-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Effective Strategies on How to Reduce Income Tax

.png)

Dmytro Serhiiev

If you're looking to lower your tax bill for the 2024 season, you're in the right place. This guide provides you with ten tax savings strategies that are both practical and legal. Simple, effective, and straight to the point, these strategies can help you keep more of your earnings without any trouble with the tax authorities.

Top 10 Tax-Saving Strategies

It's that time of the year when taxes are on everyone's mind again. Before you start filling out your tax return, consider these top tax-saving strategies. Understanding deductions and credits is crucial when figuring out how to pay less tax each year. This section outlines ten strategies to do that. From retirement savings to health accounts, education costs to business expenses, we've got you covered with tips to help ease your tax burden. We've outlined several tips for tax-saving that can ensure you keep a larger portion of your hard-earned money.

1. Save For Your Retirement

Contributing to a retirement plan like a 401(k) or IRA is a key strategy on how to reduce the taxable income you're responsible for each year. These contributions can lower your current tax bill and provide you with a nest egg for the future. Maxing out contributions to retirement accounts is among the smart ways to reduce income taxes both now and in the future.

For example:

- With a 401(k), the money you contribute is typically pre-tax, which reduces your taxable income.

- For IRAs, depending on the type, you may be able to deduct your contributions now and pay taxes on withdrawals later, or contribute after-tax money and enjoy tax-free growth.

The key is to start early in the year to spread out the impact on your take-home pay and give your savings more time to grow.

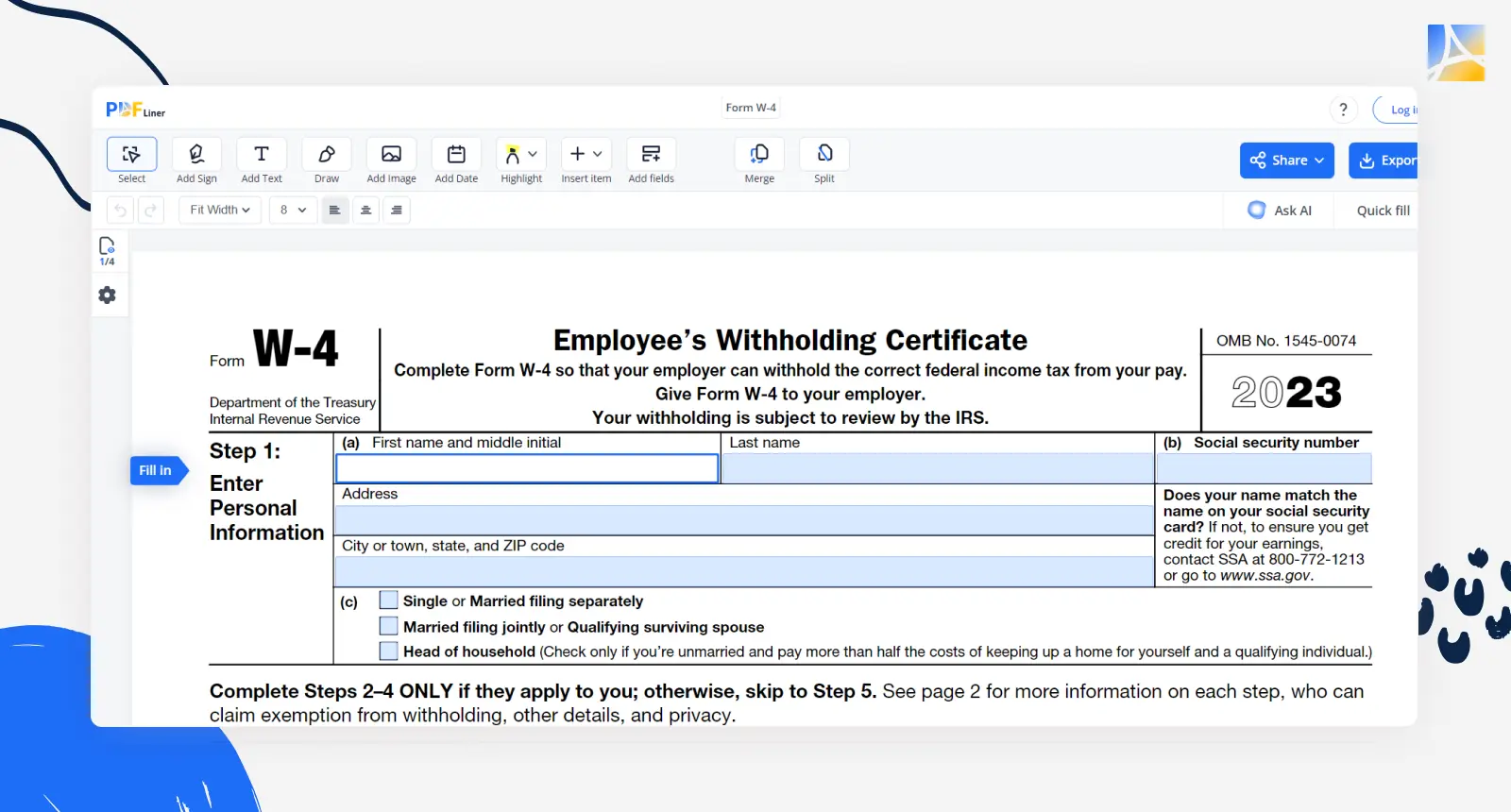

2. Alter Your W-4 Form

Your W-4 form tells your employer how much tax to withhold from your paycheck. If you had a major life change such as marriage or child’s birth, you might need to adjust your W-4 to ensure the right amount of tax is taken out. If you find that you consistently owe money when tax time comes, increase your withholding to prevent owing a large sum when you file the form.

Conversely, if you typically get a large refund, you might want to decrease your withholding to have more money available throughout the year. Reviewing and adjusting your W-4 form is one of the simplest tax-saving tips to ensure you're not overpaying on taxes throughout the year.

Printable W-4 Form 65c09d3b9580e4a026001f42

3. Contribute to a Health Savings Account

Health Savings Accounts offer a triple tax advantage: contributions are tax-deductible, the money grows tax-free, and withdrawals used for qualified medical expenses are not taxed. If you're enrolled in a high-deductible health plan, you're eligible to contribute to an HSA.

For 2024, it’s worth checking the updated contribution limits and plan ahead to maximize your contributions. Contributing to an HSA is not only wise for health planning but also crucial for how to save on taxes. Remember, unused funds roll over year to year, so you won’t lose your contributions if you don’t spend them within the calendar year.

4. Use IRS Tax Credits

Tax credits are some of the most powerful tools in reducing your tax bill because they provide a dollar-for-dollar reduction. Unlike deductions, which reduce the amount of taxable income, credits cut your tax bill itself. Familiarize yourself with various tax credits offered by the IRS and determine your eligibility.

For instance, the Earned Income Tax Credit is designed for low-to-moderate income earners, while the Child Tax Credit can help families with the cost of raising children. There are also credits for educational expenses, energy-efficient home improvements, and more. Understanding and applying for various tax credits is a cornerstone among tax-minimization strategies for reducing your overall tax liability.

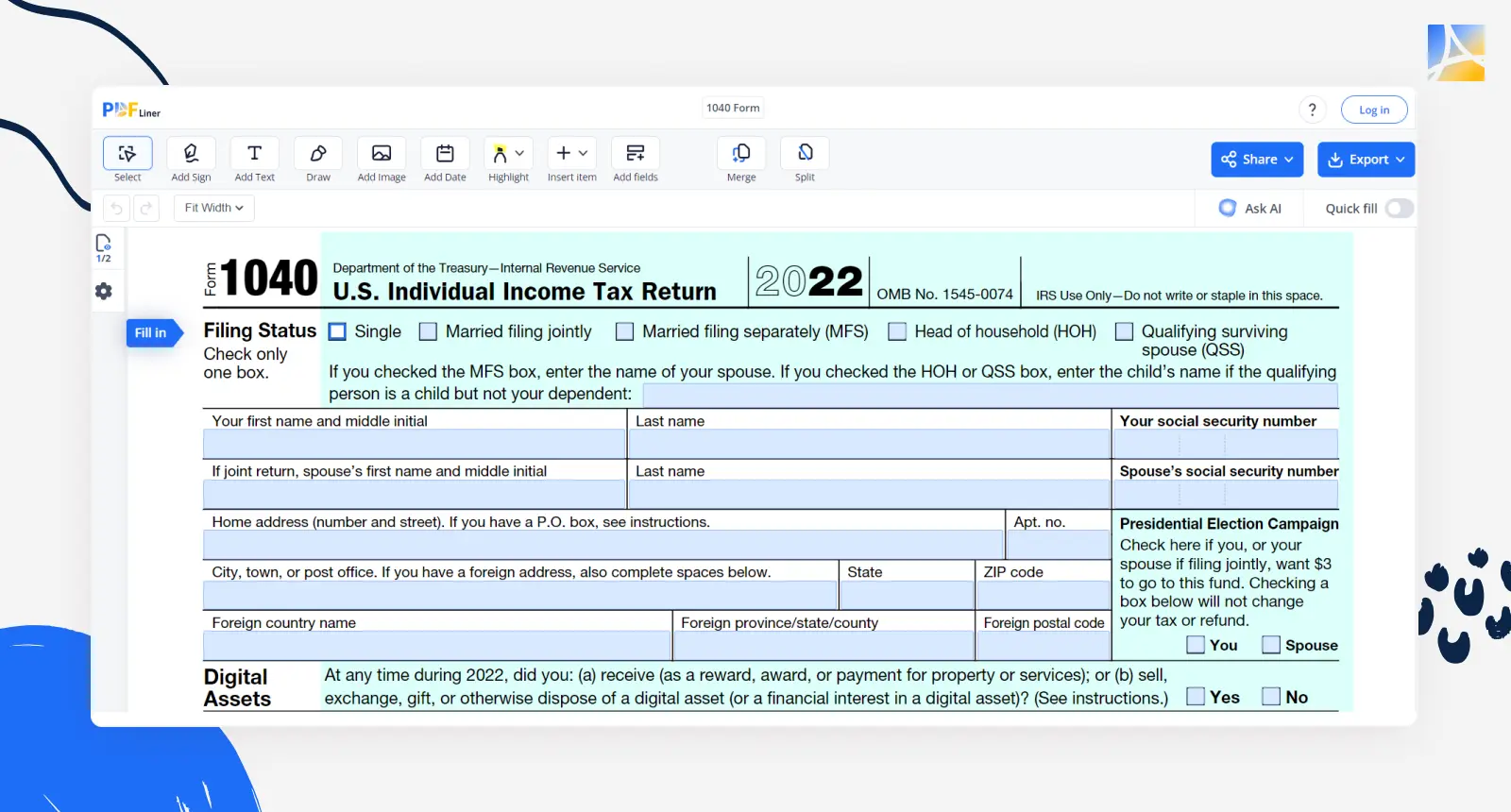

5. Charitable Contributions

Donating to charity can benefit both the world and your tax bill. If you itemize your deductions, charitable donations can be deducted from your taxable income. This includes monetary gifts, property donations, stocks, and even miles driven for charitable service. Just document your contributions with receipts or written acknowledgment from the charity.

Keep in mind that for more significant donations, you might need to include additional forms with your tax return. Strategic charitable donations are a meaningful method of reducing taxable income while benefiting society.

To get more from your charitable giving at tax time, you can give more in one year instead of spreading it out. This way, you might get to deduct more on your taxes. Also, make sure the groups you give to are approved by the IRS so that you can legally deduct your donations.

Fill Out Tax Return 656f2839815ba38085013bdd

6. Use Flexible Spending Accounts (FSA)

Utilizing an FSA is an excellent tool for lowering income tax obligations by using pre-tax dollars for medical and dependent expenses. For healthcare FSAs, the limit for contributions often changes year to year, so check the current year's limit to maximize your savings. Remember that spending FSA funds usually follows a use-it-or-lose-it policy within the plan year. Some plans offer a grace period or allow a carryover of a certain amount into the next year. When it comes to dependent care FSAs, these can be particularly beneficial for parents, as they can cover childcare costs, including preschool and summer camps. Be sure to keep all receipts and understand your employer's specific rules for eligible expenses and deadlines.

7. Start Saving for Education

Investing in education savings is a proactive way to lower your tax bill while supporting a student's future. Tools like 529 plans or Education Savings Accounts offer tax advantages. Contributions to a 529 plan, for example, aren't deductible on federal taxes but can grow tax-free and be withdrawn tax-free for qualified education expenses.

Some states offer tax breaks for these contributions. It's wise to start these savings early, as the longer your investment has to grow, the more benefit you'll receive. Make sure to understand your state's specific rules for these plans to optimize your savings.

When considering education savings, also explore the possibility of Coverdell Education Savings Accounts, which allow for tax-free growth of investments when used for qualified educational expenses. These accounts have broader usage, including K-12 expenses, unlike 529 plans which are often used for college costs.

However, ESAs come with income limits and contribution caps, so it's important to assess whether you qualify. Contributions are not federally tax-deductible, but the ability to withdraw funds tax-free for eligible educational expenses makes them a beneficial option. Regular contributions, even in small amounts, can compound over time, making a significant difference in a student’s educational funding.

8. Deduct Home Office Expenses

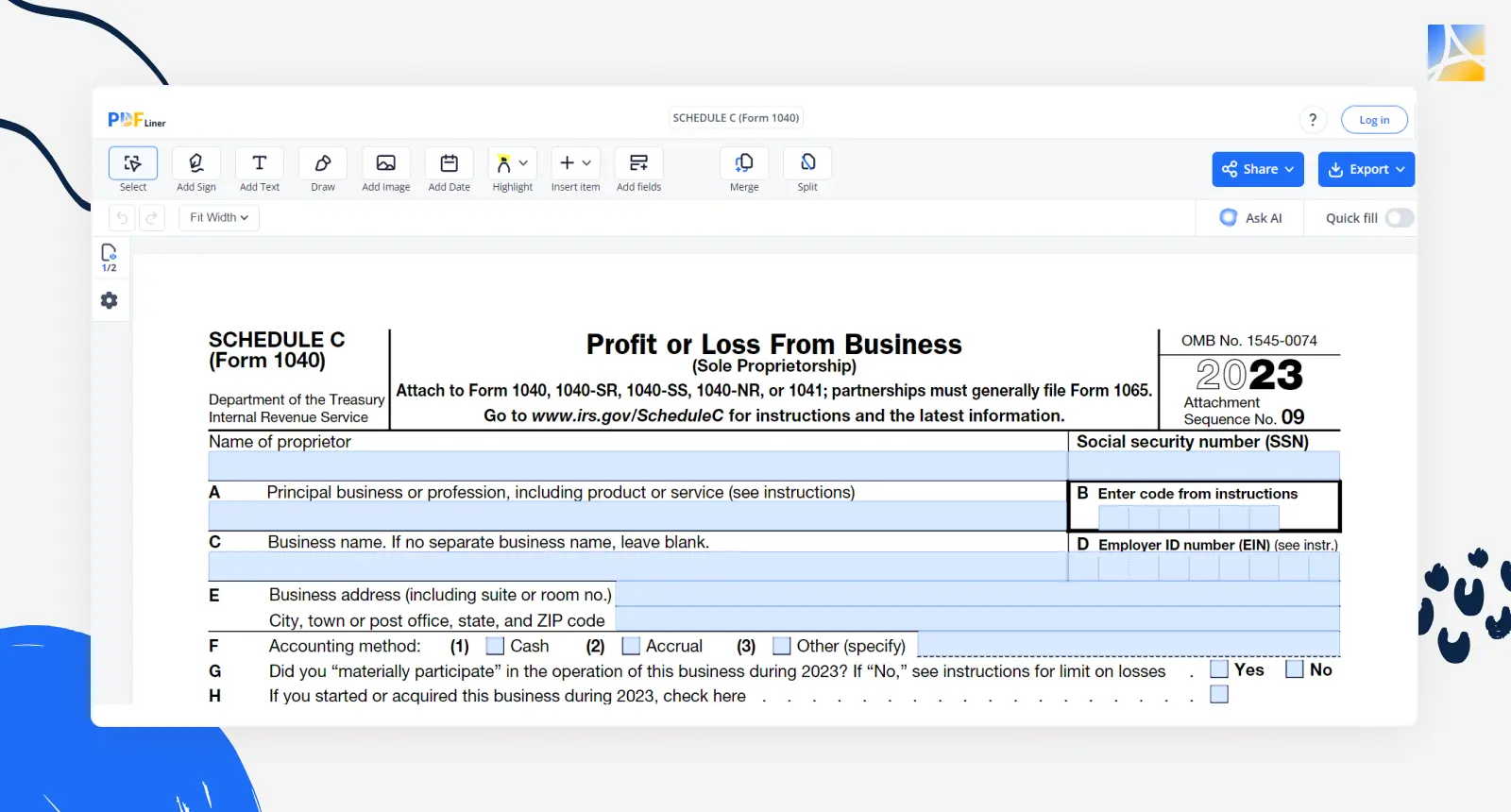

If you're self-employed and use part of your home regularly and exclusively for business, you may be able to claim a deduction for your home office. The IRS offers two options: the simplified option and the regular method.

- The simplified option allows a standard deduction based on the square footage of your office space.

- The regular method involves deducting a percentage of your home expenses (like utilities, insurance, and repairs) based on that same square footage.

Make sure to keep detailed records of your expenses and be mindful that this deduction strictly applies to spaces dedicated to business activities.

9. Deduct Side Gig Expenses (Business Expenses)

If you're hustling on the side, your side gig can offer more than just extra income, it can also provide tax deductions. Common deductible expenses include office supplies, advertising, travel, vehicle use, and any necessary tools or technology. The key is that these expenses must be ordinary and necessary for your business. Keep meticulous records and save receipts. For example, if you're a freelance graphic designer, you can deduct the cost of a new computer or design software. Be thorough in tracking all your expenses throughout the year to maximize your deductions.

Expenses related to your side business may also include indirect costs such as a portion of your home utilities, rent, or mortgage if you work from a home office. To claim these, determine the percentage of your home used for business.

For instance, if 10% of your home is a dedicated office, you may be able to deduct 10% of these costs. Choose between the actual expense method and the simplified option, which uses a standard rate per square foot. Separating personal and business expenses simplifies tracking and substantiates your deductions. Remember, the space must be used exclusively for business to qualify.

10. Schedule Deductible Expenses

Timing can greatly affect your tax return, particularly when it comes to planned deductions. If you're close to the threshold for certain deductions such as medical expenses or charitable contributions, you might consider scheduling payments within the tax year to exceed these thresholds and maximize deductibility.

For instance, if you anticipate dental surgery, scheduling it in a year when you've already had significant medical expenses could push you above the 7.5% AGI threshold for medical deductions. Similarly, bunching charitable donations in one year, rather than spreading them out, can help you surpass the standard deduction limit and itemize deductions. Always think ahead and consult a tax professional to ensure your timing aligns with the tax benefits you're seeking.

Real-Life Examples of Reducing Taxable Income

Let's look at how both employees and independent contractors can leverage tax-saving strategies effectively with real-life examples.

Employee

Consider the case of Alex, an IT specialist in a tech company with an annual salary of $90,000. To reduce his taxable income, Alex contributes the maximum amount of $19,500 to his 401(k). This brings his taxable income down to $70,500. He also enrolls in a high-deductible health plan and puts $3,600 into a Health Savings Account, which further reduces his taxable income to $66,900.

To top it off, Alex itemizes deductions and includes $2,500 in student loan interest and $6,000 in mortgage interest, which reduces his taxable income to $58,400. Beyond these, he donates $2,000 to charity and claims this deduction, which adjusts his taxable income to $56,400. By utilizing these strategies, Alex not only secures his future financial stability but also enjoys immediate tax benefits.

Independent Contractor

Now, let's look at a scenario involving Maya, a freelance graphic designer with a net income of $100,000 from her services. Maya contributes $6,000 to her traditional IRA, which lowers her taxable income to $94,000. She takes advantage of her self-employed status and deducts $15,000 for various business expenses, including home office use, equipment, software subscriptions, and a portion of her internet and phone bills, bringing her taxable income down to $79,000.

Maya also travels to conferences and client meetings, which costs her $5,000 for the year; by deducting these travel expenses, her taxable income is now $74,000. Maya also invests $1,500 in professional development courses, which are deductible, resulting in a taxable income of $72,500. Maya's careful record-keeping and knowledge of deductible expenses significantly decrease her tax bill while investing in her business's growth and personal retirement savings.

Well, there you have it. In the article above, we've explored ten strategies for lowering your tax bill, which include making the most of retirement savings, tweaking your W-4 for better withholding outcomes, taking advantage of health savings accounts, and claiming eligible tax credits. Now, let's address some common questions about these strategies.

FAQ

What can I deduct from my taxes?

You can deduct a variety of expenses from your taxes, including contributions to retirement accounts like a 401(k), IRA, or HSA. Other deductions include mortgage interest, student loan interest, charitable contributions, certain medical expenses, state and local taxes, property taxes, and business expenses if you are self-employed.

What is the maximum contribution to a 401(k) for 2024?

The maximum contribution limit for a 401(k) in 2024 was raised to $23,000. Nevertheless, it would be prudent to check the IRS website or consult a tax professional for the most current information.

Who gets audited by the IRS?

IRS audits can be random, but certain factors may increase your chances, such as high income, large charitable deductions, claiming the home office deduction, or running a business with a substantial amount of cash transactions. Keep accurate records and report income and deductions accurately to reduce the likelihood of an audit.