-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is Form 4506-C and How to Get It?

.png)

Dmytro Serhiiev

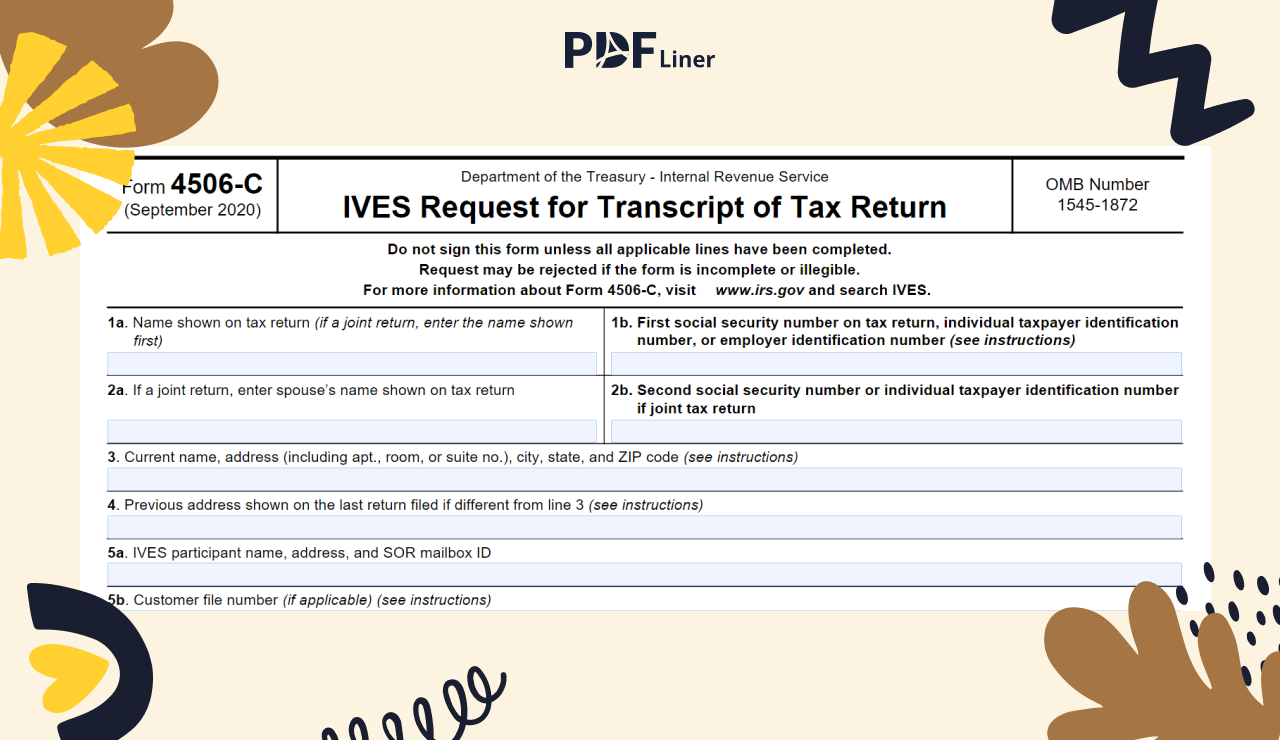

If you want to learn more about form 4506-C and its purpose, you’ve come to the right place. In this post, we’ll cover the basics of 4506-C, let you in on what this form is about, how to get it, and whether it’s submittable online or not. So, without further ado, 4506-C is an IRS document utilized for retrieving previous tax returns, W-1, and 1099 transcripts that are kept in the IRS archives.

Form 4506-C allows a third party to access a taxpayer’s documentation for income verification purposes. The form must include the taxpayer’s signature. As for the 4506 tax form, it’s used for retrieving an exact photocopy of the taxpayer’s return (as opposed to the transcripts granted upon submitting the 4506-C form). Keep reading for further details.

How to Get Form 4506-C

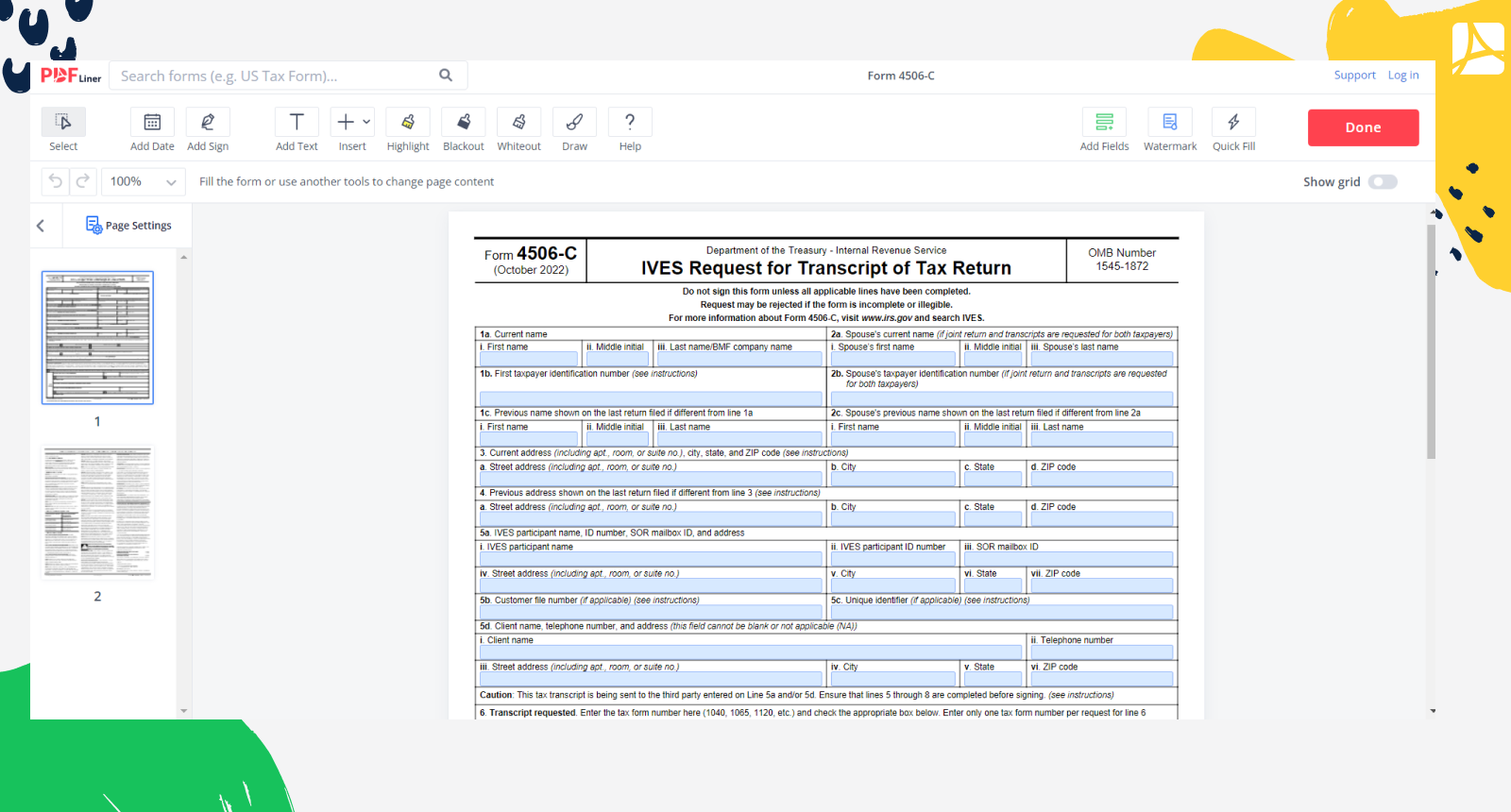

Wondering how to lay your hands on the form? We’ve got you covered. You can find form 4506-C via the IRS official website. Alternatively, you can find the form in the PDFLiner extensive template catalog. On our blog, you can also learn how to fill out form 4506-C and how to e-sign it.

Don’t forget that with PDFLiner, you get to find and complete any tax form online, while saving heaps of your time and money along the way. So, if you’re looking to go paperless and streamline your company’s workflow, you’re welcome to complete your 4506-C or 4506 form online via PDFLiner almost in the blink of an eye.

Furthermore, if you’re tired of waiting, scanning, and facing endless human errors during form completion, you’re welcome to switch from paper tax forms to digital ones. Our cloud-based tool comes with a treasure trove of features that will help you and your bookkeeper sort out most of your documentation in a flawless (and paperless!) way.

Form 4506-C 6391f2c02a21f3cea30542bf

FAQ

What is the purpose of the 4506-C form?

The purpose of this form is to provide authorized third parties with the details about a taxpayer’s past tax returns directly from the IRS, particularly for the purpose of income verification.

How much does a 4506-C cost?

As a matter of fact, it costs absolutely nothing (unless you decide to hire a tax preparer, of course). The form is used for ordering a transcript or other return information free of charge.

Can I file Form 4506-C online?

Sure, you can fill out and submit the form online. Make sure you complete the form accurately to avoid rejection. For maximum accuracy, turn to a professional bookkeeper who will eagerly sort out the issue for you. No doubt, it will be well-spent money for you.

Who should fill out a 4506-C?

The form (which is also referred to as IVES Request for Transcript of Tax Return, by the way) is filled out by the Income Verification Express Service (IVES) participants, most frequently mortgage lenders who are aimed at confirming a borrower’s income during the process of a loan application.

File Taxes Online at No Time With PDFLiner

Start filing your taxes electronically today and save loads of time!