-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Who Gets a 1099-NEC Form: Nonemployee Compensation for Newbies

.png)

Dmytro Serhiiev

Last Update: Nov 19, 2024

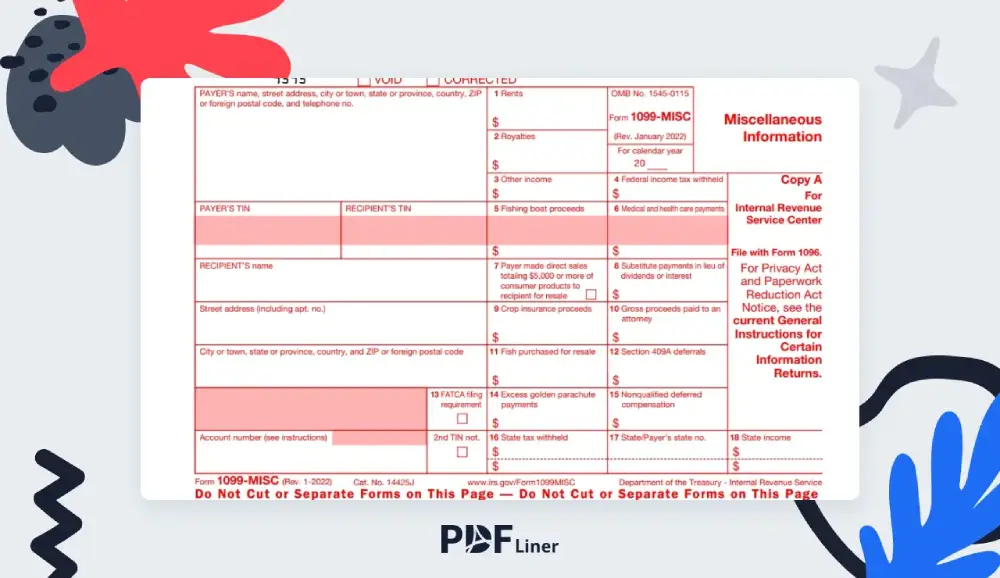

After the IRS reintroduced the old document, many taxpayers began to wonder who should receive a 1099 NEC. While many of us are used to 1099-MISC, the new 1099 NEC is an updated form we have to deal with. However, according to the IRS, the 1099 NEC form has to simplify the life of business owners and independent contractors. You don’t have to search for the appropriate box on 1099-MISC, but provide the numbers you pay for nonemployees in a specific form. You will quickly learn the 1099 NEC meaning and will be able to fill the form in several minutes.

Get 1099-NEC Form 65bb657f5447959694021119

Key Takeaways

- The 1099-NEC form is used to report payments of $600 or more to nonemployees, replacing the previously used 1099-MISC for this purpose.

- Business owners must file a form to the IRS and provide it to the recipients by January 31 following the tax year in which the payments were made.

- Independent contractors, including foreign contractors with an ITIN, should expect to receive a 1099-NEC if they were paid $600 or more by a single payer during the year.

- C corporations, S corporations, and LLCs created as S or C corps are exempt from receiving 1099-NEC forms.

Who Gets a 1099-NEC?

The form does not have to be filed if you pay your nonemployee less than $600 a year. If you don’t know who needs a 1099 NEC, you come to the right place. Here is the list of the parties that must file or expect to receive this form:

- Business owners have to report the information about them and their nonemployee as well as the numbers of the payment made in the 1099-NEC if the payment was $600 or more during the year;

- Payers have to send the information to both IRS and independent contractors who were paid $600 or more during the year;

- Independent contractors like real estate agents or freelancers who receive payments of $600 and over from one person during the year have to expect documents. The form must be equally sent to 1099 for foreign contractors. If you work with foreigners but you are a US citizen, there is still an issue 1099 to foreign independent contractors that have to provide ITIN in the form.

The form does not have to be received in several cases as well. There is a group of taxpayers that don’t have to attach the 1099-NEC to the tax report, including:

- C corporations;

- S Corporations (in case you were wondering, do s corps get 1099);

- LLCs that are created as S Corps or C Corps.

How to Get a 1099-NEC Form?

You can get the form using the IRS official website. You will need to search the form, and when you find it, download the form, print, complete, scan, and send. Yet, there is another way to do it without so much effort.

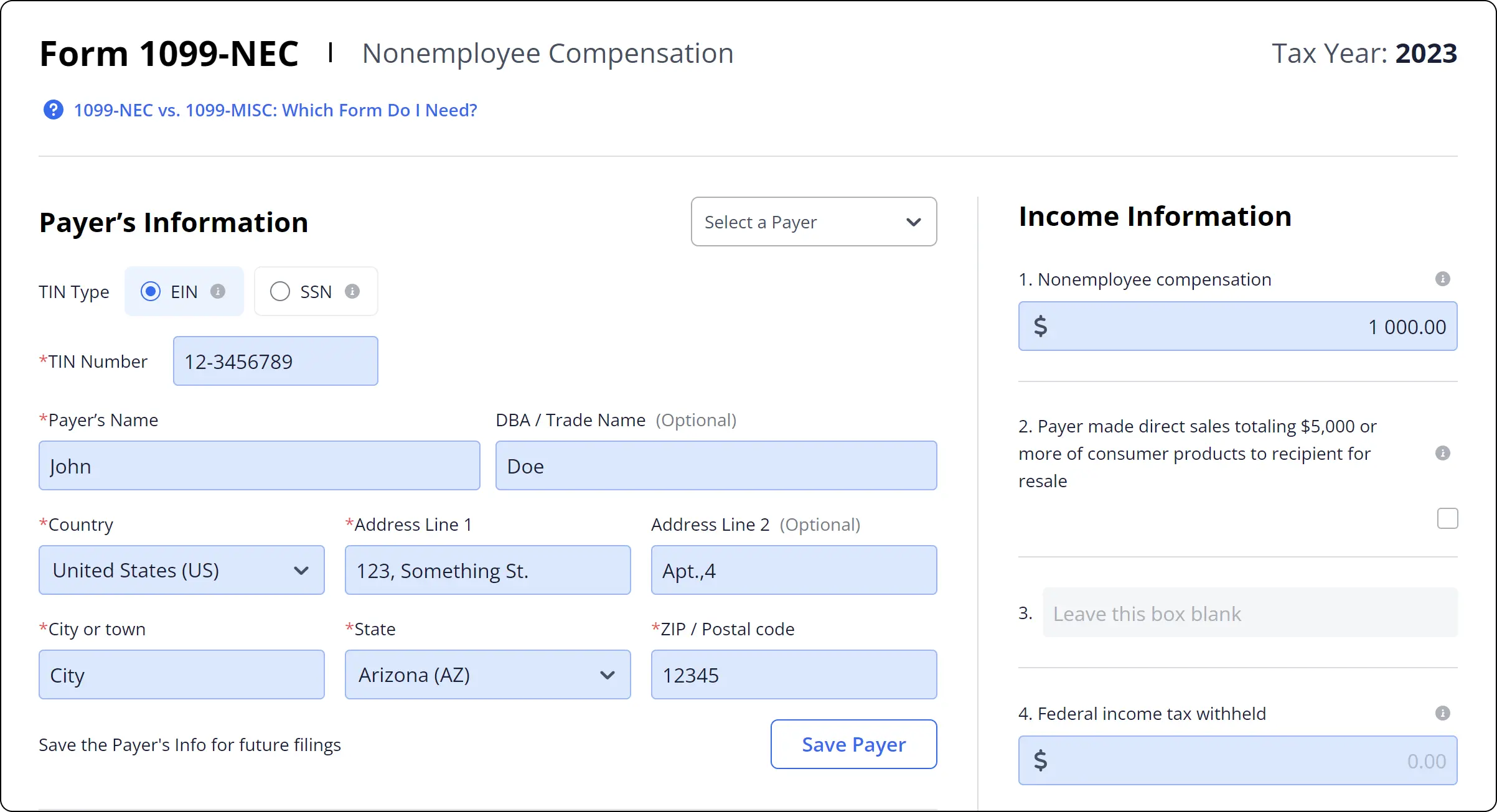

PDFLiner is your choice in case you don’t want to download and scan anything. PDFLiner is an online editor which allows you to fill the boxes and lines of the document step by step online. You don’t even have to leave the page since it provides all the data in no time.

If you want to know more about how to fill out a 1099-NEC form, there is a detailed instruction available on the website. PDFLiner provides any tool for editing you need. And since there is no need for an e-signature, you may save the copies and send them once you finish completing the form.

Get 1099-NEC Online 65bb657f5447959694021119

FAQ

Check these questions that other users ask. Perhaps they help you to understand the form better.

What is a 1099 NEC?

Form 1099 NEC is a tax form for nonemployee compensation. It is filled by payers who used nonemployee’s services and paid $600 or more to them during the year. The form must also be attached to the tax report of the nonemployee.

When is Form 1099-NEC due?

There is a due date to the form, which is January 31. If the day is Sunday, the due date when you can send the form to the IRS and nonemployees is February 1. If you have specific conditions that allow you to delay the report, you have to notify IRS and nonemployees.

Where to send Form 1099-NEC?

You have to send this form to the IRS. Another copy must be sent to the nonemployee. You have to save the filled form in your documents just in case too. It can be sent online through the IRS official app.

How to correct 1099-NEC?

You can correct the form while it is still not sent via the PDFLiner program. Make sure you’ve made all the editions correctly before you file anything. If you notice significant mistakes in the form, you have to contact the IRS.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable 1099-NEC Form 65bb657f5447959694021119