-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Filing Taxes as a Freelancer: Complete Guide

Being your own boss is exciting, but it comes with extra responsibilities like managing taxes for freelancers. This article reveals how to file taxes as a freelancer, offering a thorough exploration of prevalent forms. Learn step-by-step guidelines for buttery-smooth payment and filing of freelancer taxes. Explore valuable insights into efficient document management strategies tailored to the self-employed lifestyle. Read on to speed up your administrative processes.

List of Tax Forms for Freelancers

Using specific tax forms is crucial for freelancers. These forms align with specific income sources and deductions, ensuring accurate reporting. Proper completion minimizes errors, avoiding penalties and potential audits.

Below, we’ve provided a list of some of the most widely used forms in the context of self-employment income:

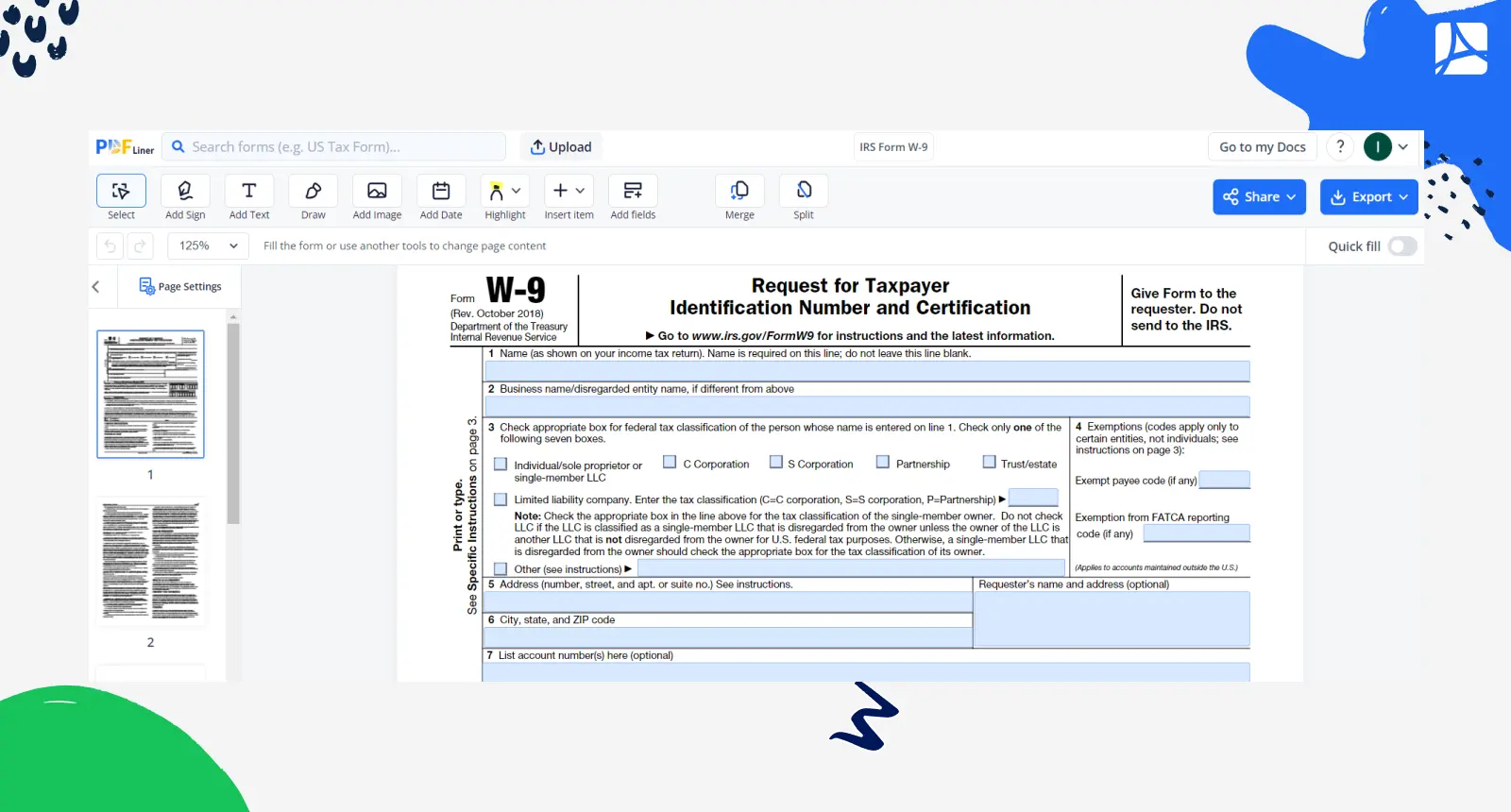

Form W-9

This document serves as a request for the freelancer's taxpayer identification number, essential for accurate reporting of payments made by clients. Its simplicity and directness make it a favored choice, aiding both freelancers and clients in maintaining compliance with IRS regulations while facilitating transparent financial transactions. Learn how to fill out a W-9 Form in just a few steps in our complete guide.

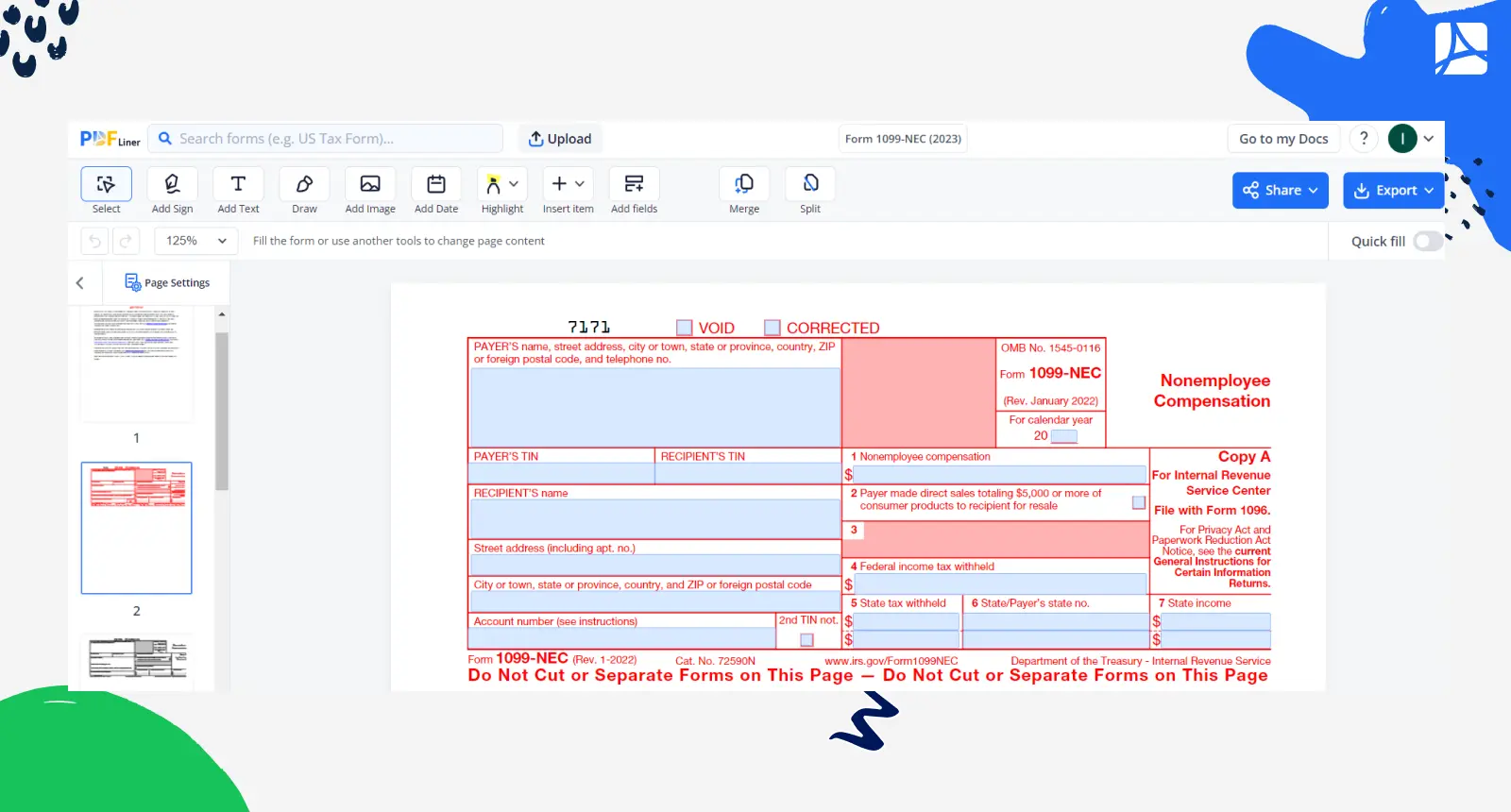

1099-NEC Form

Freelancers opt for this form as a pivotal tool in income reporting. This doc details non-employee compensation received throughout the year, which is essential for filing income tax for freelancer workers. Its distinct focus on freelance income streamlines procedures, ensuring compliance with IRS regulations. Freelancers benefit from its specific categorization, simplifying the process of reporting income and substantiating financial records. Filling out 1099-NEC is easy if you’ll follow our instructions.

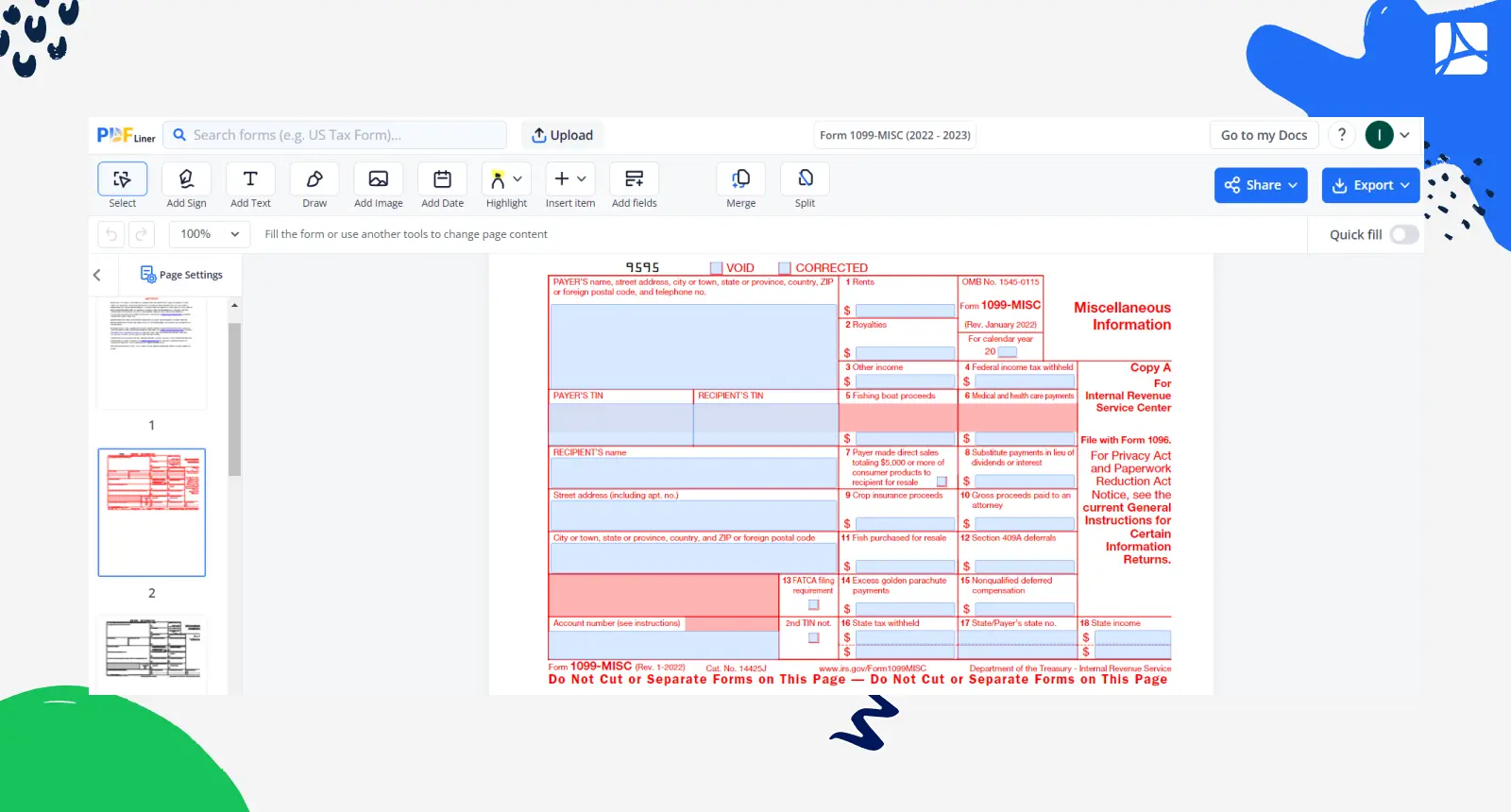

1099-MISC Form

Self-employed individuals find this form invaluable for its versatile reporting capabilities. The doc encompasses various types of income beyond non-employee compensation, including rent, royalties, and more. Freelancers utilize 1099MISC to encompass diverse income sources, ensuring comprehensive income reporting while adhering to regulatory obligations for accurate and transparent financial documentation.

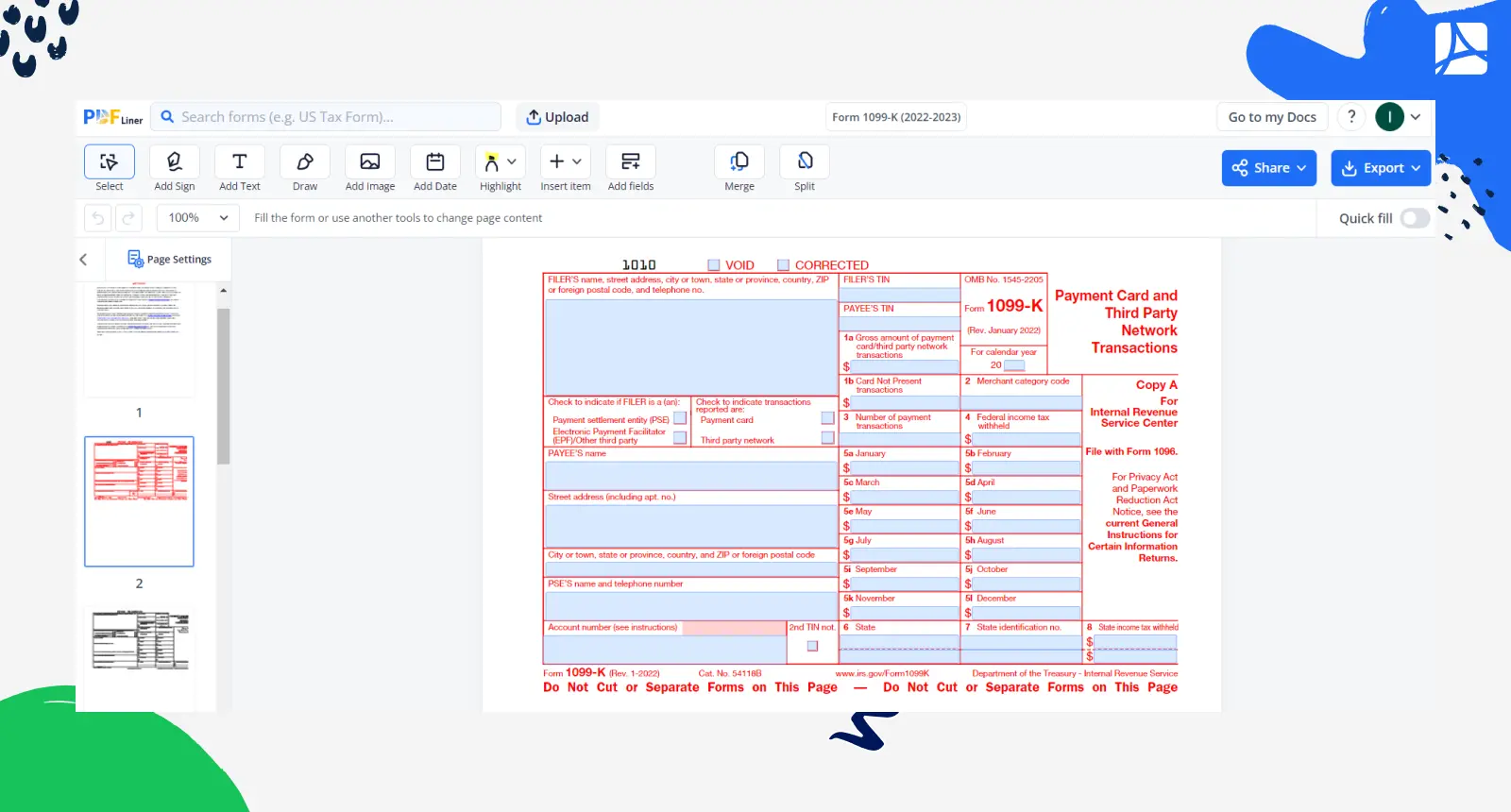

1099-K Form

This form serves as a vital instrument for freelancers, capturing income from digital payments. Independent workers embrace it to account for earnings from platforms like PayPal or credit card transactions, offering a consolidated view of their digital income. 1099K utilization ensures meticulous tracking and accurate income reporting in the modern landscape of freelance earnings.

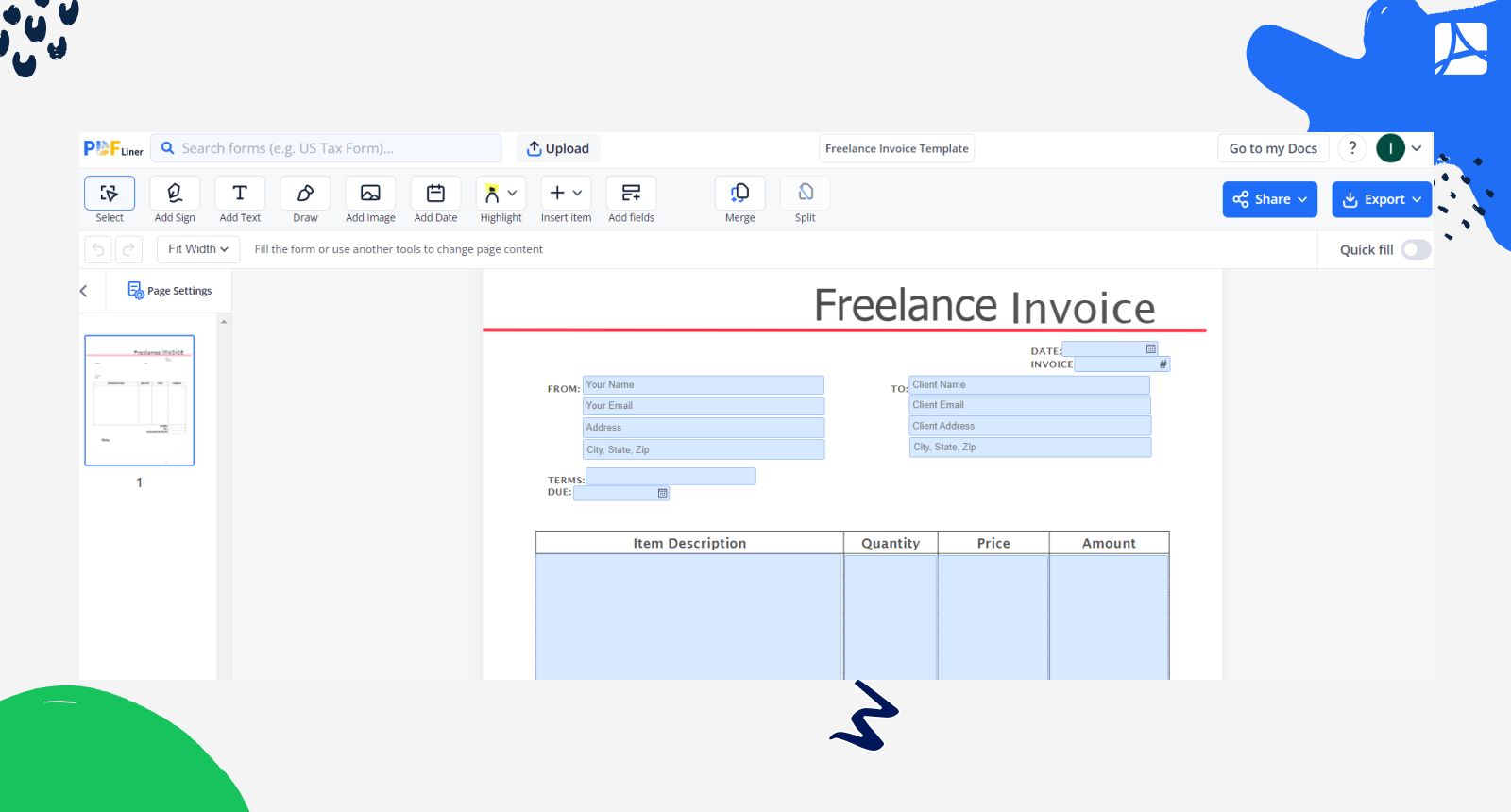

Freelance Invoice

Freelancers rely on invoice templates as indispensable tools to take their financial interactions to the next level. These files come with a pre-drafted format for billing clients, ensuring clarity in payment terms and services rendered. Their utilization speeds up the invoicing process, fosters professionalism, and aids in prompt payments, ultimately contributing to efficient financial management.

IRS Form 1040-ES

.webp)

This form is significant for independent professionals as a mechanism for estimated tax payments. They use it to proactively fulfill their obligations by projecting and submitting quarterly tax payments. This form aids in managing tax liability throughout the year, preventing underpayment penalties and ensuring smoother year-end tax filing, aligning with the irregular income patterns of freelancing.

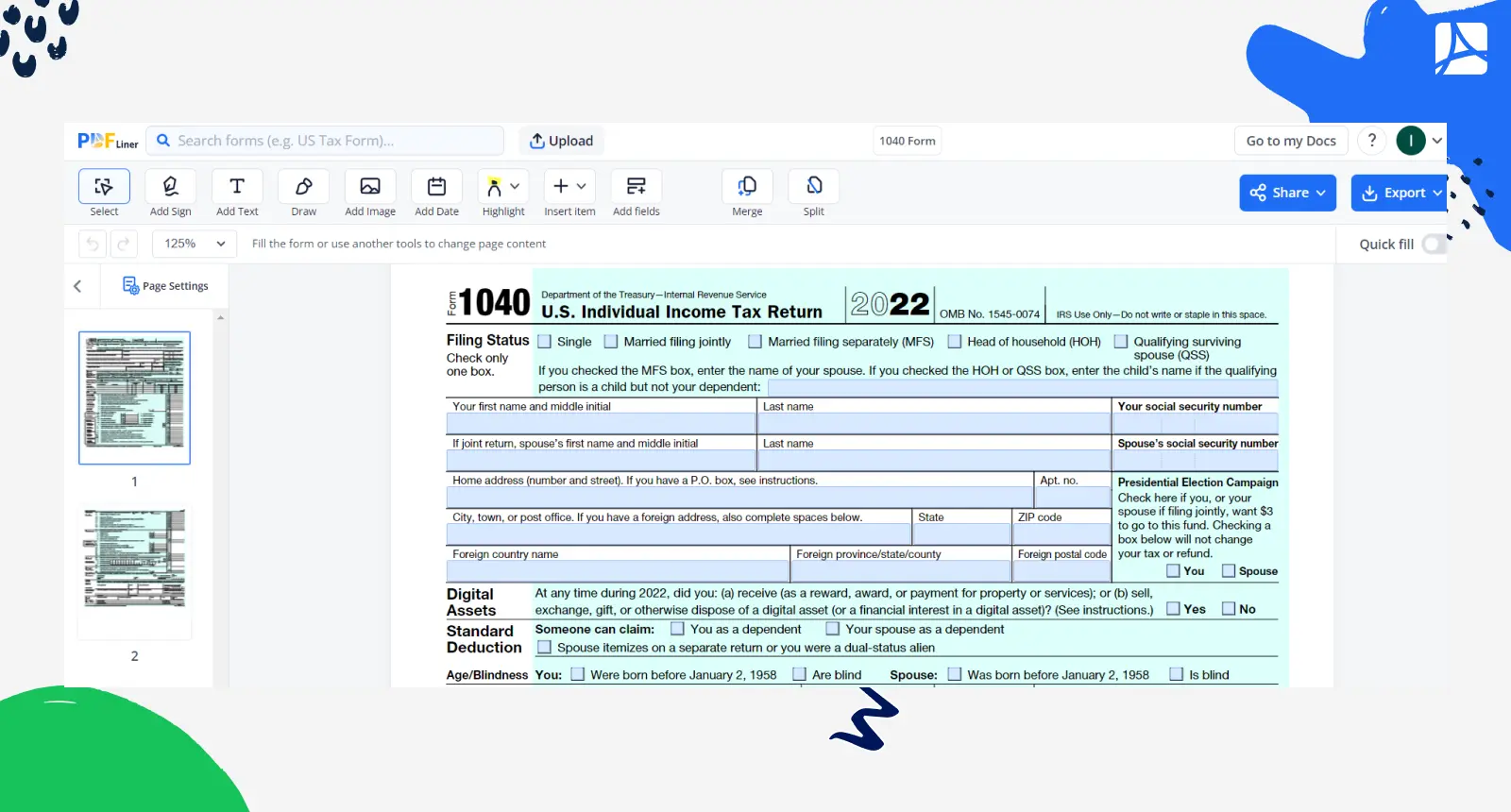

Form 1040

This form is used as the linchpin of annual income reporting. It accommodates various income sources, deductions, and credits, enabling freelancers to comprehensively present their financial status. Its flexibility caters to the intricate financial landscape of freelancing, ensuring accurate reporting and optimal utilization of available deductions. Learn how to fill out 1040 Form and complete your tax return at no time.

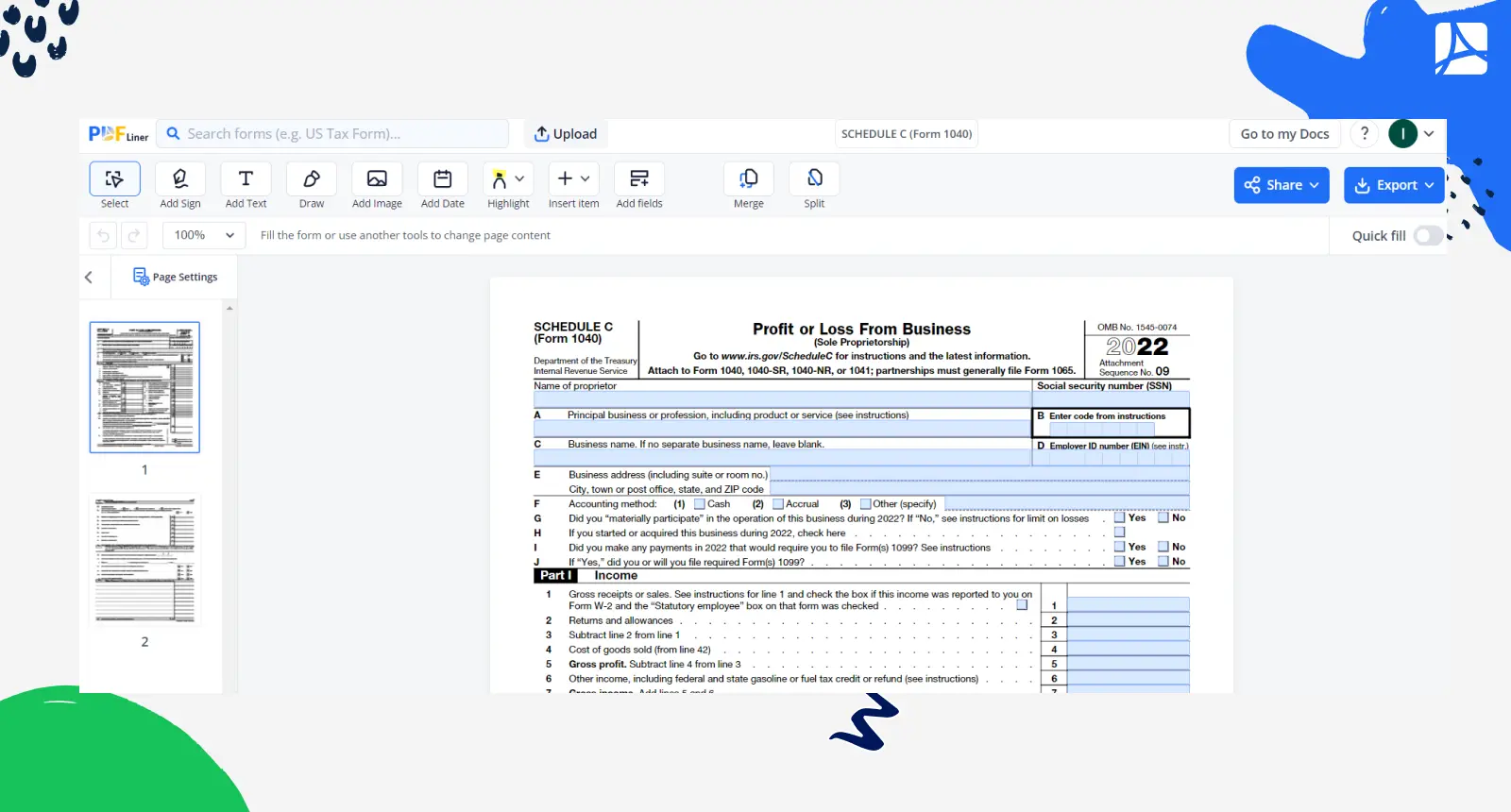

Schedule C (Form 1040)

Freelancers use Schedule C (Form 1040) for detailing business profit and loss. This doc is instrumental in categorizing expenses, deductions, and income, tailored to the nuances of freelancing. Its usage empowers self-employed individuals to accurately showcase their financial standing, optimize deductions, and ensure compliance with IRS regulations. Filling out IRS Schedule C process can be a bit confusing, so it’s better to use guides to complete it.

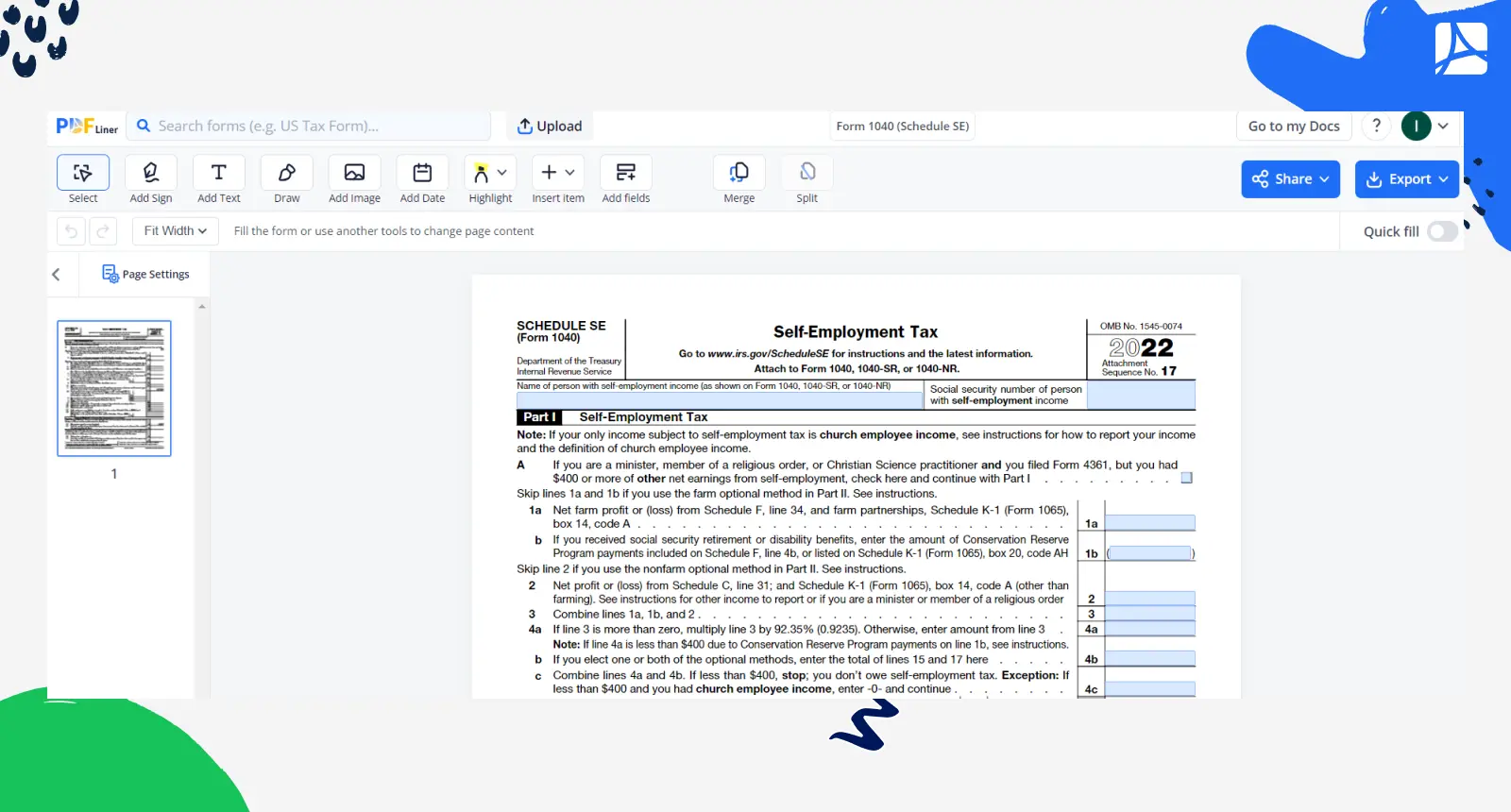

Schedule SE (Form 1040)

Freelancers utilize Schedule SE (Form 1040) to compute their self-employment tax liability. This doc factors in net earnings from freelancing to determine Social Security and Medicare taxes. By using the form, independent workers ensure accurate calculation and reporting of their tax obligation, enabling them to fulfill their financial responsibilities while benefiting from the social safety net.

How to Pay and File Taxes as a Freelancer

Learn how freelancer pay tax by following these 8 vital steps and tips from our experts:

Step 1. Know Your Freelancer Tax Obligations

Begin by grasping your responsibilities as a freelancer. Recognize that as a registered independent contractor you're accountable for the 15.3% self-employment tax, covering Social Security and Medicare contributions. Moreover, due to the absence of employer withholding, you must make quarterly tax payments to preempt underpayment penalties. Classify your work type and earnings sources to determine accurate forms and anticipate obligations.

Step 2. Organize Your Income

Create a comprehensive system to track and document all earnings. Utilize digital tools or spreadsheets to categorize different income sources, client payments, and project fees. This thorough organization ensures you report your earnings accurately when filing taxes. Keep records of invoices, receipts, and electronic payments, to make the process of calculating your tax liability maximum effective.

Step 3. Estimate and Pay Quarterly Taxes

Quarterly tax payments are essential for freelancers to avoid end-of-year shocks. Calculate your estimated tax liability by considering your projected annual income, deductions, and credits. Divide this into quarterly installments and meet the payment deadlines to prevent underpayment penalties. By consistently paying estimated taxes, you maintain a steady contribution to your annual obligation.

Step 4. Identify Your Freelance Deductions

Efficiently leveraging deductions can substantially lower your taxable income. Consider the following deductions tailored for freelancers:

- home office expenses;

- business-related equipment and supplies;

- professional fees and subscriptions;

- travel and transportation costs;

- health insurance premiums;

- marketing and advertising expenses.

Digital nomads may also apply for housing deductions and Foreign Earned Income Exclusion before filing their tax returns.

Step 5. Prepare Tax Forms

Accurate completion of required forms is crucial. Depending on your freelance income sources and deductions, gather the relevant forms such as 1099s, Schedule C, and Schedule SE. Ensure precise documentation of your earnings, expenses, and deductions. Online tax preparation software or professional assistance can simplify this process, helping you complete forms correctly and maximizing your benefits while ensuring compliance with official guidelines.

Step 6. Complete Form 1040

Form 1040 serves as the cornerstone of your annual tax filing. Incorporate information from your freelance income, deductions, and credits into this comprehensive form. Attach Schedule C and SE to report your business profits and self-employment tax. Accuracy is paramount, as errors can lead to penalties. Double-check your entries, review calculations, and consider electronic filing for a smoother submission process.

Step 7. File Tax Return as a Freelancer

Ensure all forms, schedules, and necessary documentation are accurately compiled. Choose between e-filing or traditional paper filing, both coming with their benefits. Review your return for completeness and accuracy, sign where required, and keep copies for your records. Timely submission upholds compliance and reflects your commitment to fulfilling your freelance tax obligations.

Document Management for Freelancers

Utilizing document management services like PDFLiner offers freelancers a treasure trove of advantages for efficiently managing their files. This digital platform simplifies the entire process, enhancing organization, accessibility, and security. Here are the main perks to make the most of:

- Extensive Catalog of Free Templates. PDFLiner offers a diverse range of niche-specific document templates, ensuring freelancers have access to tailored solutions for their needs. These readily available templates streamline the process of creating tax-related documents, saving time and effort while maintaining accuracy and compliance.

- Convenient Storage Dashboard. PDFLiner provides its users with an easy-to-use dashboard for storing and organizing their documents. This centralized hub simplifies document management, enabling quick uploads, categorization, and retrieval. Freelancers can effortlessly access and manage their files in one place, enhancing efficiency and organization during tax season.

- Tagging for Sorting Convenience. PDFLiner offers users the ability to tag their documents with relevant keywords or categories. This feature facilitates easy sorting and quick retrieval, enabling freelancers to swiftly find specific files when needed. Organizing documents through tagging enhances efficiency and supports a seamless tax preparation process.

- Document Sharing and Signature Sending. With PDFLiner, freelancers can effortlessly share their documents and send them for e-signatures. This feature speeds up collaborations with clients or professionals, eliminating the need for physical paperwork and accelerating the approval process. It's a convenient and time-saving solution for remote and efficient tax-related interactions.

- Top-Notch Online Editor for Customization. The platform boasts a quality online editor that empowers self-employed individuals to customize and craft documents from the ground up. This feature is particularly advantageous for tailoring tax-related forms to specific needs, ensuring precision and adherence while allowing freelancers to create documents that perfectly resonate with their unique circumstances.

- Enhanced Security. Digital document management possibilities provided by PDFLiner guarantee that your files are protected from physical damage, loss, or theft. Encrypted storage and secure user authentication help safeguard sensitive financial information.

- Instant On-the-Go Access. PDFLiner grants freelancers the ability to instantly access their files from any device and location. This convenience is vital for independent professionals who are always on the move, ensuring they can seamlessly retrieve, review, and manage their documents even when they are away from their primary workspace.

FAQ

Do I need to pay taxes quarterly?

Yes, as a freelancer, you typically need to pay taxes quarterly. This helps you meet your obligations throughout the year and avoid underpayment penalties. Estimated tax payments are required if you expect to owe $1,000 or more in taxes when filing your annual return.

How much do freelancers pay in taxes?

Freelancers' tax payments vary based on factors like income, deductions, and location. They're subject to self-employment tax of 15.3%, which covers Social Security and Medicare contributions. Additionally, federal and state income taxes apply. Utilizing deductions and credits helps lower the final liability, making the actual amount paid dependent on individual circumstances.

How much should you save for taxes as a freelancer?

Freelancers should save around 25-30% of their income for taxes. This buffer accounts for self-employment tax, federal and state income taxes, and potential deductions. Regularly setting aside a portion of earnings ensures they're well-prepared to meet their obligations without financial strain when the not-so-anticipated season arrives.

How do I keep track of freelance income?

Make use of a top-level record-keeping system. Utilize tools like spreadsheets or accounting software to log all earnings, invoices, and payments. Categorize income sources for easy tracking and organization, ensuring accurate financial documentation when filing taxes.

Filing Taxes as a Freelancer is Easy with PDFLiner

Find all the needed documents and fillable IRS forms in one place

.png)