-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Detailed Form W-9 Guide: What it is and How to Fill it Out in 2025

.png)

Dmytro Serhiiev

Last Update: Nov 30, 2024

Being an independent contractor has its advantages, but it also comes with much more personal responsibility; especially, when it comes to reporting your earnings. In this post, we will talk about how to fill out W-9 form, and who, how and when to file it.

Complete W-9 Form 65f013686d1834a70e07c82d

Key Takeaways

- W-9 form is essential for reporting taxpayer information, primarily used by U.S. independent contractors and freelancers for income exceeding $600 annually from a single company.

- Completing a W-9 form involves six straightforward steps: providing personal/business names, selecting tax classification, reporting exemptions (if any), entering address details, supplying SSN or EIN, and signing the document.

- Common mistakes to avoid when filling out a W-9 include providing incorrect TIN, failing to sign and date, selecting wrong entity type, and not updating information when changes occur.

- There's no specific deadline for filing a W-9, but it's recommended to submit it before January to allow timely preparation of 1099 forms, which have a January 31st deadline.

What Is Form W-9 and How Does It Work

The W-9 form is a document created by the IRS for reporting taxpayer information to entities that have the right to collect such data. The form is not sent to the IRS but forwarded to the party that requested it.

Companies need the information reported in a W-9 form (TIN mostly) to fill out 1099 Forms and report to the IRS the exact amount of compensation paid to non-employees in the past tax year.

The W-9 form most offen needs to be filled out by an U.S. independent contractor or freelancer who performs services for the company on an as-needed basis, without being employed by it. There is also a variation of this form a W-9S Form, designed for student loans.

Individuals and business that live outside of the U.S. and don't have the TIN should fill out Form W-8 instead.

You need not worry about how to fill out a W-9 as an independent contractor if your earnings from a particular company did not exceed $600 over the duration of a single year.

How to Get a W-9 for Freelancer or Business

Now that we understand who needs it, let us see how to get a W-9 form.

For Independant Contractors:

Most often, the company that contracts you to perform certain services will send you a blank W-9 form and ask you to complete it.

If an independent contractor does not receive the said form from the company that paid for their services, they may download the form from the official IRS website or use the current version at PDFLiner.

In rare cases, the company may issue a form of its own that is in a substantial way similar to the standardized W-9 form and features all the same certifications.

For Businesses:

If you need to get an independant contractor's tax information, like SSN or EIN use W-9 as it's the only legal way to request such info. You can share the W-9 template via PDFLiner, keep track of the progress, and securely store the document afterwards.

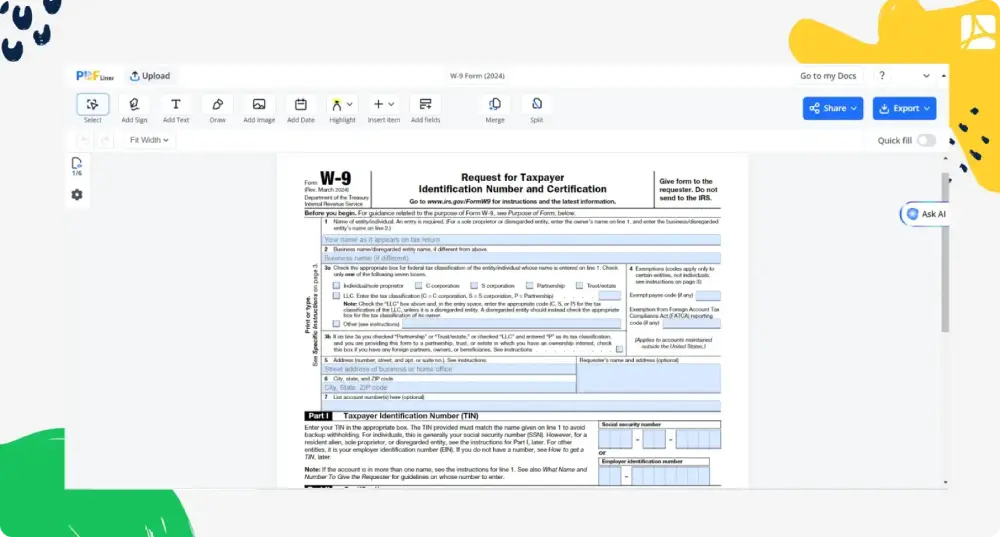

How to Fill Out W-9 Form in 2025

Now it is time to talk about how to complete a W-9 form correctly. Although many people are anxious when it comes to completing tax forms, the process is very uncomplicated. Moreover, there is not much difference between how to fill out W-9 as LLC and how to fill out W-9 form for an individual. Here are the step-by-step instructions for your conveniance:

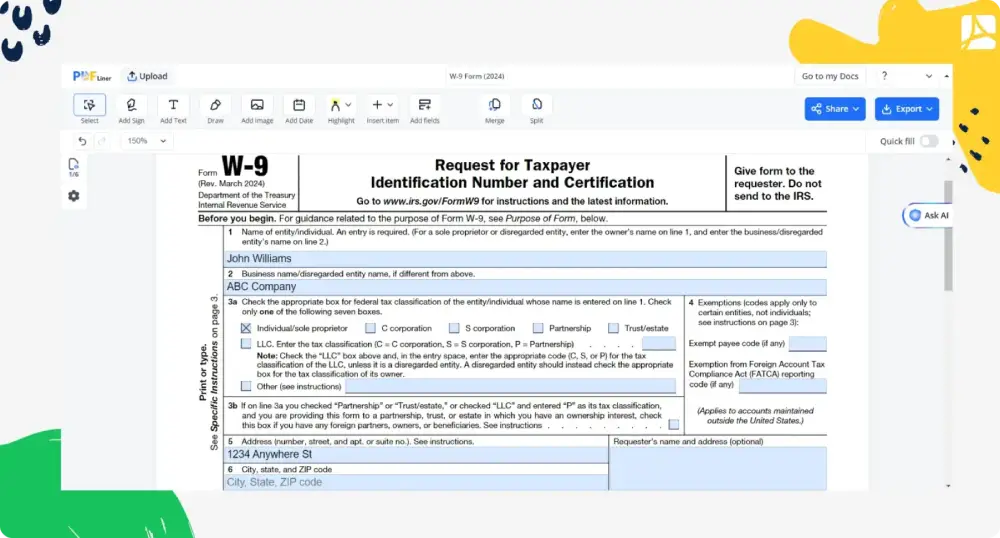

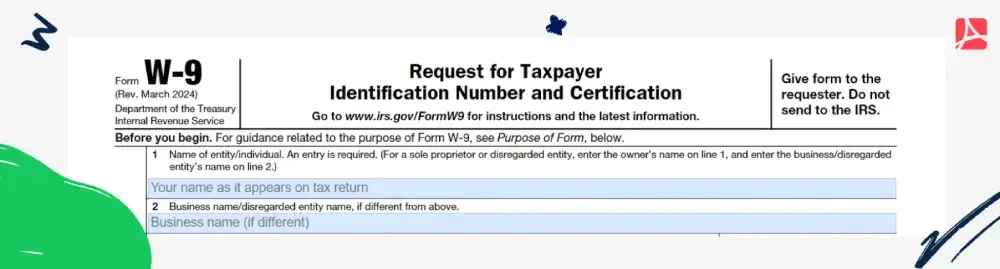

Step 1: Specify your name and the name of your business if you have one.

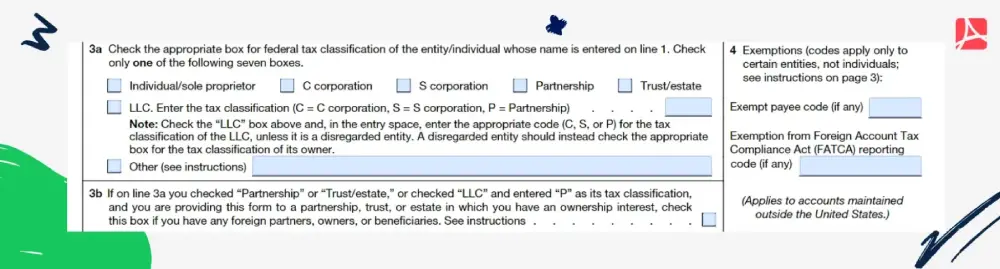

Step 2: Select the federal tax classification that applies to you, which can be an individual, a sole proprietor, an LLC (first option).

For businesses with multiple shareholders, there are several options available.

You can choose a C corporation which can have an unlimited number of investors or shareholders, and the corporation's income, as well as each investor's income, should be reported separately.

Alternatively, you can opt for an S corporation, which is limited to 100 shareholders. In this case, the corporation's profits and losses are passed through to the shareholders, who report them on their tax returns.

Another option is a partnership, which is a business entity where two or more people share ownership and profits of the company.

Step 3 (optional): If you have any tax exemptions you should report them in section 4. The first line is for entities that are exempt from backup withholding. It must be filled out with a number or letter code that explains the reason for exemption. The second line in this section is for entities that hold their accounts outside the US and are therefore exempt from reporting under the FATCA regulations.

Step 4: Provide your full address so that the requester can mail your copie of 1099. The account number line is to inform about any account numbers that you have for the requester (if you have any).

Step 5: In Part I of the W-9 form, you will need to provide your Social Security Number (SSN) or Employer Identification Number (EIN). The former is for individuals and single-member LLCs, and the latter is for multi-member corporations and partnerships. Sole proprietors are free to choose either one of the two.

Step 6: Part II is for signing and dating the document. The fastest way would be to click on the Sign Field and create your electronic signature using PDFLiner.

If you’re wondering how to fill out a w9 for a child, you’ll find that it is no different than doing it for an adult. When filling out a W-9 form, a minor will have to specify their name and TIN. The form can then be either signed by the minor himself/herself or by their legal guardian.

W-9 Real-Life Examples

The best way to understand how to complete a document is to see the filled out example. Here are two the most common examples for your conveniance.

Example 1: Freelance writer - Sole proprietor

.webp)

Samantha is a freelance writer recently hired by a marketing agency to work on several projects. The agency requests Samantha complete a W-9 form before they can process her payments.

Samantha opens W-9 form and starts filling it out. She enters her full legal name, "Samantha Smith," as it appears on her Social Security card. Since she operates under the "Smith Creative Designs" business name, she writes that in the second line. As a sole proprietor, she checks the "Individual/sole proprietor or single-member LLC" box.

Samantha doesn't have any exemptions, so she skips that section. She provides her mailing address, which is also her home address since she has a home office. Finally, Samantha enters her Social Security Number as her TIN. After reviewing and signing the document, she emails the completed and printable W-9 form to the marketing agency.

Example 2: Contractor - IT consultant - single-member LLC

.webp)

W-9 Form example for contractor

Michael is an IT consultant who owns an LLC called "Tech Solutions". A company has recently contracted him to help upgrade its network infrastructure. Before the payment for his services, the company requests Michael to provide a completed W-9 form.

Michael finds the fillable W-9 form at PDFLiner and starts filling it out. He enters his name and his LLC's legal name, "Tech Solutions LLC". Since his business is a single-member LLC, he checks the first box for his federal tax classification.

Michael doesn't have any exemptions, so he leaves that section blank. He provides the mailing address of his registered business office, where he would like to receive any tax documents from the company. Michael writes his EIN as the Taxpayer Identification Number because he owns an LLC.

Note: If you owe a single-member LLC and don’t have any employees, you don’t have to get EIN; you can use your SSN instead.

After carefully checking everything, Michael e-signs it and adds a current date to certify the accuracy of the information provided. He then submits the printable W-9 form to the company that contracted his services.

Samantha and Michael completed and submitted their W9s, providing the necessary information to their respective clients. This process ensures they comply with tax regulations and can be accurately compensated for their freelance and contractor work.

How to File a W-9 Form

The entity that requested the W-9 form should provide you with a blank copy of the document, which you then fill out and return. There is no deadline for filing a W-9 form. You do it after each chargeable event like receiving payment for the services you provide in the capacity of an individual contractor, paying mortgage interest, or depositing money to your IRA account. However there is a deadline for 1099 Forms and it's January 31st, so it's better to send you W-9 to the requester before the begining of January. This way accountants will have enough time to prepare and send you a copie of 1099-NEC, for example.

If you struggle to understand how to fill out W-9 for LLC or need detailed instructions on how to complete W-9 as an individual, get in touch with your tax advisor or reach out to the IRS directly.

Common Mistakes to Avoid When Completing Form W-9

There are a couple of common mistakes that people often do, but it's always better to notice them before you file the form:

- Providing an incorrect Taxpayer Identification Number (TIN), such as a Social Security Number (SSN) or Employer Identification Number (EIN) that does not match the name on the form.

- Failing to sign and date the form.

- Indicating the wrong entity type, such as selecting "Individual" when the entity is a corporation.

- Failing to provide an exemption reason when claiming an exemption from backup withholding.

- Providing a wrong address.

- Using a fictitious business name when the individual is doing business under a different name.

- Entering incorrect information if the form is being filed by an agent, nominee, or custodian.

- Filling a wrong form, for example, providing a W-8 instead of a W-9.

- Not updating the form if any information changes, such as a change in address or TIN.

- Not providing the form in a timely manner when requested by the requester.

Try to avoid these errors in your filing process.

Frequently Asked Questions

When you know all the benefits of the paperless office solution, it’s much easier to make this choice. Here you will find some questions about this topic.

How much taxes will I pay on a W-9?

For the income, which is reflected in the W-9 form and is liable to backup withholding, the IRS currently sets the flat rate at 24%.

How does a W-9 affect my taxes?

Providing incorrect information on a W-9 form or not reporting some types of income will lead to backup withholding at a rate of 24% being applied to the earnings payable to you.

How to fill out a W-9 as an independent contractor?

Enter your name and business name, if applicable. Specify your business entity according to the federal tax classification. People exempt from backup withholding and reporting under the FATCA regulations should enter a code in the corresponding boxes. Provide your correct address and zip code. Date and sign the document.

How to fill out a W-9 for a business?

In the ‘Name' box, provide the name you or your business use when filing for taxes. If not already mentioned in the top line, the second line is for your business name. Select the correct classification for your business. The Exempt Payee box is only for when your business isn’t required to have backup withholding. Enter the full legal address. In Part I, provide EIN or SSN if you do not have EIN. Sign and date in Part II.

How to fill out W-9 for the landlord?

The landlord may ask the renter to fill out the W-9 form to handle their security deposits properly. The completion process is the same as the one described above.

How to send a W-9?

There is no trick to how to file a W-9 form. You can deliver it to the requester in person, send it via regular mail or courier post office, or email the filled-out form.

How long is a W-9 good for?

There is no expiration date on a W-9 form. You only need to update it in time if the information you provide here changes.

PDFLiner Solves All PDF Editing Issues

Start filing your taxes electronically today and save loads of time!

Fillable W-9 Form 65f013686d1834a70e07c82d

.webp)