-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Create a W-9 Form Template for Freelance Work

.png)

Dmytro Serhiiev

In the world of freelancing, preparation is key. And that's also true with regard to handling tax paperwork like the W-9 form. To speed up this process and save heaps of your precious time, creating a W-9 form template is a must. In this article, we'll provide basic details about the W-9 form, let you in on how to get a W-9 as a freelance specialist, as well as explore step-by-step instructions on how to craft the W-9 form for freelancers.

Fillable W-9 Form 65f013686d1834a70e07c82d

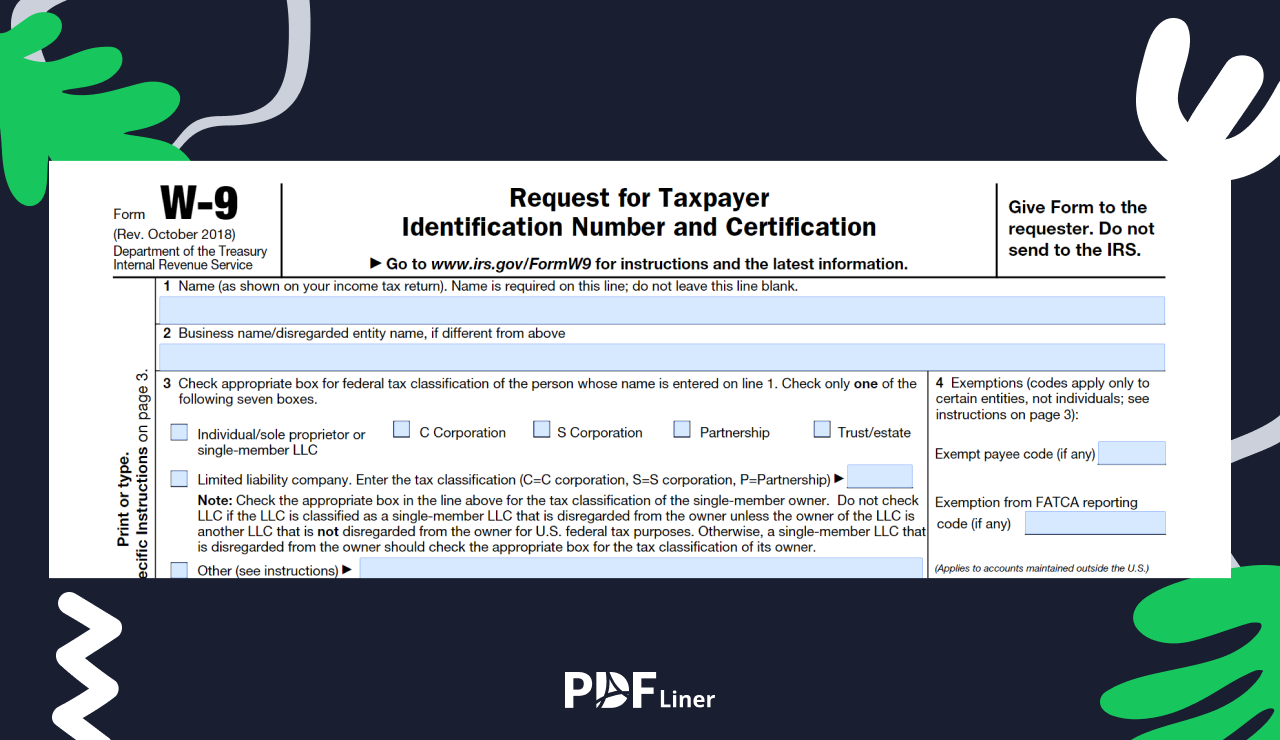

What Is a W-9 for Freelancers?

So you're diving into the world of freelancing, and suddenly, you hear about this thing called the W-9 form. What's that all about? Let's break it down like a bad dance move at a family wedding — painfully simple.

- What's the deal with W-9? The W-9 form is what your clients need to fill out their side of the tax paperwork.

- Completing the 1099. Have you ever heard of the 1099 form? Yes, that's what your client needs the W-9 for. They use the info from your W-9 to fill out their 1099 form, which reports your earnings to the IRS.

- Personal vs. business. If you're freelancing without an official business setup, no worries. You can use your personal tax info on the W-9. But if you've got yourself a fancy Single Member LLC, you'll need to use your business info instead.

- The reason it matters. Getting your W-9 sorted keeps the tax train chugging smoothly. It ensures your clients have the right info to report your earnings accurately, which means no unexpected tax surprises down the line.

So, you have the outline of the W-9 form template. It might seem like just another piece of paperwork, but trust us, it's your ticket to keeping the taxman happy.

Why Do Freelancers Need the W-9 Template?

Why on Earth do freelancers need to bother with this thing called the W-9 template? Well, let us break it down for you in detail:

- Time is money. We all know time is precious, especially for freelancers. Do you fill out a W-9 every single time a client asks for it? Nobody usually has time for that!

- Using templates is fast. That's where the W-9 template swoops in like a superhero with a cape. You whip it out once, customize it with the date and maybe the client's name, and boom! You're good to go for future gigs.

- Date and name game. Speaking of customization, that's the beauty of it. Just tweak the date and add the client's name if needed. It's like topping up your ice cream with sprinkles — easy-peasy.

- Avoid headaches. Let's be real, who wants to deal with paperwork headaches? With a W-9 template, you're saving yourself from the agony of repetitive form-filling and keeping your sanity intact.

A quality blank W-9 template is the secret weapon to streamline your paperwork affairs and keep you focused on what matters — getting those projects done with a laser-like focus.

W-9 For Freelancers 65f013686d1834a70e07c82d

How to Fill Out a W-9 as a Freelancer

Whether you're working as an affiliate marketer or freelancing in your unique style, filling out Form W-9 sticks to the same procedure. Below, we’ve provided a step-by-step guide for coping with this task.

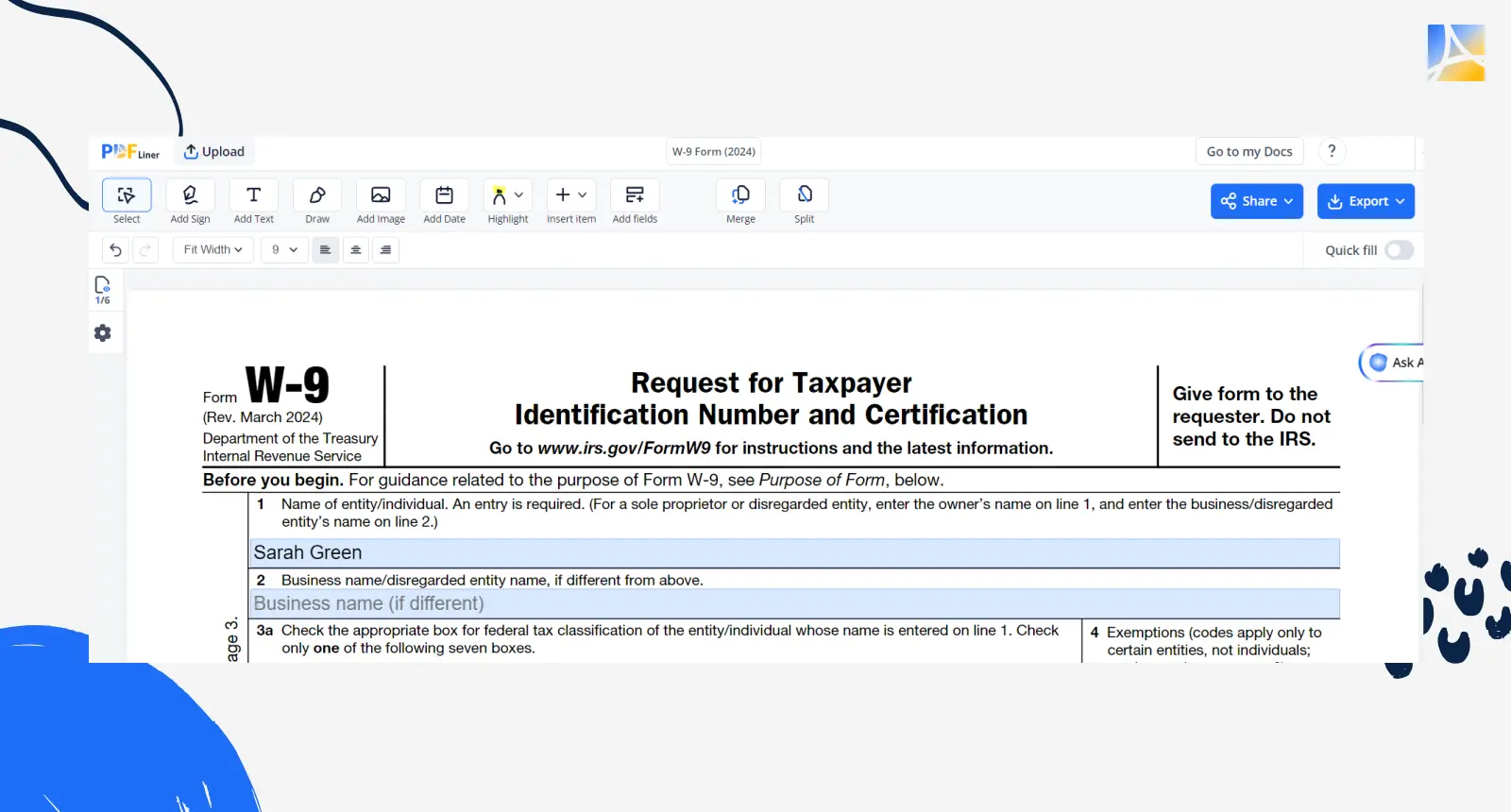

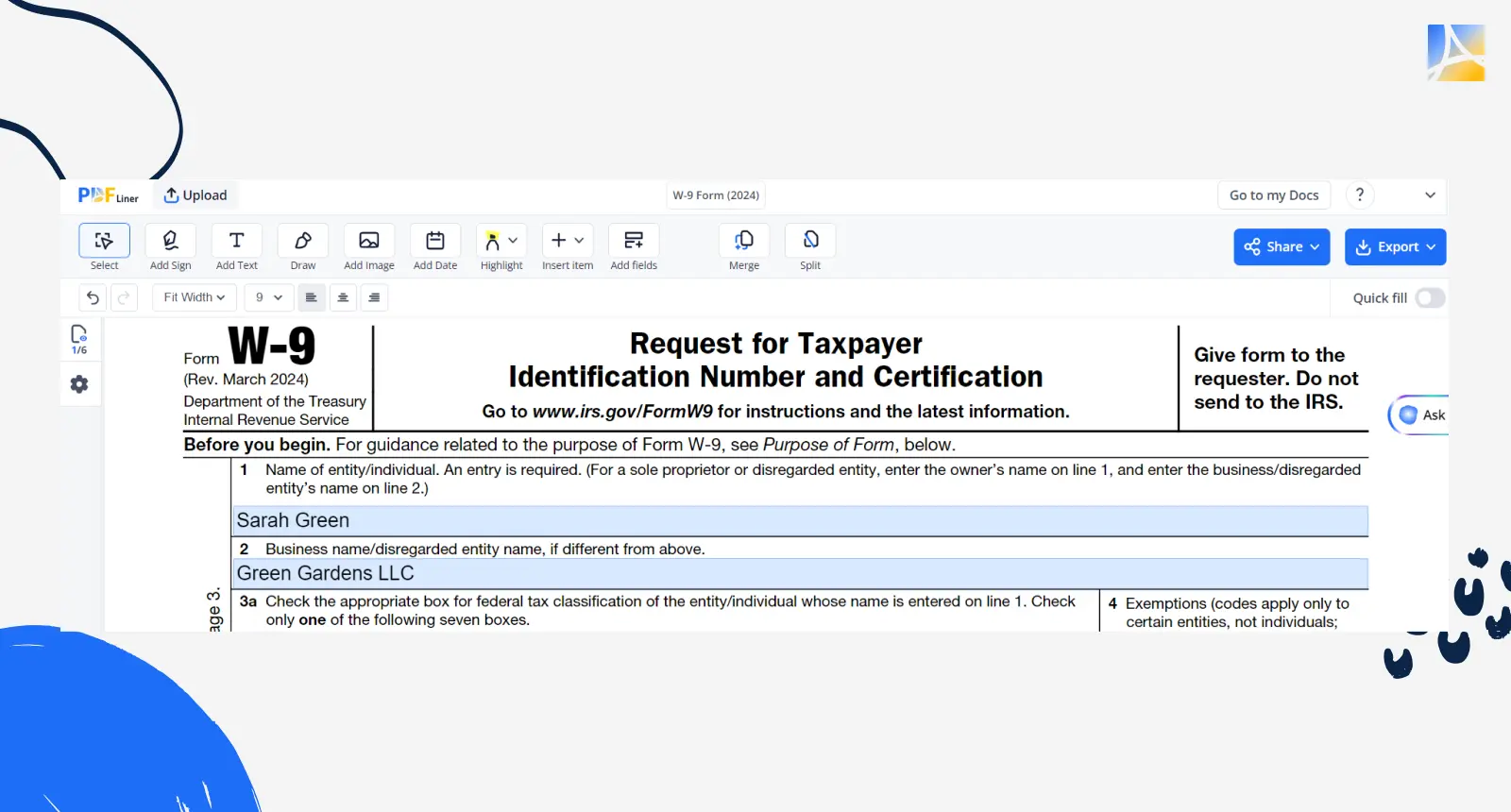

1. Sorting out line 1

If you're flying solo in the freelance or affiliate marketing world without a fancy business setup, just pop your human name right on line 1. But if you're part of a partnership or a corporation, get serious and use the real business name on line 1. No playing around with DBA names! Don't even think about slipping in the name of a disregarded entity here. That's a big no-no.

2. Proceeding to line 2

If you've got an extra name, like a disregarded entity or a DBA, different from what you put on line 1, this is where it goes. An example is Sarah Green, who runs her single-member LLC called “Green Gardening Services.” She'd specify “Sarah Green” on line 1 and “Green Gardens LLC” on line 2. But if you're not playing any name games, just leave line 2 blank and keep it simple.

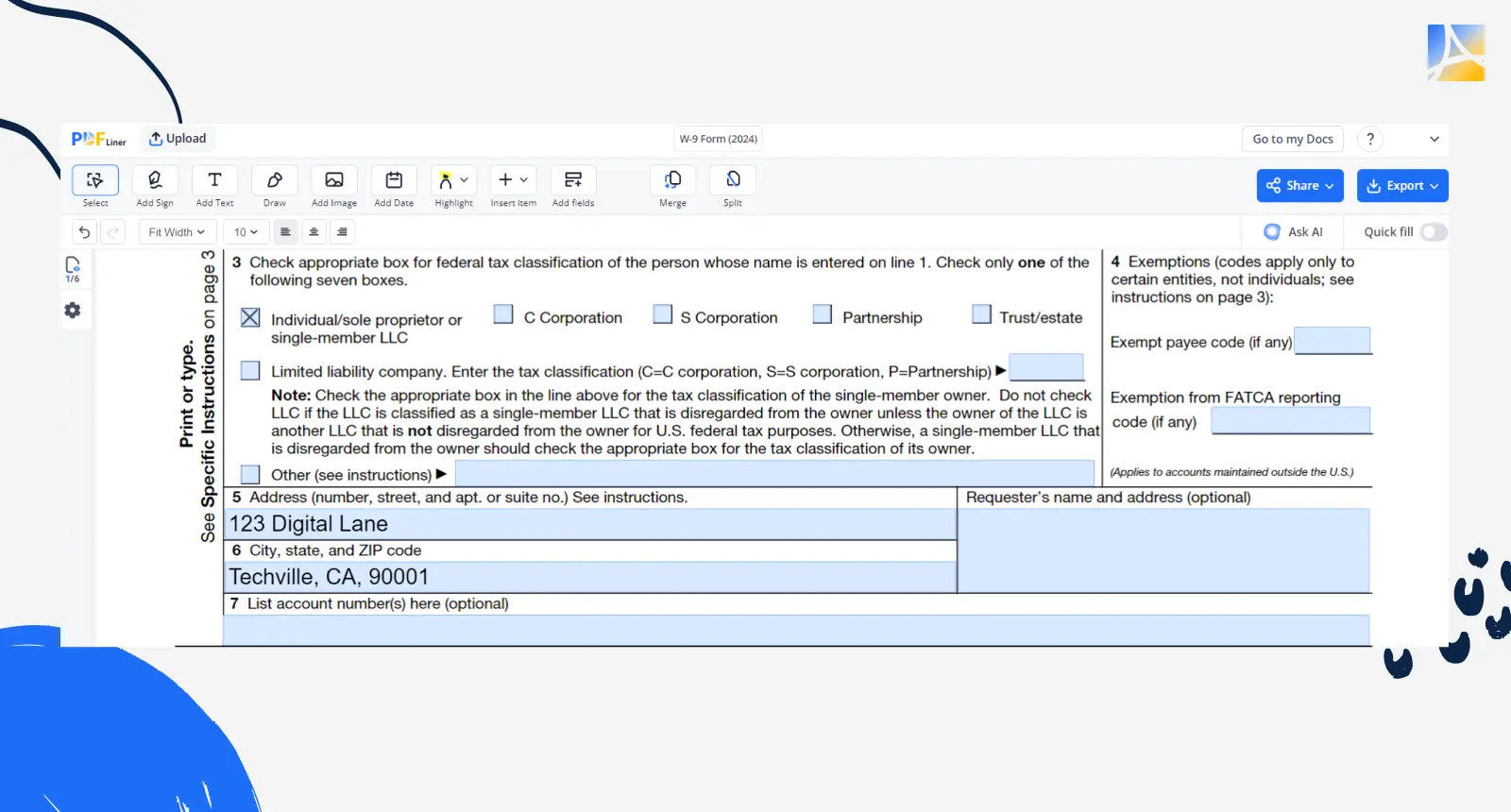

3. Section 3: breaking it down

In section 3, tick just ONE box. If you are a freelancer, then simply check the first box even if you registered in an LLC.

Got it? Good. Now go mark that W-9 line 3 freelance box like a pro!

4. Section 4: the exception zone

Usually, this area stays empty. But if you're a C corporation taking only wire transfers and your freelancing isn't in the medical field, there's a chance you could snag an exemption. However, if you're all about keeping things simple and hassle-free, it's probably best to keep it blank.

5. Lines 5 and 6: the address zone

Enter the address where you get your business mail. Don't worry, we're not asking for your childhood home address or your secret hideout — it's just where your business is located.

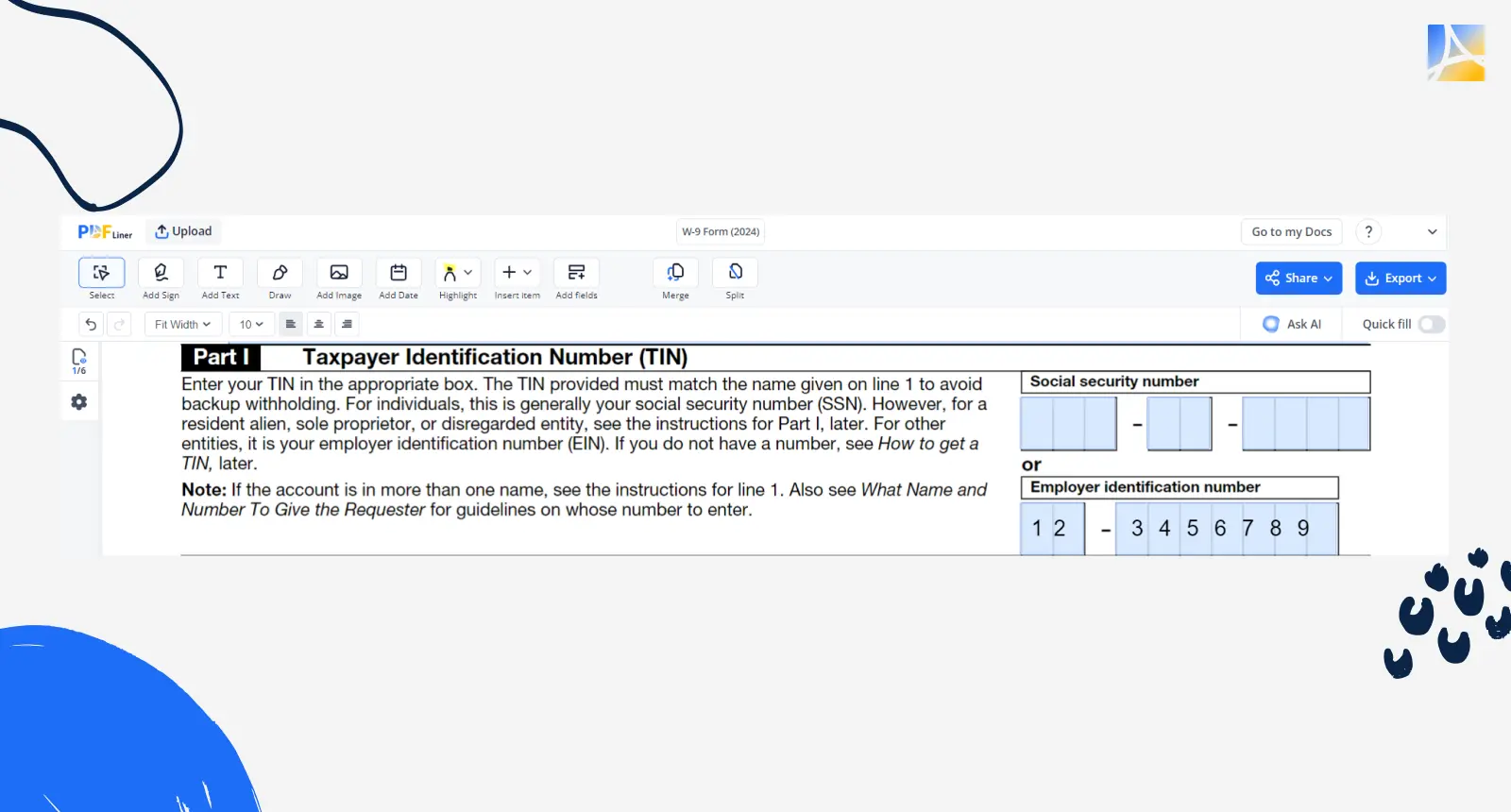

6. Part I: name and numbers

If you put a person's name on line 1 and they have a social security number, enter that number where it says and skip the EIN part.

Now, if the name on line 1 belongs to a person who doesn't have a social security number (like a resident alien), enter their ITIN in the social security number spot.

However, if the name on line 1 is a business, specify that business's EIN in the EIN spot and forget about the social security number section.

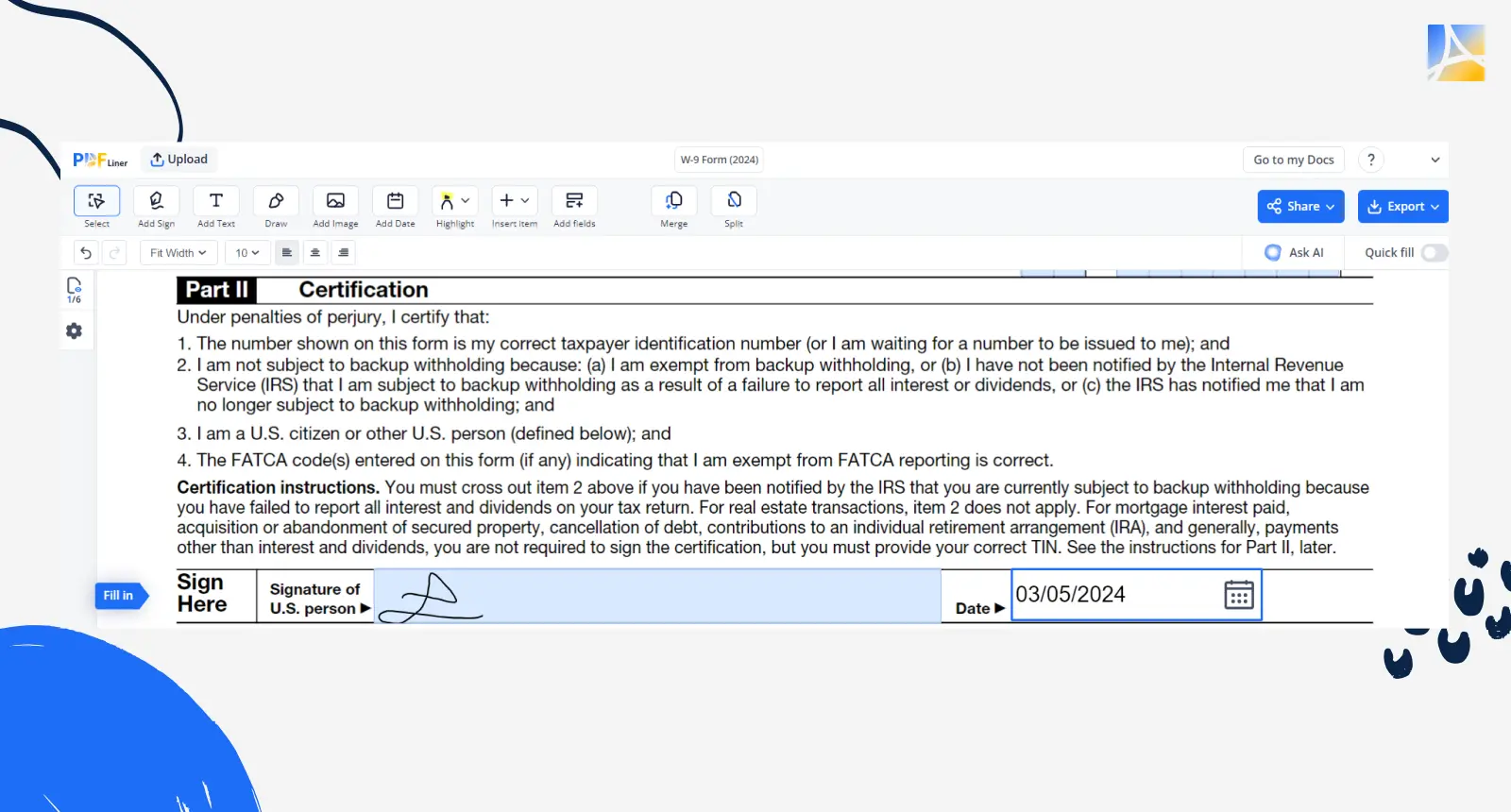

7. Part II: statements

Take a peek at the three statements. Scratch out number 2 if it doesn't apply to you. Then, place your signature and the date where they tell you to.

Quick note. If you're not a US person or business, hands off this form! If you're not sure, call a solid tax expert for backup.

Create W-9 65f013686d1834a70e07c82d

How to Use the W-9 Form Template

So, you've got your hands on a W-9 form template via PDFLiner's handy file catalog — nice job! Now, let us educate you how to put the doc to work:

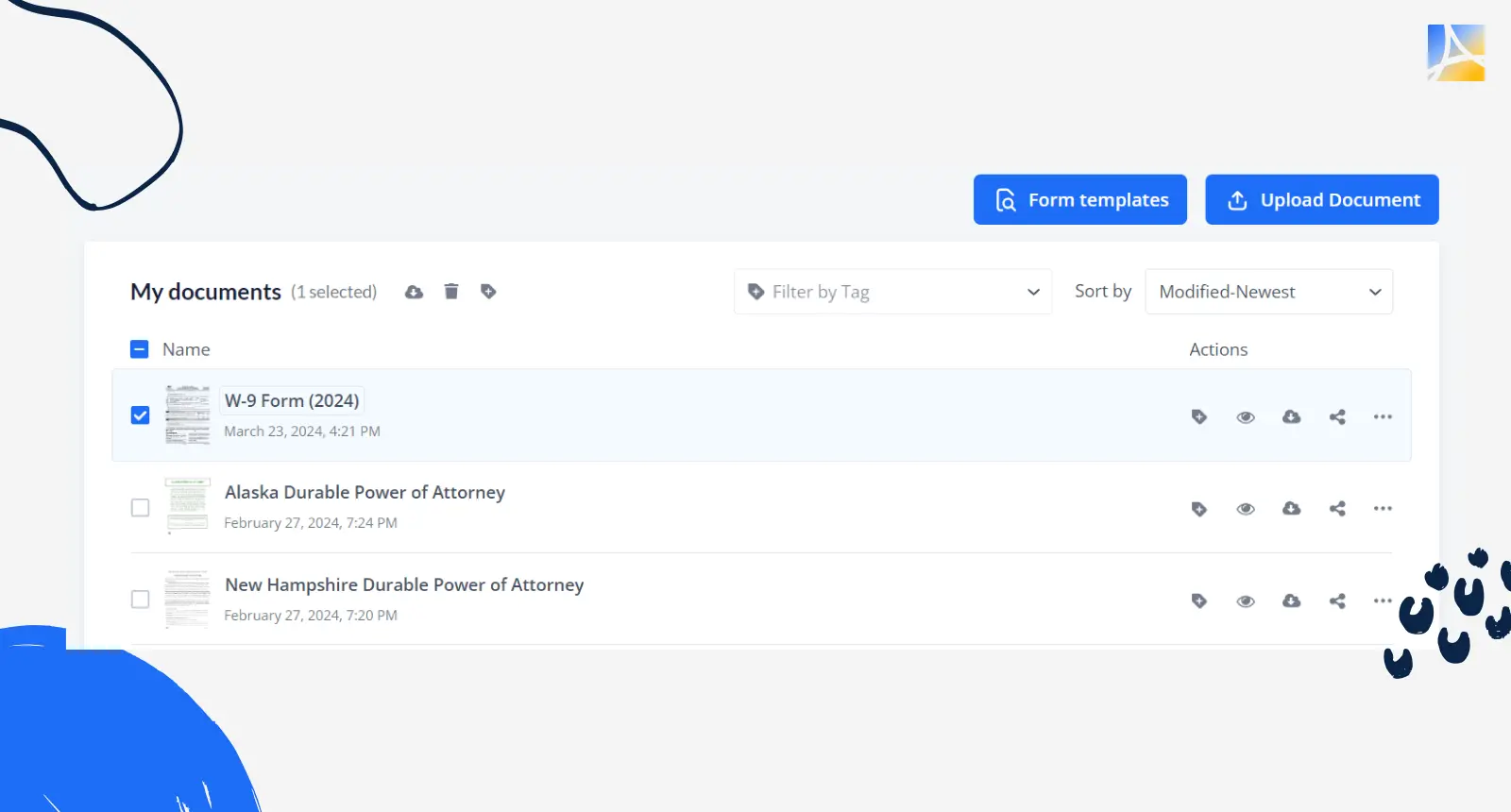

1. Save the template in your dashboard

Start by tucking away that file in your W-9 creator PDFLiner dashboard.

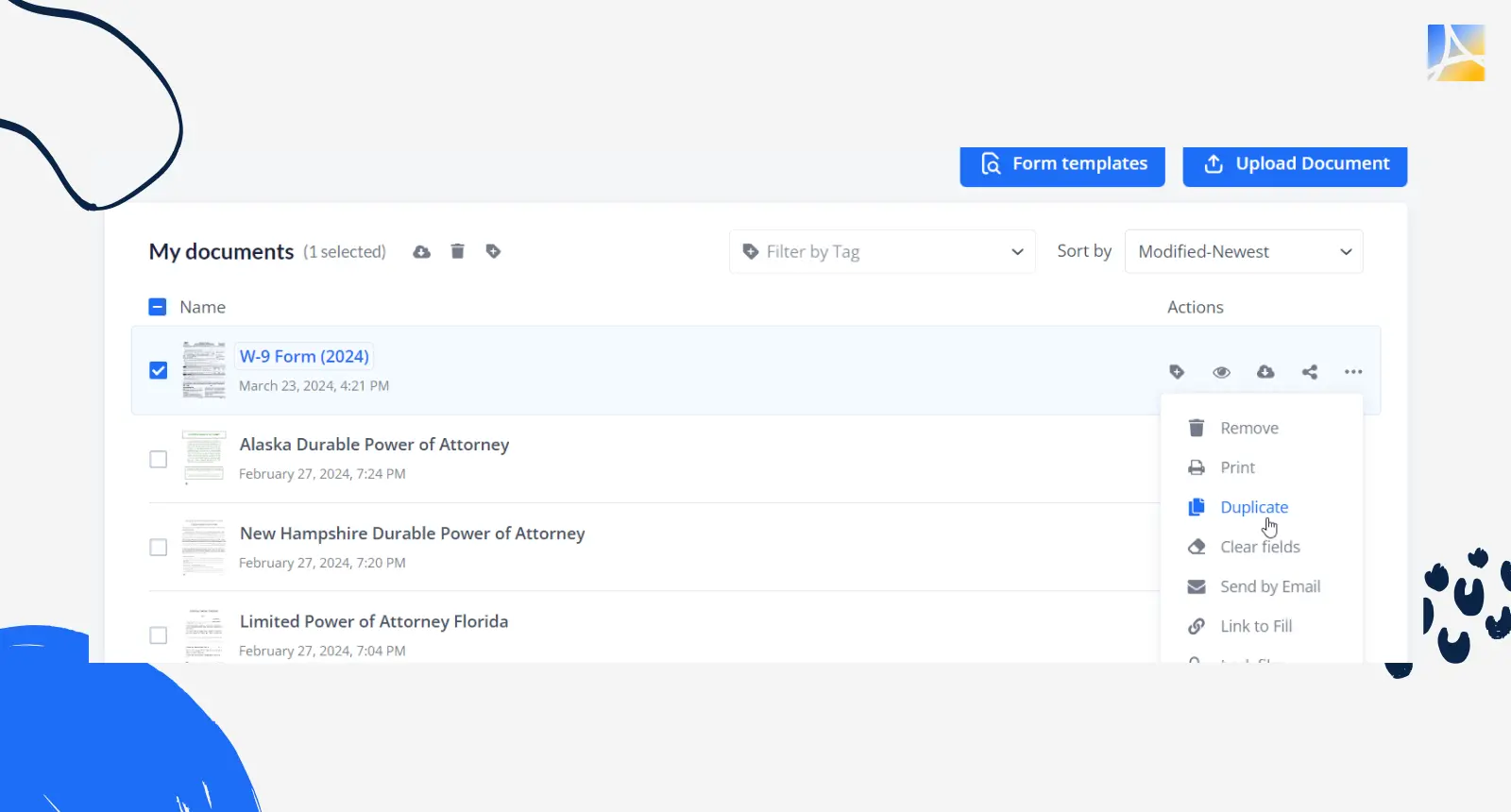

2. Duplicate the document every time W-9 is requested

Whenever someone asks for a W-9, don't start from scratch. Just duplicate the template like a boss and save yourself some precious time.

3. Write the name of the requester

Keep track of who's asking for your info by specifying their name. Sort of like a little black book of all your tax paperwork, friends.

4. Fill out the current date

Don't forget to stamp that W-9 with today's date to keep things current.

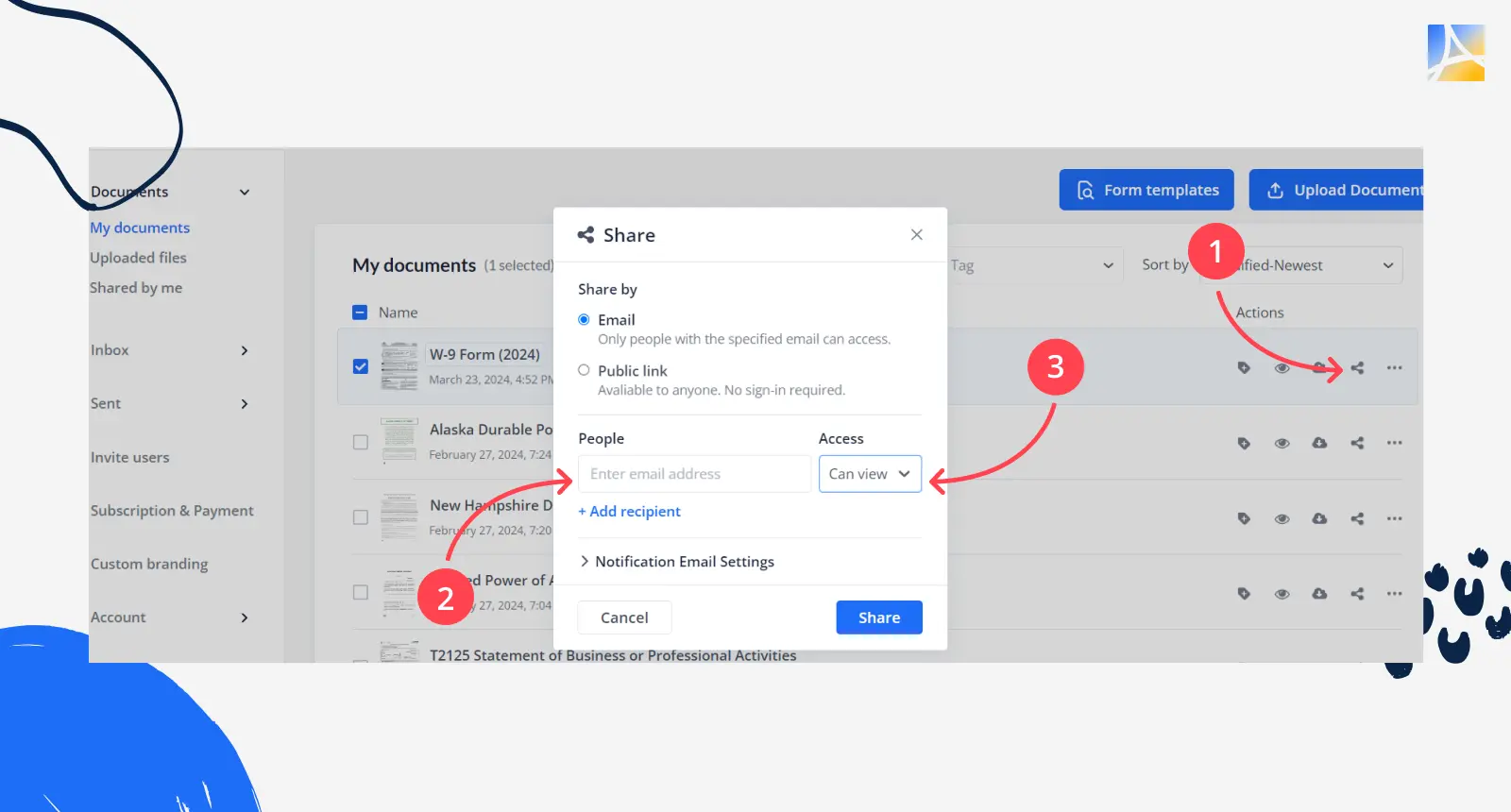

5. Share the PDF (view only)

Once it's all filled out, share the PDF with the requester in view-only mode. That way, you're showing your doc without letting anyone mess with it.

At the end of the day, freelancers can simplify their tax obligations by making the most of the W-9 template. This tool speeds up paperwork, as well as frees up your time for core work. Embrace the template to manage tax requirements efficiently. With PDFLiner, you will remain organized, save time, and stay on top of your tax affairs.

Fill Out Tax Forms Online Safely

Complete & send forms easily using PDFLiner

Get W-9 Form 65f013686d1834a70e07c82d