-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

1099: How to Calculate Taxes and File the Form Online

.png)

Dmytro Serhiiev

If you run a small business or have other income sources other than salary, chances are high that you’ve been wondering how to file taxes with 1099. This article explains the how-tos of this common tax form as well as which variety you might need depending on how you generate your income.

Fillable 1099 Form 65bb66ba44aa4904c305d679

What Is a 1099 Form

Form 1099 is a US Internal Tax Revenue (commonly known as IRS) form. It’s used to report income that an individual gets from sources other than salary, wages, or tips. Such income can arise from business activities where you pay to independent contractors, or from interests, dividends, cancellation of debt, real estate transactions, healthcare, medical, educational, and retirement programs, and more (see below for all the varieties).

As part of the tax return collection system, its key purpose is to gather information that can be used to calculate the amount of tax to be paid. It’s the legal responsibility of every individual to provide complete and correct information regarding their income when it is due. Penalties may ensue if you fail to comply with the effective 1099 regulations and the deadlines (see How to File a 1099 Form), the scale of which varies considerably.

What Are 1099 Form Variations?

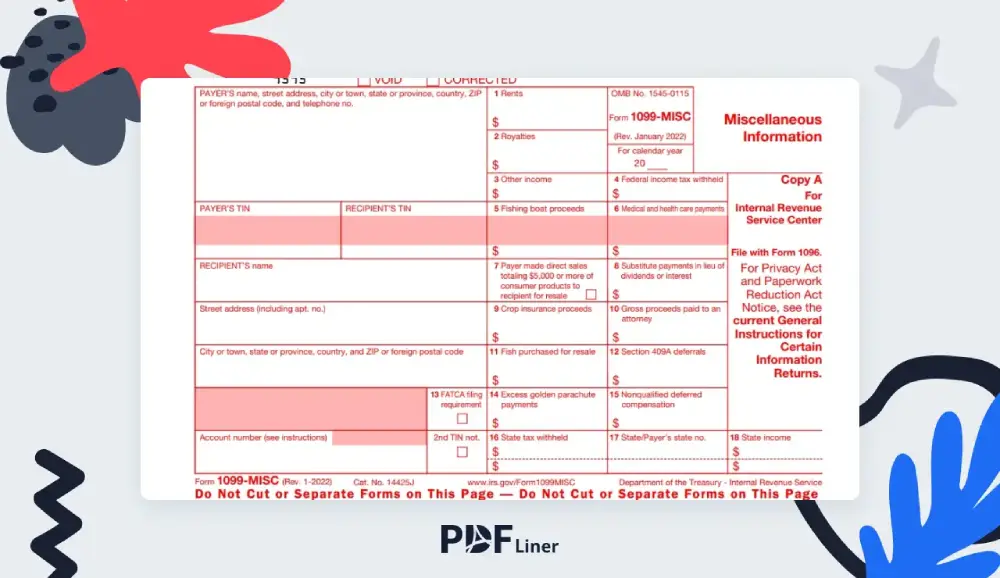

1099-MISC was presumably the most well-known 1099 version until 2020 because it was the one prescribed to small businesses. However, the IRS has recently introduced 1099-NEC for this purpose. If your payments to an individual contractor have exceeded $600 this year, choose 1099-NEC.

1099-MISC is reserved for miscellaneous income, in particular, that arising from rents, prizes and awards, payments to an attorney, and more when amounting to at least $600 over the year.

Other common 1099 varieties include 1099-INT for interest amounts received from savings bank accounts and the like, 1099-DIV for dividends and distributions from investments, 1099-C used to report that your lenders have forgiven your debt, 1099-R for any retirement-related payments arising from individual retirement accounts, pensions, and other plans, and 1099-S as a way to report proceeds from real estate transactions.

Printable 1099-INT Form 65bb66ba44aa4904c305d679

There are also such forms as:

- 1099-A (acquisition or abandonment of secure property);

- 1099-B (broker/barter transaction proceeds);

- 1099-CAP (changes in corporate control and capital structure);

- 1099-G (government payments);

- 1099-H (health insurance advance payments);

- 1099-K (merchant card and third-party network payments);

- 1099-LTC (long-term care benefits);

- 1099-OID (original issue discount);

- 1099-PATR (distributions from cooperatives);

- 1099-Q (qualified education program payments);

- 1099-SA (health/medical savings account distributions);

- SSA-1099 (social security benefits);

- RRB-1099 and RRB-1099-R (payments by the Railroad Retirement Board).

Before you learn the answer to how to file for 1099, you need to gather the information you’ll need in order to report your taxes correctly. The procedure depends on the kind of income you’re dealing with.

Printable 1099-NEC Form 65bb657f5447959694021119

1099: How to Calculate Taxes

Before you learn the answer to how to calculate for 1099, you need to gather the information you’ll need in order to report your taxes correctly. The procedure depends on the kind of income you’re dealing with.

- If you are a freelancer, you’ll mostly work with 1099-NEC forms, replacing 1099-MISC for independently contracted work. Your customers who have paid you more than $600 over the course of the year are expected to send you 1099-NEC Copy B with the amount of payment stated. It’s your responsibility to submit the same to all of your subcontractors as long as your yearly payment to them is above $600.

- Please note that, in the context of self-employment, 1099 has a lower threshold of $600 a year. Other limits apply to other 1099 varieties depending on the income source in question. It’s thus best to know which specific form you are going to use in advance to calculate the amounts to be entered accordingly.

- Another thing to consider when calculating your taxes is whether any withholding is required. This is potentially covered by Box 4 in 1099-NEC, and there are dedicated boxes in a number of other varieties as well. Tax withholding is what happens when the taxpayer identification number has not been provided or is incorrect, or in cases where the taxpayer is known to have failed to fully report their interest and/or dividend income.

- A certain percentage of payments to which backup withholding applies, in particular royalty payments, rents, profits, and more, is then withheld, and Form 945 is filed with the IRS, and the payee is notified. The rate is presently 24%. The total amount withheld is to be included in 1099, so you need to take it into account when calculating your taxes for a 1099.

In most cases to calculate your taxes you would need to:

- gather all your 1099s that you received during the year;

- sum up all the income shown in them;

- calculate 15.3% self-employment tax (12.4% - social security tax and 2.9% - Medicare).

How to Fill Out a 1099 Form

.webp)

If you have been wondering how to fill out a 1099, you need to choose between paper and electronic filings.

As soon as you have a form at hand (see the FAQ section to find out how to how to get a form 1099), start by entering your identification details. It’s also essential that you have the necessary information, such as TIN (use Form W-9 to request it) and address, about each of your independent contractors.

Please note that 1099 forms come in several copies. For example, 1099-NEC consists of several parts, namely Copy A to be filed to the IRS, Copy 1 for the Federal State Department, and Copy B to be sent to the contractor. You need to fill all of the copies unless you are the recipient.

For other 1099 varieties, see the specific instruction by the IRS to learn which amount to enter in which box.

How to File a 1099 Form

For those unsure how to file taxes, 1099 reports can be submitted to the IRS by mail or electronically. The former option needs a filled-out 1096 as a cover sheet.

With the IRS Filing Information Returns Electronically System, you need to use an e-file service to create an appropriate 1099 file. Submit your Transmitter Control Code at least 30 days before the 1099 deadline. Use Form 4419 to request a TCC from the IRS if you don’t have one already.

Form 1099 is to be filed with the IRS by January 31. Customers must send 1099-NEC forms to their contractors by the same date. The same deadlines apply to 1099-MISC with Box 7 filled. Other 1099 types are expected by February 28 (by paper) and March 31 (electronically).

Copy B can be mailed to your contractor or sent via email after you have requested and obtained consent via the same medium.

Frequently Asked Questions

How to get 1099 forms?

The answer to how to issue a 1099 depends largely on which submission method you choose.Those submitting by paper should remember that the form is not downloadable, because the IRS will use a special scanner to read it. Instead, you need to contact the IRS by phone or on their website to get the required 1099 variety on paper or buy pre-printed 1099 forms.For those wondering how to file a 1099 online, a number of websites offer e-file 1099s. Scanned copies or PDFs are not appropriate formats for electronic 1099 submission.

How to get 1099 from Uber?

Uber drivers wondering how to file taxes on a 1099 should check Uber’s Tax FAQ on their website. Generally, taxi drivers who don’t know how to get Uber 1099 forms need to check the Tax Information tab on drivers.uber.com to see whether they have met the earnings threshold.

If the requirements for a 1099 have been fulfilled and you have chosen electronic delivery, you will find the forms in the same tab. They will appear not later than January 31 (as of 2022). The deadline remains the same for those who prefer paper. Hard copies will arrive by mail.

How to file 1099 for someone?

If you have worked with an independent contractor and your cooperation meets the criteria for a 1099, you need their taxpayer details, requested from them using a specialized form. With 1099-NEC, it’s Copy B that you send to the contractor. How to file 1099 online if you are a customer depends on whether your contractor is willing to receive their forms electronically. You need to receive consent or use mail.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

1099 Form 65bb66ba44aa4904c305d679