-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

W-9 for Independent Contractors: Understanding the Details

.png)

Dmytro Serhiiev

Last Update: Jan 3, 2025

As an independent contractor, knowing your way around tax forms can save you lots of headaches down the line. As Will Rogers, humorist and entertainer from the 20s, once wittily said, “The difference between death and taxes is death doesn't get worse every time Congress meets.” It’s ironic, but we can always act smart upon it! In this post, we'll dwell upon the nuances of the W-9 form, let you in on how to fill out a W-9 as a freelancer, and generally make sure that independent contractors are well-equipped to go through tax season with confidence.

Fillable W-9 Form 65f013686d1834a70e07c82d

Key Takeaways

- Ensure the information on your W-9 is precise and free of mistakes to avoid any issues with the IRS. This includes correct names, business details, and your Taxpayer Identification Number (TIN).

- Whether you're a sole proprietor or have an LLC, choose the correct entity type and provide the appropriate taxpayer identification numbers such as SSN or EIN.

- Secure your W-9 forms by using passwords for PDF documents, sharing them only with intended recipients, and considering the establishment of a Single-Member LLC to further protect personal assets.

W-9 for Contractors: Special Requirements

When it comes to dealing with the IRS, W-9 for contractors can, indeed, be like those pop quizzes you didn't see coming. But don't worry, though. Below, we've provided some special requirements you should know about.

- Accuracy is key. Make sure your information on the W-9 is as precise as a laser-guided missile. The IRS doesn't have time for guessing games.

- Sign with care. Your signature on the W-9 is paramount. Double-check it because once it's there, it's like an unbreakable contract.

- Don't forget the TIN. Your Taxpayer Identification Number (TIN) is crucial. Keep it handy and utilize it wisely.

- No room for mistakes. Cross your T's and dot your I's. The IRS doesn't appreciate sloppy handwriting or careless errors.

- Know your business status. If you're a contractor without an officially registered business, you can use your personal tax information. However, if you're operating as a Single Member LLC, you must use your business information.

Remember, working as a contractor LLC filling out W-9 doesn't have to be rocket science, but it does require attention to detail. So, as experts, we recommend that you go the extra mile and tackle those special requirements like a pro.

How to Fill out W-9 as a Contractor

If you’re a small business owner and do jobs for others on a regular basis, filling out Form W-9 for each person you work with is a must. The document aids your customers in keeping tabs on what they pay you. Remember, it's up to you to give your clients a completed W-9. And even if you're a lone wolf freelancer or a temp worker, you still need to do the W-9 dance.

W-9 forms for independent contractors can be really daunting, it's true. But we are here to guide you through the completion process with ease. Below, you’ll find a step-by-step guide that will satisfyingly answer your “How to fill out a W-9 as an independent contractor?” question.

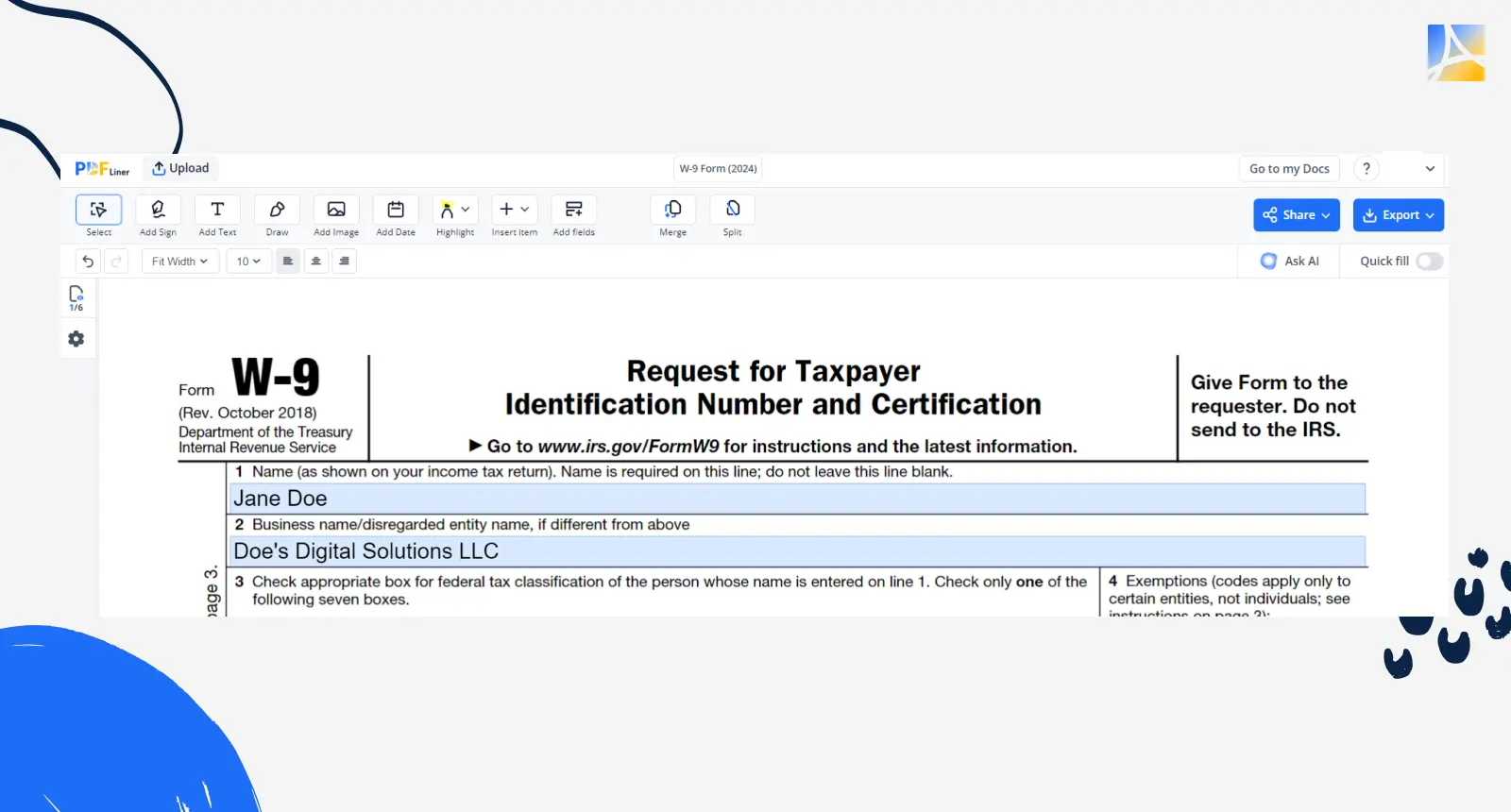

1. Indicate your name and your company name

Write or type your name exactly as it says on your tax return. Now, onto the business name. If you're flying solo without a business name, feel free to leave this box blank. However, if you've got a company name, pop it in there. Even if you're a one-person show with a limited liability company (LLC), the IRS wants to know your company's name. They may call it a 'disregarded entity,' but it still needs a name on that form. And if you're part of a partnership or rocking the corporate life, make sure to accurately indicate the entity's name.

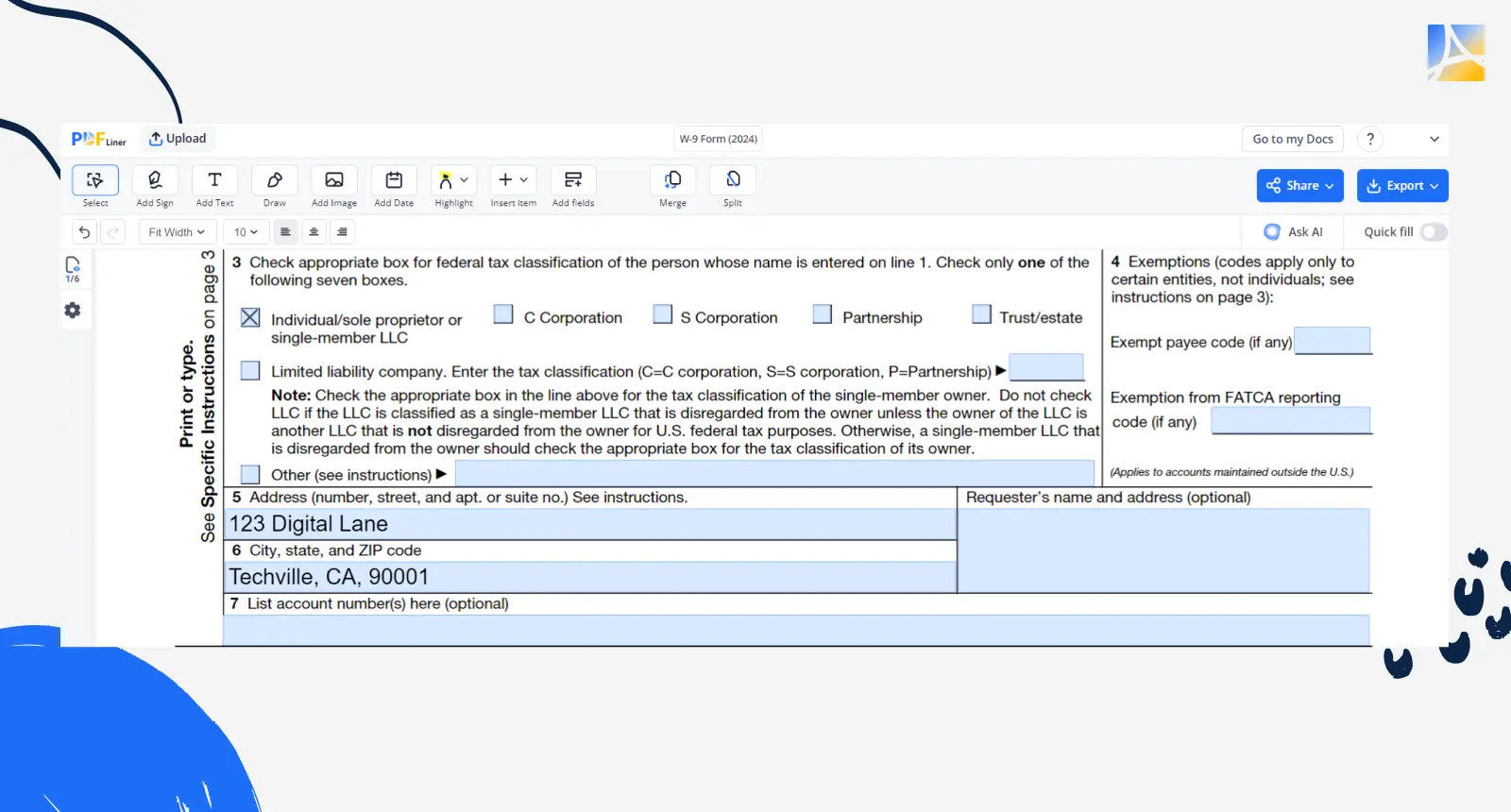

2. Specify your type of entity

Check a box that tells the IRS what kind of business you're running. If you haven't gone through the paperwork to form a business, you're a lone wolf, aka a sole proprietor. But if you've taken the plunge and formalized your business, it's decision time. Are you a fancy C corporation, a snazzy S corporation, part of a partnership, or living the limited liability company life? Once you've sorted that out, don't forget to drop your company's address in there. If you're a solo act, your home address will do just fine. And don't forget the zip code — the IRS loves those.

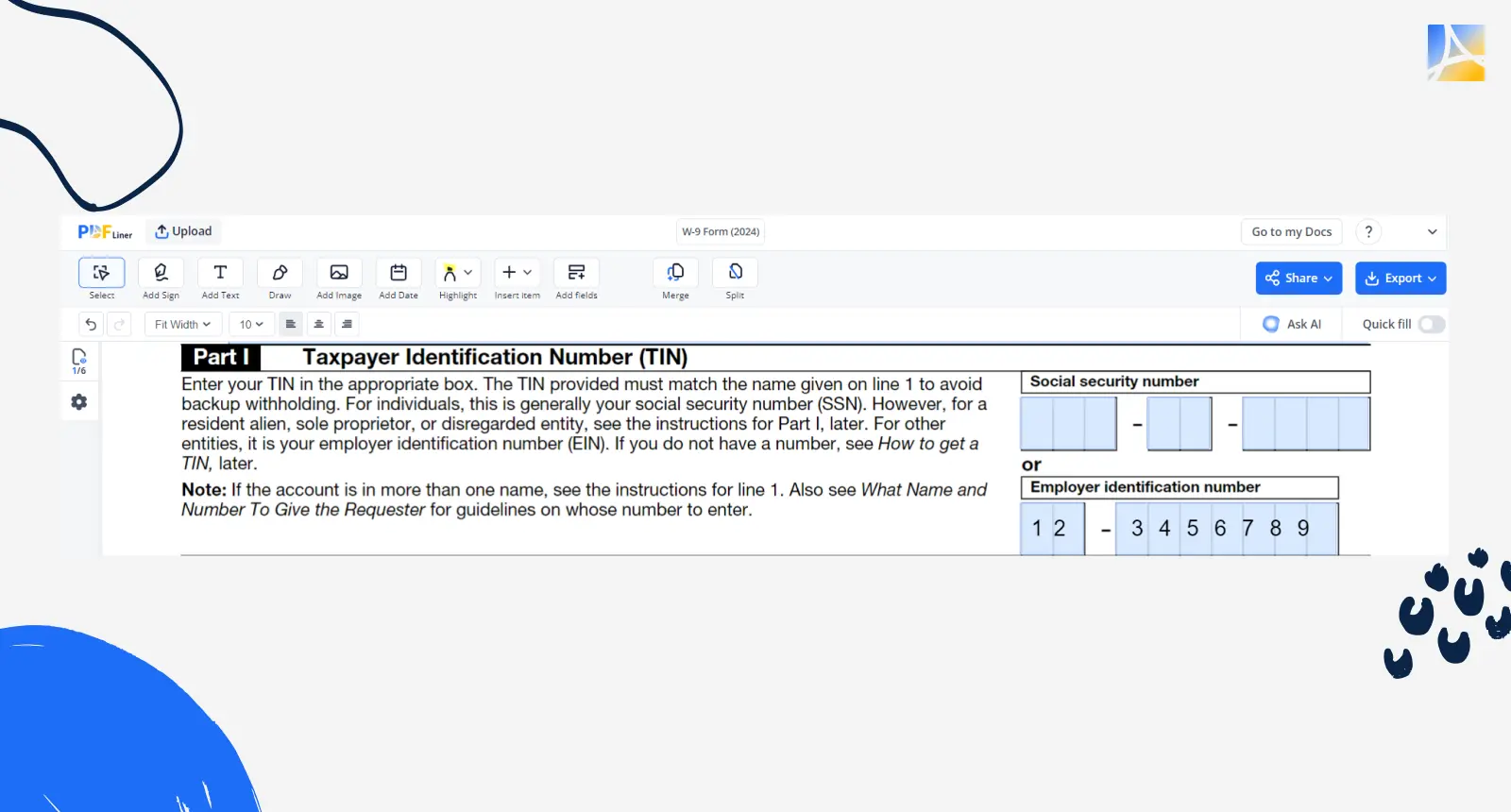

3. Indicate your taxpayer identification number

If you're a lone ranger or rocking the LLC life, your trusty SSN is your go-to. But if you've got a posse or are part of a bigger business crew, whip out that Employer Identification Number (EIN). Just make sure you use the right one for the name you put at the top of the form. Match your EIN with your business name and your SSN with your personal name.

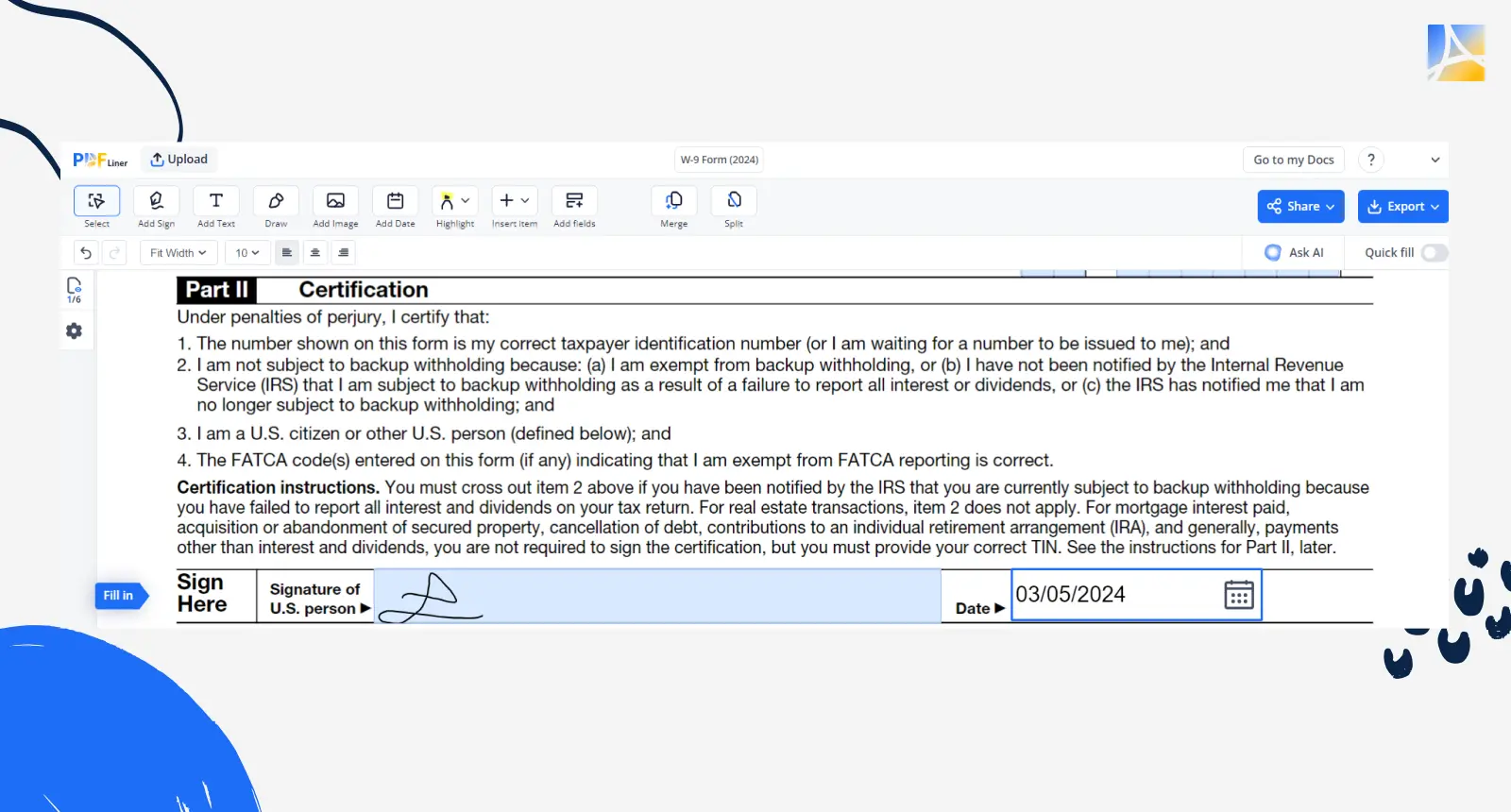

4. Seal it all with your signature

Your signature here says you're not dodging taxes but proudly flying the flag as a US citizen. It's your way of saying, “I'm legit.” Plus, it's your solemn vow that your name and taxpayer ID are spot on. Important: don't forget to date your signature to seal the deal.

5. Keep your copies

Last but not least, let's talk about something crucial: keeping track of your W-9 forms. For every client you work with, you need to fill out one of these forms. Depending on how many clients you have, you might end up with quite a few of these forms over the year. Why is this important? Well, if the IRS ever asks whether you've given your taxpayer information to the clients, you'll have proof with these forms. So, make sure to hold onto them in case you ever need to show them to the tax authorities.

Long story short, accurate completion of your W-9 equals smooth sailing with the IRS and keeping your financial ship afloat. So, whether you're a one-man team freelancer or part of a business pack, follow the steps we’ve provided above if you ultimately want to emerge victorious, armed with the knowledge to conquer tax season with ease.

Create W-9 65f013686d1834a70e07c82d

W-9 Examples for Contractors

For independent workers, the W-9 form is the very first step in handling taxes. Let's peek at two real-life scenarios:

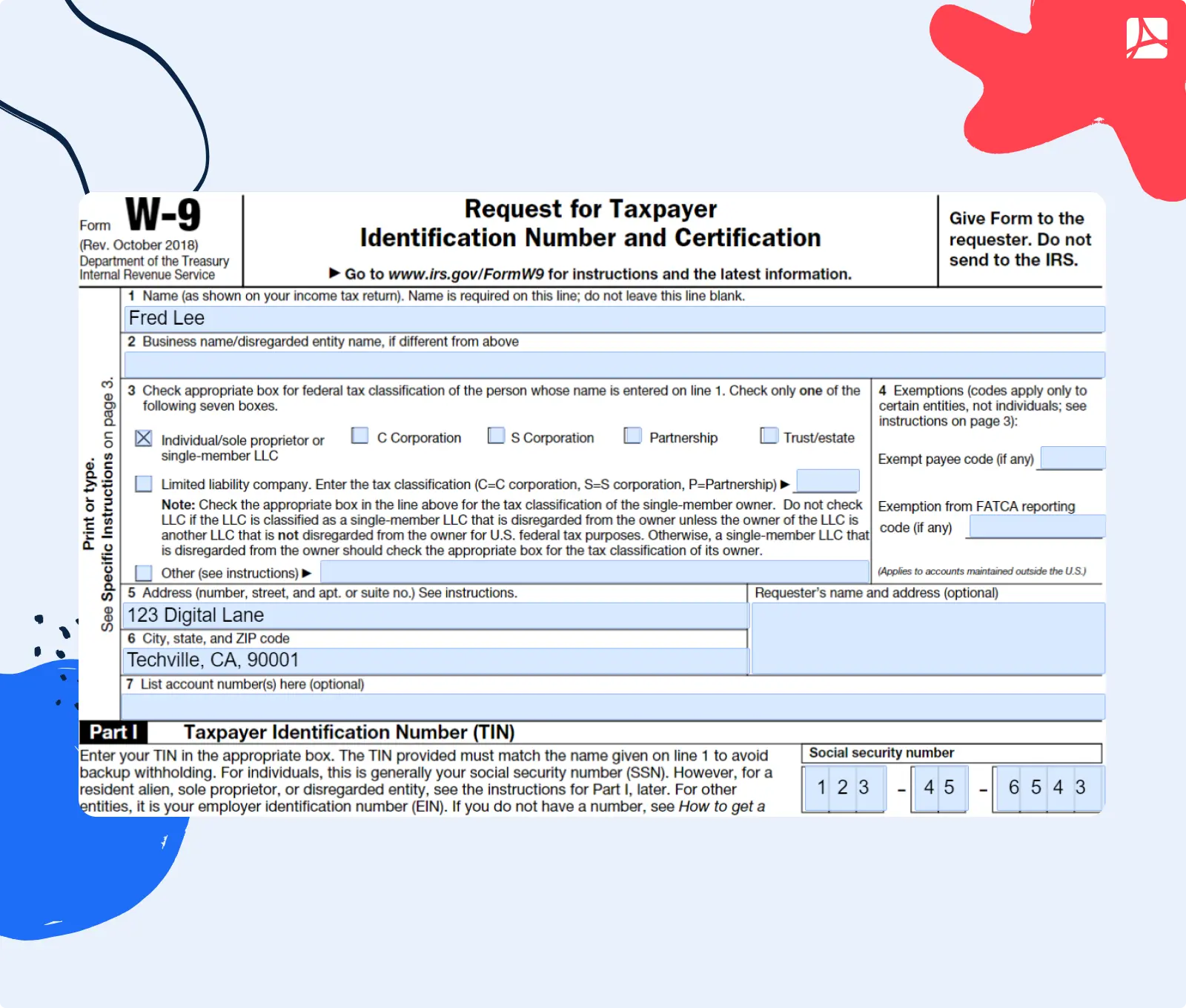

- Contractor Without Single Member LLC. Fred Lee, a graphic designer, fills out W-9s for his various gigs. Without an LLC, all the income is tied directly to him. He writes his name on line 1, chooses the first option, “Individual”, writes his home office address, and specifies the name of his client. Then he enters his SSN, signs and dates the form and sends it to the client by email.

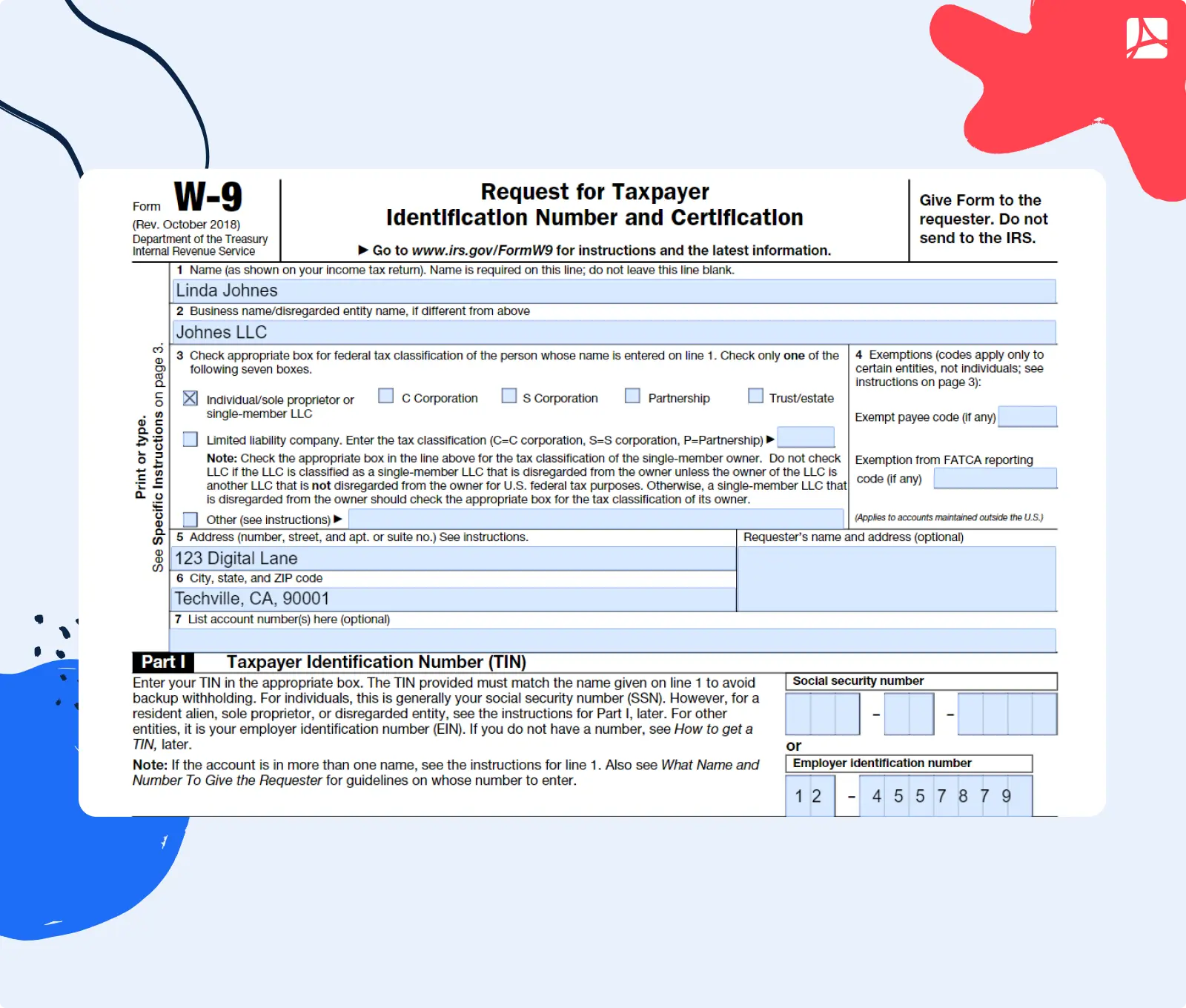

- Contractor With Single Member LLC. Linda Johnes, with her cleaning business under an LLC, finds W-9s less stressful. She writes her name, then her business name Johnes LLC, she also chooses the first option as a “Single-member LLC”. Linda writes her office address, then enters her EIN, sign and dates the form and saves the W-9 as a template.

That said, the W-9 form kicks off the tax life for freelancers. Take Fred: no LLC means that he would need to fill out a tax return as an individual only. But Linda, with her LLC, would also need to file the tax return for her LLC.

W-9 For Contractors 65f013686d1834a70e07c82d

Protecting Contractor’s Tax Info on W-9

According to the wise words of Benjamin Franklin, “An investment in knowledge pays the best interest.” With regard to safeguarding contractor's tax information on W-9 forms, Franklin's wisdom offers invaluable guidance. Below, we've provided some practical steps and expert tips to follow.

1. Protect PDF with a password

Just as we invest in securing our future, safeguard your W-9 form with a password for the sake of its confidentiality and integrity.

2. Share the W-9 view only to a specific email

Like sharing knowledge with select individuals, limit access to your W-9 by sharing it only with designated email addresses. This will minimize the risk of unauthorized access.

3. Keep records

Embracing Franklin's belief in the power of knowledge, maintain meticulous records of your tax documents. This will empower you with clarity and accountability in your financial endeavors.

4. Register a Single-Member LLC and use your EIN

Following Franklin's philosophy of prudent investments, consider establishing a single-member LLC and obtaining an EIN to protect your personal assets and enhance your financial security.

At the end of the day, by heeding Franklin's advice and investing in the protection of your tax information, you not only shield your financial well-being but also lay the groundwork for future prosperity.

FAQ

Do 1099 employees fill out W-9?

Yes, absolutely. 1099 employees, also known as independent contractors, indeed fill out W-9 forms. It's how they provide their taxpayer info to clients so that Uncle Sam knows what's what when tax time arrives.

What is the primary paperwork for independent contractors?

For independent contractors, the main paperwork stars are the W-9 form, 1099-NEC, and a bunch of Schedules C, SE, and 1. Each of these documents plays a vital role in the contractor's financial affairs and makes tax season easier.

Do W-2 employees need to fill out W-9?

The answer to this question is a definite “no.” W-2 form employees don't fill out W-9s. Those are for independent contractors. W-2 employees already have their tax info sorted with their employers. So, no need for them to dive into the W-9 paperwork.

Complete Tax Forms Online and Save Time

Fill out forms in a few minutes using PDFLiner and concentrate on your business

Get W-9 Form 65f013686d1834a70e07c82d