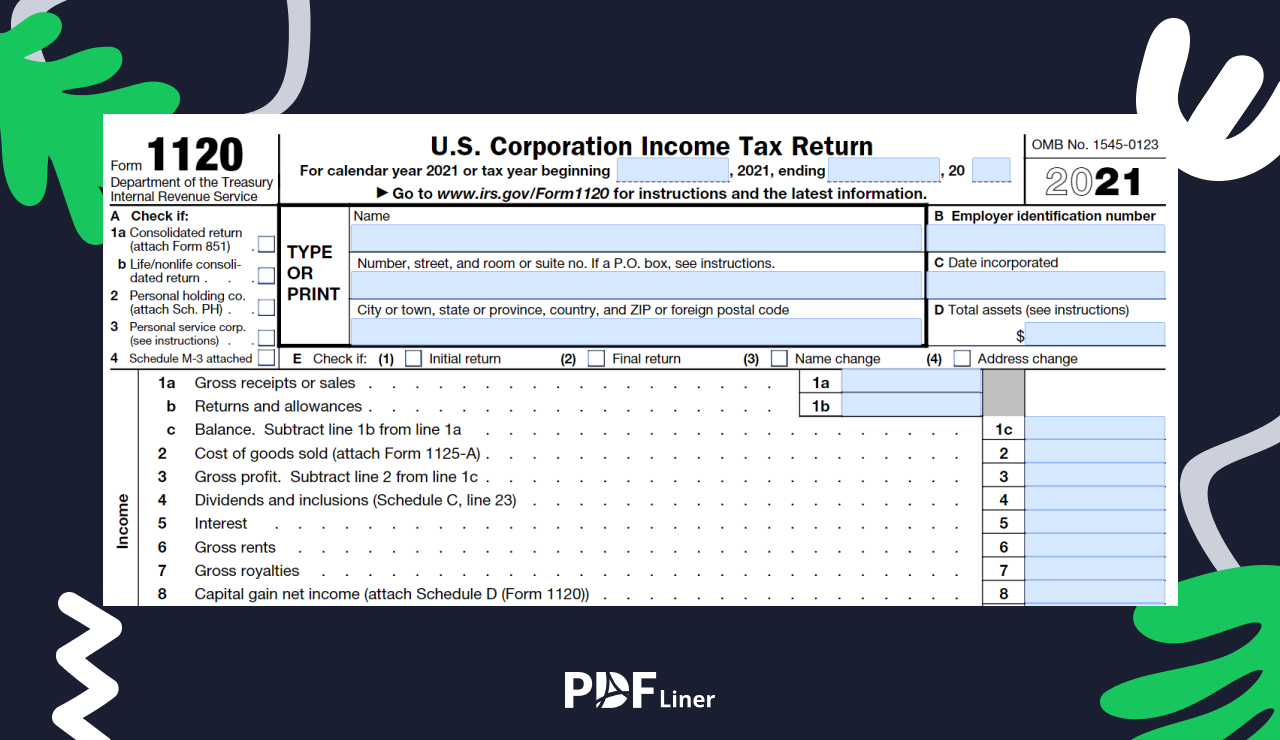

What Is 1120 Tax Form?

.png)

Dmytro Serhiiev

Are you a business owner in the US? Then filing an income tax return should definitely be on your must-do list. Are you kinda on the fence about what form to utilize for this? Making futile attempts to get the gist of paying taxes for your corporation? We’ve got you covered. In this piece, we’ll let you in on form 1120. Keep reading for details.

Fillable Form 1120 65e8f4f222f3177f0e0e318a

What Is a Form 1120 Used For?

Let’s start with the definition. It’s a six-page document utilized by the US corps for the purpose of reporting their assessable income and losses, as well as determining the precise amount of business tax they owe to the government. We hope that answers your ‘What is an 1120?’ question.

Under certain circumstances, this 6-pager is filed with some extra docs and schedules. Therefore, always look up the extra docs you need and prepare them ahead of time.

With that said, 1120 form is utilized for:

- accounting your corp’s income;

- reporting your refundable credits;

- documenting your entity’s losses and deductions;

- itemizing your total assets.

The tax return 1120 template is easily accessible via this website or via our platform. Aside from this particular form, in our huge library of fillable templates, you can find any niche-specific, pre-made, and easily adjustable PDF blank form. Whether you’ll opt for digital or manual doc management, our service is invariably your best bet.

Who Files 1120 Form

Sorting out this doc should be your ultimate mission if your entity is:

- an organization operating as a corporation;

- an LLC;

- a farming corporation;

- an operated-from-abroad domestic disregarded entity.

Wondering if filing form 1120 is what you should do even if you have no taxable earnings? The answer to this question is yes. Moreover, you should sort out this doc even if you’ve faced bankruptcy. When it comes to S corps, things may get a bit tricky here. Although they do feature the ‘corporation’ part, S corps report taxes via Form 1120-S. Hopefully, you’ve now seen the full picture in terms of the 1120 vs 1120s comparison.

Fill Out Form 1120 65e8f4f222f3177f0e0e318a

How to Fill Out Tax Form 1120: Instructions

Focus on maximum factual precision if you want your forthcoming tax season to be crowned with peace of mind. To achieve that precision, as you progress through the doc, errorlessly indicate the name, address, CEO ID info, and total assets of the entity in question.

Upon finishing with that part, keep on with the rest and specify this important data:

- your earnings, deductions, transactions, and credits;

- tax numbers, money saved for later use;

- additional details about your operation;

- entity assets and liabilities.

.png)

Don’t neglect adding your signature and the current date to the document when you’re through with it. Did you know that you can e-sign your LLC tax return form 1120 digitally? Yes, PDFLiner will absolutely help you with that. Your e-signature will be perfectly legit and 100% secure with our service.

.png)

Having said all that, of course, digital document management is a lot more convenient than coping with your administrative affairs by hand. Going online in this respect saves heaps of your time and allows you to concentrate on what you’re most passionate about: building rapport with your clients and boosting your revenue.

In case this particular form is a challenge for you to fill out either time- or specificity-wise, you’re welcome to turn to expert assistance. Any investments in this sense are guaranteed to pay off very soon, for they will ensure errorlessness and precision in your affairs. With a reliable bookkeeper leading you through the process, you are bound to succeed in filling out any complicated form.

Upon sorting out the doc, don’t forget to forward it by the 15th day of the 4th month following the closing of your tax year. In case the deadline falls on Saturday, Sunday, or holidays, no worries. As it usually happens, it’ll be extended to the next workday. So, now that we’ve guided you through the basics of how to fill out and file this document, your mission is to ensure that you cope with it all in a timely manner. Because you don’t want to mess with the IRS.

How to Sign Form 1120

The 1st page of the six-pager is where you should add your signature. If you want to use our e-signature tool for this, follow these easy steps:

- Hit the ‘Add Sign’ button in the upper right corner of the form page.

- Choose the best-suiting method of generating your signature.

- Add it where you want it to appear. And that’s about it. Yes, it’s that easy and convenient.

Another perk is that you can easily send any document for signature via our platform. It’s effortless and exceptionally time-saving. No more paper, no more scanning, no more waiting!

Tax Form 1120 65e8f4f222f3177f0e0e318a

How to File Form 1120

You can make the most of more than one method in order to submit this form to the IRS. The first one implies filing the form online. The second is filling out and submitting the doc in the offline world. The former method is all about effortlessness, speed, and security.

While the latter one comes with a lot of disadvantages. For example, if you send the form by mail, it may get lost or damaged. To prevent that from happening, opt for private delivery services that provide written evidence with the date when the file was sent.

FAQ

How to get form 1120?

Feel free to find a perfectly fillable and adjustable template of this form via our catalog. We have a treasure trove of industry-specific templates that are 100% free. Alternatively, you can download the form from the corresponding governmental website.

Where to file 1120 corporate tax return?

Just like with most tax docs, you should file this form to the corresponding tax authorities. Feel free to do it either in the online or offline format. Quick tip: the online format is more convenient.

When are 1120 tax returns due?

Just like with most tax docs, you should file this form to the corresponding tax authority by the fifteenth day of the fourth month following the closing of your tax year. Get the submission going in a timely manner to prevent penalties.

What is the difference between form 1120 and 1120S?

That’s an easy one. The former is for corps, while the latter is for S-corps. Both forms are available here on PDFLiner. Lay your fingertips on either of them and get the online customization going.

Fill Out Forms At No Time with PDFLiner

Start filing your forms electronically today and save loads of time!

Form 1120 Online 65e8f4f222f3177f0e0e318a