-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 1040-ES: Quick Detailed Guide

.png)

Dmytro Serhiiev

The Quarterly Federal Tax Return or the IRS 1040-ES Form is your option to pay the income taxes quarterly, making it easier for you to keep an eye on your quarterly income taxes. In this article, we’ll cover all the most important aspects of this form in simple words to help you understand its purpose and start using it for your good. Let’s start!

-min.png)

What Is Form 1040-ES

Unlike the 1040 Form, which lets you report your annual income tax, the 1040-ES estimated tax form lets you break down the whole thing into more convenient quarterly installments.

If this form is needed in your case, you can learn how to get form 1040-ES latest version in our brief guide. Click the link to read it.

1040-ES Form 65bb5abff7884042f10e12d5

Who Has to File a 1040-ES

-min.png)

Figuring out if you have to file Form 1040ES or not involves some simple calculations. You have to:

- Take the paid tax for the previous tax year;

- Come up with an estimated tax amount for the next year;

- Calculate 90% of the amount;

- Compare the previous year’s tax with the 90% or the estimated tax and take the smaller number. For instance, if the estimated tax is $1,000 and the previously paid is $500, you have to take the second.

You are required to use this form in case you run a sole proprietorship, LLC, S corporation, or partnership, and you expect your income tax for the tax year to exceed $1,000. If your business is a C corporation, 1040-ES is required for estimated taxes over $500.

How to Fill Out Form 1040-ES

Here’s your step-by-step walkthrough of the 1040-ES form. Pages 1-5 include the detailed instructions that will help you figure out your specific case. Page 6 is a self-employment tax and deduction worksheet, and page 7 includes the tax schedules for the tax year you are going to report.

1. Page 8, Estimated Tax Worksheet – on this page, you have to do the calculations on each line in order to figure out your total estimated tax for the year. Make sure to apply custom percentages if you are a farmer or fisherman. Your aim is to calculate the total estimated tax amount as accurately as possible to avoid underpayments that exceed $1,000 as they are followed up by underpayment penalties. You can figure out the required annual payment to avoid penalties on line 12c. This will be the least amount you have to pay to avoid problems.

-min.png)

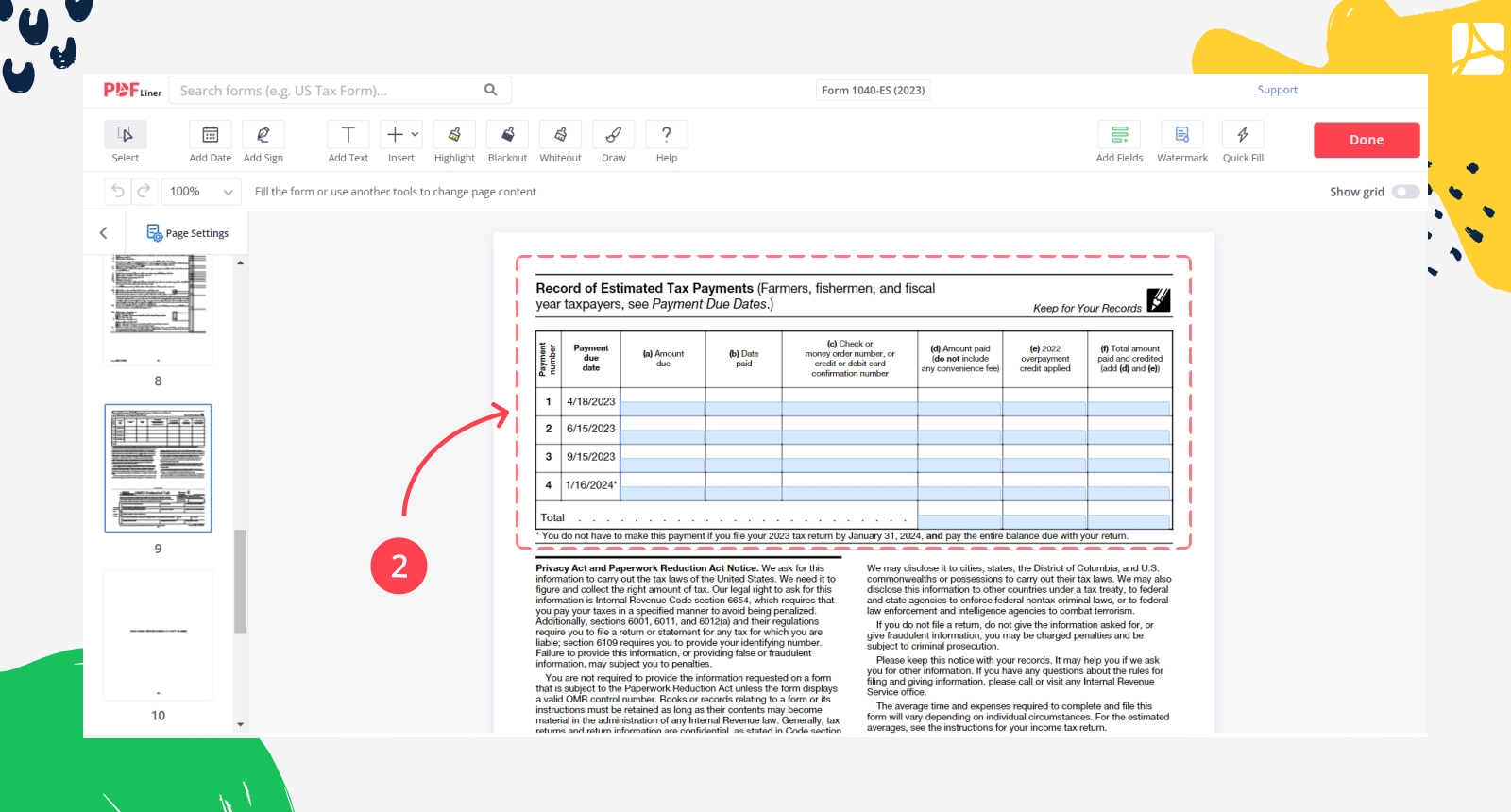

2. Page 9, Record of Estimated Tax Payments – this is a table in which you can record all four quarterly payments along with dates, overpayment credit, check/money order number or credit confirmation number, and the total amount of tax paid during the tax year.

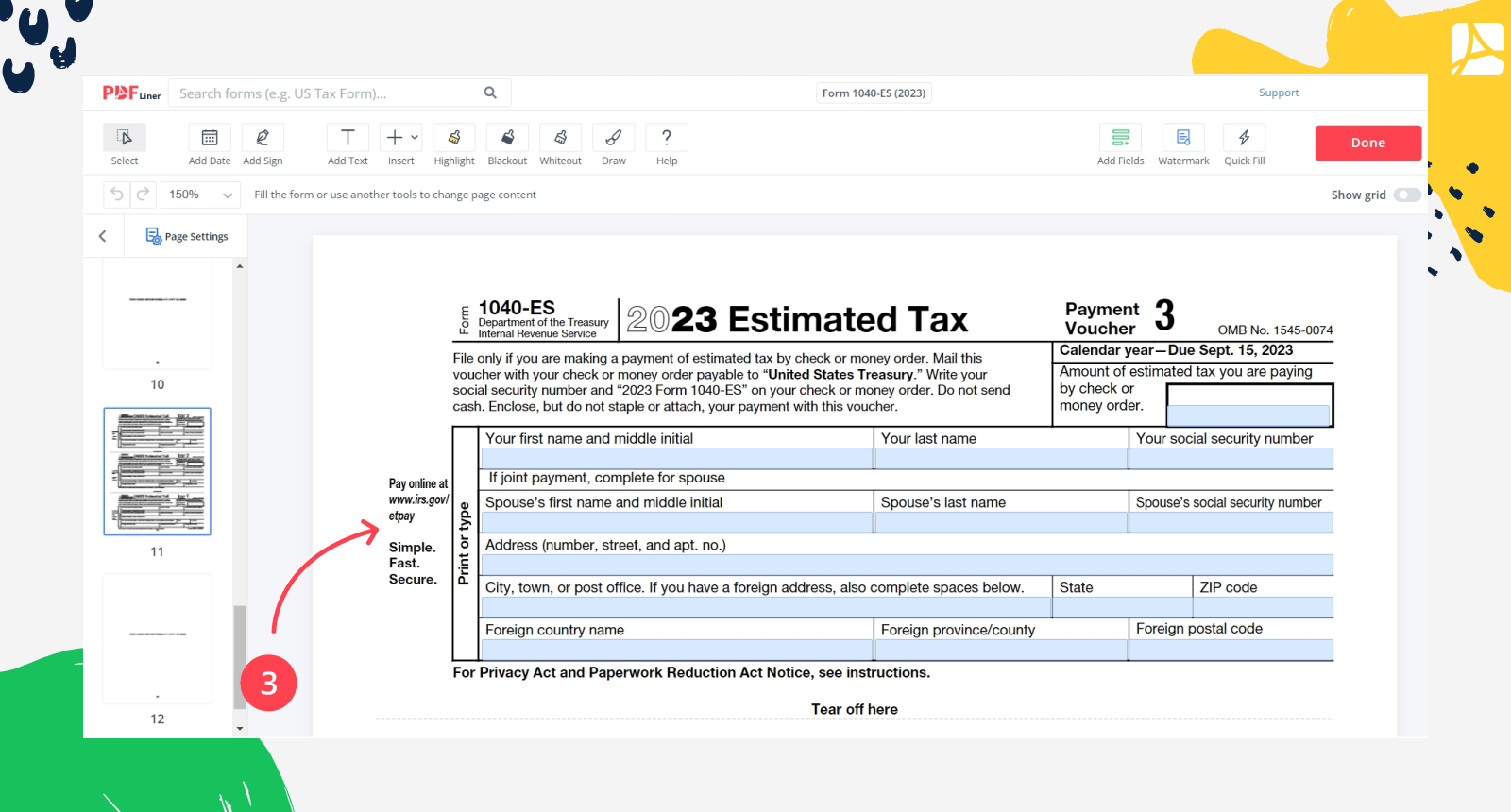

3. Payment Vouchers – the rest of the form includes 4 separate payment vouchers. All 4 are the same and require you to include:

- yours and your spouse’s names;

- your social security numbers (SSNs);

- full address or foreign country name;

- the amount of estimated tax you are willing to pay by check or money order.

Cut one payment voucher each time you need to send payment.

You can fill out your 1040-ES on PDFLiner. The platform provides a versatile PDF editor with direct access to the latest 1040-ES form template. You can save, print, or email the form directly from the editor as well as sign it digitally in 4 different ways. The service stores your complete forms on an encrypted cloud and lets you share access to particular documents with up to 5 users within one account, depending on the plan you choose.

Fill Out 1040-ES 65bb5abff7884042f10e12d5

How to File 1040-ES

1040-ES instructions on filing are quite easy to remember. Let’s review them:

Quarterly tax payments must be done by the 15th day of the month that follows the end of a quarter. The exception is in case the 15th day is a weekend or a federal/state holiday.

When your form is complete, send it to the IRS by mail or electronically. You can figure out where to send 1040-ES in your state by calling the IRS or using the online IRS office locator. Electronic submission is done via the IRS e-file system on the official website or a website of any other authorized e-file provider.

FAQ

Here are some extra brief answers to the questions that may still buzz in your head.

Where to mail 1040-ES payment?

Thinking “where do I send my 1040-ES payment”? You have to locate your state IRS office and mail your payment to their address. The easiest way is to call the IRS and ask for the right mailing address for your city. However, the quicker and more convenient way is to send the quarterly payments electronically.

Can I skip an estimated tax payment?

Well, you can, but this will result in penalties and interest from the officials. Even if you overpay the total tax amount but delay or skip one of the quarterly payments, be ready to pay the penalty and get a refund for overpaying separately. If there were provable emergency circumstances, you wouldn't be fined for skipping.

Can I pay 1040-ES tax online?

One of the most convenient options is to make payments via the IRS2Go mobile app. The IRS offers some more options on its website too. By paying the tax online, you can assure that the IRS receives your payment on time, and the check doesn’t get lost by the postal service.

How to pay 1040-ES online?

You can pay by phone, IRS2Go mobile app, credit or debit card online, and the IRS website. There you can use either your bank account for direct payment or one of your cards.

What happens if I underpaid my estimated taxes?

If the difference between the estimated tax and the underpaid amount of tax is not $1,000 or more, there will be no penalty. Generally, the IRS recommends prepaying to avoid underpaying. Make sure that line 11c on your form displays the estimated tax amount as accurately as possible. You can pay the exact amount stated on line 11c.

What happens if you overpay estimated taxes?

Your right is to claim a refund for the amount you overpaid without any penalties. You have to claim for a refund within a 3-year period after overpaying, or the IRS may refuse to process it.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out 1040-ES Form 65bb5abff7884042f10e12d5