-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out 941 Form: A Filling and Filing Guide

.png)

Dmytro Serhiiev

The Employer’s Quarterly Federal Tax Return (short name IRS Form 941) is a federal tax form designed by the Internal Revenue Service of the USA to let employers report the amounts of taxes withheld for FICA taxes (Social Security and Medicare), estimated income tax payments, and employer payments. In this article, we provide a detailed guide on how to fill out the 941 form properly.

Fill Out 941 Form 65f86b5466fb65a8340566e5

What Is a 941 Form

To figure out how to file the 941 form IRS, you should first learn the right definition of the document. Form 941 is a quarterly report that lets you return the information on:

- the number of withholdings from your employee federal income taxes based on their Form W-4 copies;

- FICA tax figures for the employer portion;

- the size of withholdings based on Social Security and Medicare wages of the employees;

- tax credits for taking part in relief programs related to COVID-19 pandemic.

Note: If you hire a freelancer, they are not considered as your employees, but rather independent contractors. Therefore you don't need to file form 941 for them.

Employers must know how to file Form 941 to be able to report the correct amount of withholdings to the IRS every tax year. There’s no need to provide a copy of the form to the employees, but it has some extra use cases. You can also use a copy:

- to know the final amount of under- or overpayment by subtracting the amounts that are already paid;

- for accurate total payroll tax liability calculations;

- to adjust amounts due.

If you expect that your federal income tax and FICA tax will be below $ 1,000, you can try to report your tax return on the 944 Form. However, this option can be used only if the IRS permits you to do it. Call the service or send a written request to figure out.

Fillable 941 Form 65f86b5466fb65a8340566e5

How to Calculate 941 Tax

How to pay the 941 tax correctly? You have to calculate it first! In part I of the form, you have to state:

- how many employees wages, tips, etc. during the pay period;

- income tax from wages and other compensation.

Use lines 5a-5d to multiply the figures by correct indexes established for the current tax year. If there are no wages, tips, and other compensations, skip and go to line 6.

There are no calculation boxes for lines 6−15, so you have to use a spare sheet of paper and prepare all the related forms and reports for precise calculations. If you don’t want to learn how to complete Form 941 and calculations seem too difficult, you can request help from our tax experts or learn how to e-file 941 in paragraph four.

In Part II, you should check one of the boxes that match your situation. If you check Box 2, you should additionally provide the figures on your tax liability for the quarter and make sure that it’s equal to line 12 of Part I.

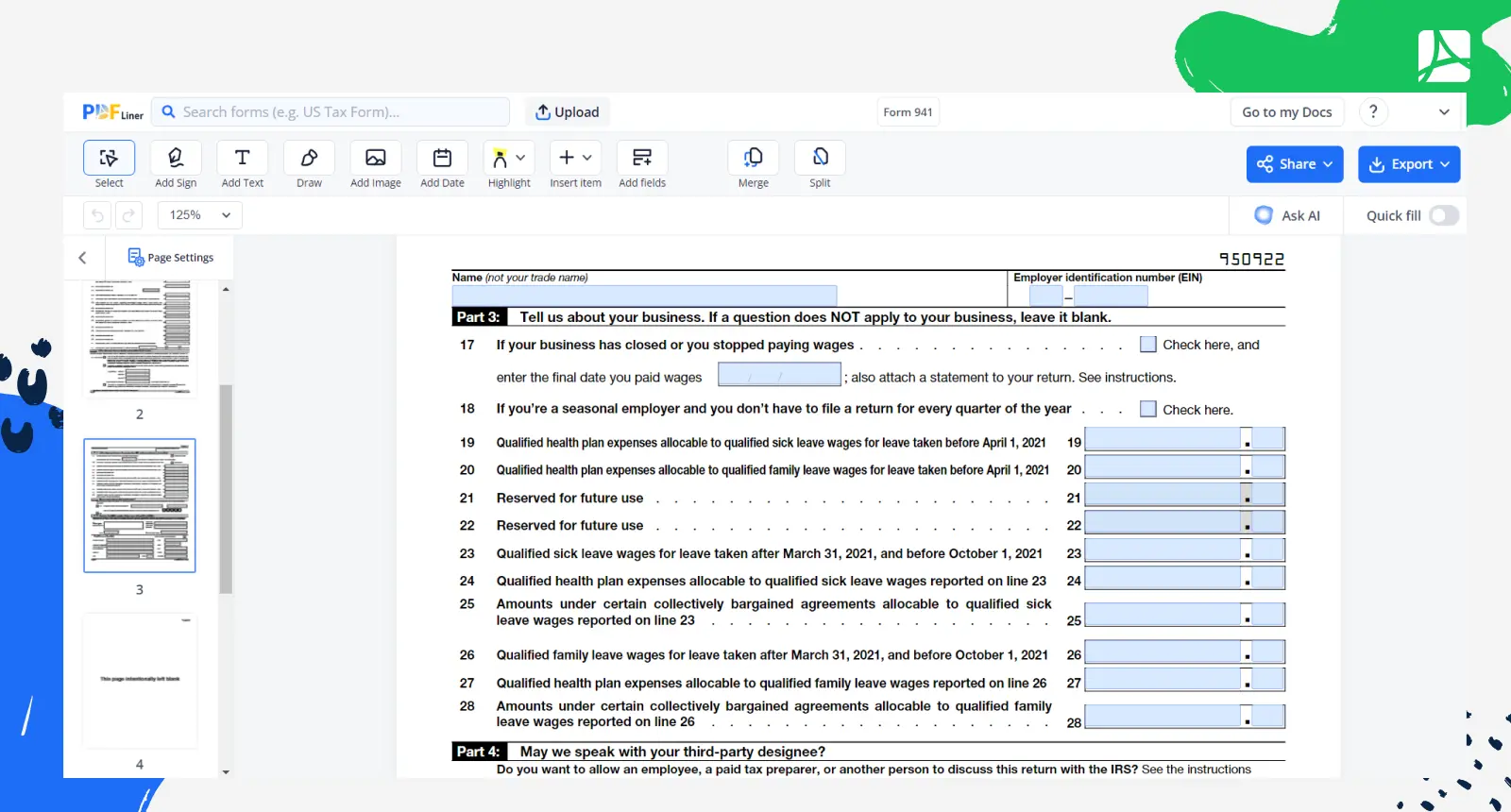

In Part III (lines 17−25), you have to provide figures only in those lines that apply to your business. Leave the lines that don’t apply blank. When the boxes are complete, verify the form by signing it correctly.

How to Fill Out 941 Form

First of all, you need to gather all the information required by the form. We recommend preparing in advance as you may discover unpredicted difficulties with getting certain information. Here is the list of what you need:

- Business address, and EIN (Employer Identification Number);

- The proof of the number of employees;Total wages paid through the reportable quarter;

- Taxable Medicare and Social Security wages for the same quarter;

- The total amount of withholdings from employee wages (income tax, Medicare, Social Security);

- Employment tax deposits that have been already made for the reported quarter.

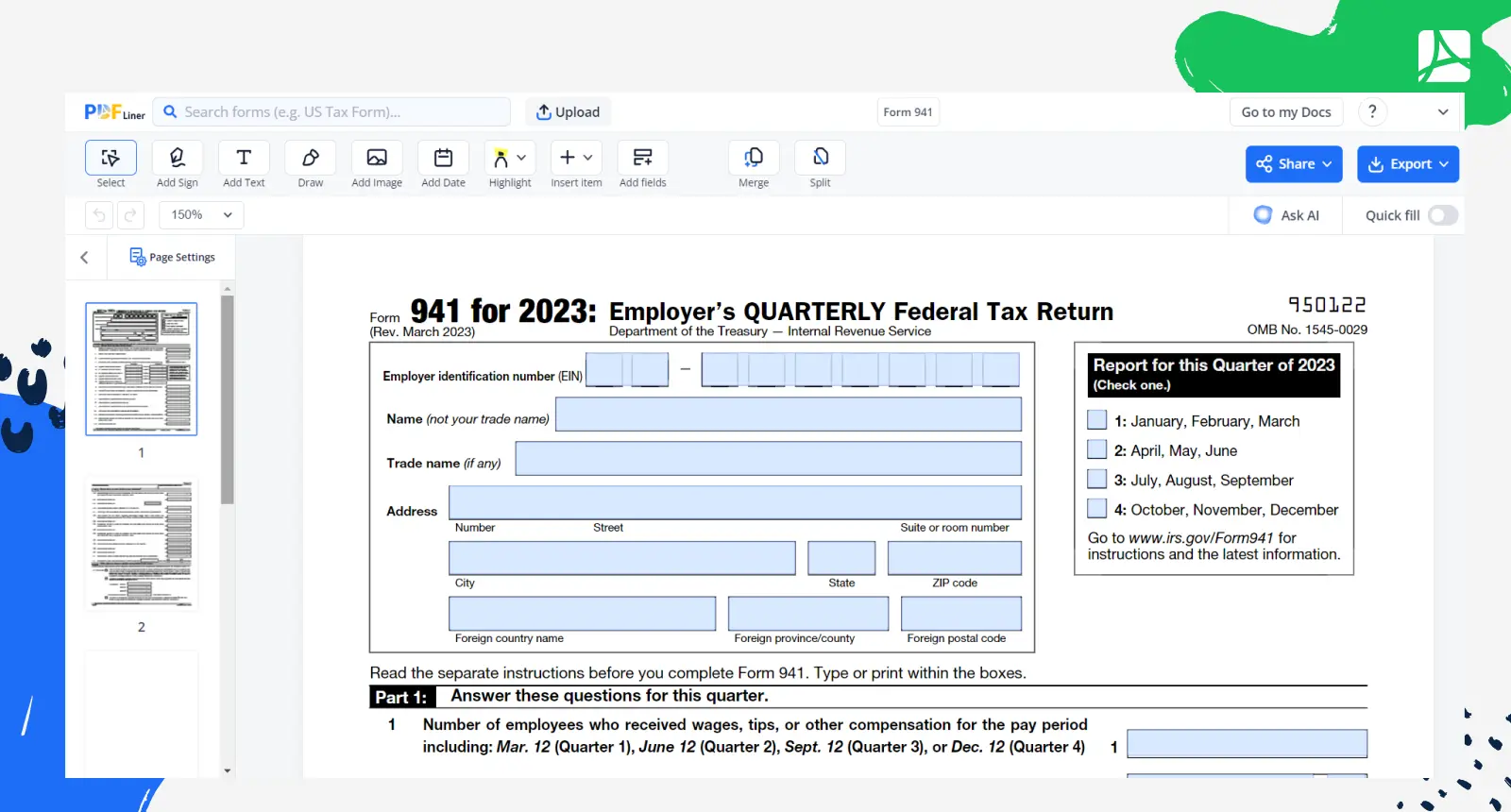

Here are the steps to fill out the 941 form:

1. Provide business information — business name, trade name, EIN, etc. The quarter you’re filing for goes here as well.

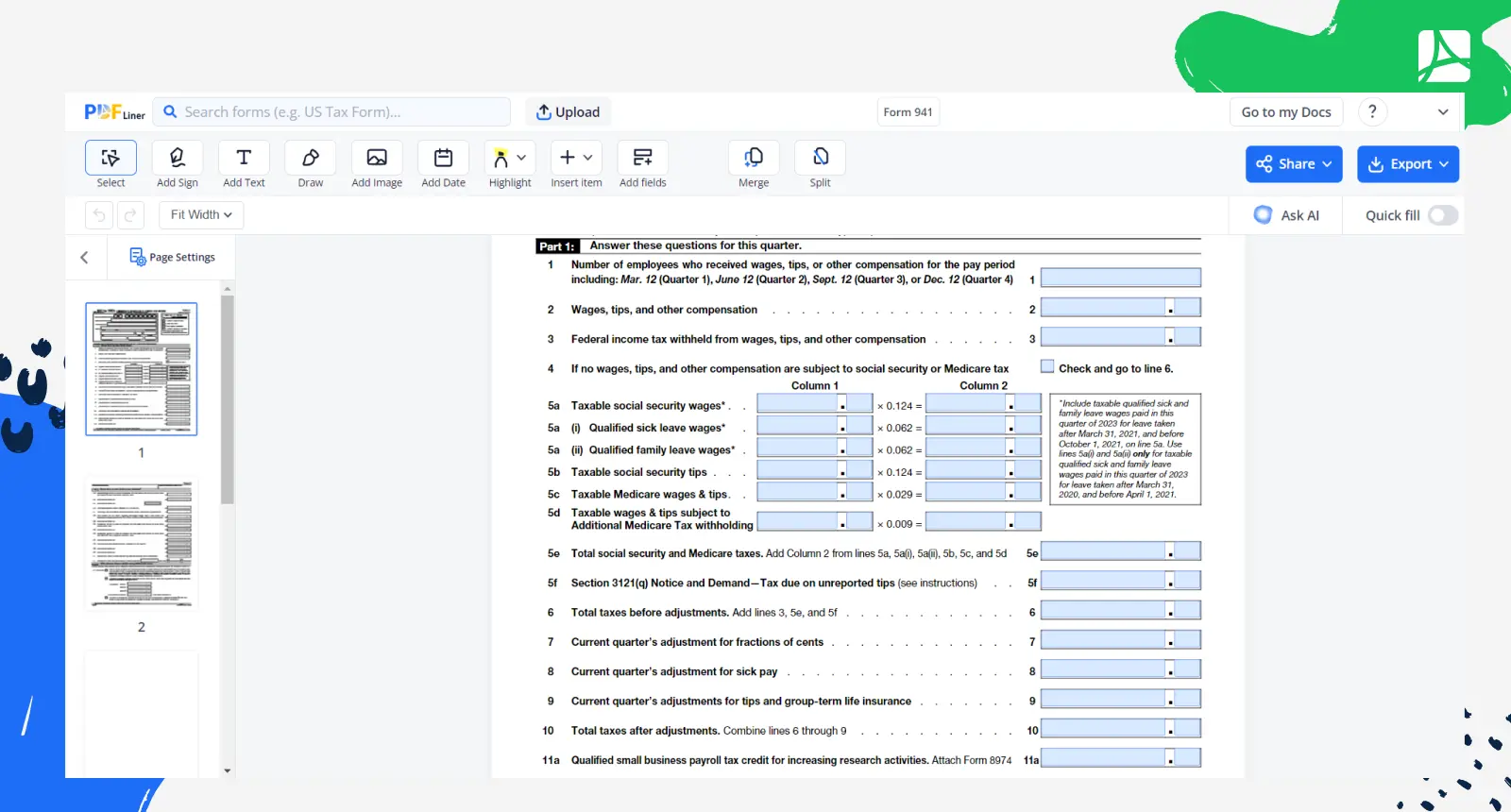

2. Part 1 (Lines 1−5d) — this is the part that requires the most focus from you as you have to make precise calculations in lines 5a-6. Lines 1−4 require the exact number of employees who received payments within the quarter, their total wages (tips or other compensations), income tax withheld, etc. You should also report if the wages, tips, or compensations your business paid are not subject to Medicare or/and Social Security taxes.

Fill lines 7−9 if you have any reportable adjustments. After that, you have to fill line 10 by combining lines 6−9 to figure out your total taxes after adjustments. Line 11 requires you to claim the payroll tax credit and attach Form 8974 if your business has it. If you can claim the credit, you have to subtract it from line 10 to calculate the final total tax after adjustments.

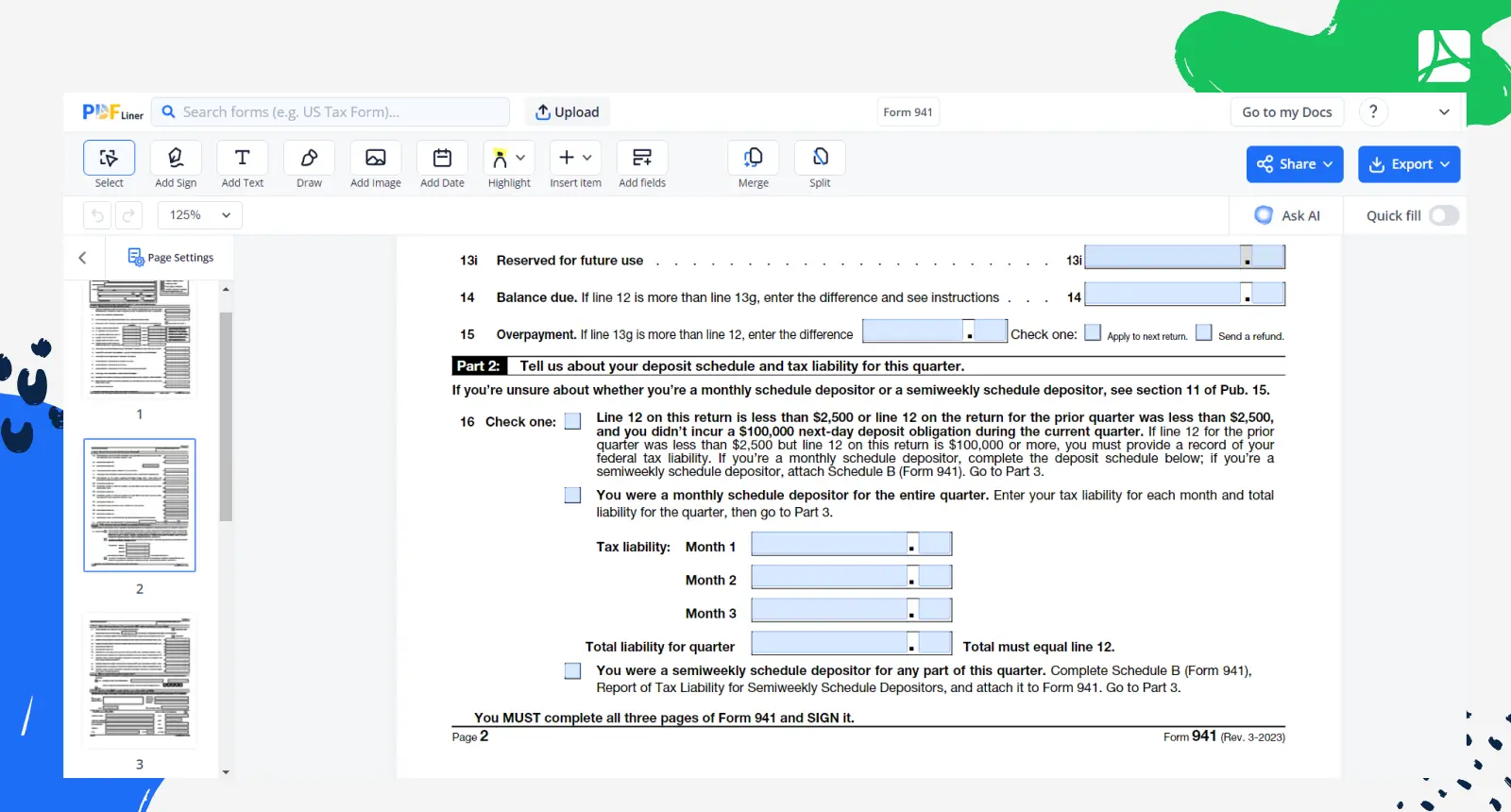

If you made any deposits for the quarter, subtract them in line 13. If the result reveals that your liability is higher than the amount of deposit for the quarter, you will have a balance due indicated in line 14. In the opposite situation, calculate the overpayment in line 15.

3. Part 2 — choose the section that applies to your business. Report your monthly tax liability if you choose the second option.

4. Part 3 — select line 17 if your business has closed. If you’re a seasonal employer, choose line 18.

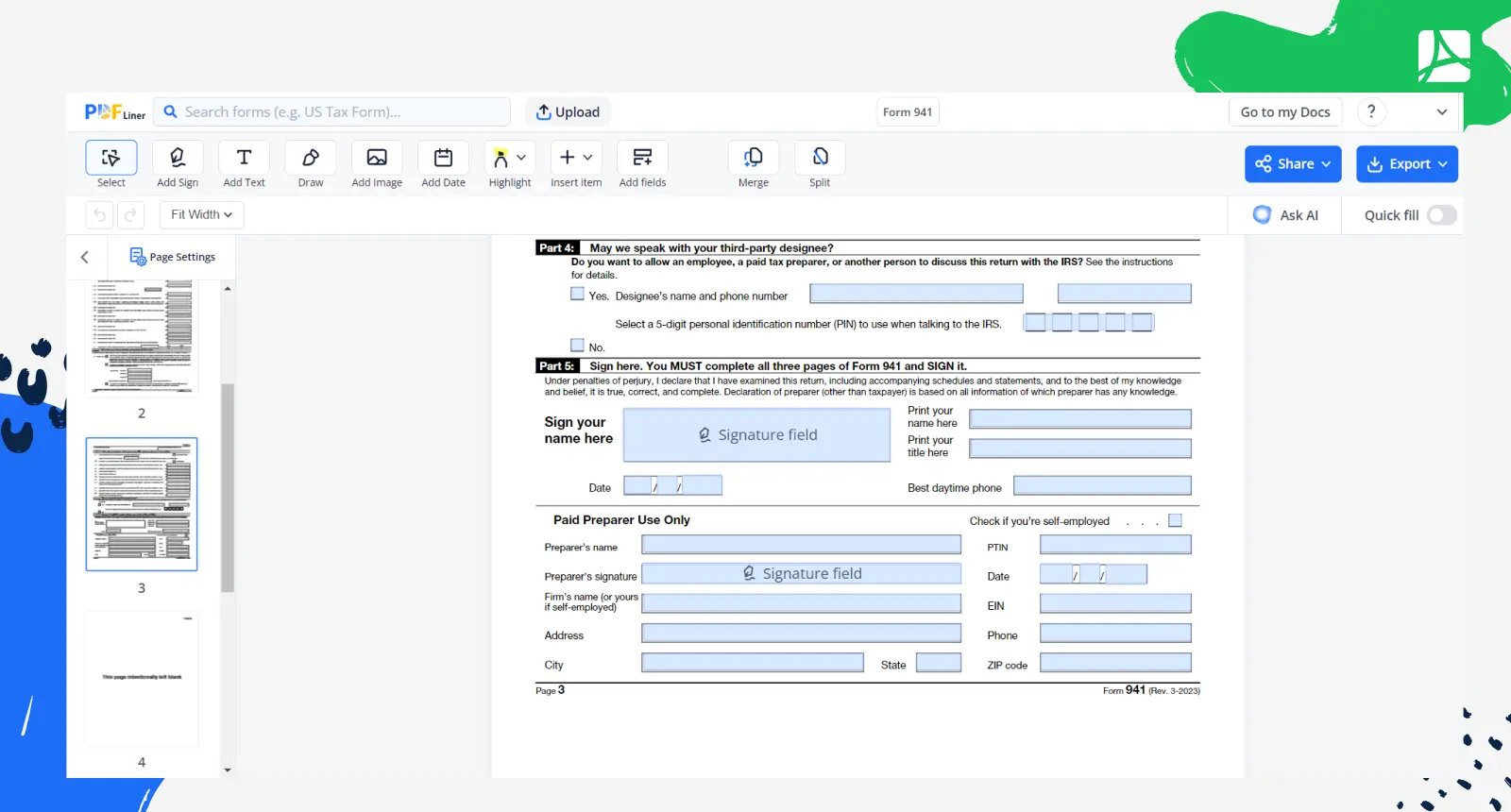

5. Part 4 — provide a designee if needed.

6. Part 5 — before signing the form in this part, make sure to review the entire document for any mistakes.

Fill Out 941 Form 65f86b5466fb65a8340566e5

How & Where to File 941 Online

Now that you know how to fill out the 941 form with correct numbers, you may be interested in returning the form to the IRS in time and as fast as possible. In this paragraph, we will teach you how to file the 941 online.

First of all, you have to remember Form 941 Schedules. Unlike the majority of other tax forms, this IRS form has to be filed by the last day of the last month of the quarter. For instance, April 30 is the end day for reporting wages paid from January to March. This rule applies to each quarter of the financial year. These due dates also work if you are filing your 941 Form online.

To mail the form, use our platform to complete 941 online and print it to mail directly to the IRS. See the mailing address here. You can also save the form with a PDF and efile it with your favorite tax software.

Now you know how to file form 941 electronically and by mail. Hope these 941 instructions for filling out and completing the form were helpful for you.

FAQ

In this section, we gathered answers to some of the most frequently asked questions received from our readers and customers. Read the answers attentively to know more on how to fill out the 941 tax form.

How to get copies of filed 941 forms?

If you fill the form online, you should print a copy and save it in your archive. In addition, you can also keep an electronic version of the form on your computer and corporate cloud server to be able to restore it in case of an emergency.

How to e-file form 941?

You can file form 941 electronically by filling it out on our website or any other online or offline tax software. Using our platform, you can send the form directly to the IRS. You can also save it onto your computer and send it via email, bypassing third-party websites.

How to amend form 941?

If you need to make corrections to any quarter, you have to file an additional Form 941-X (Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund). It includes boxes for each figure and a separate part on which you have to explain your corrections for the reported quarter. The explanation must be as detailed and logical as possible.

How to amend a 941 on time?

The best way is to file it before the end of the quarter.

How to pay 941 taxes online?

You can use the Electronic Federal Tax Payment System to make your payments online. There’s also an option to make direct electronic payments right on the IRS website.

How to print the 941 in Quickbooks?

You have to follow these simple steps:

- Go to "Employees";

- Find Quarterly Form 941;

- Press the small arrow button to choose year or quarter and check the quarter ending date;

- Click OK, then click "Open Draft";

- Click "Print your Records".

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out Form 941 65f86b5466fb65a8340566e5