-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

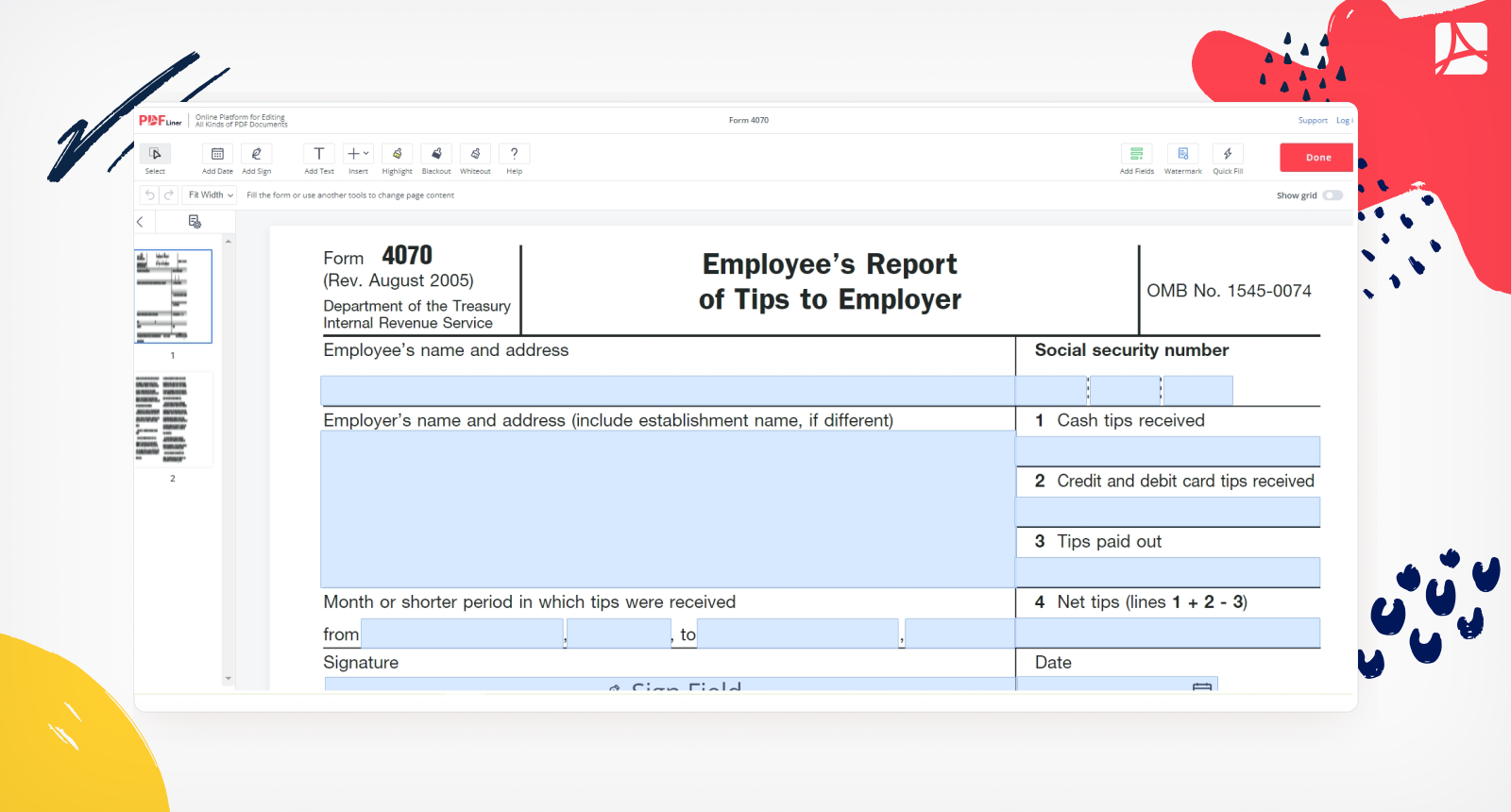

What is Form 4070, and How to Fill it Out

Tax season is upon us yet again. For many of us, this time of year is dreaded as we scramble to get our paperwork in order. One of the forms that we may need to complete is Form 4070. This form is used to report tips received by employees. Here is a brief overview of what you need to know about Form 4070.

Fillable Form 4070 5f3156b58a04d3569a1ba2a2

What is Form 4070: Employee Tip Reporting?

Tip Form 4070 is an IRS form used to report tips received by an employee. The employee must complete the form and submit it to their employer by the end of the month in which the tips were received. The employer is then responsible for forwarding the form to the IRS.

Tips are considered taxable income and must be reported on Form 4070. The amount of tax owed on tips is calculated using the employee's marginal tax rate.

4070 Form 5f3156b58a04d3569a1ba2a2

Who Should File an Employee's Report of Tips to Employer?

Any employee who makes more than $20 in tips in a single day is required to report those earnings to their employer on Form 4070. You will need to submit these in a report by the 10th day of the next month unless that day is a holiday or weekend.

How to Complete Form 4070?

There are two ways to report tips on Form 4070. The first is to include the tips with your regular wages on your Form W-2. The second is to report the tips separately on Form 4070.

If you choose to report tips separately on Form 4070, you must complete the following information:

- Your name, address, and Social Security number;

- The name and address of your employer;

- The date you received the tips;

- The total amount of tips you received;

- The total amount of tips you reported to your employer;

- Your signature;

- Your employer's signature;

- Your employer's phone number.

Once you have completed Form 4070, you should give it to your employer. Your employer is responsible for forwarding the form to the IRS.If you have any questions about Form 4070 or how to report your tips, you should contact your employer or the IRS.

Frequently Asked Questions

What do allocated tips mean?

"Allocated tips" refers to tips that are specifically designated for distribution to employees. Allocated tips may be given to employees in cash or may be added to their regular paychecks.

How to calculate allocated tips?

To calculate allocated tips, divide the total amount of tips earned by the number of employees who worked during the shift.

How to report tips to IRS?

All tips that are received by an employee must be reported to the IRS. The employee must complete a Form 4070A, which is available on the IRS website. The form must be completed and filed with the employer.

How must an employer report tips to the IRS?

An employer must report tips to the IRS by completing a Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips.

PDFLiner Solves All PDF Editing Issues

Start filing your taxes electronically today and save loads of time!

Tip Form 4070 5f3156b58a04d3569a1ba2a2

.png)