-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

W-9 vs. 1099 Forms: What’s the Main Difference?

.png)

Dmytro Serhiiev

Last Update: Dec 29, 2024

“Like a diamond, the more clarity we have, the more value we bring.” These words by Ruth Saw echo profoundly in today's topic: W-9 vs. 1099. In this post, we will offer you clarity when it comes to comparing W-9 and 1099 forms and provide you with details and nuances on the topic for the sake of the ultimate clarity. Keep reading.

Fillable W-9 Form 65f013686d1834a70e07c82d

Key Takeaways

- The W-9 form is used to collect taxpayer identification information, while the 1099 form is used to report income to the IRS.

- The W-9 is filled out by the individual or business providing services and is kept by the requester for record-keeping, not sent to the IRS. In contrast, the 1099 is filled out by the payer, sent to the recipient, and filed with the IRS.

- The W-9 is necessary to issue a 1099, as it provides the payer with the necessary taxpayer information needed for reporting income.

Is a W-9 the Same as a 1099 Form: Shorter Version

The W-9 and 1099 forms are distant relatives in the tax paperwork family. They're related, but each has its purpose. Below, we've dwelled upon the W-9 or 1099 comparison in detail and more straightforward terms:

W-9 Form

- The W-9 form is a way for a person or business to gather your taxpayer identification number (TIN), usually your social security number or employer identification number (EIN).

- When you're asked to fill out a W-9 or W-9S Form, it's because someone needs your information for their records, typically if they plan to report payments made to you to the IRS.

- It's not about money changing hands. It's just setting the stage for future transactions.

- You don't send the W-9 to the IRS. You keep it for your records and provide it to the requester.

1099 Form

- Consider the 1099 form the receipt you get after purchasing. It's proof that you've received income from a particular source.

- If you were paid $600 or more by someone during the year for services rendered, they would most likely fill out and send you a 1099 form.

- The person or business that paid you reports this income to the IRS using the information you provided on your W-9.

- You have to use the info from 1099 when you file your taxes so that they know about the income you've received, and then you should keep the form for your records.

The W-9 sets the stage, and the 1099 seals the deal by documenting the transaction for tax purposes.

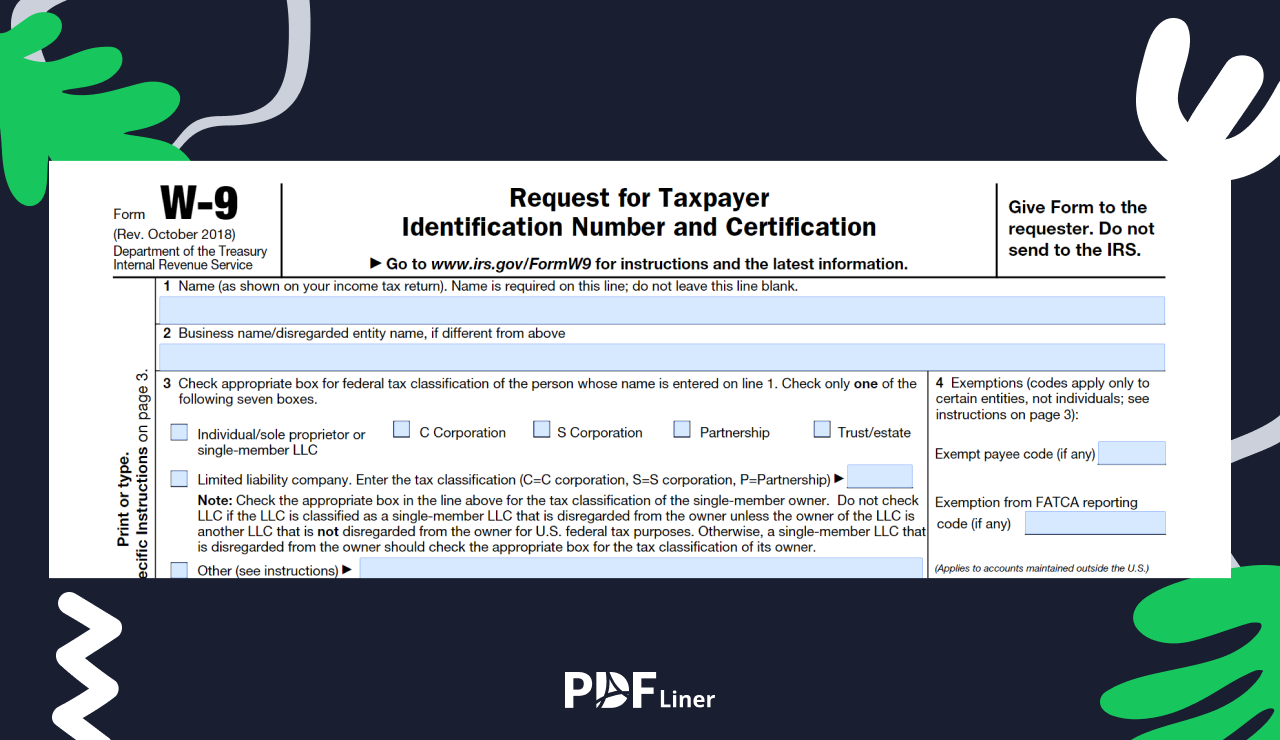

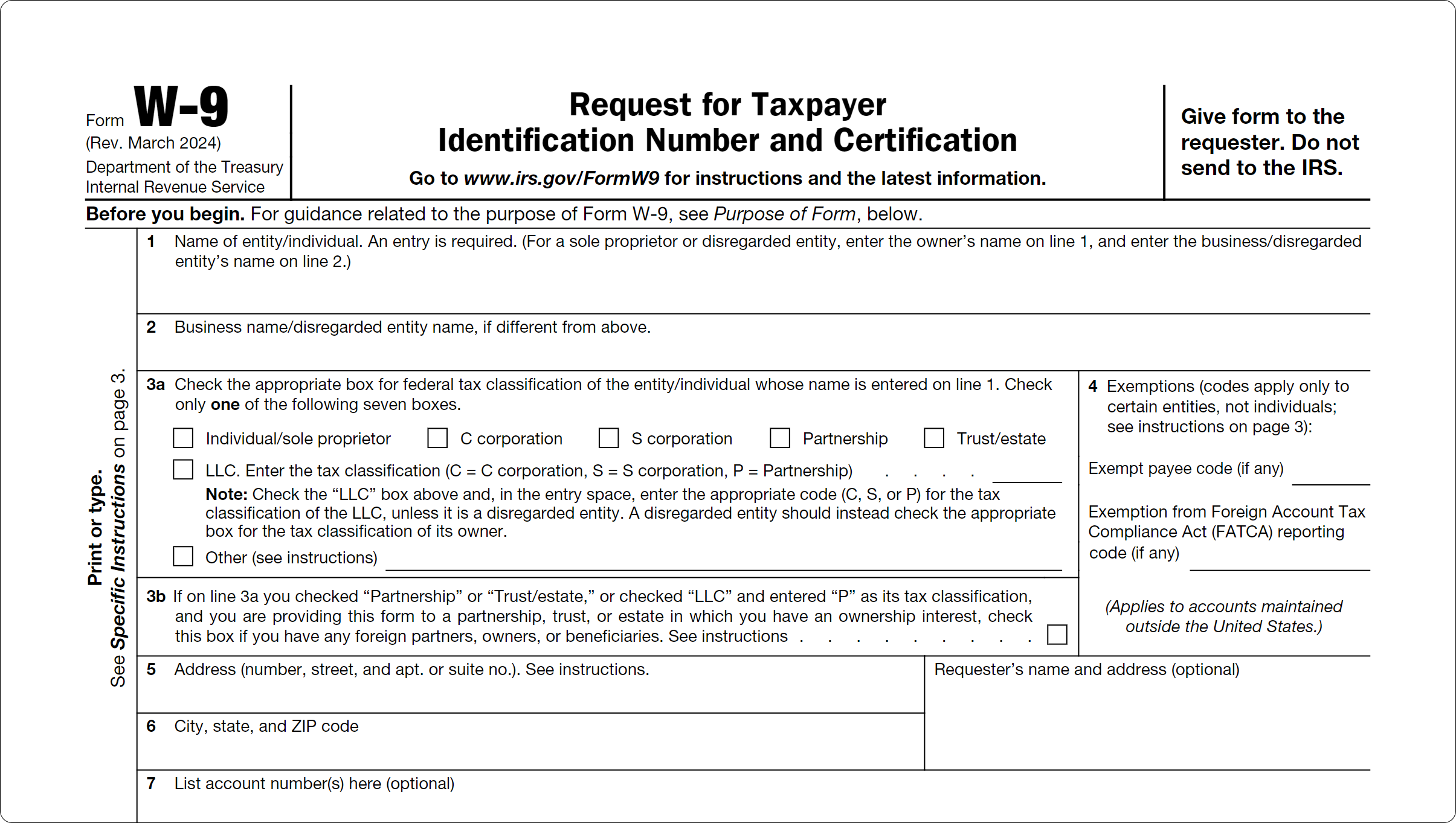

What Is a W-9 Form

Let's shine some light on the W-9 form. Find more details below.

- What it is

- The W-9 form is like introducing yourself to the taxman. It's where you spill the beans on who you are and how the IRS can reach you.

- Ever had someone ask for your social security number or employer identification number? Well, chances are they may ask for it on a W-9 form.

- It's not just for individuals. Businesses also fill out the W-9 form for 1099 employees to provide their taxpayer info.

- The main purpose? So that whoever is paying you knows how to report those payments to the IRS.

- Why it matters

- If you're doing any kind of work that results in income, expect to fill out a W-9 at some point.

- Without a completed W-9, you might find yourself chasing after your hard-earned cash come tax time.

- Plus, it's a tax requirement, so you’d better not ignore it. The taxman has a way of finding out!

Long story short, W-9 for contractors might seem like just another piece of paper, but it's your ticket to keeping the taxman happy and your finances in order.

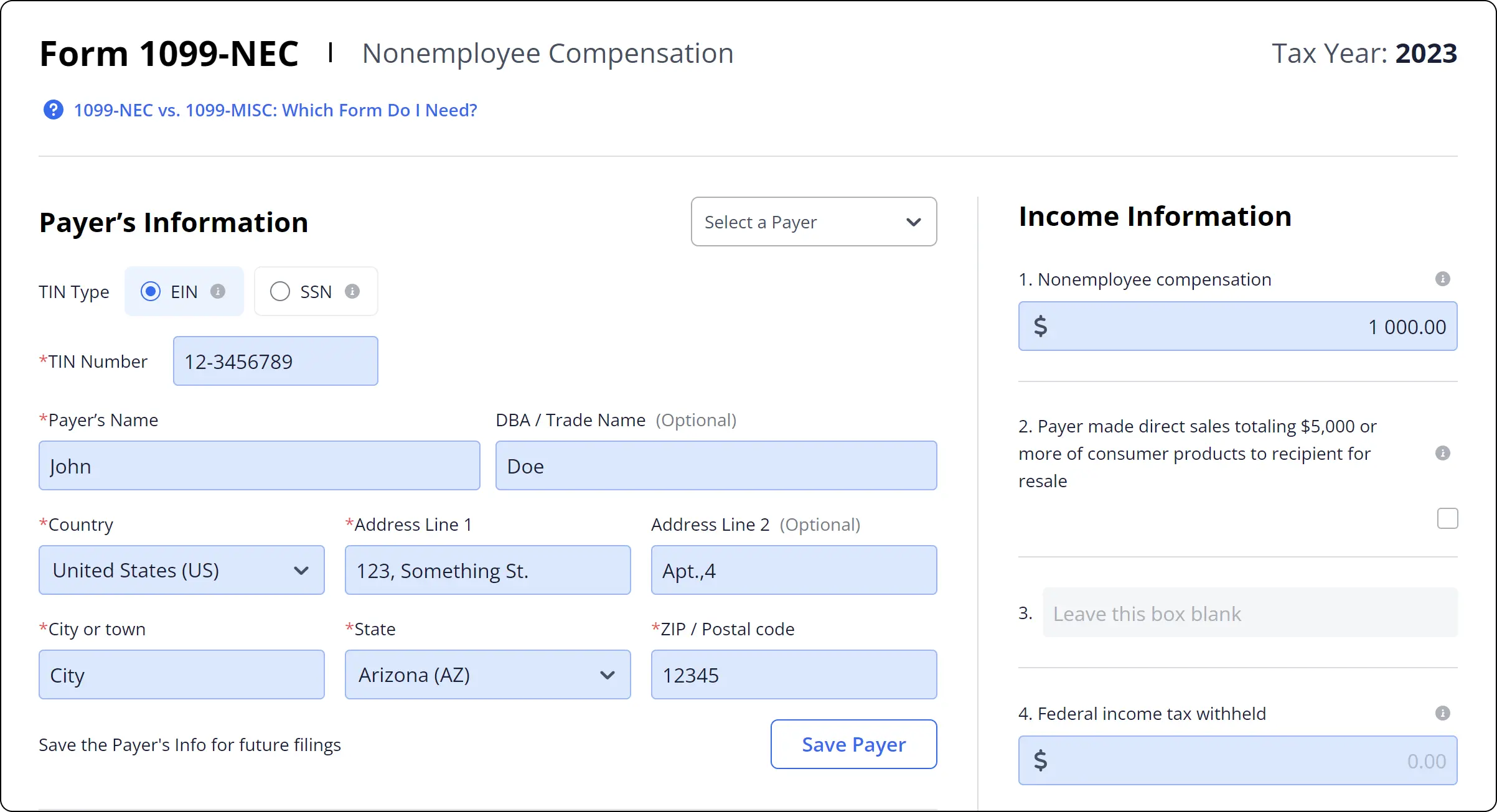

What Is a 1099-NEC Form

Below, we've outlined the details of Form 1099-NEC:

- The 1099-NEC is an official document utilized to report non-employee compensation. NEC stands for “Non-Employee Compensation,” which means money you made outside of traditional employment.

- This file is the official record of money earned from freelancing or contracting gigs. Think of it as your tax receipt for side hustle success.

- If you earned $600 or more from a client's payments during the year, expect a 1099-NEC to land in your mailbox when tax time approaches.

- The doc details the total compensation paid to you for your services and thus makes sure that both you and the IRS are informed about your earnings.

Who fills it out:

- It's the employer's job to handle the 1099-NEC paperwork.

- As for you, the recipient of those earnings, just sit tight and wait for your tax mail to arrive.

Summing this section up, the 1099-NEC form is a necessary document for accurately reporting income earned outside of traditional employment arrangements.

Fillable 1099-NEC 65bb657f5447959694021119

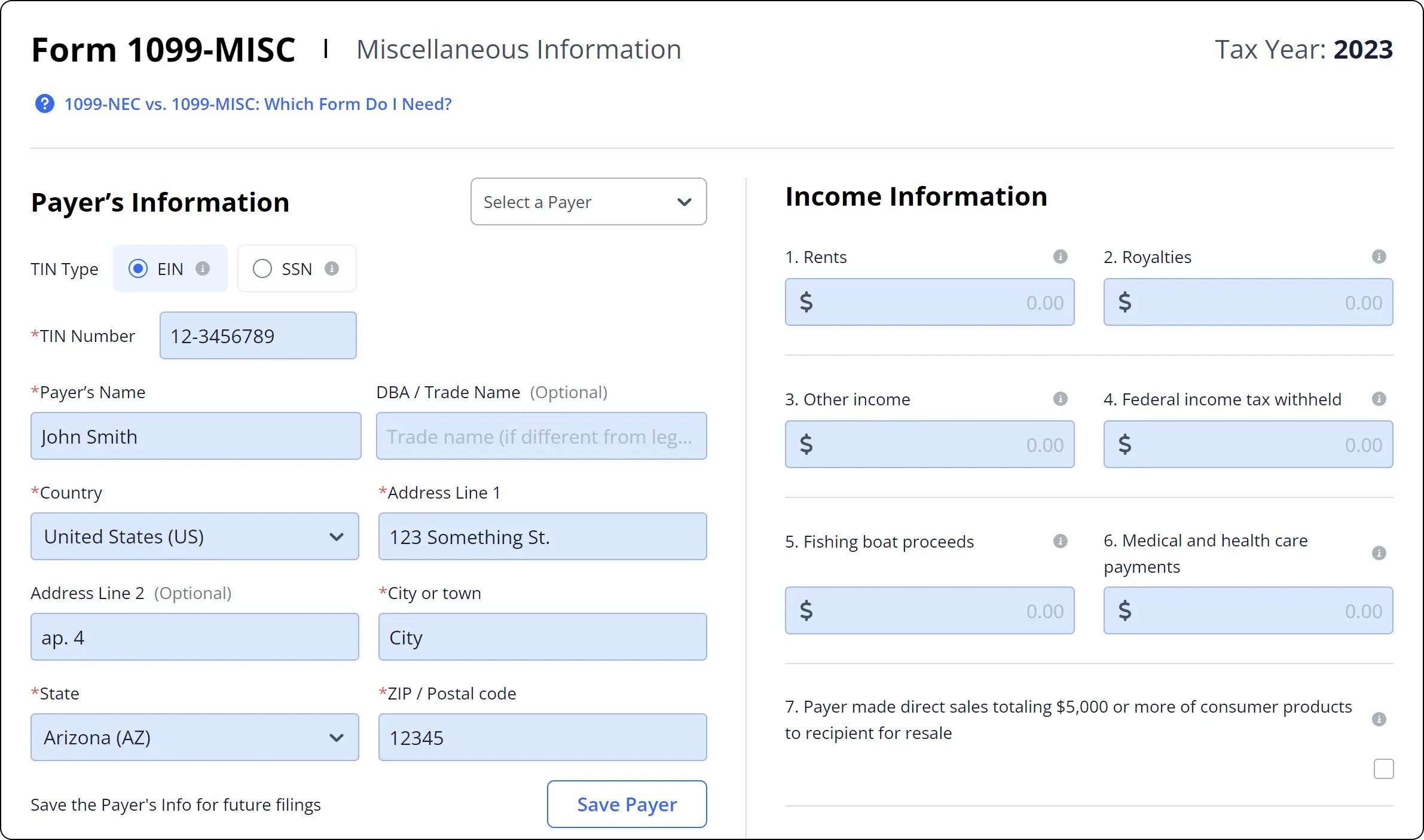

What Is a 1099-MISC Form

The Form 1099-MISC, now referred to as “Miscellaneous Information,” is a document from the IRS used to report various types of miscellaneous income, for example, rents, prizes, payments to attorneys, and healthcare payments.

Before 2020, it was a “go-to” for reporting income from side gigs and freelancing. But then, in 2020, the IRS introduced the 1099-NEC for non-employee compensation. So, while the 1099-MISC used to be an all-in-one tool, now it's more like the old, reliable form, handling everything except for freelancers and contractors.

Wondering who has to fill it out? Well, if you pay out at least $10 in royalties or broker payments, or dish out $600 or more in certain categories in a year, this file is for you.

What's included in those categories? We’ve provided the details below:

- We're talking about rent payments, prizes, and awards (still dreaming of that jackpot?), as well as other types of income that don't fit neatly into a box.

- There's even more: it also covers things like medical payments made during business matters, crop insurance payouts, and even cash for fish (yes, you’ve read that right!).

- Also, don't forget about those direct sales of consumer products. If you sling goods to someone for resale, and it adds up to $5,000 or more — it's 1099-MISC time!

When is the deadline? Payers need to send this form to recipients by Feb. 1 and file it with the IRS by March 1 (or March 31 if they go digital).

Whether you're a fisherman, a landlord, or just a lucky prize winner, keep an eye out for the 1099-MISC. It's your ticket to keeping Uncle Sam happy and your finances in check!

Fillable 1099-MISC 65bb60ced1918f924e00be1b

W-9 Versus 1099: Compare Forms

Let's wrap up our guide with an ultimate comparison between the W-9 and 1099.

1. Main purpose

- W-9 Form. W-9 is a sort of friendly introduction. Its main purpose is to collect taxpayer information from individuals or businesses. It's like sharing your contact info before plunging into a transaction.

- 1099 Form. This one, on the other hand, is the aftermath. Its main purpose is to report income earned by individuals, e.g. freelancers or contractors, to the IRS. It's the official record of money changing hands.

2. Who should fill it out

- W-9 Form. Anyone about to start a business transaction should fill out a W-9. Whether you're a contractor, vendor, or freelancer, this form is for you. It's like handing over your business card before sealing the deal.

- 1099 Form. If you paid someone $600 or more for services rendered during a year, you're responsible for filling out a 1099. It's basically letting the IRS know whom exactly you paid and how much.

3. Where to file

- W-9 Form. You don't file the W-9 with the IRS. Instead, you keep it for your records and provide it to the requester when needed.

- 1099 Form. This one is filed both with the recipient and the IRS. You send a copy to the person you paid and another to the IRS to keep them updated.

Before we finish up, let's remember the wise words of the Chinese philosopher Confucius. He used to say, “Knowledge without practice is useless. Practice without knowledge is dangerous.” Now, let's transfer this idea to our topic of sorting out the W-9 and 1099 forms: if you know exactly how these docs work, you are guaranteed to keep your tax profile strong, practice-wise.

Though the W-9 and 1099 forms might seem like just another set of bureaucratic hoops to jump through, we recommend that you treat them as the nuts and bolts holding the tax system together (which they actually are). Whether you're starting a business relationship, working on your tax reporting, or getting your taxes in order, knowing the difference between them is vital for staying on the IRS's good lists.

Last but not least, if you're wondering, “Do I need a W-9 to issue a 1099?”, the answer is a definite “yes.” The W-9 form lays the groundwork for issuing a 1099 and ensures everything is above the board when the tax season arrives. With this know-how under your belt, you are all set for the tax season!

W-9 For LLC 65f013686d1834a70e07c82

Complete Tax Forms Online and Save Time

Fill out forms in a few minutes using PDFLiner and concentrate on your business

Get W-9 Online 65f013686d1834a70e07c82d