-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get a 1099-MISC Form — Quick Guide

The 1099 form from the IRS is a legal document with which you report how much money you paid to people for some odd/occasional jobs for you. It’s important to keep in mind that you must list only those expenses spent on workers who aren’t your regular employees.

1099-MISC Online 65bb66ba44aa4904c305d679

1099-MISC for 2023 should be used to report:

- Rental payments.

- Attorney payments.

- Award/prize money.

- Money paid for freelance work.

- Expenses related to healthcare.

You can check the full list here. But how to get a 1099 form? There are two ways: let’s examine each one.

PDFLiner

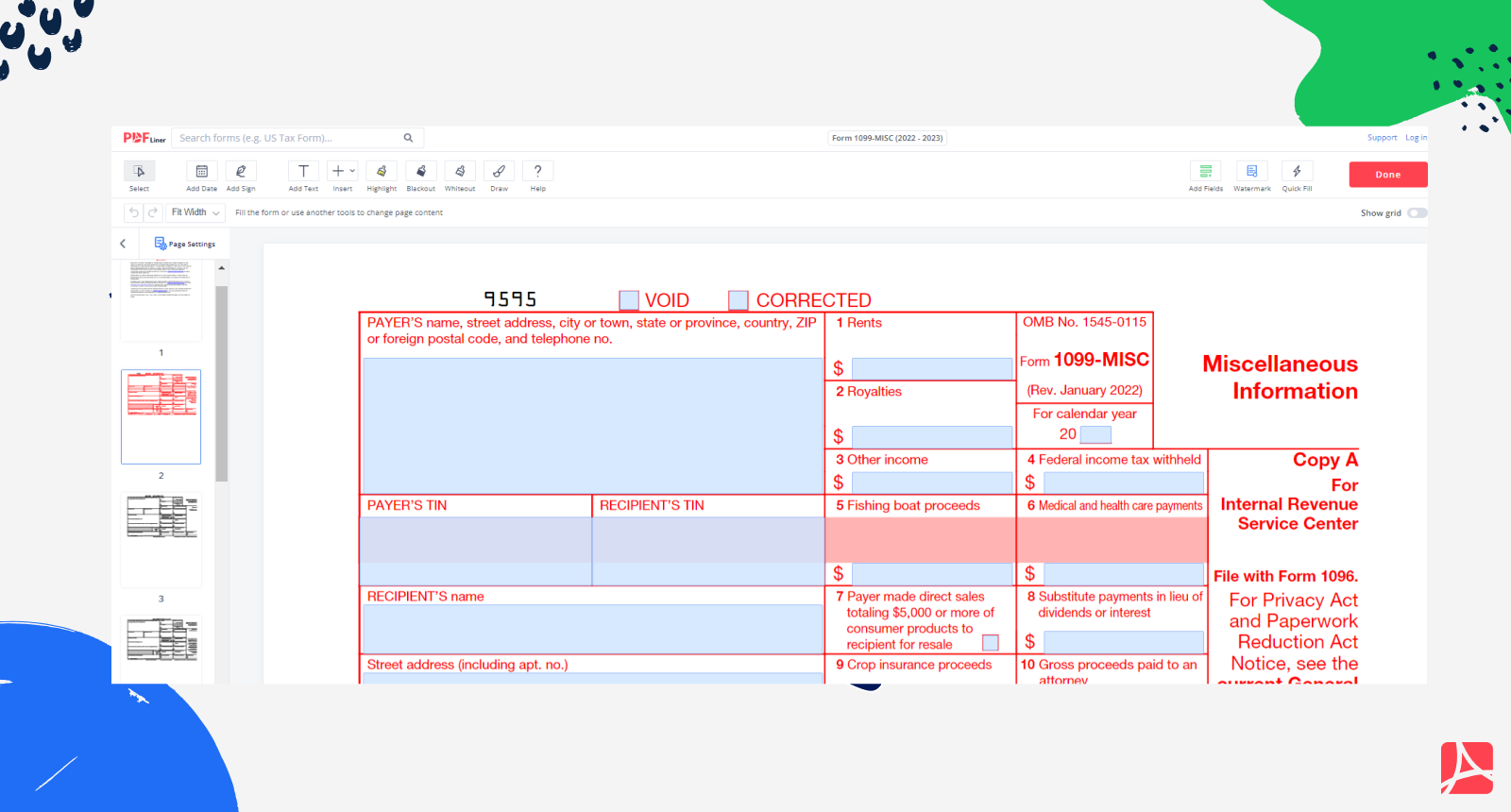

You can get the 1099 form online using PDFLiner. You can just simply click this link to open the form or search for it on the PDFLiner Forms search.

Here’s what to do:

- Click on Search for Documents.

- Type in the name of the document that you need: in our case, it is the 1099 tax form.

And voilà: the service will browse this document plus all the forms that start with the 1099 code. Thus you’ll be able to use the 1099-MISC form to file it today.

But there’s more you can gain from PDFLiner. The service also allows you to request and store W9 forms from vendors edit PDF documents online. For free. You don’t need tools like MS Office or advanced Acrobat Reader to fill it out or create a 1099 form from scratch.

After that, you can download a document to print it or share it online with anyone: your boss, lawyer, spouse, employees, etc. Besides, there’s an e-signature tool and a cloud backup feature.

Plus, if you do it for the first time, PDFLiner offers an easy guide on how to fill out a 1099-MISC form for employees.

Edit 1099-MISC 65bb66ba44aa4904c305d679

IRS

.png)

You’ll instantly get the PDF, but there’s a major downside — the IRS provides no tools for filling out the form. You will need freeware applications like Apache OpenOffice, Calligra, and other similar tools to do the job if you have no editing software. Therefore, using the PDFLiner service is more quick and straightforward.

Fillable 1099-MISC 65bb66ba44aa4904c305d679

Frequently Asked Questions

Here are a few popular questions on what to do with the 1099-MISC form.

What is a 1099-MISC form used for?

The form is used for reporting expenses spent on non-employed workers.

Who gets a 1099 form?

Everyone who makes money from freelancing, interest, winning monetary prizes, and so on. Check here for more info.

How does 1099-MISC affect my taxes?

1099-MISC shows your income, which should be reported on your tax return. Use a tax calculator to know how much you owe.

What happens if I don't file my 1099-MISC?

If you fail to file the form on time, you’ll be punished with a fine starting with $50 per form.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

1099-MISC Form 65bb60ced1918f924e00be1b

.png)