-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get Form 1040-ES What You Should Know

.png)

Dmytro Serhiiev

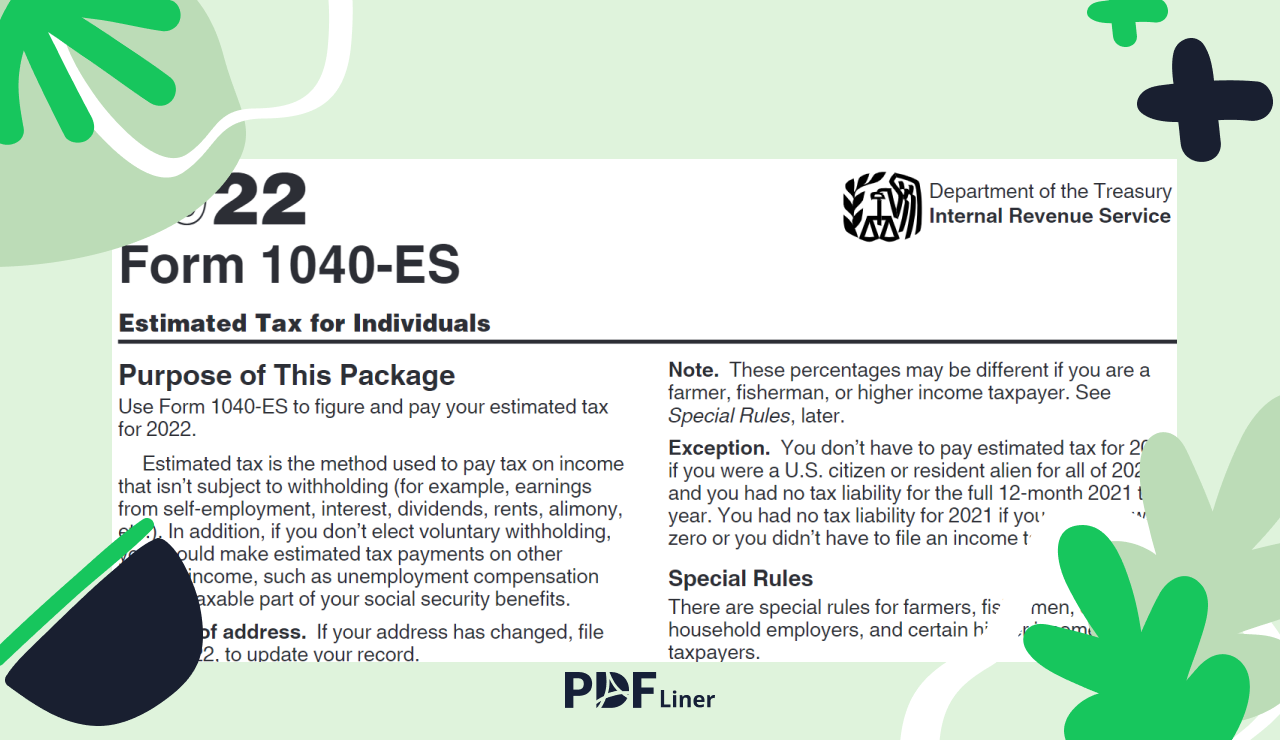

It’s not a secret that tax forms can be quite confusing for many people. To put it simply, IRS 1040-ES is a type of form created to help you assess and pay out your estimated tax. As stated in the IRS instructions, this form is used by an individual to pay tax on the kind of income, which is not subject to withholding. This may include interest, self-employment earnings, alimony, and more.

How to Get Form 1040-ES

When it comes to where to get the 104-ES form online, there are two easy ways: download it from the IRS website or access it directly on the PDFLiner site. It is a good idea to study examples of this form before you start entering your personal information. According to the regulations, the form is applicable to both citizens of the United States and its resident aliens.

PDFLiner allows you to quickly manage your finances by helping you edit documents, handle your files, and process all the widely used tax forms. Besides filling out all the necessary documentation and editing it, you can also sign PDFs online.

.png)

While it's important to know how to get form 1040-ES, it is also essential to fill it out correctly and in full. If you have some doubts, and you want to know the most updated way on how to fill out the 1040-ES estimated tax form, we have prepared a detailed guide and also provide official instructions. With its help, you will be able to successfully complete all the necessary sections without having to fix anything or worry about their accuracy.

FAQ

What is a 1040-ES?

It is a form provided by the IRS that is designed to calculate and pay out estimated taxes for a particular year.

Do I need to file 1040-ES?

Without considering any exceptions, if you expect to owe $1,000 in taxes or more after all respective credits and deductions, and your credits and withholding will be less than the estimated number, it’s necessary for you to follow the 1040-ES instructions and file this form.

Where do I send my 1040-ES payment?

Your payment should be sent to the Internal Revenue Service address according to the state that you live in.

How to pay 1040-ES online?

The IRS offers a number of online payment options, including direct pay, electronic fund withdrawal, pay by card, an IRS2GO app, and an online payment agreement.