-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

A Complete Guide to 1099 Forms for Small Business Owners in 2025

.png)

Julia Hlistova

Last Update: Jan 23, 2025

Navigating tax obligations as a small business owner can be daunting, especially when it comes to understanding and create 1099 forms. These forms play a critical role in reporting payments made to non-employees, such as contractors and vendors, ensuring compliance with IRS regulations.

By the end of this article, you’ll have a clear understanding of your 1099 filing obligations and the steps needed to stay compliant in 2025. Let’s dive in!

What is a Small Business 1099?

When small businesses incur specific expenses or receive particular types of income, they may need to send or receive a Form 1099. The IRS establishes thresholds to determine the necessity of filing a 1099 form. Generally, the IRS requires 1099 forms for transactions exceeding $600.

For example, if you earn more than $600 in miscellaneous income, like prize money, you'll likely receive a 1099. Similarly, if you pay a freelancer over $600, you must provide them with a 1099. There are various 1099 forms for different transactions, such as interest income, real estate proceeds, and debt cancellation.

Employee vs. Contractor

According to the IRS, “an individual is an independent contractor if the payor has the right to control or direct only the result of the work, not what will be done and how it will be done.”

To ascertain worker status, the IRS applies Common Law Rules that are categorized into three areas: behavioral, financial, and type of relationship. Generally, the more control you exert over the worker and their contributions to the business, the more they use the 1099 form for employees.

The following general rules, although not exhaustive, can guide you in the right direction. Workers are likely independent contractors if they:

- Use their own equipment (e.g., laptop, phone, tools) to complete their work

- Operate on a temporary basis and receive payment "per project"

- Serve multiple clients, often simultaneously (look for an individual business license)

- Work from an offsite location (infrequent meetings at your business site are acceptable; extended periods of onsite work are not)

- Have the flexibility to set their own hours and schedule

Conversely, you should classify workers as employees if they:

- Are compensated weekly or monthly

- Receive training and detailed instructions from your business

- Work full-time on a consistent basis

- Perform most of their tasks on your premises

- Can be terminated at any time (as opposed to being subject to contractual conditions)

- Provide services that are integral to your daily operations

Why this distinction matters

- Tax reporting requirements: For employees, you must issue a W-2 Form to report wages and withheld taxes. For independent contractors, you issue a 1099-NEC Form if you’ve paid them $600 or more in a calendar year for their services.

- Legal obligations: Employees are protected by labor laws, including minimum wage, overtime pay, and unemployment insurance. Contractors are not, which means fewer obligations but more risk of misclassification penalties.

- Financial impact: Employers pay additional taxes for employees (e.g., Social Security, Medicare, and unemployment insurance), while contractors handle these taxes themselves.

When to Issue a 1099 Form to a Vendor or Contractor

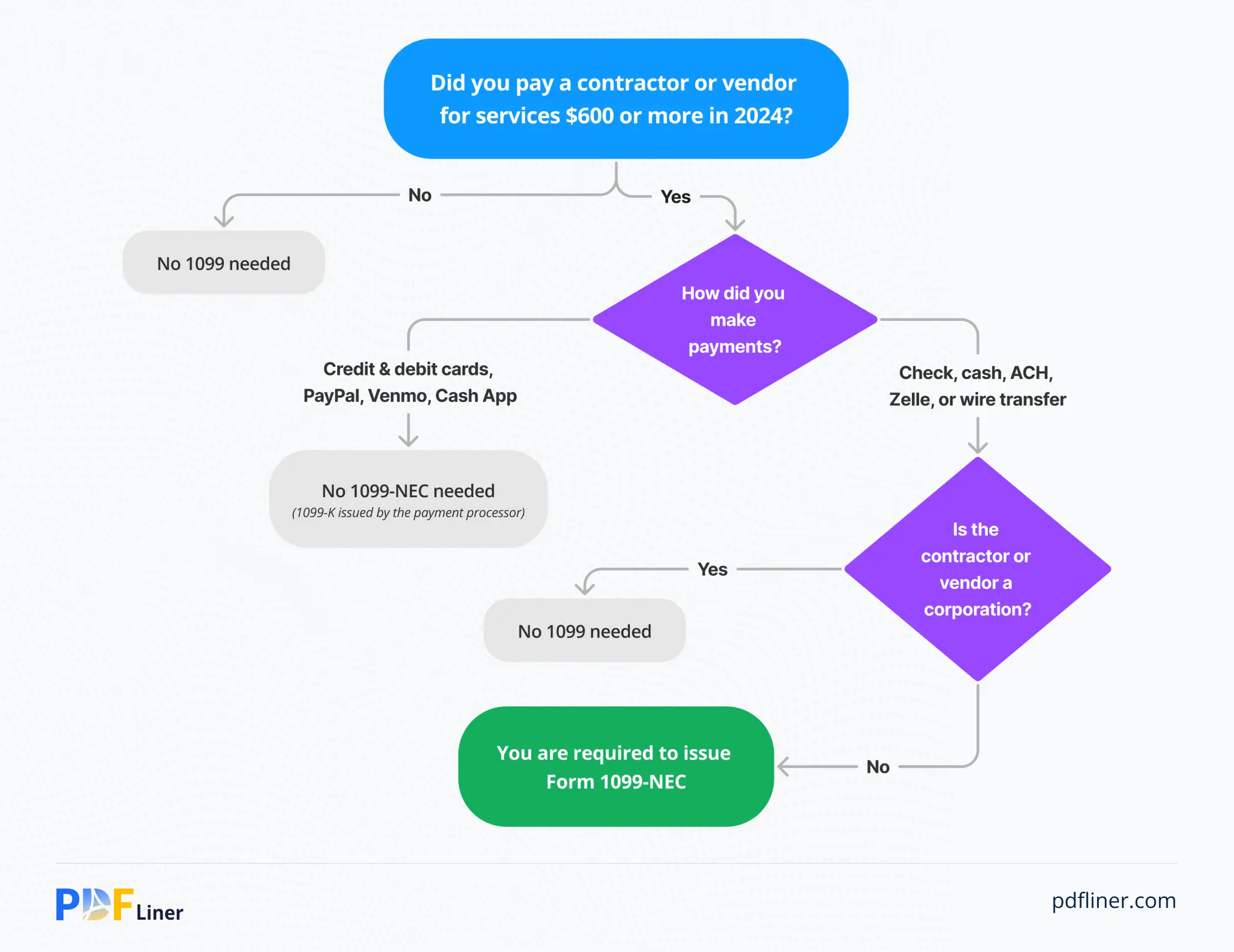

You are required to issue a 1099 for contractors and vendors if:

- You’ve paid $600 or more during the tax year for services.

- The payment was made to an individual, partnership, LLC, or unincorporated business (payments to corporations are generally exempt, except for specific services like attorney fees).

- Payments were made in cash, check, or electronic transfers (but not via credit card or payment platforms like PayPal, as those are reported on a 1099-K).

Exceptions

You typically don’t need to issue a 1099 form if payments were made for goods rather than services or if the vendor is structured as a C-corporation or S-corporation (with the exception of attorney or medical services). To determine whether a contractor is a corporation, review their Form W-9, where they indicate their business entity type. This step ensures you’re issuing 1099 forms only when required.

Vendor vs. сontractor: What’s the difference?

Contractors: These are individuals or businesses you hire to perform services for your business, such as freelancers, independent consultants, or tradespeople. Payments to contractors are reported on a 1099-NEC Form.

Vendors: Vendors are companies or individuals that sell products, goods, or services, such as office supplies, software, or utilities. In some cases, payments to vendors for specific services (e.g., legal or professional services) may also require a 1099 form.

Which 1099 Form Do I Need?

The IRS provides various 1099 forms, each serving a specific purpose for reporting income. While there are many types of 1099 forms, the focus for most small businesses is on 1099-NEC and 1099-MISC. Here’s a breakdown of these and other commonly used forms.

1. 1099-NEC (Non-Employee Compensation)

Use the 1099-NEC to report payments of $600 or more made to non-employees, such as freelancers, independent contractors, or other 1099 self-employed individuals.

- When to use: Payments for services, not products, made to individuals, partnerships, or LLCs (but not corporations).

- Common examples: Graphic design services, consulting, repairs, or any professional services.

Form 1099-NEC 65bb657f5447959694021119

2. 1099-MISC (Miscellaneous Income)

The 1099-MISC is used to report a variety of payments not covered by the 1099-NEC. While its use has decreased since the introduction of the 1099-NEC, it’s still required for:

When to use:

- Rent payments: Over $600 for commercial space.

- Awards/prizes: Over $600 not for services.

- Attorney payments: When it involves gross proceeds paid to attorneys.

- Common examples: Payments for office rentals, royalties exceeding $10, or medical and health care payments.

Form 1099-MISC 65bb60ced1918f924e00be1b

3. 1099-K (Payment Card and Third-Party Network Transactions)

The 1099-K reports payments processed through credit cards or third-party payment networks like PayPal or Stripe.

- When to use: Form 1099-K is issued by payment processors (PayPal, Stripe) for total transactions exceeding $600 in 2025. If you pay a contractor through these systems, you do not need to file a 1099-K yourself — the payment processor will handle this. Additionally, such payments should be excluded from 1099-NEC and 1099-MISC forms.

- Common examples: Online sales processed via e-commerce platforms or gig worker payments through apps like Uber or DoorDash.

4. 1099-INT (Interest Income)

The 1099-INT is used to report interest payments of $10 or more earned in a year.

- When to use: Financial institutions issue this form to individuals or businesses that earn interest on savings accounts, bonds, or other investments.

5. 1099-DIV (Dividends and Distributions)

The 1099-DIV reports dividends and distributions of $10 or more received from investments.

- When to use: For dividends paid by mutual funds, stocks, or other investments and capital gains distributions.

1099 Forms filing deadlines

Taxpayers are not required to print and mail Forms 1099-NEC and 1099-MISC; electronic filing is encouraged and mandatory if filing 10 or more forms.

The 1099-NEC deadline is January 31, regardless of whether you file by paper or electronically with the IRS. For 1099-MISC, the deadline is February 28 for paper filing and March 31 for e-filing. For both forms, the deadline to send a copy to the recipient is January 31.

Potential penalties for incorrect or late filings

Failing to file a correct 1099 form promptly can lead to penalties that quickly escalate, ranging from $60 to $660 per form, depending on how overdue the filing is. For small businesses, the maximum penalties are lower.

- $60: Filed not more than 30 days late

- $130: Filed more than 30 days late, but before August 1st

- $330: Filed on or after August 2nd

- $660: Intentional neglect to file

Always verify any updates on the IRS.

TIN Mismatch: In addition to penalties for late submission, errors such as name/TIN mismatches could also incur penalties. If numerous forms are filed, the likelihood of encountering name and TIN mismatches increases.

If you, as a payor, often submit returns with name/TIN mismatches and the number of erroneous forms exceeds 50, you will receive an IRS B-notice (CP2100 or CP2100A for fewer than 50 mismatches) for each instance. This scenario requires you to send the B-Notice to the contractor and request an updated W-9 to ensure correct filing in the future.

Why it's important to collect Form W-9 from all service vendors?

Making a Form W-9 from all service vendors before issuing their first check is essential for accurate tax reporting and compliance with IRS regulations.

This form is not only essential for obtaining accurate information about the TIN, legal name, and business type but also helps determine whether a 1099 form is required based on the vendor’s classification and any applicable exemptions.

Additionally, having this information upfront allows you to verify the TIN using IRS TIN Matching Services, reducing the risk of errors or mismatched records that could lead to penalties. Without a W-9, you may be forced to withhold 24% backup taxes from payments, creating unnecessary administrative headaches.

How To Fill Out And File: 1099-NEC And 1099-MISC

Filing 1099-NEC and 1099-MISC forms is a necessary task for small business owners to report payments made to contractors and vendors. With PDFLiner, you can easily handle both forms using a unified process. Here’s a step-by-step guide on how to create a 1099.

Step 1: Log in to PDFLiner

- Visit PDFLiner and log in or create an account.

- Navigate to the relevant form: 1099-NEC or 1099-MISC.

Step 2: Input payer information

- Enter your business or individual name.

- Provide your trade name (if different) and complete address.

- Input your TIN (SSN or EIN).

- Save this information in PDFLiner for future filings.

Step 3: Add recipient information

- Input the contractor or vendor’s name, trade name (if applicable), address, and TIN.

- Use their completed Form W-9 as a reference.

- Validate the TIN using PDFLiner’s TIN Matching Service to avoid errors or penalties.

Step 4: Fill in payment details

- For 1099-NEC:some text

- Use Box 1 to report non-employee compensation exceeding $600.

- Report backup withholding in Box 4, if applicable.

- For 1099-MISC:some text

- Complete the appropriate boxes:some text

- Box 1: Rent payments over $600.

- Box 2: Royalties over $10.

- Box 3: Other income.

- Box 6: Medical and health care payments.

- Box 10: Gross proceeds paid to attorneys.

- Include state tax details in Boxes 16–18, if required.

- Complete the appropriate boxes:some text

We’ve created a detailed step-by-step guide on how to fill out a 1099-MISC form.

Step 5: Submit to the IRS

Once you've verified your information, click the "Submit to IRS" button. A summary page will appear, allowing you to review all details one final time before confirming your submission.

After submission, the form will enter a filing queue. PDF Liner will provide email notifications with updates, and you can monitor the filing status via your dashboard.

State-Specific Considerations

With the rise of remote work and cloud-based platforms, small businesses can now easily hire contractors and freelancers from across the United States. However, navigating 1099 reporting for multiple states can be intricate.

Key considerations include:

- State-specific forms: Some states have additional forms or unique requirements for 1099 reporting.

- State Taxpayer Identification Numbers (TINs): Contractors may need to obtain state-specific TINs, and employers must ensure these are accurate.

- State tax withholding: Certain states require employers to withhold state income tax from payments to independent contractors and report these amounts on state-specific 1099 forms.

- State-specific filing deadlines and requirements: Filing deadlines and reporting criteria can differ significantly among states.

- State-specific penalties: Failing to comply with state requirements may result in penalties and interest charges.

While the IRS Combined Federal/State Filing Program (CF/SF) streamlines reporting for some states, specific 1099 forms, like the 1099-NEC, often necessitate direct filing. This process can be challenging due to varying thresholds, deadlines, and methods of filing across different states.

To simplify compliance, PDFLiner offers an option for state filing in electronic format when submitting your 1099 forms. This feature ensures your forms are filed directly and accurately, helping you meet state-specific requirements with ease.

Do I need to file a 1099-NEC or 1099-MISC for every payment?

No, you only need to file a 1099-NEC or 1099-MISC if the total payments to a contractor or vendor exceed $600 during the tax year. For royalties, you must file a 1099-MISC if the total is $10 or more.

What’s the difference between the 1099-NEC and 1099-MISC?

The 1099-NEC is used exclusively for reporting non-employee compensation (e.g., payments to freelancers or contractors). The 1099-MISC is used for other types of payments, such as rent, royalties, medical services, and attorney fees.

When are the filing deadlines for 1099-NEC and 1099-MISC?

- 1099-NEC: Must be filed by January 31, 2025, whether filing electronically or by mail.

- 1099-MISC: Must be filed by February 28, 2025 (paper) or March 31, 2025 (e-file).

How can I ensure I’ve entered the correct Taxpayer Identification Number (TIN)?

Use PDFLiner’s TIN Matching Service to validate the TIN against IRS records before submitting your 1099 forms. This reduces the risk of errors and penalties for mismatched or incorrect TINs.

Can I file both 1099-NEC and 1099-MISC forms electronically?

Yes, PDFLiner allows you to complete and file both forms electronically. Simply fill out the forms, validate the data, and click Submit to IRS directly from the platform. Electronic filing is faster and mandatory if you’re submitting 10 or more forms.

Fill Out 1099 Forms with PDFLiner

Start filing your documents electronically and save loads of time!