-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

2024 Investor’s Handbook: Short-Term vs. Long-Term Capital Gain

.png)

Dmytro Serhiiev

When you sell an investment, the government is always there to collect its share of the profit through capital gains tax. How much you must fork out after selling your stocks, real estate, or collectibles depends on a few factors, which we will explore in detail in this post.

Calculate Capital Gains 65a18a00a2a2de1f26089ce5

Key Points

- Capital gains tax depends on such factors as regular income tax rate and holding period.

- Short-term gains (<1 year) face regular income rates; long-term gains (>1 year) benefit from lower rates.

- Recent short-term rates: 10–37%; long-term rates: 0–20%, favoring lower income brackets.

- Tips to reduce capital gains tax include using various investment accounts for different investment types, favoring long-term investments over short-term ones, tax-loss harvesting, and donating assets to charity.

- Crucial forms for accurate and timely capital gain reporting include 1099-DIV, Qualified Dividends and Capital Gain Tax Worksheet, Form 8949, Schedule D Form 1040, and Form 1040.

What Is a Short-Term Capital Gain?

According to the Internal Revenue Service (IRS), capital gains are the taxpayer’s additional form of income and should be reported and taxed as such. However, there is a notable difference between long and short-term capital gains:

- A short-term capital gain is something of a quick win that occurs when you've held your asset only for a year or less and now sell it to make a profit. Commending your commercial spirit, the IRS bites off a chunk of the profits equal to or even slightly bigger than what you usually pay in taxes on your regular income.

- There are no fixed short-term capital gains tax brackets. How much short-term capital gains tax you pay depends on which tax bracket your regular income puts you in. According to the US progressive tax system, higher-income individuals pay higher tax rates. So, if you fall into the 12% tax bracket with your regular income, you pay a 12% tax on your short-term capital gains. But here is a catch: if these gains push your total income into a higher tax bracket, you will get taxed at a higher rate on those gains.

What Is a Long-Term Capital Gain?

The long-term capital gain is a patient investor’s playground. Unlike the fast-paced race nature of short-term capital gains, this one is more like a marathon. As is evident from the name, capital gains long-term occur when you have owned your asset for over a year before selling it. The IRS is much more flexible with individuals disposing of their long-term investments and is willing to cut them a little slack in the form of lower taxes.

Holding on to your assets for an extended period (longer than one year) before cashing them in offers you unique tax benefits. Their future uniqueness depends on a few crucial factors, including your income level, which tax bracket you fall in for that long-term gain, and the overall time you possessed the asset before selling it.

The IRS will also tax you differently depending on what you sell – whether it is your principal home or a collectible painting – you might be required to pay less or more tax on your capital gain profits. Factors such as your marital status can also play in here, making the whole thing more or less favorable for you.

Short-Term Capital Gains Tax Rate vs. Long-Term

The US capital gains tax landscape isn’t what you’d call navigation-friendly, with many nuances and reservations to watch out for. Comparing short-term or long-term capital gains and outlining their key differences can help you a bit. However, to make this journey bump-free, you must dive deeper into the specific numbers and prognoses for capital gain rates in 2024.

Short-term capital gain tax rates 2024

For the impatient ones wanting more action on their investments, the short-term capital gains rates for 2024 will break down as follows:

Singles

- If you earn up to $11,000, you are with the 10% lot; the $11,001–$44,725 earners will dish out 11%, and those hitting the $44,725 mark will have their rate bump up to 12%.

- If your income is above $44,726 and up to $95,375, you are in for the 22% tax rate.

- Taxpayers surpassing the $95,376 threshold and going all the way up to $182,100 will have a 24% tax rate, which will turn into 32% once they move to the $182,101– $231,250 group.

- Singles making between $231,256 and $578,125 will pay 35%, while anything over $578,125 calls for 37%.

Head of household

- Anything below $59,850 falls into the 10–12% tax rate category.

- Those making between $59,851 and $182,100 will have to give the taxman a cut of 22–24% of their profits.

- Heads of households bringing in between $182,101 and $578,100 will have to part with 32–35% of that money.

- Finally, with an income of over $578,100, the tax is 37%.

Married filing jointly

- Married couples filing together will give away 10–22% of their profits if their income is between $22,000 and $190,750.

- A jump to 364,200 will have you paying 24%, and a further increase in your income of up to $462,500 means you will get taxed at the 32% rate.

- Those pushing it past $462,501 and over $693,750 will get the hardest hit with a 35–37% tax rate.

Married filing separately

If you are married but filing solo, the numbers are similar to what you’ll pay as a single, with the only exception being that your 35% and 37% thresholds start lower – at $231,251 and over $346,875, respectively.

Long-term capital gain tax rates 2024

Fortunately, things are less confusing for long-term capital gain taxpayers in 2024:

Singles

It is set at 0% for those earning less than $47,025. 15% relates to anything below $518,900, and 20% for anything above.

Head of household

Heads of households pay 0% for up to $63,000. Then, it is 15% of their income of up to $551,350 and 20% for everything else.

Married filing jointly

Married but filing together will have a 0% tax rate if their income is up to $94,050. However, they will have to dish out 15% and 20% if it is up to $583,750 or over that mark, respectively.

Married filing separately

Separate filers will owe nothing if their taxable income is up to $47,025. They will have to give away 15% and 20% if it is up to or over $291,850.

Comparing tax rates

How do these stack up against each other? In the short-term vs. long-term capital gain battle, the latter wins. The longer you spend investing, the less tax you pay, especially when placed in the lower tax brackets. The decision ultimately lies with your financial strategy and your overall financial resilience. Whether you are here for a quick thrill or a mature gain, understanding the tax implications will help you navigate that tricky terrain wisely and keep more of your hard-earned money to yourself.

How Is Capital Gains Tax Calculated

Here is what a typical capital gains tax calculation process looks like, presented in a simple stepwise manner:

Step 1: Determine your gain.

Step one is to calculate the capital gain, which is essentially the difference between what you originally paid for an asset and what you made by selling it. If the result is positive, it is a capital gain. If not — a capital loss. Naturally, you do not pay taxes on capital losses; these can work somewhat in your favor by reducing taxes on capital gains.

Step 2: Calculate the holding period.

How your capital gain will be taxed depends on how long you’ve been keeping the asset before selling it. Holding it for exactly one year or less puts you into the short-term gain taxpayer category. Any period of over a year makes you a long-term investor with potentially lower tax rates.

Step 3: Apply tax rates.

For short-term gains, your tax rate aligns with your regular income tax bracket, ranging between 10% and 37%. The tax brackets for long-term gains are 0%, 15%, and 20%. To be sure you are filing within the right tax bracket, always check with the IRS official website for the latest updates and guidelines on capital gains taxation.

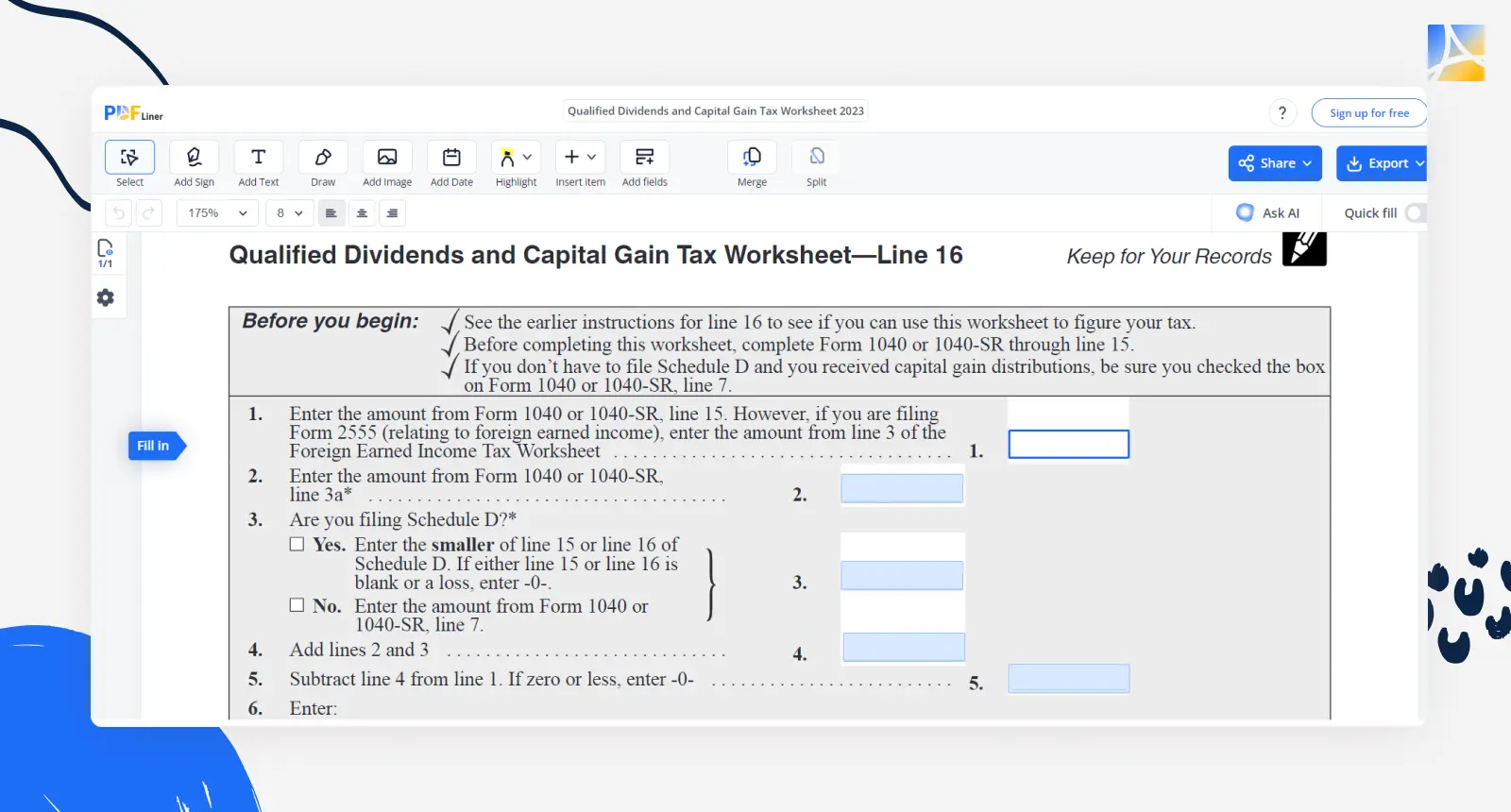

Step 4: Use qualified dividends and capital gain tax worksheets.

There can be dividends and gains that qualify for lower tax rates. Knowing how to play them nicely into your annual IRS tax form is a wallet-benefitting move. Using tools like the Qualified Dividends and Capital Gain Tax Worksheet can help you navigate this territory more confidently.

Step 5: Utilize online calculators.

If your number-crunching skills aren’t super-polished but you are determined to get this done by yourself without outsourcing the job to a professional tax accountant, you can use a capital gains calculator available on the Internet for free.

Tips to Reduce Capital Gains Tax

A widespread misconception is that you have to be a tax pro knowledgeable about all the nitty-gritty of the process to be able to reduce your capital gains tax effectively. The truth is that strategic thinking, basic financial literacy, and some prudent tax-reduction strategies can go a long way in helping you optimize your tax position and decrease your overall tax burden.

Whether you are looking for ways to reduce capital gains tax on property or stock sale, the following practical recommendations will help you get started.

1. Be smart about the accounts you use

If doing a lot of active buying and selling or dealing with investments seems a little tax-heavy to you, we advise you to place them in accounts that give certain tax benefits, like 401(k)s, IRAs, and 529 college savings plans. For tax-friendly investments and those you plan to hold on to for a while, regular brokerage accounts will do just fine.

2. Play the long game with your investments

When considering the sale of the investments in your regular brokerage account, pay attention to how long they have been parked there – ideally, for over a year. In the race between capital gains long-term vs short-term, the former is always guaranteed to do much better tax-wise.

3. Leverage your capital tax losses

If selling some of your assets places you in the red, you can use that to your advantage to decrease the capital gains tax on your other investments. The strategy is known as tax-loss harvesting, allowing you to use up to $3,000 in investment losses to shrink your taxable income. You can also carry the leftovers forward if your capital losses for the year exceed $3,000, thus creating a financial safety net for yourself.

4. Give appreciated assets to charity

Consider donating appreciated assets to charity. Apart from being a feel-good move on your behalf, this strategy can reduce your capital gain liability, on top of providing benefits in terms of charitable contribution tax deduction.

5. Do not rush into selling your principal home

It is possible to reduce the capital gains tax rate on profits derived from selling real estate. For that, you have to put your principal home on sale, which you have owned and used as your principal residence for at least two out of the last five years before selling it. If you are filing solo, that should usually give you an exclusion of up to $250,000 of capital gains and up to $500,000 if you’re filing jointly with your spouse.

US tax laws regulating capital gains at the federal and state level are a complex and complicated territory. Even if you think you know everything about how capital gains tax works, navigating this landscape can be difficult. Consider hiring a tax advisor who will take time to assess your financial standing and short-term/long-term financial goals and provide personalized recommendations on the best strategies to boost your capital gains income potential.

Forms to Calculate and Report Your Capital Gain Taxes

Apart from knowing how to calculate your capital gain taxes, you need to be able to report them timely and accurately. Otherwise, you risk getting yourself into hot water with the IRS. Below is a quick overview of the forms you might need to complete when documenting and reporting your capital gains. While tax season is not everyone's favorite time of the year, you can make the process more bearable if you know your way around these.

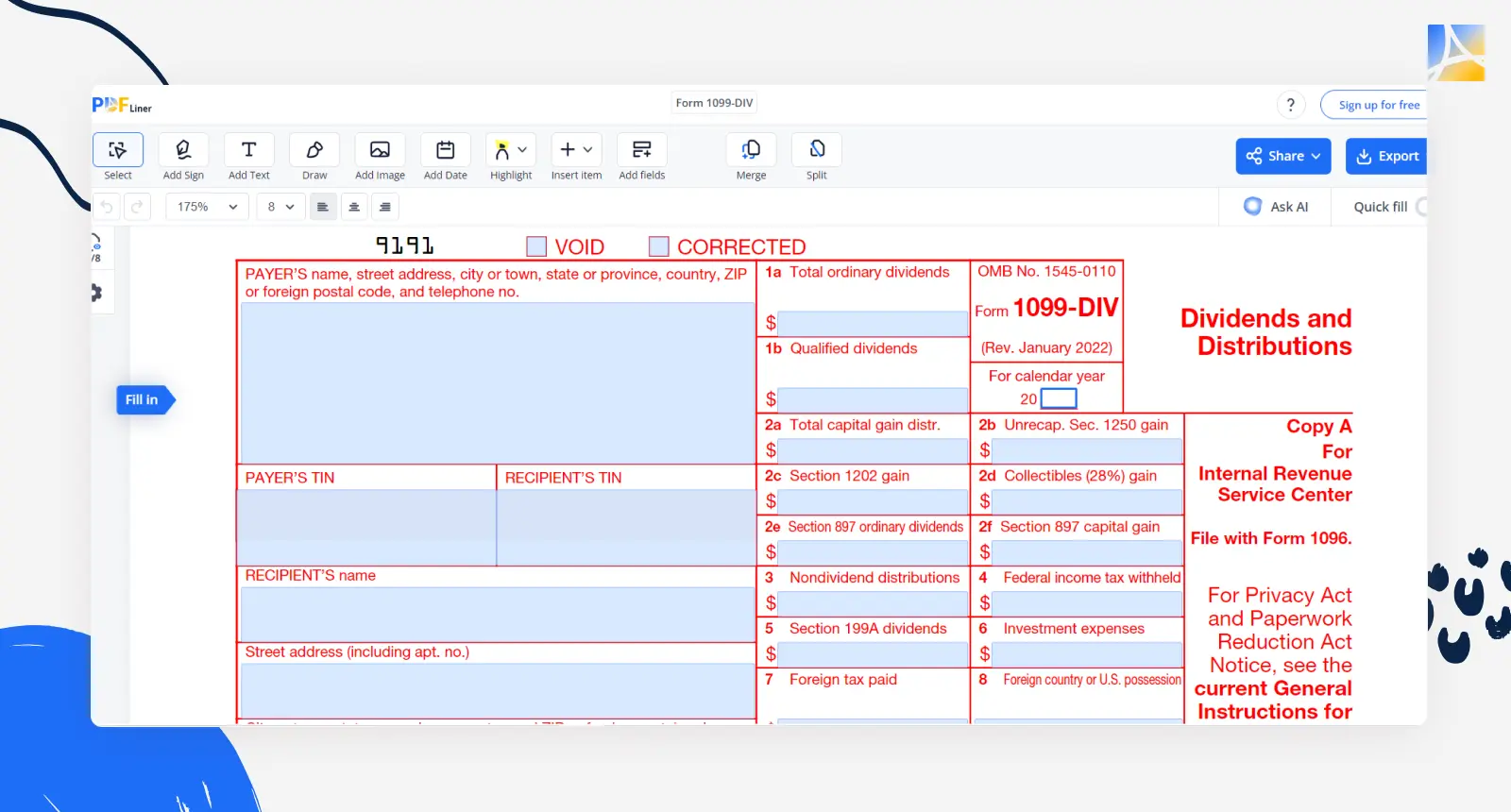

Form 1099-DIV

This informational return form is issued by a financial institution to investors who have earned more than $10 in dividends or capital gains distributions during the tax year. Investors then use information in this financial report to fill in their tax returns.

Fillable 1099-DIV 65e799fce8ff53f48d038222

Qualified Dividends and Capital Gain Tax Worksheet

This worksheet is a versatile tool for calculating the tax on your qualified dividends and net capital gains. Once you calculate the tax on the regular income, you fill out this worksheet to figure out the tax on your capital gains from investments. After that, you pay the higher of the two amounts to the IRS. The worksheet helps ensure you benefit from the preferential tax rates associated with qualified dividends and long-term capital gains.

Capital Gains Worksheet 65a18a00a2a2de1f26089ce5

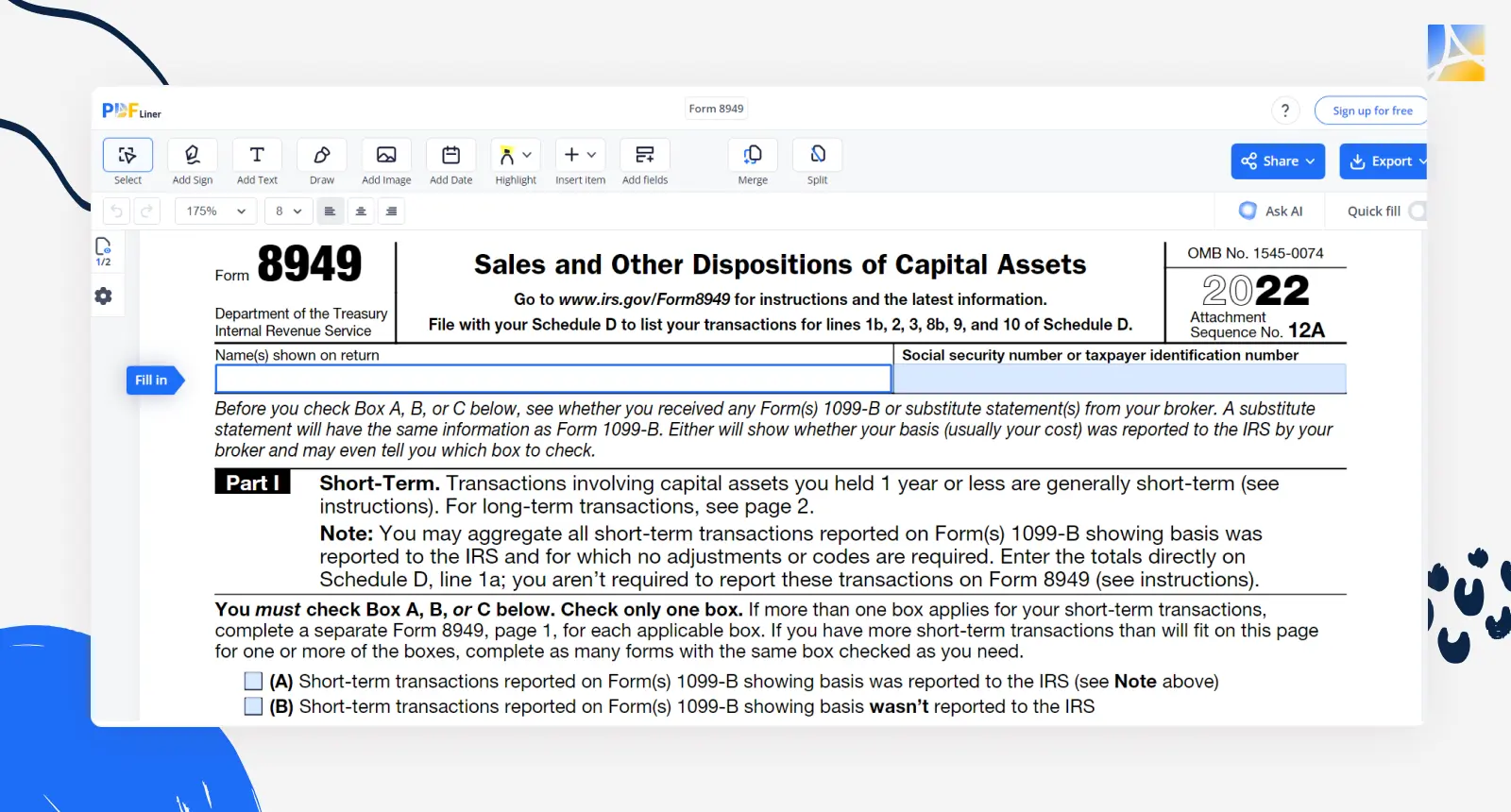

Form 8949

Taxpayers use Form 8949 to list each transaction of stocks or assets and specify what occurred within the reporting period. They provide details such as when they bought these assets and how much they sold them for. The IRS uses this form to calculate the total capital gains or losses, helping taxpayers understand how much tax they owe or if they qualify for a refund.

Fillable Form 8949 63bee2be47efc7a58b0338e5

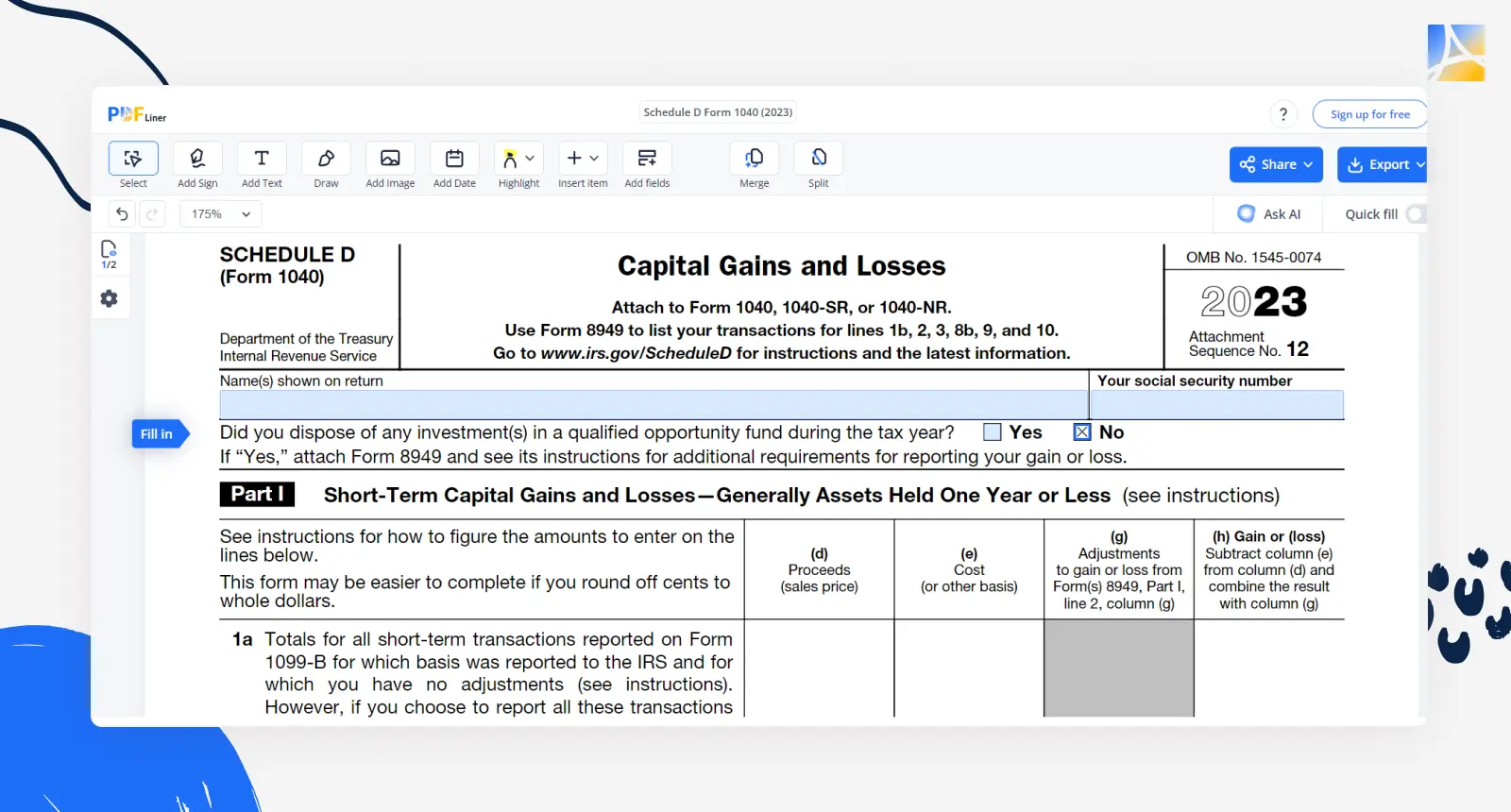

Schedule D Form 1040

This document is there for reporting to the IRS your capital gains or losses from the sale of stocks or assets like real estate. Schedule D is a core part of your tax return that sums up your investment profits and losses, helping you figure out your final tax bill or refund.

Fill Out Schedule D 65b03cdad4996140c60ff058

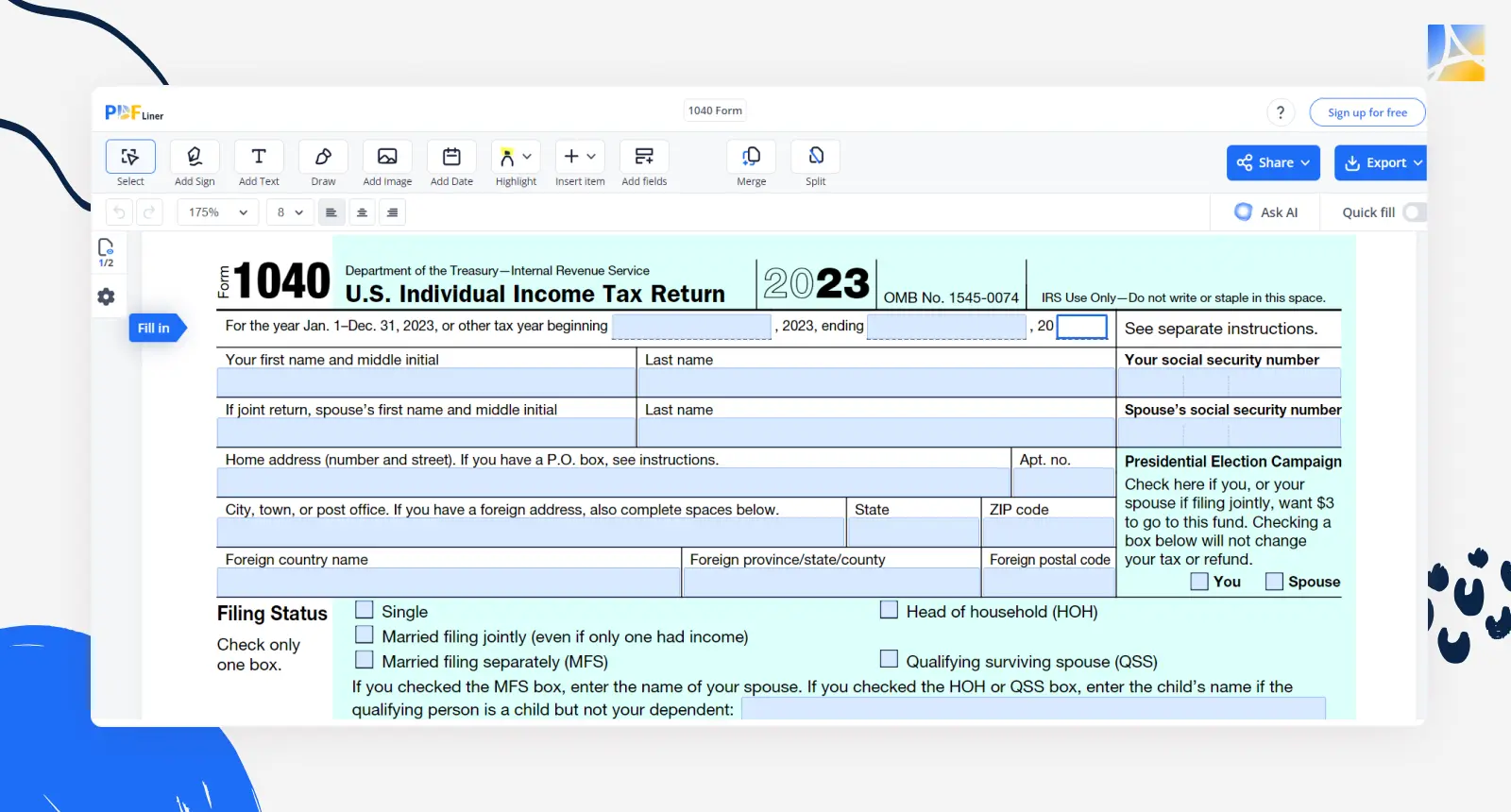

Form 1040

This form is something of a boss fight in your favorite video game. In Form 1040, you report your overall income, deductions, and credits. When it comes to capital gains, you are expected to attach forms like Schedule D and Form 8949 to shed light on your investment wins and losses. The IRS uses this info to calculate your final tax bill or refund, making sure that everything is fair and square.

Remember that capital gains tax legislation is prone to change, so it is necessary to keep up with the latest regulations in this field. It will also not hurt to talk to a tax whiz before you report anything to make sure you have got it all covered and stay ahead of any money-costing surprises.

Fillable Tax Return 656f2839815ba38085013bdd

Fill Out Tax Forms Online and Save Your Time

Speed up your tax return this year using PDFLiner