-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Different Types of 1099 Explained: Which One Is for You?

.png)

Dmytro Serhiiev

Last Update: Nov 22, 2024

When tax season comes, 1099 forms often cause a bit of a headache. Don't worry: we're here to make things easier. This guide will break down what 1099 forms are in a comprehensible way. Whether you're a freelancer, a landlord, or someone trying to make sense of the paperwork, we'll walk you through the different types of 1099 forms and explain how they might apply to you.

Key Takeaways

- 1099 forms are crucial for reporting various types of income, especially for freelancers, landlords, and investors, simplifying the process for accurate tax filing.

- The most frequently encountered forms include 1099-MISC for miscellaneous income, 1099-NEC for non-employee compensation, 1099-INT for interest income, and 1099-DIV for dividends.

- 1099 forms can be found on the PDFLiner website, which also offers convenient and secure ways to fill them out.

What Are 1099 Forms

Have you ever looked at a 1099 form and thought, "So, what are 1099 forms for exactly?" These forms are important for the IRS to keep track of money you earn from an irregular job. Here's a quick look at what they mean for you:

- Freelancing or Working on Your Own: If you earn money freelancing or doing contract work, you need the 1099-NEC form. It's like companies filling out a report card about your earnings on the 1099-NEC, showing the IRS what is on a 1099 tax form.

- Interest and Stock Dividends: Do you have some extra cash from a savings account or stock market investments? This comes to you on a 1099-INT for the interest and a 1099-DIV for dividends.

- Renting out Property: If you're a landlord and earn rent money, you have to report it using a 1099-MISC form.

Remember, if you're making money in ways other than a regular paycheck, you'll probably get a 1099 form. These usually arrive by January 31st after the year you made the money. Keeping these forms in order is a big help when it's time to take care of your taxes.

Most Popular Types of 1099s

When sorting through tax papers, you’ll encounter different types of 1099s. They're pretty common due to the diverse 1099 form requirements covering various income sources. Let's explore the most common 1099 forms, and check out a few examples of 1099 forms in everyday life. Getting to know these forms will not only add to your tax knowledge but also help you simplify your tax filing experience.

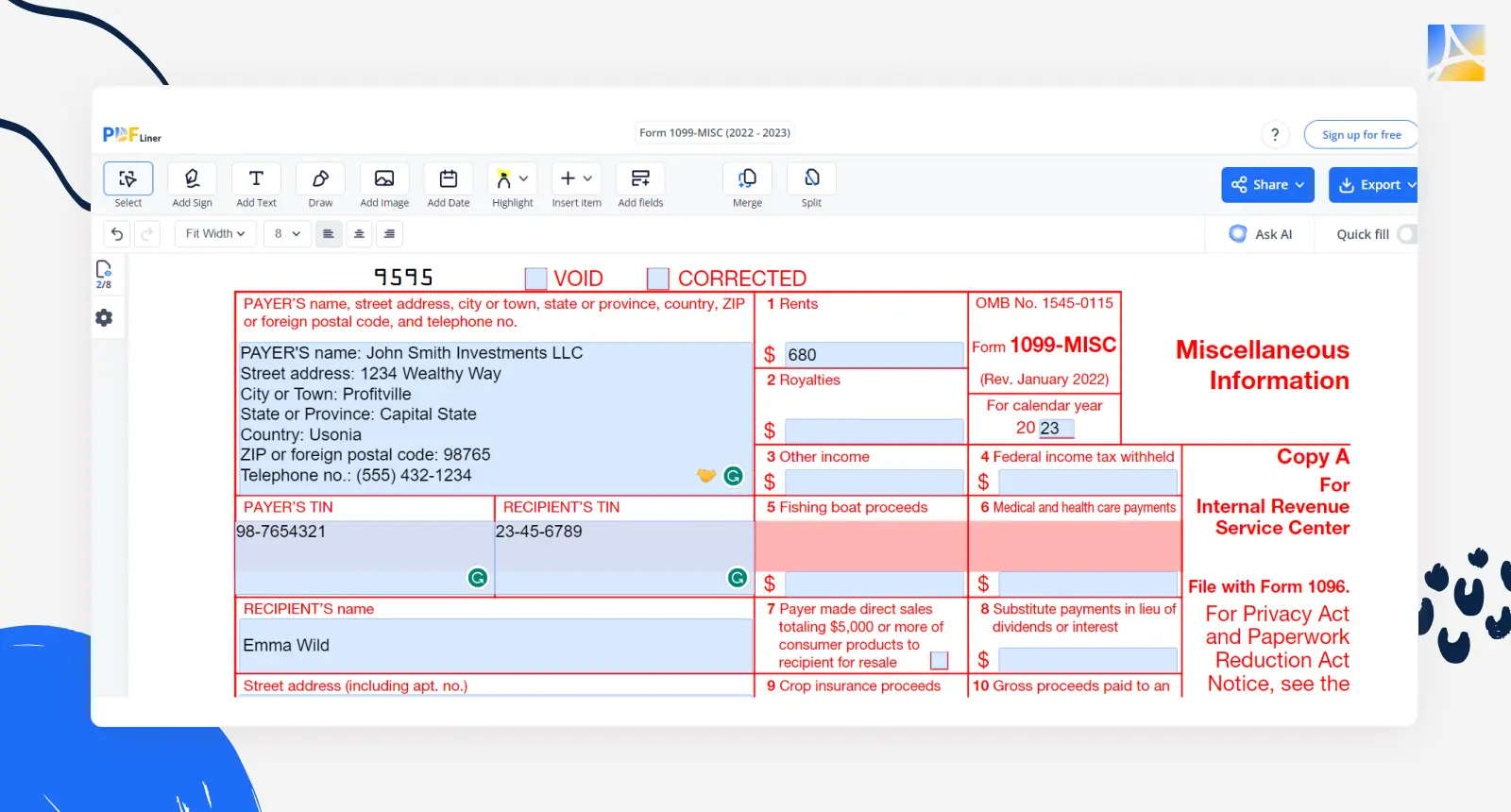

1. 1099-MISC

The 1099-MISC form reports miscellaneous income, which can include payments such as rent, awards, or legal settlements. It's the go-to form for reporting several types of income that don't fall under other specific 1099 categories.

Example of 1099-MISC use:

- Scenario: Let's consider a freelance photographer, Emma, who also owns a small rental property.

- Rental Income: Emma rents out a portion of her property for events and workshops. For the year, she earns a total of $8,000 from various renters. Each renter, if they are a business entity paying more than $600, is responsible for issuing a 1099-MISC to Emma, detailing the rental income paid.

- Legal Settlement: In the same year, Emma won a legal settlement in a copyright dispute for $3,000. The law firm representing her would issue a 1099-MISC form to report this settlement amount.

Create 1099-MISC 65bb60ced1918f924e00be1b 665bb60ced1918f924e00be1b65bb60ced1918f924e00be1b

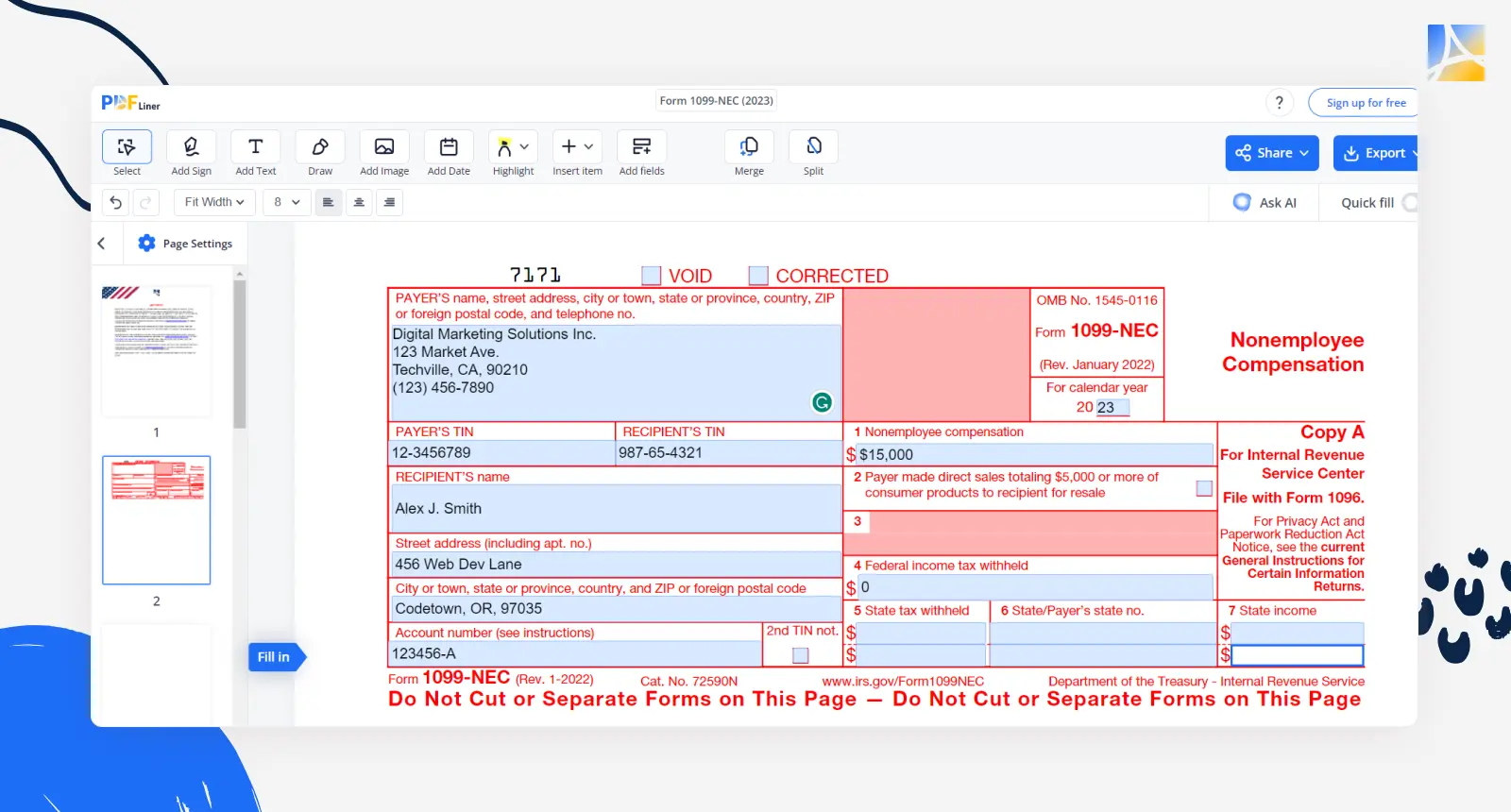

2. 1099-NEC

Form 1099-NEC is specifically designed to report income paid to independent contractors and freelancers. This form replaced the 1099-MISC for reporting non-employee compensation starting in the tax year 2020. It's particularly relevant for those who work on a contract basis or have their own freelance business.

Example of 1099-NEC use:

- Scenario: Meet Alex, a freelance web developer who works with various clients throughout the year.

- Freelance Income: Throughout the year, Alex works with several clients and earns a total of $50,000. One of his major clients is a digital marketing agency from which he earns $15,000 for a website redesign project. Since this income exceeds the $600 threshold, the agency is required to issue a 1099-NEC to Alex, reporting the payment made to him.

- Additional Clients: For his other projects, each client who pays Alex more than $600 throughout the year will also issue a separate 1099-NEC form. These forms will detail the respective amounts paid to him.

Create 1099-NEC 65bb657f5447959694021119

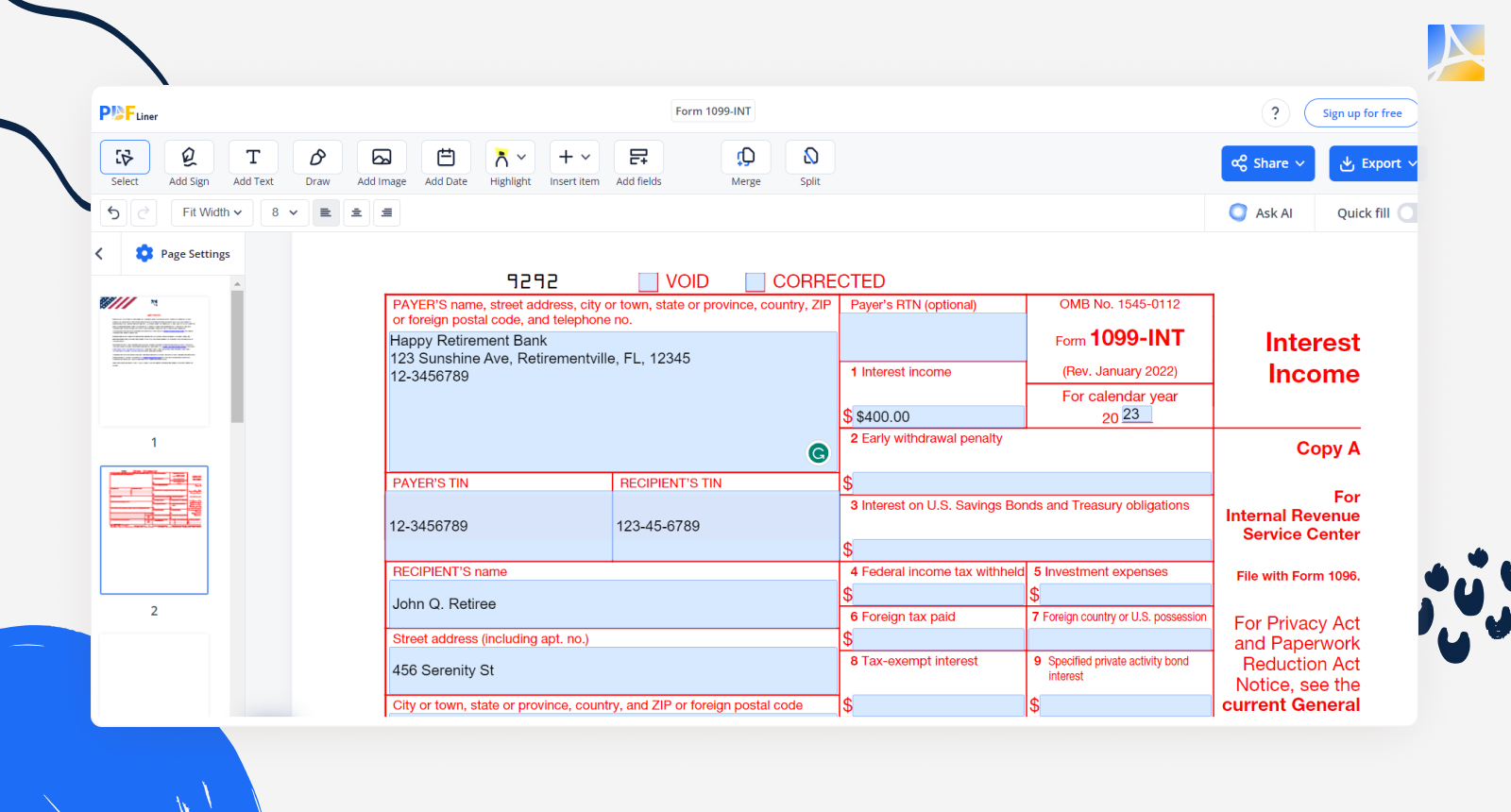

3. 1099-INT

The 1099-INT serves to report interest income. This form is commonly issued by banks, financial institutions, and others who pay interest to an individual. Interest income can come from a variety of sources like savings accounts, interest-bearing checking accounts, or investments in bonds.

Example of 1099-INT use:

- Scenario: Imagine a retiree, John, who has a diversified portfolio of savings and investments.

- Savings Account Interest: John has a high-yield savings account that brought him $400 in interest over the year. The bank where John holds his savings account will issue a 1099-INT form to him detailing the amount of interest earned. This form helps John accurately report his income from interest on his tax return.

- Bond Investments: Additionally, John had invested in municipal bonds, which paid him $1,000 in interest during the year. The entity that issued the bonds will also provide John with a 1099-INT form reflecting this interest income.

Create 1099-INT 65bb66ba44aa4904c305d679

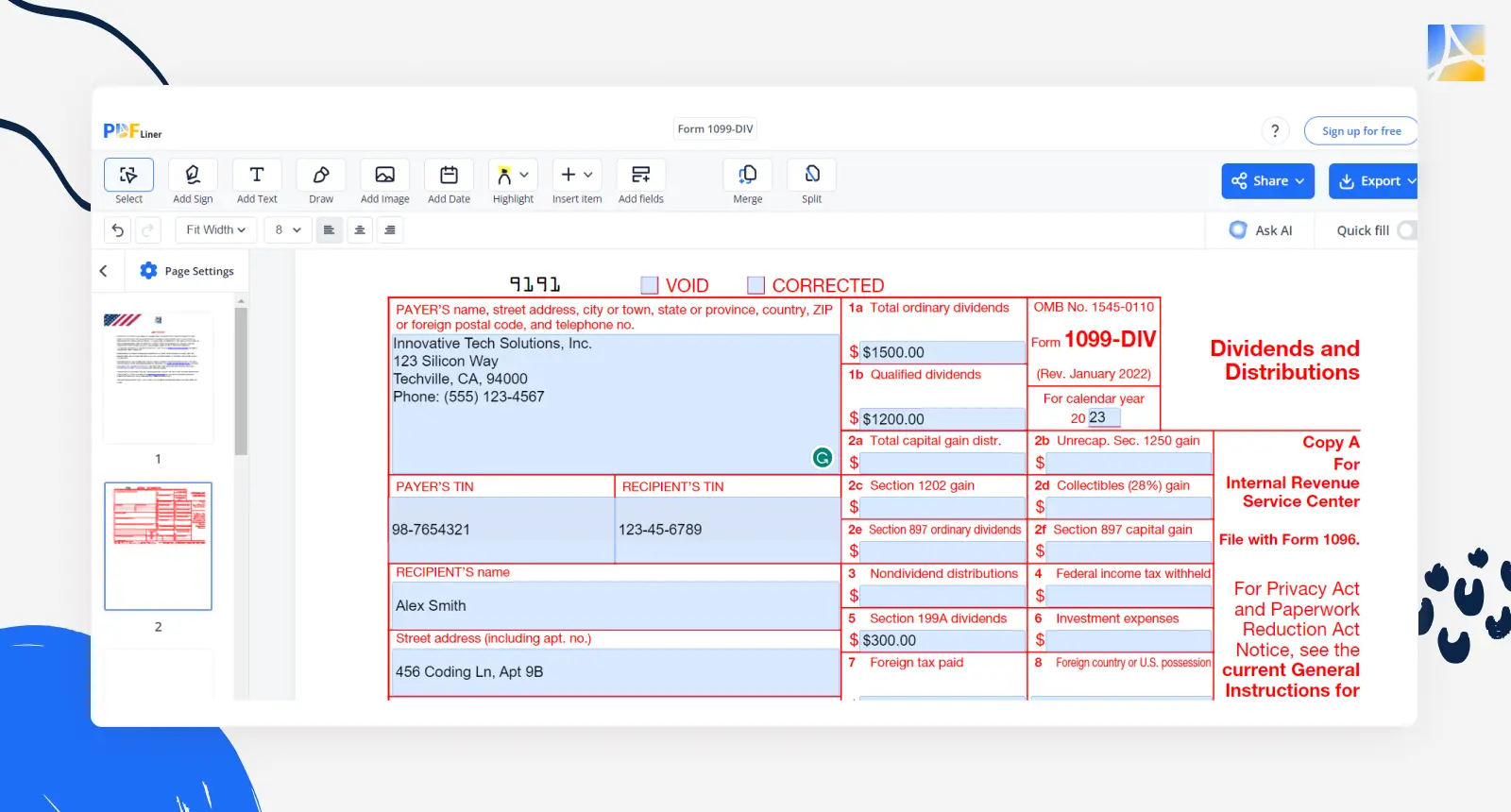

4. 1099-DIV

Form 1099-DIV is specifically used to report income from dividends and distributions. The form is essential for anyone who earns income from stocks, mutual funds, or other investments that pay dividends. Understanding how this form works can be crucial for investors in managing their tax liabilities.

Example of 1099-DIV use:

- Scenario: Meet Alex, a software engineer who invests in the stock market. This year, he received dividends from various stocks he holds in his portfolio.

- Dividend Income: Throughout the year, Alex earns a total of $2,500 in dividends from his investments. Each company he has invested in is responsible for sending him a 1099-DIV form. These forms will detail the amounts paid to him as dividends, which are categorized as investment income.

- Reporting on Tax Return: When Alex prepares his tax return, he must include these dividends as income. The 1099-DIV forms provide the necessary details to report this income accurately. This is important because dividend income may be taxed differently than regular income, and accurate reporting is crucial to determine the correct tax liability.

Create 1099-DIV 65e799fce8ff53f48d038222

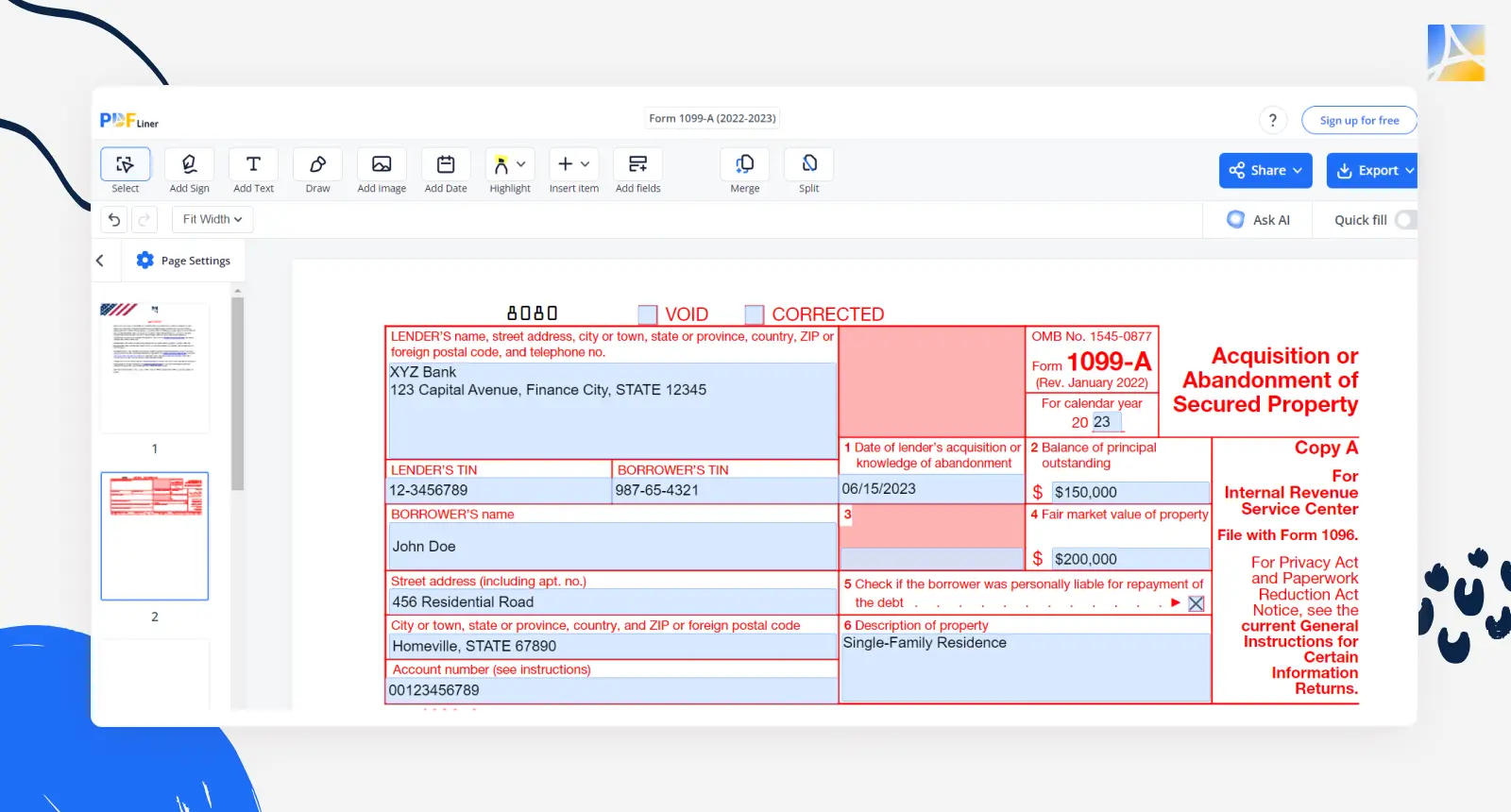

5. 1099-A

The 1099-A is for reporting information related to the acquisition or abandonment of property secured by a loan. This form becomes relevant in situations like foreclosure, where a lender takes possession of a property due to non-payment of the mortgage.

Example of 1099-A use:

- Scenario: Meet John, a homeowner who faces foreclosure on his home due to financial difficulties.

- Foreclosure Process: After several missed mortgage payments, John's lender initiates the foreclosure process. The house, valued at $200,000, has an outstanding mortgage balance of $150,000 at the time of foreclosure.

- 1099-A Issuance: Following the foreclosure, John's lender is required to issue a 1099-A form. This form would include key details such as the date of the foreclosure, the property's fair market value (in this case, $200,000), and the remaining loan balance ($150,000).

Create 1099-A 61cc1df14def9a61496963a5

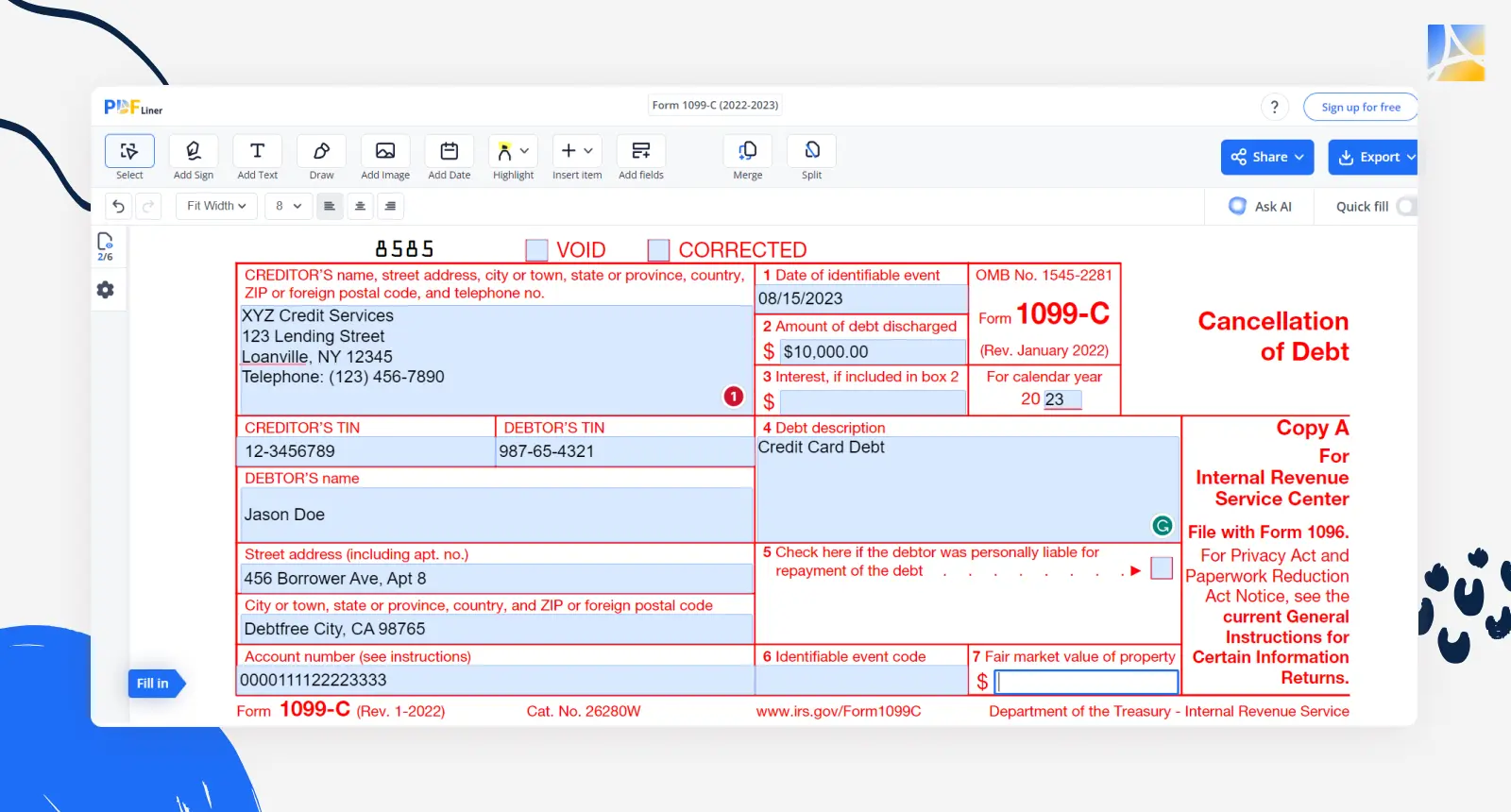

6. 1099-C

Form 1099-C reports the cancellation of debt. When a debt is forgiven or discharged for less than the full amount owed, the IRS considers the forgiven amount as taxable income. This form becomes particularly relevant in situations like settled debt negotiations, foreclosures, or repossessions.

Example of 1099-C use:

- Scenario: Consider Jason, who has accumulated $20,000 in credit card debt. Due to financial difficulties, he negotiates with the credit card company and settles the debt for $10,000.

- Debt Forgiveness: The credit card company agrees to the settlement, forgiving $10,000 of Jason's debt. This forgiven amount is considered taxable income. Therefore, the credit card company will issue a 1099-C to Jason, indicating the $10,000 as canceled debt.

Create 1099-C 61cc24e2ff28fd7905509862

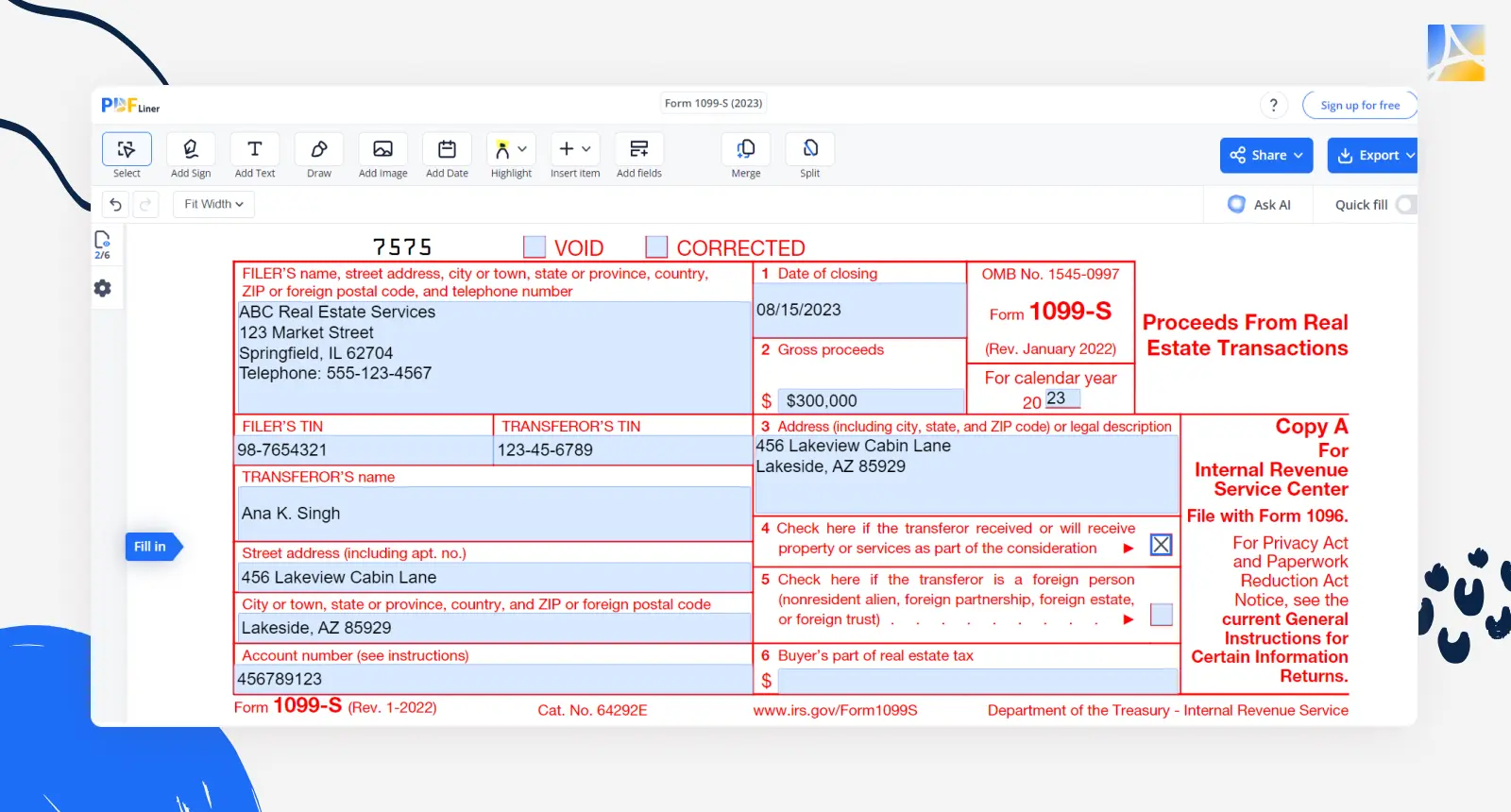

7. 1099-S

Form 1099-S is specifically used to report proceeds from real estate transactions. It comes into play when you sell or exchange real estate and need to report the transaction for tax purposes.

Example of 1099-S use:

- Scenario: Imagine a couple, Raj and Ana, who decide to sell their vacation home.

- Real Estate Sale: Raj and Ana bought their vacation home a few years ago for $200,000. This year, they sold it for $300,000. The transaction resulted in a capital gain of $100,000. The real estate agent or the company handling the closing of the sale is responsible for issuing a 1099-S form to Raj and Ana. This form will detail the gross proceeds from the sale of the property.

- Reporting on Tax Return: Raj and Ana must report this transaction on their tax return. The information from the 1099-S form helps them (and the IRS) determine if there are any capital gains tax liabilities. Depending on the duration of their ownership and use of the home, they might qualify for a capital gains exclusion.

Create 1099-S 61b0d42323f74a452d0dc672

Less Common Types of 1099 Forms

While some 1099 forms are frequently encountered due to their application in common financial transactions, several other forms are less widespread but equally important. These forms cater to more specific or unique financial situations. Understanding them can be particularly relevant if you're involved in diverse financial activities or investments.

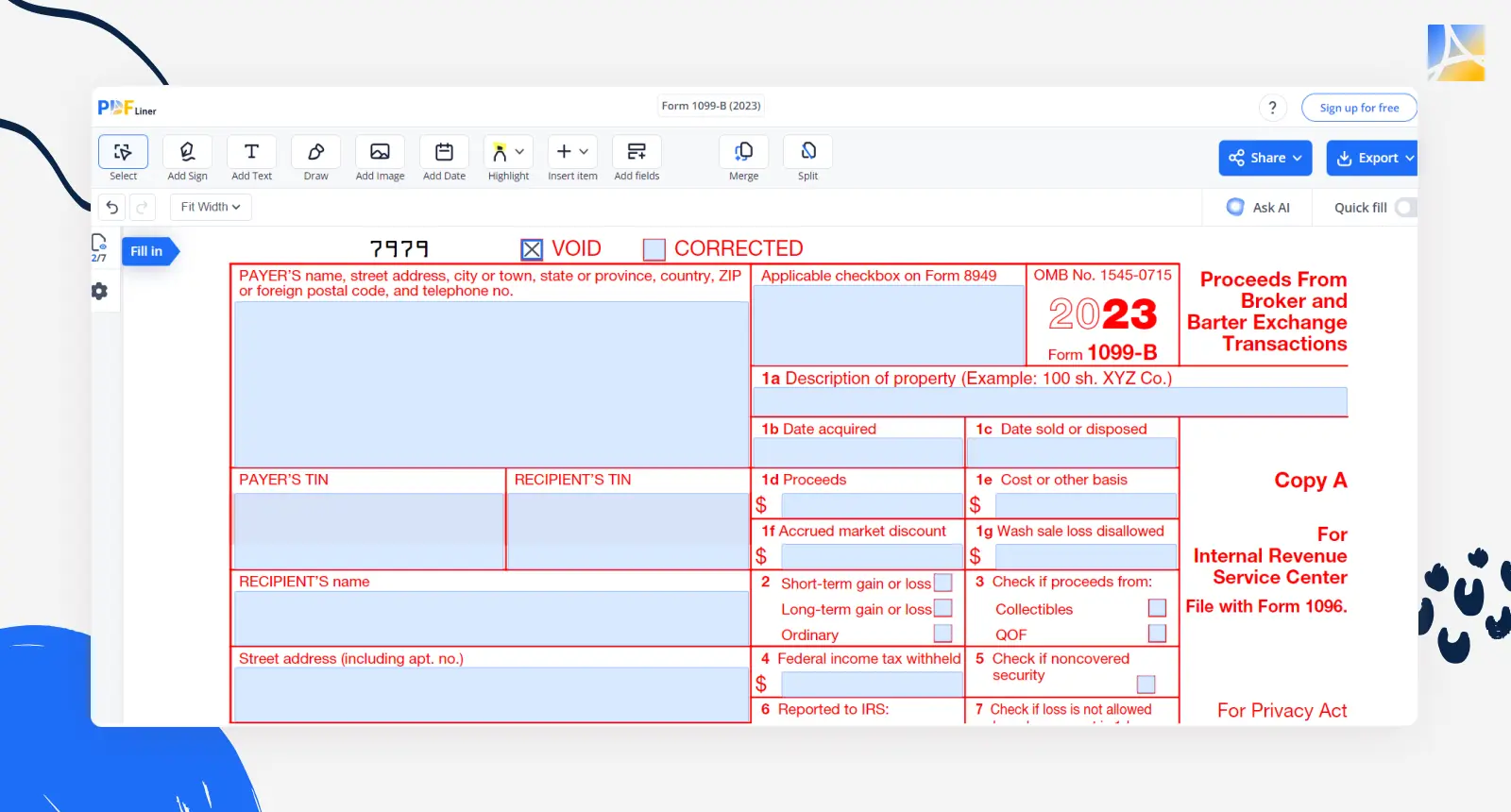

1. 1099-B

Form 1099-B for the proceeds from broker and barter exchange transactions. It's typically issued by brokers or mutual fund companies to report on the sale of stocks, bonds, mutual funds, and other securities. The form details the date of the sale, the purchase price (cost basis), the sale price, and any gains or losses. This information is crucial for taxpayers to report capital gains or losses on their tax returns.

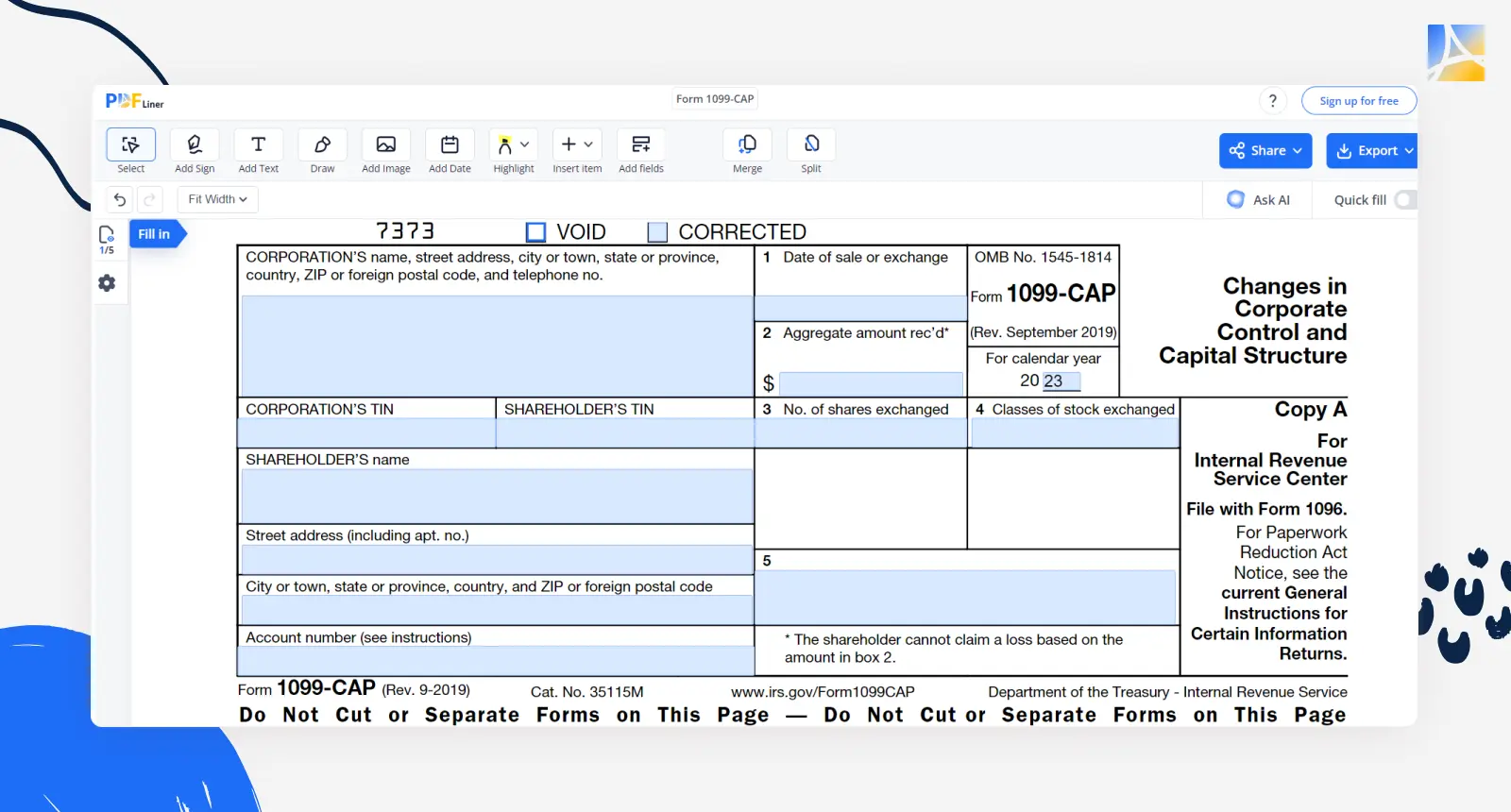

2. 1099-CAP

The 1099-CAP form is for changes in corporate control and capital structure. This form is relevant for shareholders in a corporation that has undergone a significant change in capital structure, such as mergers, acquisitions, or large-scale reorganizations. The form reports any cash, stock, or other property from an acquisition of control or a substantial change in a corporation's capital structure. This information helps shareholders report any capital gain or loss from these transactions on their tax return.

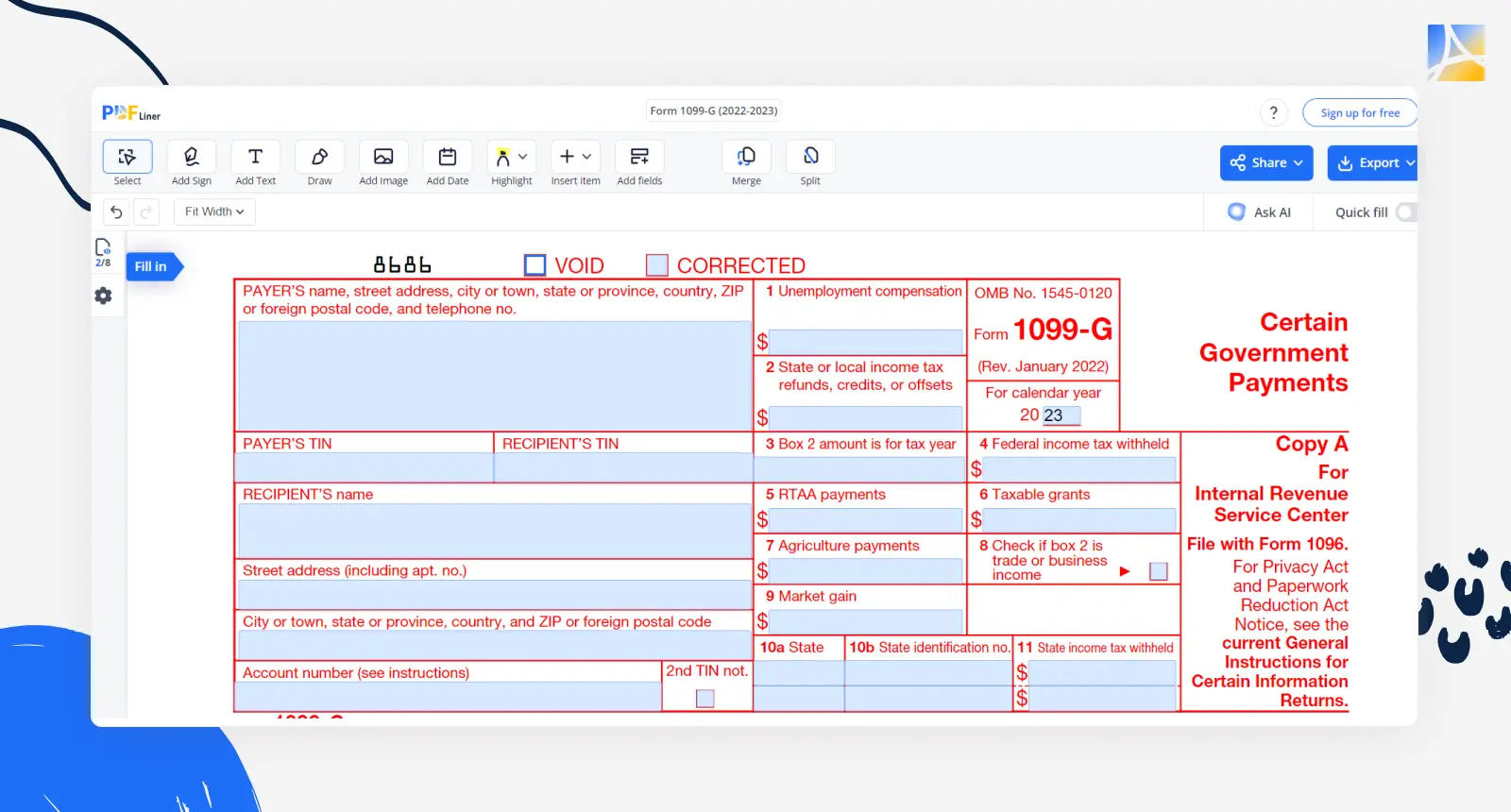

3. 1099-G

Government agencies issue Form 1099-G to report certain types of payments. The most common use of this form is to report unemployment compensation, state and local income tax refunds, credits, or offsets. It also covers taxable grants, agricultural payments, and certain payments from the Department of Agriculture.

If you've received a tax refund from your state or unemployment benefits during the tax year, you will typically receive a 1099-G form. This form helps you determine if any part of your state or local tax refund is taxable or if you need to report any other income covered by this form on your federal tax return.

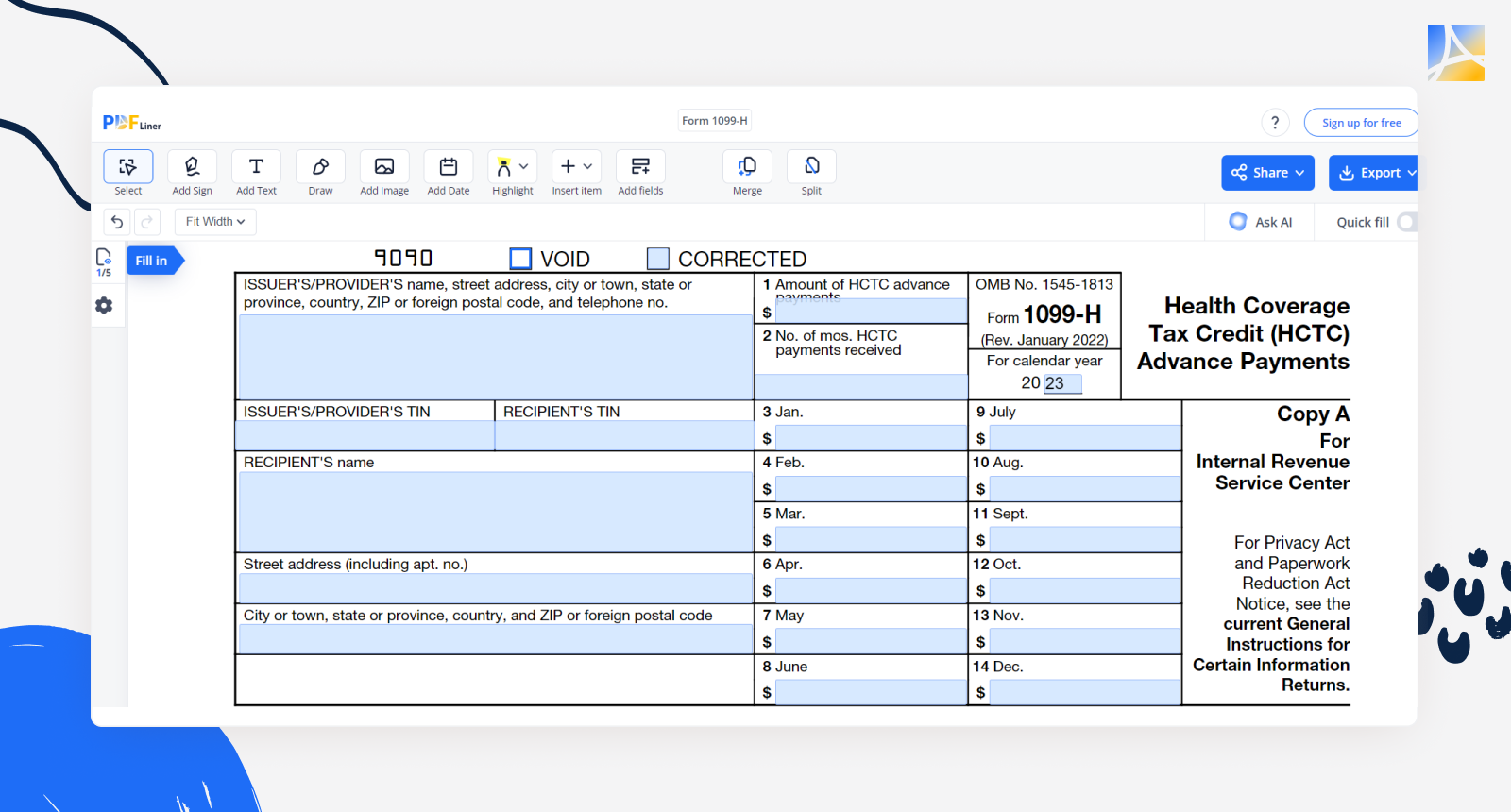

4. 1099-H

Form 1099-H reports the total amount of health insurance advance payments so taxpayers can reconcile the amount on their tax returns and ensure proper declaration of these subsidies.

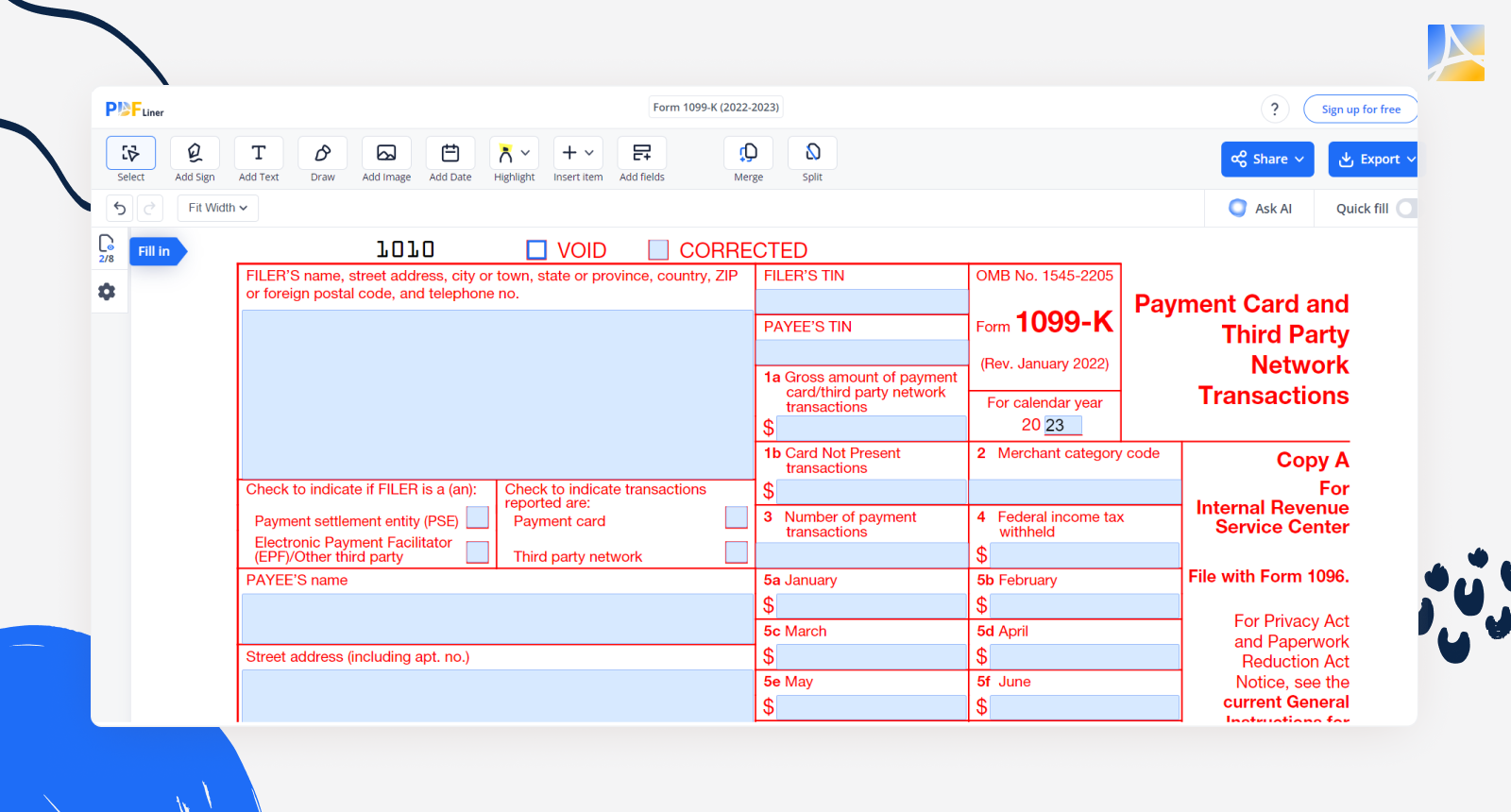

5. 1099-K

Payment settlement entities issue 1099-K to report transactions processed through their networks. This includes third-party network transactions and payment card transactions. It’s commonly used by people who receive payments through platforms such as PayPal, Stripe, or Square or for those who conduct a significant amount of business through credit card transactions.

The form reports the gross amount of the transactions processed, helping taxpayers to report this income accurately. With the growing prevalence of digital and card payments, especially for small businesses and independent contractors, the 1099-K form has become significantly important.

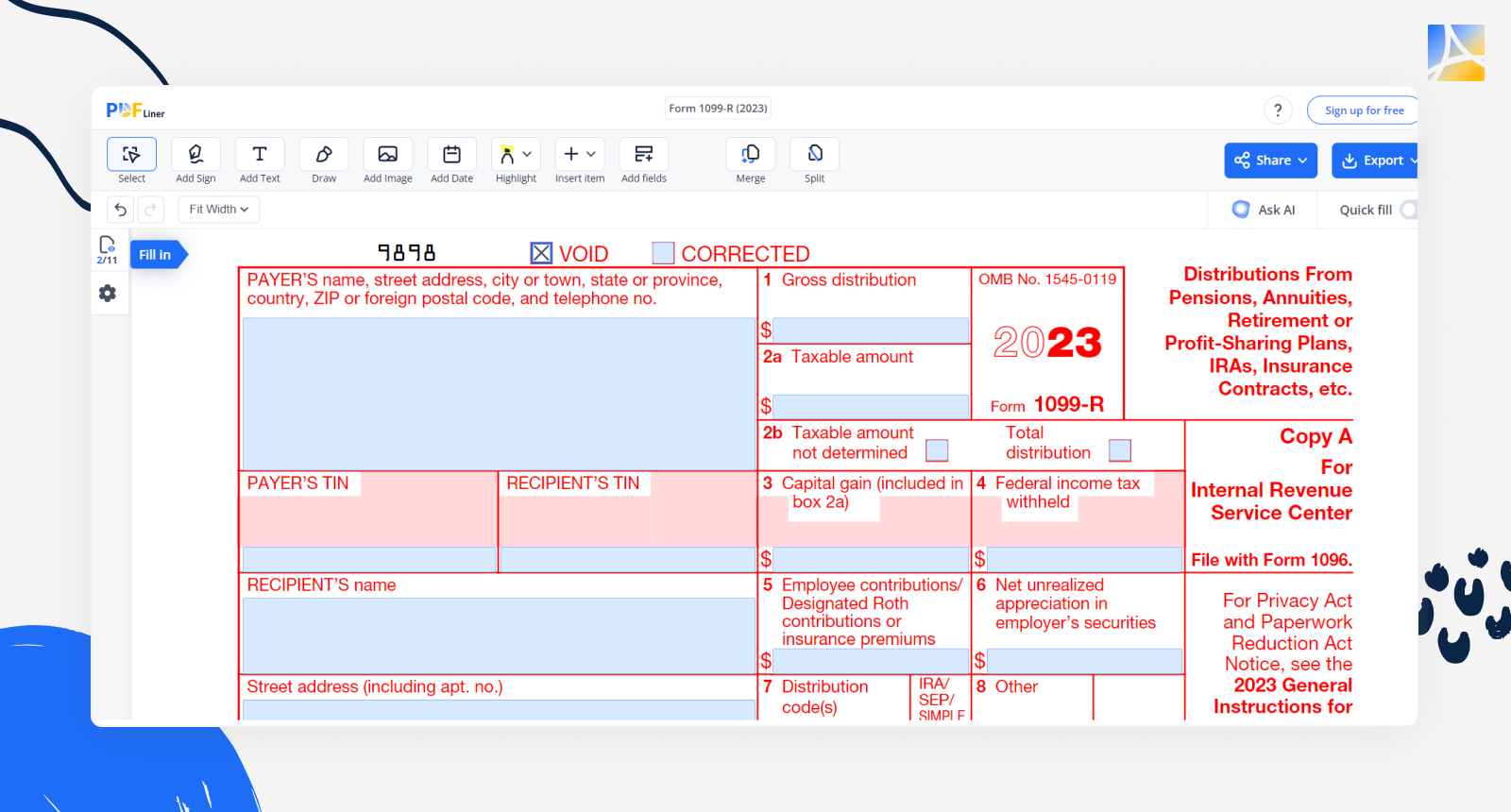

6. 1099-R

The 1099-R form is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts. It is an important form for retirees or individuals who have taken distributions from any retirement account. It may also indicate whether the distribution was a regular pension, a lump-sum distribution, or a premature distribution subject to additional taxes.

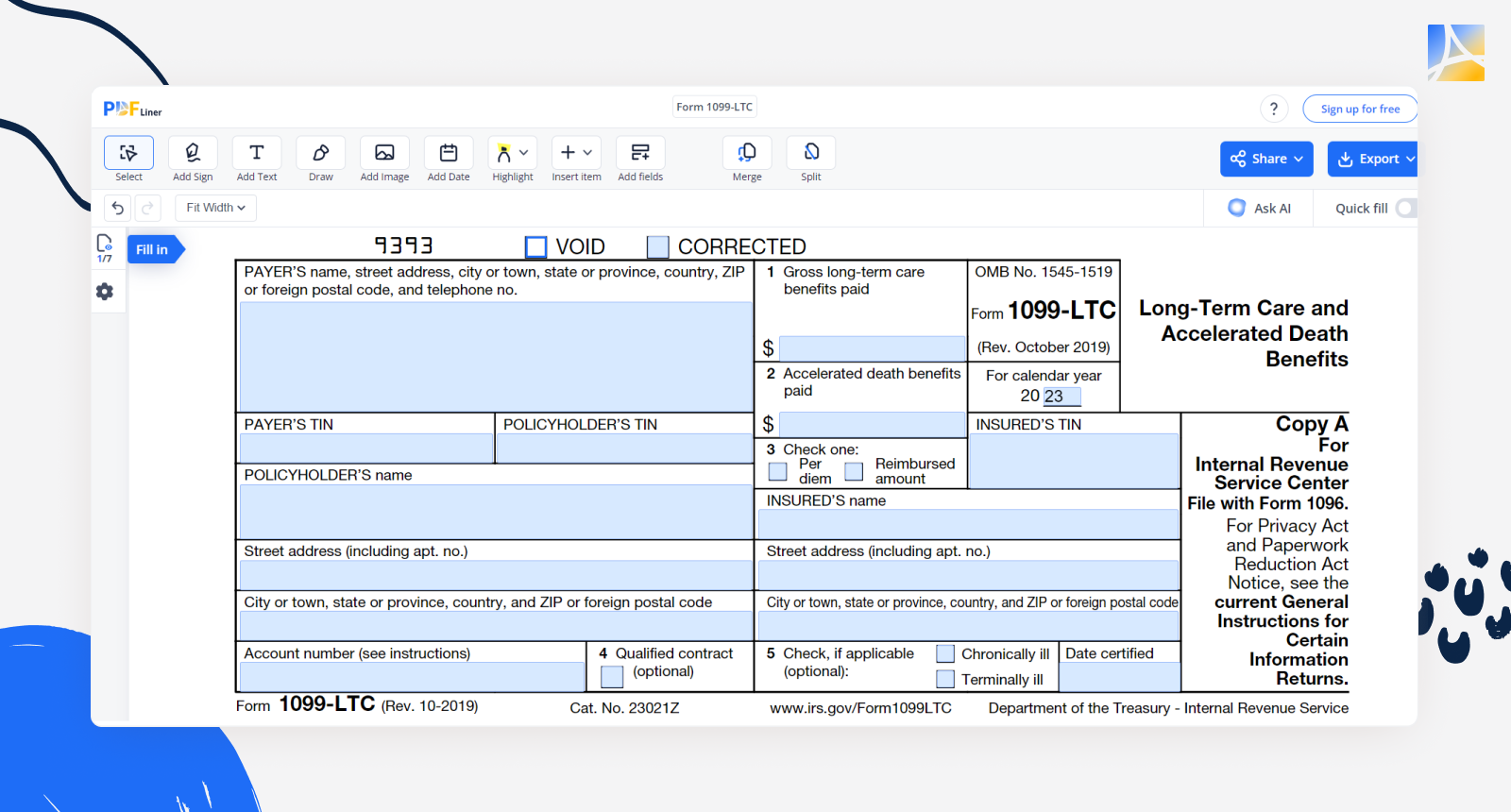

7. 1099-LTC

The 1099-LTC form reports any benefits received under a long-term care insurance contract or payments made under a life insurance contract. This form is particularly relevant for individuals who have received these types of benefits during the tax year. This information is crucial for taxpayers to accurately report these amounts on their tax returns, as certain long-term care benefits may be tax-exempt.

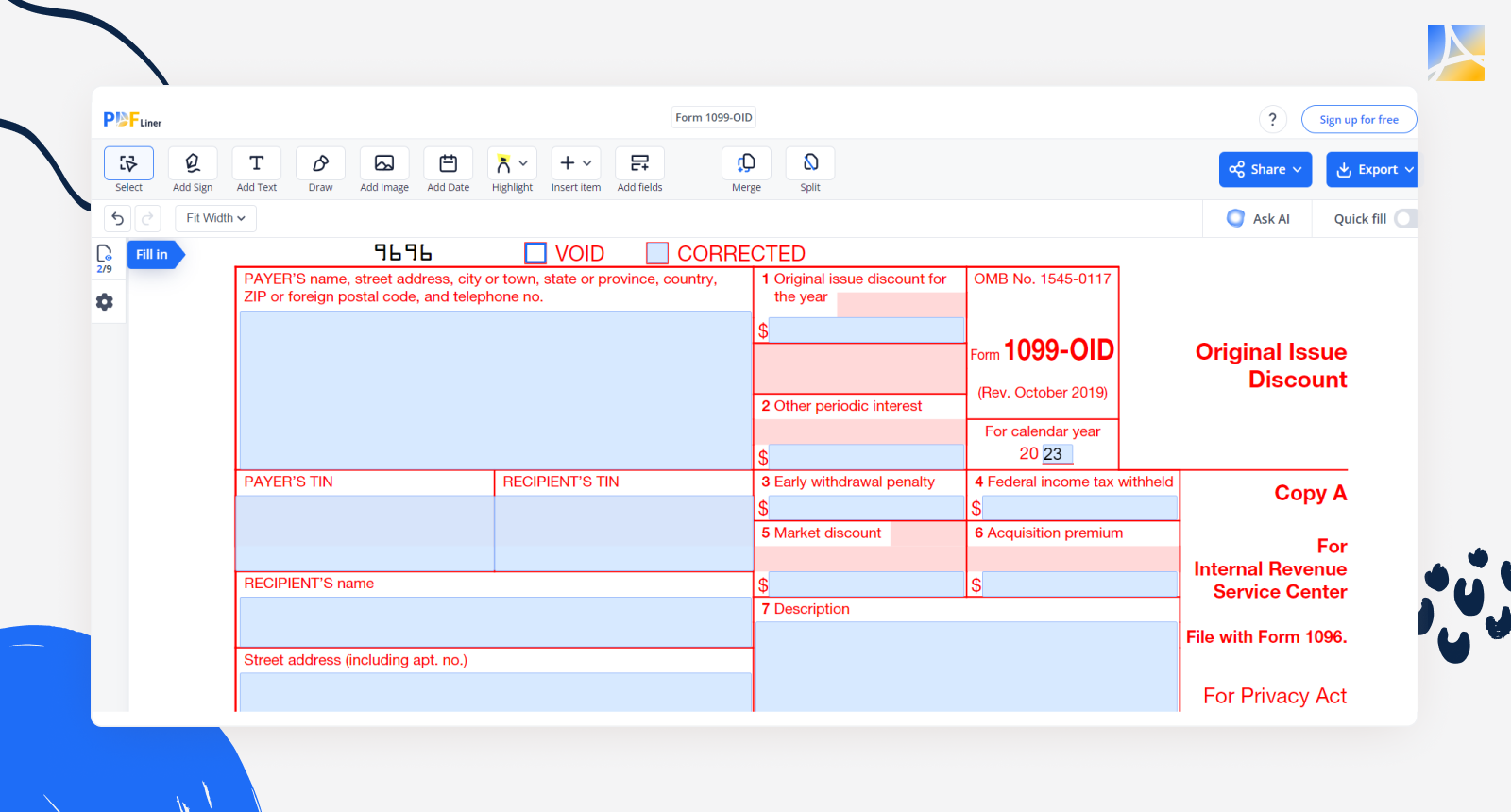

8. 1099-OID

The 1099-OID form is used to report the amount of original issue discount or other accruals on bonds, notes, and other financial instruments for the year. The OID form shows the amount that is considered to be taxable interest for the year, which the bondholder needs to indicate on their tax return.

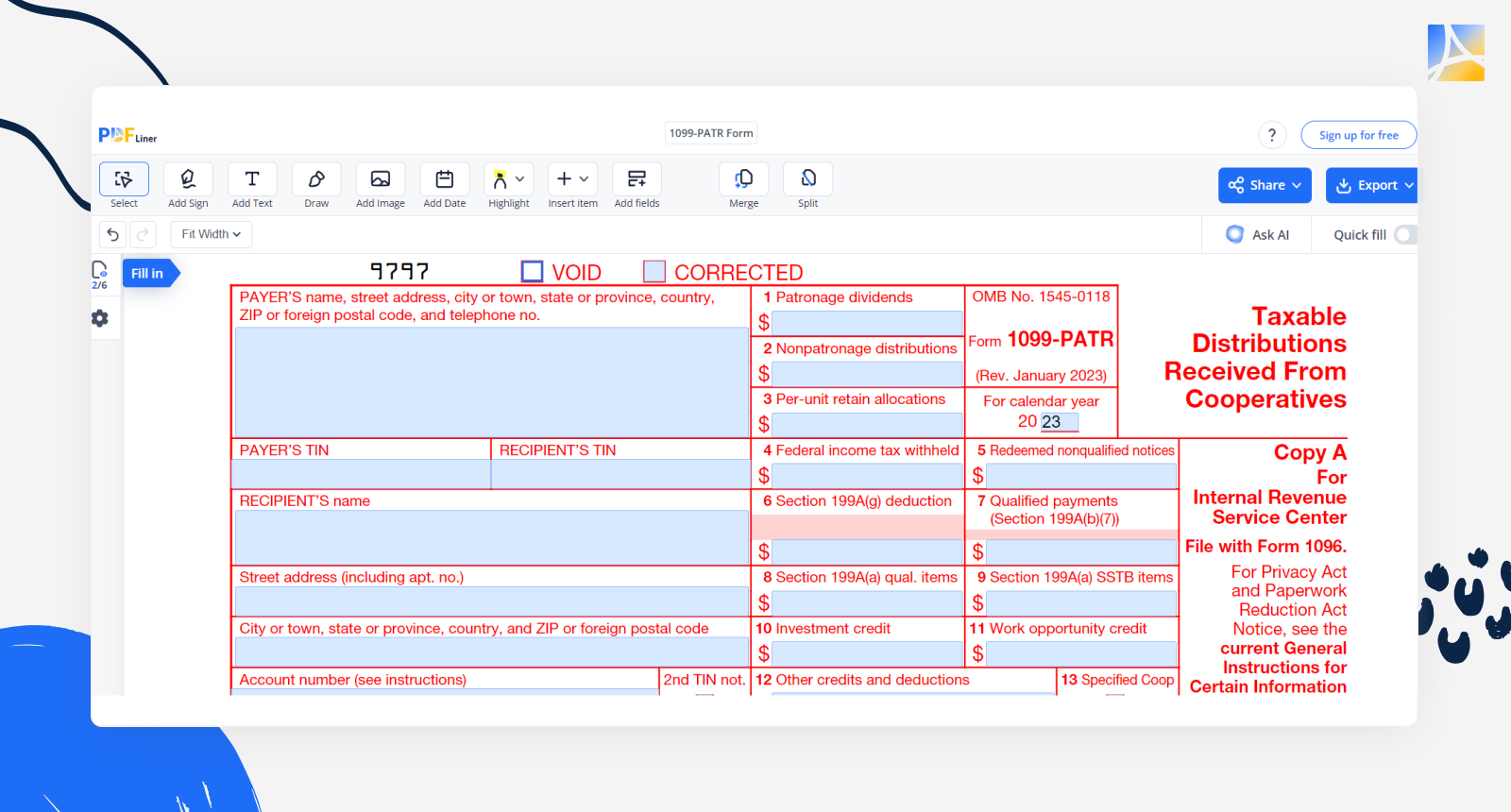

9. 1099-PATR

The 1099-PATR form is issued to patrons of cooperatives who receive more than $10 in patronage dividends, a type of distribution that cooperatives make to their members or patrons. It's commonly used in agricultural cooperatives, but it can apply to any cooperative business model. The form reports the amount of patronage dividends, which might include cash, property, or other benefits, and helps the recipient in reporting this income on their tax return.

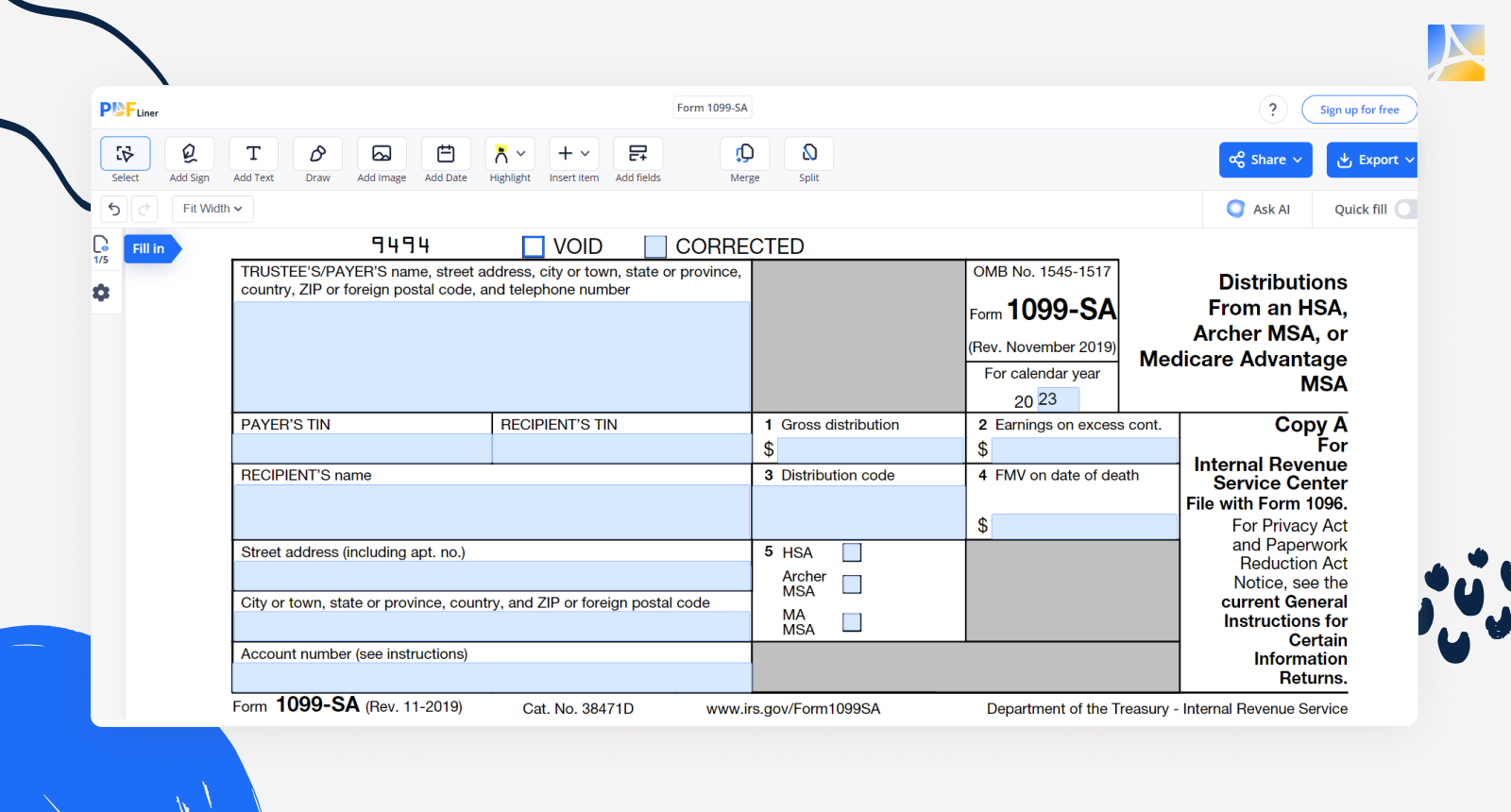

10. 1099-SA

The 1099-SA form is used to report distributions from health savings accounts. This form is crucial for individuals who have used funds from these accounts for medical expenses. The form details the amount of distributions taken from these accounts and is necessary for determining the portion of the distribution used for qualified medical expenses, which is not taxable, versus any part used for other purposes, which may be subject to tax and penalties.

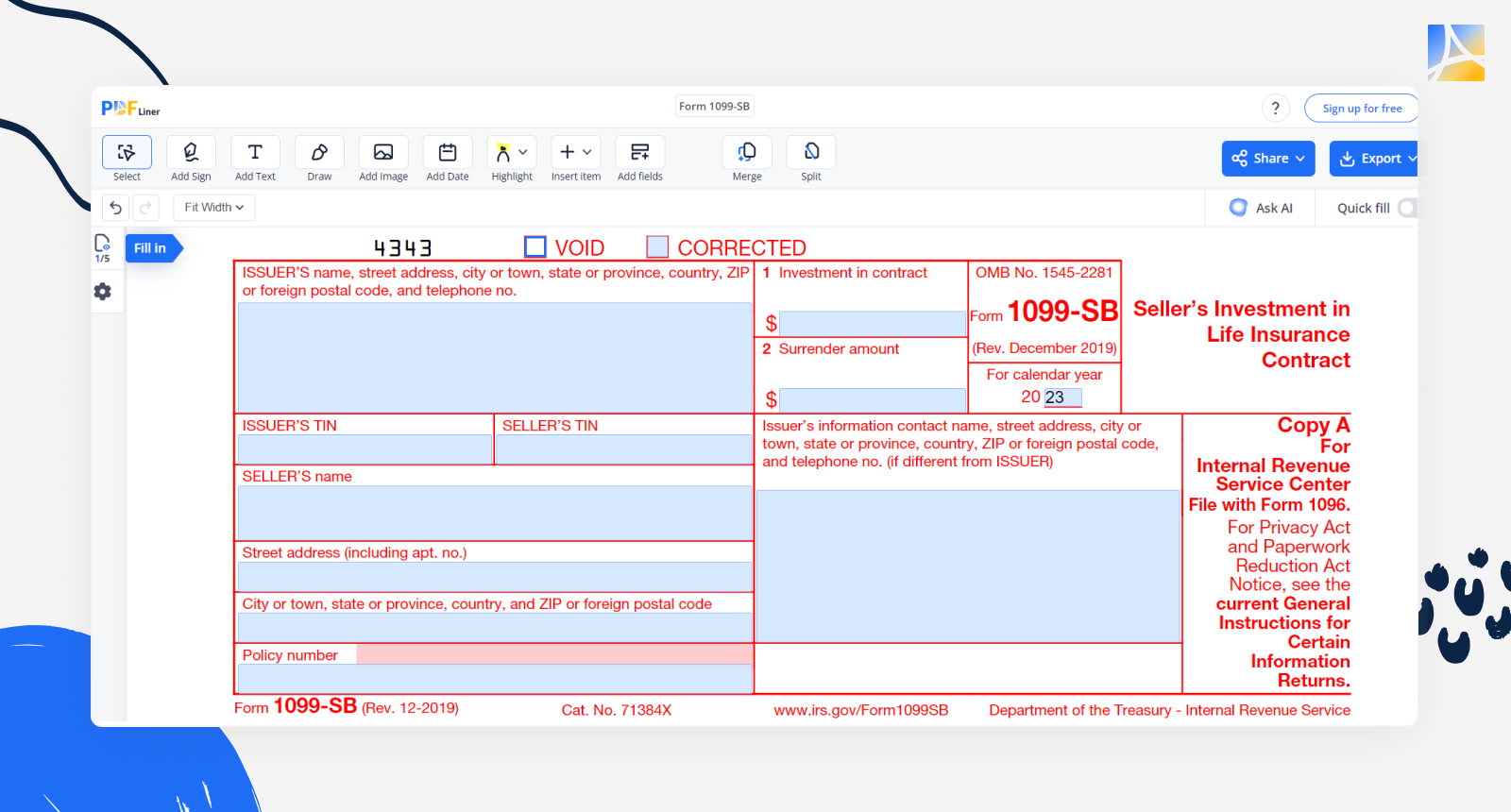

11. 1099-SB

The 1099-SB form is issued by life insurance companies to report the seller's investment in a life insurance contract. It provides details about the seller's basis (investment) in the contract and the total amount of the death benefit. This information is crucial for individuals who have sold a life insurance policy and need to report the transaction accurately for tax purposes, particularly focusing on any gains realized from the sale.

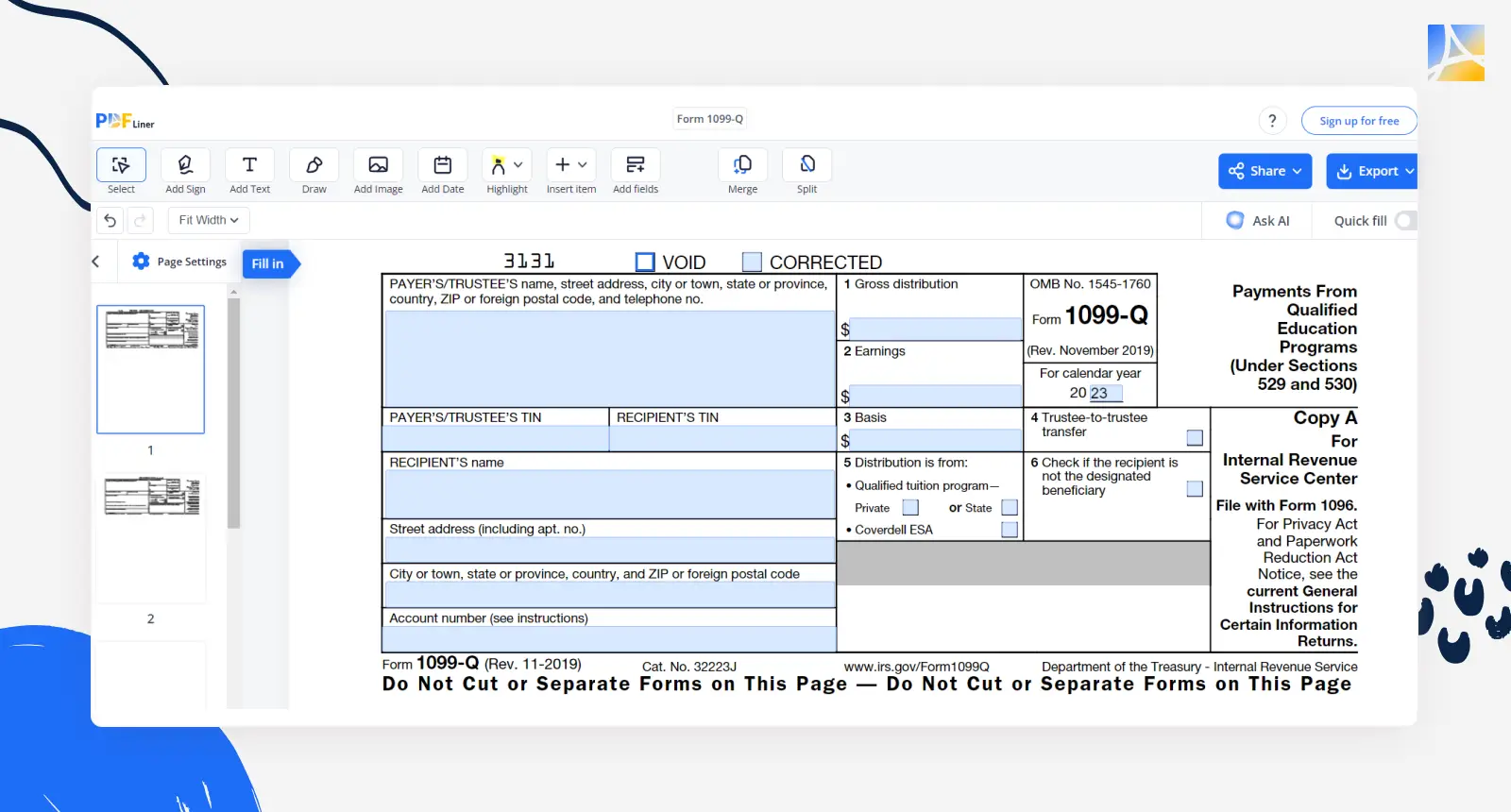

12. 1099-Q

The 1099-Q form is utilized for reporting payments from qualified education programs such as 529 plans or Coverdell Education Savings Accounts. This form is issued to the beneficiary or the account holder of these education savings plans. It reports the total distribution amount, the portion of the distribution that represents earnings on the original investment, and the portion that represents the return of the principal.

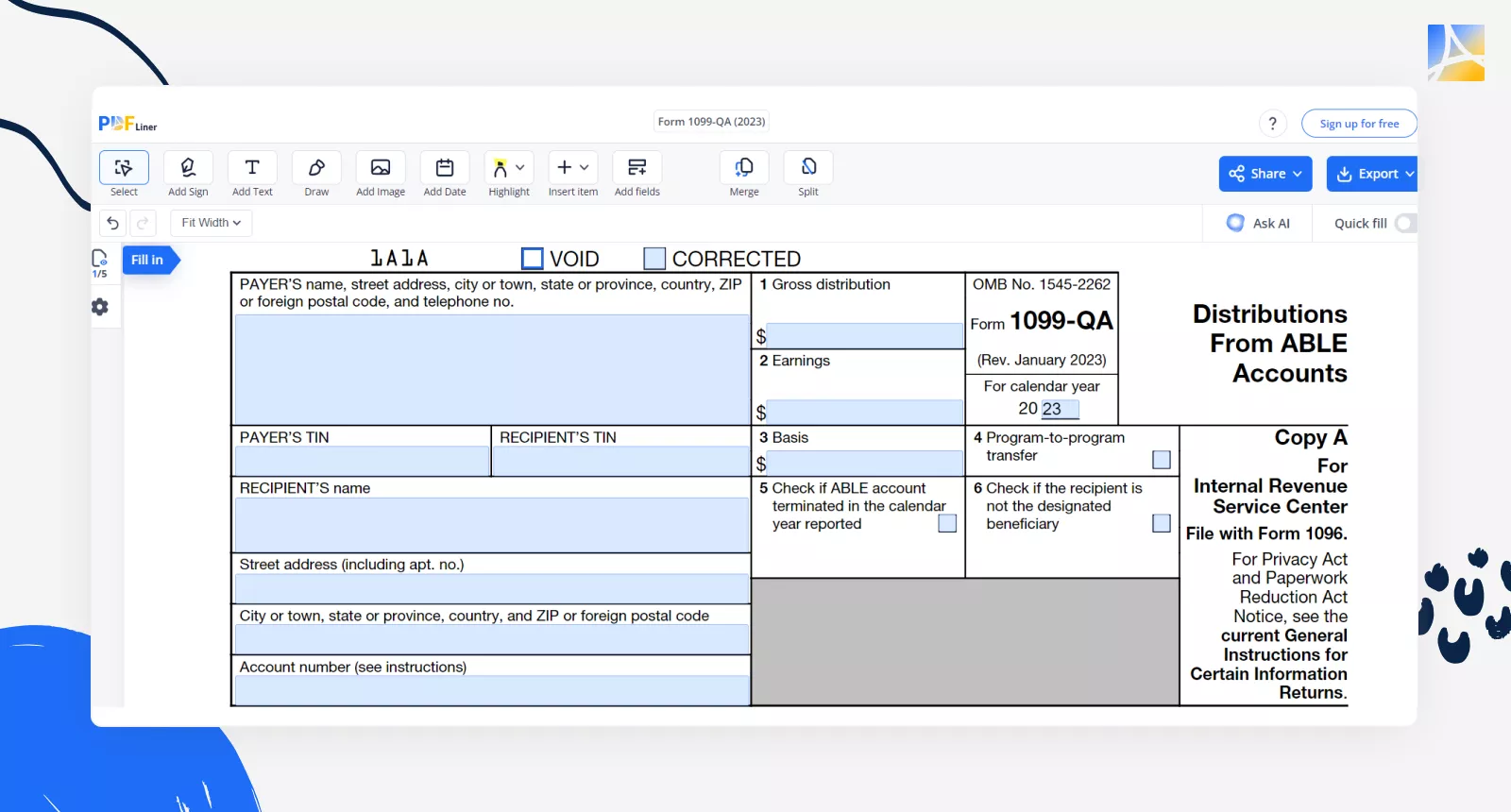

13. 1099-QA

The 1099-QA form reports distributions from Achieving a Better Life Experience accounts. ABLE accounts are tax-advantaged savings accounts for individuals with disabilities and their families. The 1099-QA form reports the total annual distribution amount from the ABLE account and specifies the portion of the distribution that represents earnings on contributions.

How to Get 1099 Forms

When tackling your taxes, having all your 1099 tax documents lined up is half the battle. There are two primary ways to get these forms, depending on whether they need to be filed with the IRS or used for other purposes.

For 1099 forms that must be filed with the IRS, such as those you need to issue to freelancers or contractors, it's essential to use the official versions of these forms. These official forms can be ordered directly from the IRS. The IRS requires specific, scannable versions of these forms for processing, so downloading and printing them from online sources isn't suitable for submission to the IRS. You can request these forms for free by visiting the IRS website or by calling their order hotline.

For copies of 1099 forms needed for personal record-keeping or informational purposes, which are not sent to the IRS, you can conveniently access them right here on PDFLiner. Our platform provides digital versions of a wide range of 1099 forms. This service simplifies the process, offering a quick and efficient solution for managing your 1099 forms without the need for ordering physical copies from the IRS.

Filling Out 1099s Quickly and Securely

When it comes to managing 1099 forms, PDFLiner stands out as an efficient and secure solution. It makes understanding 1099 form details a breeze, so you can fill them out without breaking a sweat. Whether you're dealing with a 1099-MISC, 1099-NEC, or any other type in the 1099 series, PDFLiner provides the tools you need to complete them accurately and efficiently.

The process is streamlined for your convenience. You can access and fill out the necessary forms directly on the website. Our platform allows you to add information securely, customize the forms to fit your specific needs, and then save or print them for your records. With PDFLiner, the focus is on making your tax preparation process as hassle-free as possible, ensuring that you can efficiently handle your 1099 forms on time.