-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out a 1099-MISC Form - A Step-by-Step Instruction

.png)

Dmytro Serhiiev

Last Update: Dec 21, 2024

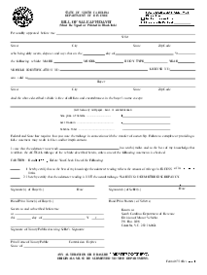

Being a business owner includes a range of bureaucratic documents you have to follow up to unless you want the IRS to be cautious about you. While most forms are filed for the processes inside a business, knowing how to file a 1099-MISC helps report on your external (non-employee) payments. So take a look at the 1099-MISC How to Report Guide below.

1099-MISC Form 65bb60ced1918f924e00be1b

Key Takeaways

- Form 1099-MISC is used by businesses to report miscellaneous payments of $600 or more to non-employees, such as rent, royalties, and other income types.

- The filing process involves collecting recipient information, accurately completing the form's various sections, and submitting it to both the IRS and the payment recipient by specific deadlines.

- Important deadlines include January 31st for sending copies to recipients, February 28th for paper filing with the IRS, and March 31st for electronic filing with the IRS.

- Failure to file or late filing can result in penalties ranging from $50 to $270 per form, with potentially higher fines for intentional violations.

What Is a 1099-MISC Form

As a derivation of 1099, a 1099-MISC is meant for filing by businesses to report payments other than non-employee payments. For example, royalties or fishing boat proceeds. Such payments have to be in the range of $600 and more. Also, rent and awards can be subject to the 1099-MISC consideration if, again, they are over the estimated payment range (see our article to learn how to get a 1099-MISC form).

The annual information statement should be sent to all recipients before January 31st, so they can report the amount from all their 1099s on Schedule C. As a payer, you are also responsible for reporting the amount of payment to the IRS. File all copies A of the form using Form 1096 before February 28th if you are using mail, or before March 31st if you are e-filing. Note that in order to get a scannable version of copy A that IRS accepts, you need to order information returns directly from the IRS website.

Here you'll find detailed instruction on how to fill a copy of 1099-MISC and file it to different receipients:

- Copy A — For the Internal Revenue Service Center.

- Copy 1 — For the State Tax Department (if needed).

- Copy B — For recipient.

- Copy 2 — Needs to be filed with the recipient’s state income tax return if requested.

- Copy C — For the Payer.

Fill Out 1099-MISC Form 65bb60ced1918f924e00be1b

Who Files Form 1099-MISC

Before getting to know how to file a 1099-MISC, you should know a little about the taxation procedures and what comes with it.

If your business or organization make payments to an individual or entity in the course of their trade or business, you might need to file the form. In case the services provided for you have come to $600 or more from a single entity, then you need to handle the form and send a copy of it to the service provider.

In the case of 1099, the payer doesn't pay any taxes, because this is not an employer payment. The receiver pays the full amount, which is usually a 15.3% rate.

How to Fill Out a 1099-MISC Form

Here is what you need to do to handle the form correctly:

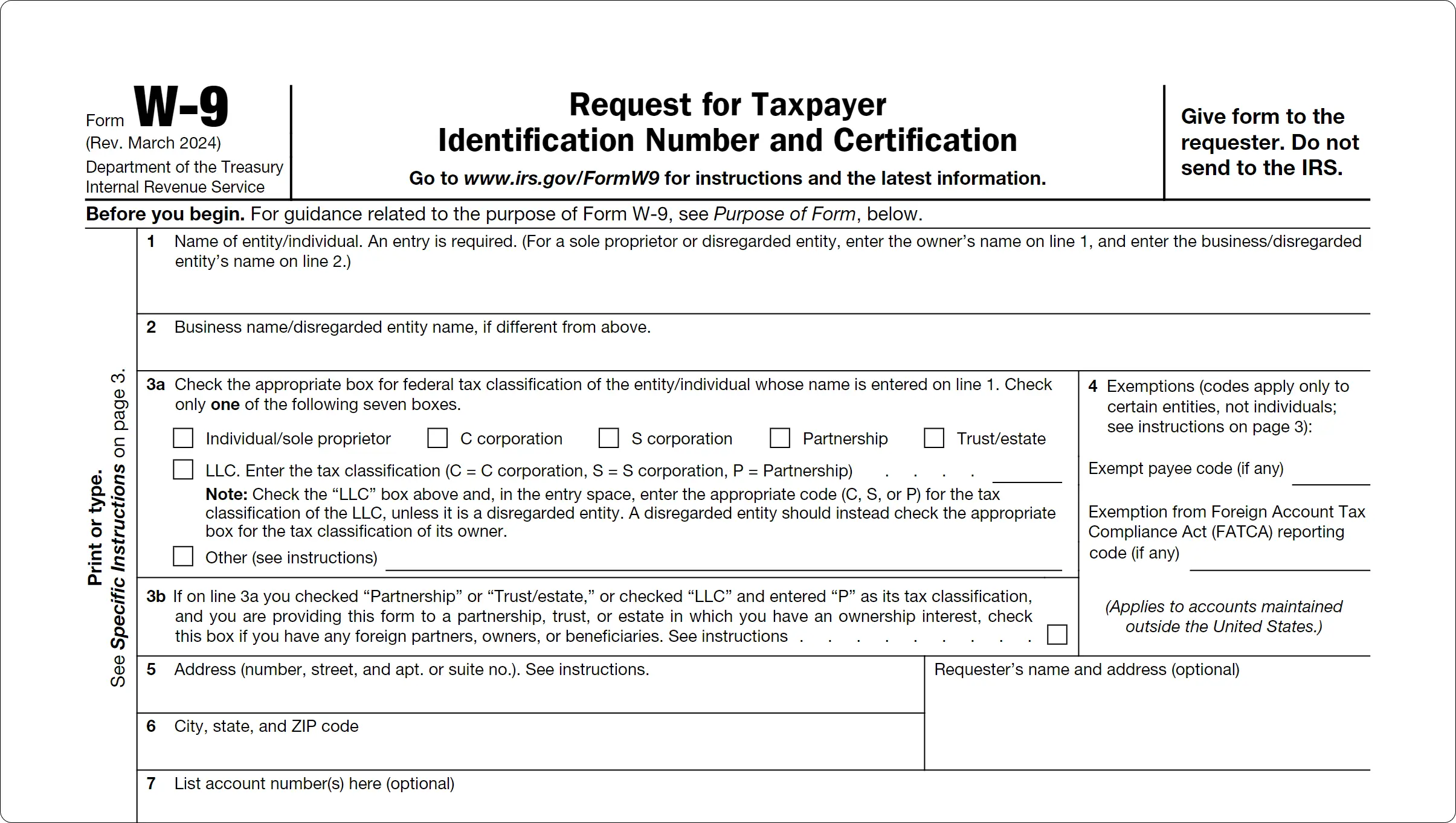

Step 1: Acquire your information

How to report 1099-MISC forms? First and foremost, you need to request and get a W-9 form completed by a receiver, to proceed with a 1099-MISC. Make sure it includes all the necessary information. You will need the name, address, and tax identification number (TIN) of the person or business you paid to.

Mind that the IRS highly recommends that you keep all the previous W-9 and 1099 forms for at least a couple of years.

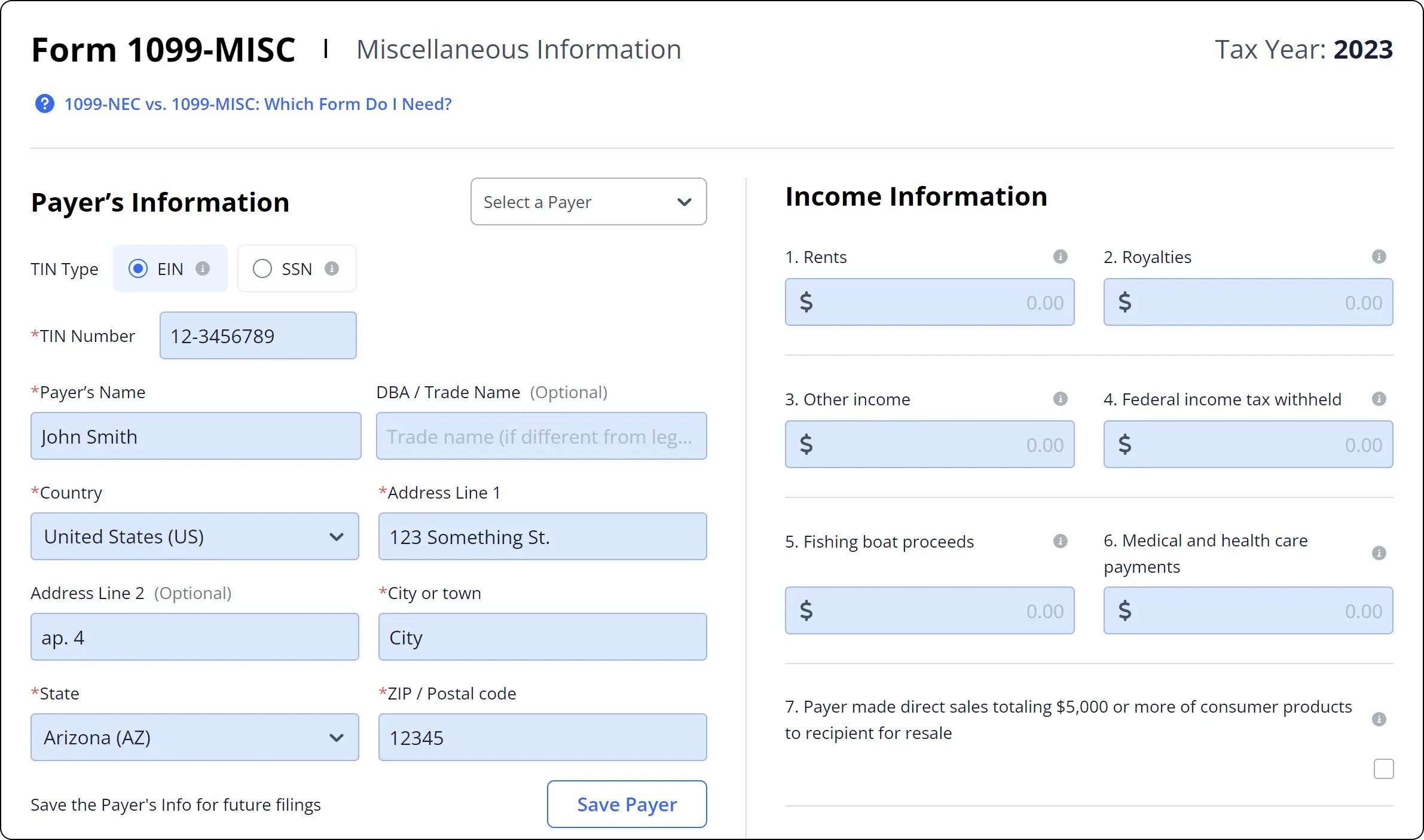

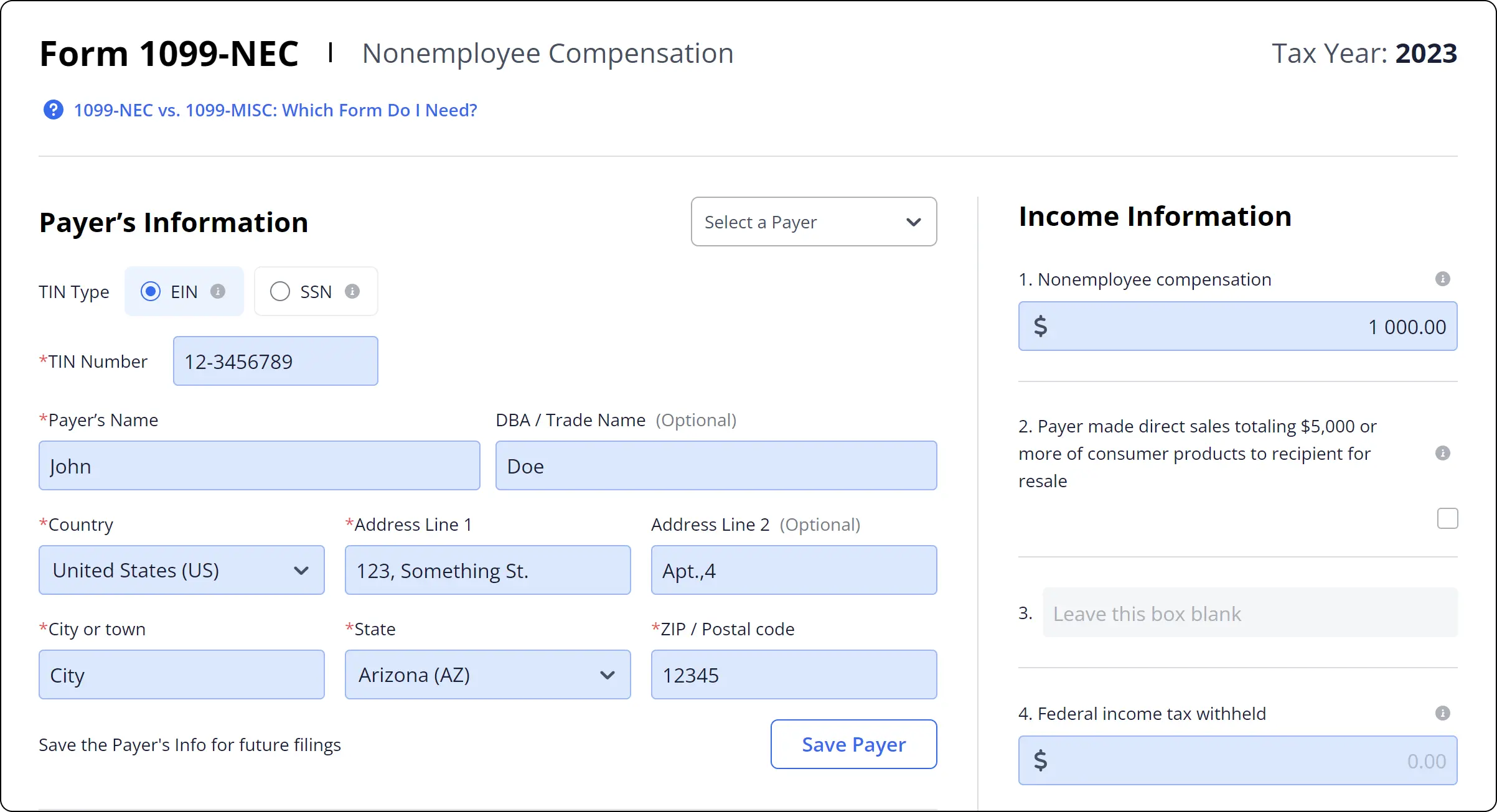

Step 2: Start with a personal info

Once you opened the form in PDFLiner editor proceed to the left part of the form which requires some personal details. Provide the payer’s information. Select and enter your Taxpayer Identification Number type (EIN for businesses and SSN for individuals). including the names, full addresses, TINs, the recipient’s account number, etc.

Enter the correct tax identification number. If you are a business, use your Employer Identification Number (EIN). Then fill in your legal name, business name if applicable, and full address.

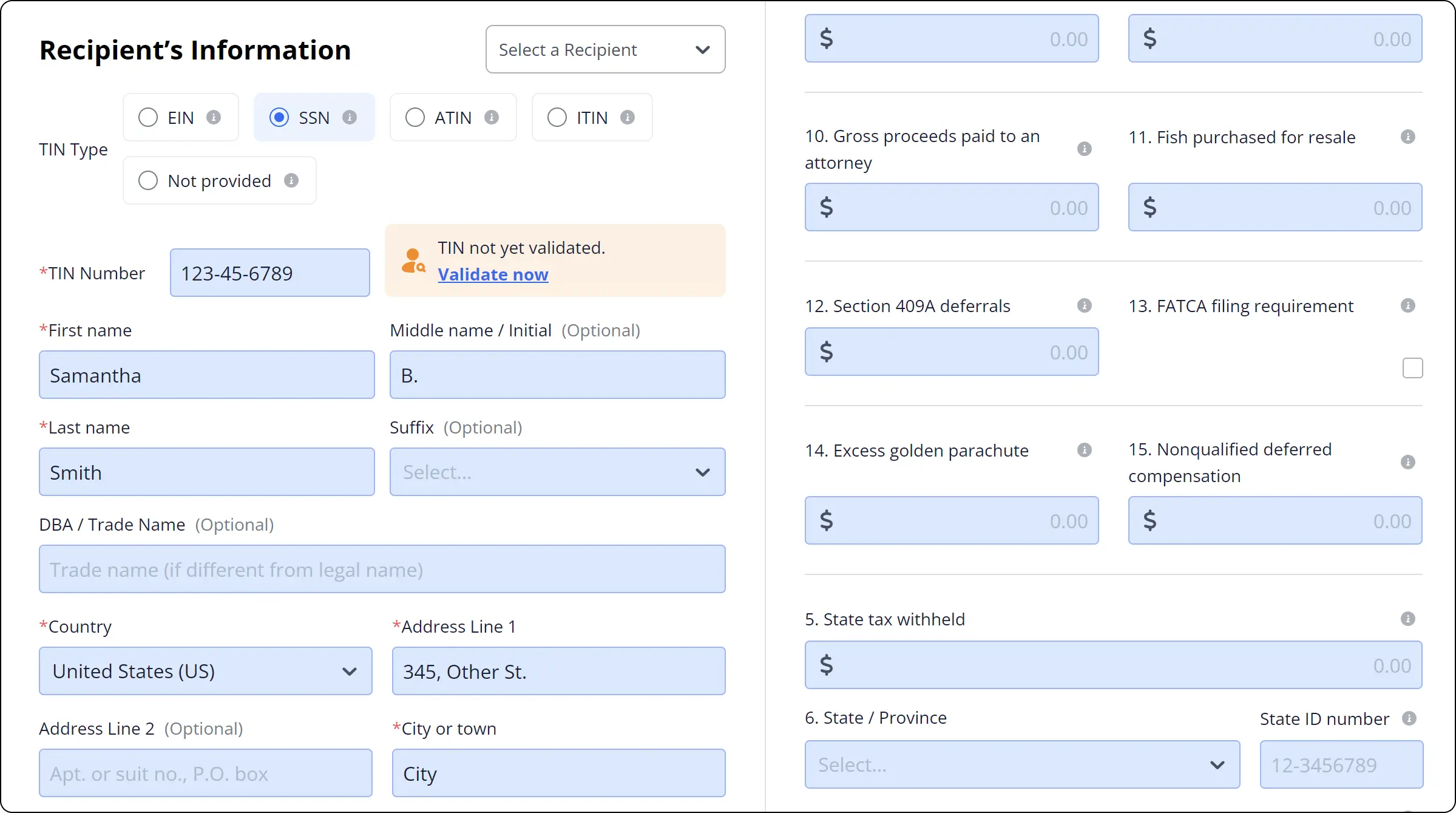

Step 3: Enter and validate receipient's info

Next, input or choose the recipient’s details, including their Taxpayer Identification Number (TIN), name, and address. Once you've entered all required information, click the "Validate now" button to ensure all TINs are correct and to avoid any penalties.

Step 4: Fill out an appropriate payment line

Use a correct box for the type of payment you made:

Line 1: Rents — here you should report the payments made for any types of rents if they exceed $600 (each of them, not the total amount of rent).

Line 2: Royalties — enter all the gross royalty payments made during the year if they are equal to or exceed $10.

Line 3: Other income — if there is a reportable income (that is equal to or exceeds $600) that you paid to the entity, but you can’t include it in any of the lines, enter it here.

Line 4: Federal income tax withheld — enter the exact withheld amount or leave blank if there’s no applicable amount.

Line 5: Fishing boat proceeds — here you should enter the actual amount of all proceeds from the catch sale or the fair market value (FMV) or the portions that belong to each member of the crew. Normally, there are 10 or fewer crew members on the fishing boats that are reportable in this form.

Line 6: Medical and health care payments — all the payments above $600 made to any health care providers, private physicians, medication suppliers, or service providers belong here.

Line 7: Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale — here you don’t have to enter the dollar amount of the sale. Simply enter a cross in the box if it applies to you.

Line 8: Substitute payments in lieu of dividends or interest — here you have to report any aggregate payments that are equal to or exceed $10 (in lieu of dividends) paid to a customer’s broker. If the loan of customer’s securities results in tax-exempt interests, report them here as well.

Line 9: Crop insurance proceeds — if the crop insurance proceeds exceed $600, enter the amount here. If not, leave blank.

Line 10: Gross proceeds paid to an attorney — if you paid $600 or more for legal services provided by an attorney during the year, enter the total amount here.

Line 11: Fish purchased for release — enter the amount paid to the seller to purchase fish for release purposes.

Line 12: Section 409A deferrals — leave blank and see the Notice 2008−115 to figure out the details.

Line 13: Excess golden parachute payments — enter the total of excess payments if you made any.

Line 14: Nonqualified deferred compensation — given that the nonqualified deferred compensation (NQDC) plan doesn’t satisfy the 409A section requirements, you have to report all the deferred amounts if they match the 109A section income definitions. Don’t forget to include the earnings made on the deferred amounts).

Line 15: State tax withheld — fill this section only if you participate in the Combined Federal/State Filing Program or in case you are required to submit physical copies of the form to the state tax department.

Line 16: State/Payer's state no. — see line 15.

Line 17: State income — see line 15.

If you are still not sure about how to fill out a 1099-MISC, it might be a good idea to consult with a tax professional or refer to IRS guidelines for more information on your tax obligations.

1099-MISC Form 65bb60ced1918f924e00be1b

How Do I File 1099-MISC Form

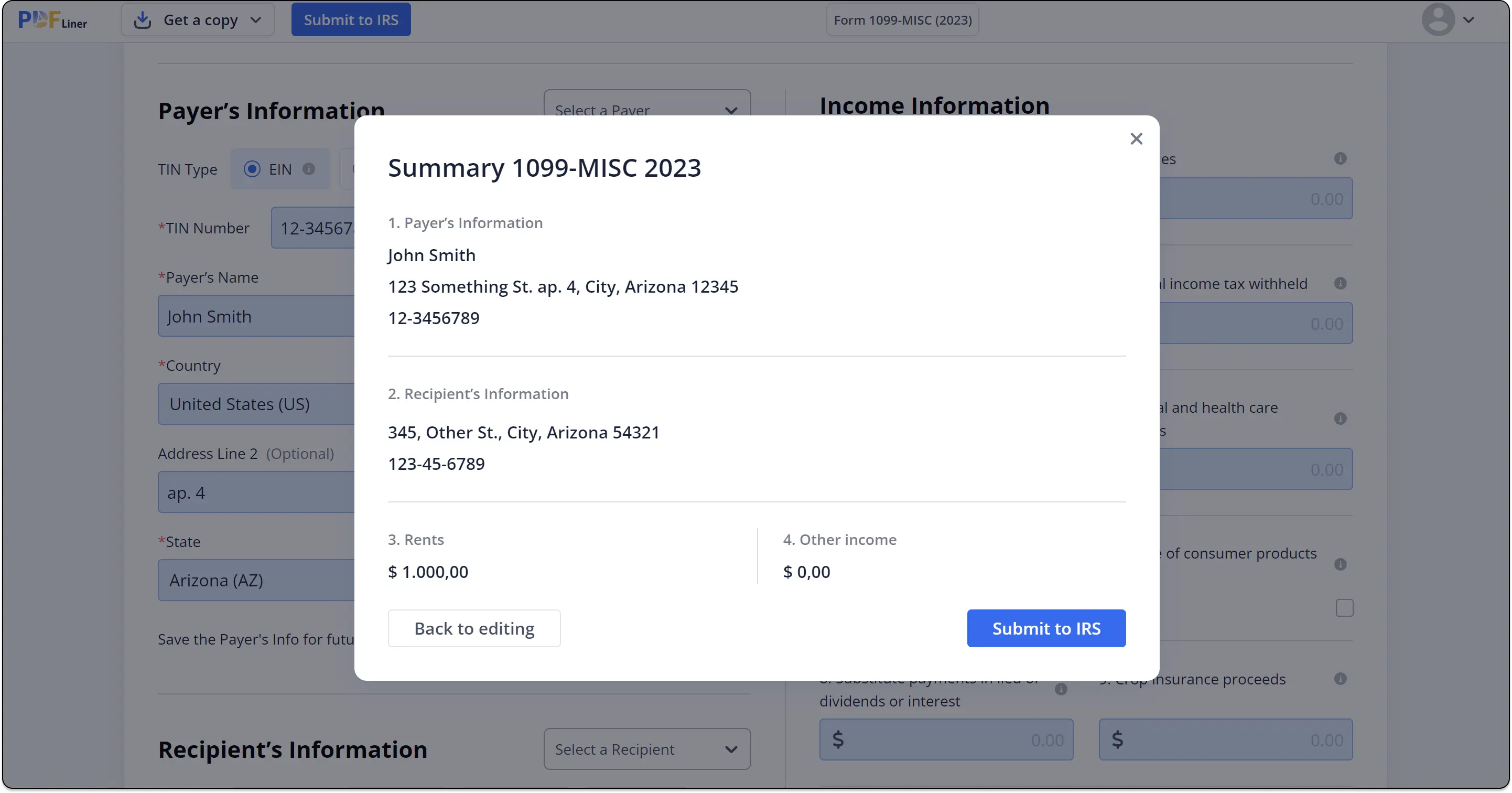

Hopefully, after learning how to handle Form 1099-MISC, how to file taxes won’t be a problem. When you’re done dealing with the form, it’s time to submit it.

After validating the details, click the "Submit to IRS" button. You’ll see a summary page where you can review everything one last time before confirming the submission.

When submitted, the form will be added to a filing queue. PDF Liner will send you email notifications with updates, and you can track the filing status through your dashboard.

When Is a 1099-MISC Due Date

Form 1099 MISC deadline was updated with the introduction of the new Form 1099-NEC version. If you need to file the 1099 MISC form electronically, there’s an option to submit it by March 31, 2025. Copy B of Form 1099-MISC must be filed to the recipient by January 31, 2025. If the final due date is Saturday, Sunday, or a national holiday, the final due day automatically skips to Monday or the nearest working day.

The standard penalty for failing to submit the form in time varies from $50 to $270 per form, depending on how long the business postpones the form submission. If the IRS detects an intentional violation of the form requirements, the fine can be from $550 to 10% of the total income reported on the 1099-MISC form. The $556,500 yearly fine limit doesn’t apply here, which means that the total fine can be larger than 10% exceeds the limit.

If you don’t receive the needed information, but the IRS does, you will receive a notice that requires you to pay the tax on unreported income. There will probably be interest on taxes and a payment window of 30 days.

What Is The Difference Between 1099-MISC And 1099-NEC

Choosing 1099 NEC vs 1099 MISC can be quite tricky because both forms are designed for business income reporting purposes. Let’s figure out what options each form provides to businesses.

Businesses need to issue the IRS Form 1099-MISC for miscellaneous income to report various payments that were made within the tax year. Businesses must file as many copies as there are persons and unincorporated entities that received from $600 for items and healthcare or from $10 in royalties. Nonemployee compensations are not reported in Form 1099-MISC anymore starting from 2020.

1099-NEC Form 65bb60ced1918f924e00be1b

As for Form 1099-NEC, you need this form to report Nonemployee Compensations starting from 2020. The reportable size of the compensation starts at $600 and has no upper limit. Now, this form replaces the 1099-MISC Box 7. Your business must send an individual copy of 1099-NEC to every contractor and business that received commissions, prizes, fees, awards, or payments for provided services. There are exclusions, though. Here is the list of entities that don’t need a copy of 1099-NEC from your business:

- Entities that received payments for physical goods and products from your business;

- C corporations and S corporations don’t need this form from you unless you paid them for medical services, health care, or any attorney services.

To check if you are dealing with a C or S corporation, check out the W-9 from these entities.

FAQ

Do you have some questions about how to issue a 1099-MISC? Find the answers here!

How to issue 1099-MISC forms?

The process of issuing includes collecting information about your annual payments, getting contact and taxpayer’s information from your contractor, and filling out two copies of the form. While it is of no importance whether the form is submitted online or by mail, you have to send a copy to your contractor for their tax return.

How to file taxes with a 1099-MISC if I am a contractor?

You don’t file the form yourself if you are/have been a hired person. The document is completed by your employer, who later sends you a copy of it. Upon your acquisition of the form, you have to use it to complete your Schedule C.

How to correct a 1099-MISC?

Of course, you need to review your form for mistakes before sending it to the IRS. However, you can submit the form again by ticking the box ‘Corrected’ at the top of the document and submitting it anew. In this case, you also have to make amends to your corresponding forms, e.g., 1096.

How to file 1099-MISC for free?

When handling the form, it can be filed either by yourself, using the IRS forms from the website, or with the help of online services. The latter provides a full range of services that enable you to have a fast and quick filing. All you need to do is supply an agency with online information about your taxpayer’s account, whereas the rest is done by them.

Go Paperless with PDFLiner

Fill out, edit, sign, and share any document online and save the planet!

.webp)