-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out a 1099-NEC Form in 2023: Useful Advice

.png)

Dmytro Serhiiev

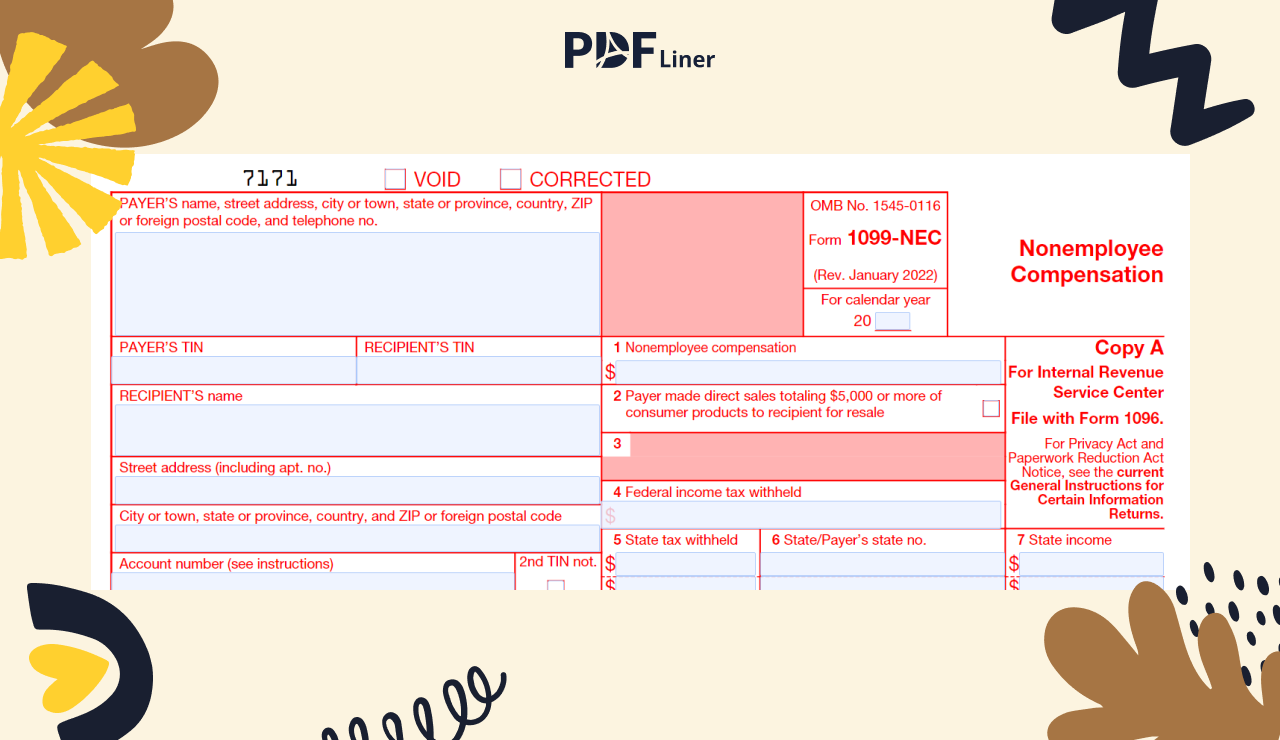

Nonemployee Compensation or NEC form is required from the 2020 year by the IRS. Many taxpayers are wondering how to fill out a 1099-NEC since they are used to filing 1099-MISC. The IRS asked all businesses to use this form after they made the payment of $600 or more to any person that wasn’t their employee.

What is a 1099-NEC

The 1099-NEC form is used for reporting non-employee compensations. Business owners who work with self-employed taxpayers have to learn how to fill out 1099 NEC instead of 1099-MISC. Yet, the 1099-NEC form is not entirely new. It was used in 1982 and earlier. Until 2020 businesses had to use 1099-MISC to inform the IRS on payments of $600 and more to their nonemployees, like independent contractors. These payments were usually filed as compensation for nonemployees and had to be indicated in box 7 of Form 1099-MISC.

Recently, the IRS decided to make these payments clear and re-opened 1099-NEC for it. The form has separate deadlines and instructions on filling out a 1099 NEC. All the taxpayers who use this form, no matter whether they are business owners or self-employed freelancers, have to file them by the deadline on January 31. If you want to know how to get form 1099-NEC, you can read the article dedicated specifically to this procedure.

Who Fills Out a 1099-NEC Form

You have to learn how to file 1099 NEC if you are a business owner that hires an independent contractor or freelancer for specific work and pays $600 or over. If you are paying less or paying the exact sum of money to several nonemployees in total, you don’t have to file the form. The minimal amount is $600 for a person. If you used 1099-MISC before, you have to switch to 1099-NEC.

If you are self-employed and received a payment of $600 and more from the business during the year, you have to ask for this form. A business owner who hired you has to send it to you no later than by January 31 of every year. This form will be used for your own tax return report.

How to Fill Out a 1099-NEC Form in 2023

Read this detailed instruction on how to complete a 1099 NEC before you download it. The good news is that you can file it online without downloading it.

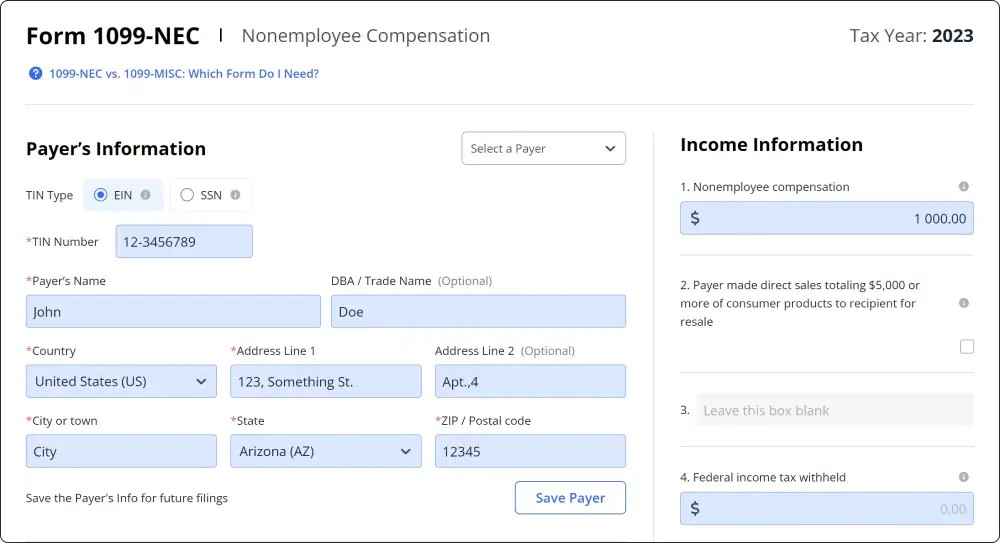

Step 1: Begin by entering the payer’s information, just like with Form 1099-NEC. Here you can add brand new information and save it for later use or choose the one you saved before. Select and enter your Taxpayer Identification Number type (EIN for businesses and SSN for individuals), then fill in your legal name, business name if applicable, and full address.

Step 2: Next, input or choose the recipient’s details, including their Taxpayer Identification Number (TIN), name, and address. Make sure to have a Form W-9 on hand from your recipient to collect their TIN, which is necessary to complete the form.

Step 3: Once you've entered all required information, click the "Validate now" button to ensure all TINs are correct and to avoid any penalties.

Step 4: After entering the payer and recipient details, move on to the appropriate boxes. Use Box 1 to report rent, Box 2 for royalties, and Box 3 for other income, such as prizes or awards.

Step 5: For medical and health care payments, you'll need to fill out Box 6 and for attorney payments or Box 10.

More instructions about specific box you can find in the form.

Step 6: If backup withholding applies to the payments, such as when the recipient fails to provide a valid TIN, report it in Box 4.

Step 7: If the state requires state tax withholding as well you should also fill out these boxes below.

PDFLiner already made the form simple to navigate. You can complete and file it online without downloading. After you complete the form, you can save it anywhere you want and send copies to the nonemployee and IRS.

Fill Out Form 1099-NEC 65bb657f5447959694021119

How to File 1099-NEC Form Online

After validating the details, click the "Submit to IRS" button. You’ll see a summary page where you can review everything one last time before confirming the submission.

When submitted, the form will be added to a filing queue. PDF Liner will send you email notifications with updates, and you can track the filing status through your dashboard.

There is a strict deadline for this form. All 1099 forms must be completed and sent until January 31. If this is Sunday, you can postpone it to February 1. There is not a 30-day automatic extension. Yet, if your business meets some specific conditions, you have to inform the IRS about it and ask for the delay. If the IRS does not find your conditions exclusive, you still have to provide the form by the date or pay the fee.

FAQ

Check out the most popular questions about the 1099-NEC form. Read the answers as they may help you to complete the document.

What is the difference between 1099 MISC and 1099 NEC?

Form 1099 MISC covers a wide range of income sources, like prizes, royalties, rents, and even awards. Form 1099 NEC was created specifically for nonemployee compensation. You may use both forms at once.

How to correct 1099-NEC?

If you notice mistakes you’ve made after sending the form, you have to contact the IRS. They may ask to fill the same form correctly. If you notice mistakes before sending it, use PDFLiner to edit the document.

Can I efile a corrected 1099-NEC?

Yes, you can send the corrected form as an efile. You can do it via the IRS website or their app. You have to register there in advance.

What happens if I don't receive a 1099 NEC?

If you are an independent contractor and you have not received the form by the deadline, which is January 31, you have to contact the business owner. If the problem is not fixed, you need to contact the IRS.

What if my 1099 has the wrong address?

Don’t worry. The IRS does not use the address you’ve included for the returns. If you submitted the form with a different address, the IRS may still accept it. Yet, you have to correct the address in NCTracks to receive the paper payment.

File Taxes Online at No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out Form 1099-NEC 65bb657f5447959694021119