-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Change W-4 Form: Updating Your Tax Withholdings Correctly

.png)

Dmytro Serhiiev

If you're wondering how to change my W-4 form online, you'll be pleased to know it's a straightforward process that you can complete with a few clicks. For you to ensure that your paychecks are in line with the current tax situation, this article provides a clear explanation of how to update the W-4 form. This practical step can make a significant difference in your financial planning for the year.

Update Form W-4 65c09d3b9580e4a026001f42

When Can I Change My W-4

Your W-4 form isn't set in stone; you have the flexibility to update it as needed. Events like marriage, the birth of a child, or a new job warrant a review of how to change withholdings on your tax forms. These changes can affect your tax status and are good prompts to take another look at your withholdings.

It's a common misconception that W-4 forms can only be updated with a change of employment or at the start of the year. How often should W-4 forms be updated? It's best to do it whenever you have a major life or financial change. The IRS recommends that everyone do a "paycheck checkup" at least annually. This is especially important if you encounter unexpected tax outcomes, like owing more than you anticipated or receiving a sizable refund.

Acting after tax season can be beneficial, particularly if your previous return didn't turn out as planned. Learning how to adjust W-4 can help you avoid tax surprises in the future. Additionally, significant changes in your life, such as a spouse starting or losing a job, divorce, or a shift in income, are important times to consider Form W-4 update. To avoid unexpected tax bills, it's important to know how to update tax withholding for your current finances.

How to Update W-4 Form Online

Updating your W-4 online can streamline your tax withholding process, making it easier to manage your income and taxes. Most employers have an electronic system in place, allowing you to make the changes quickly and securely.

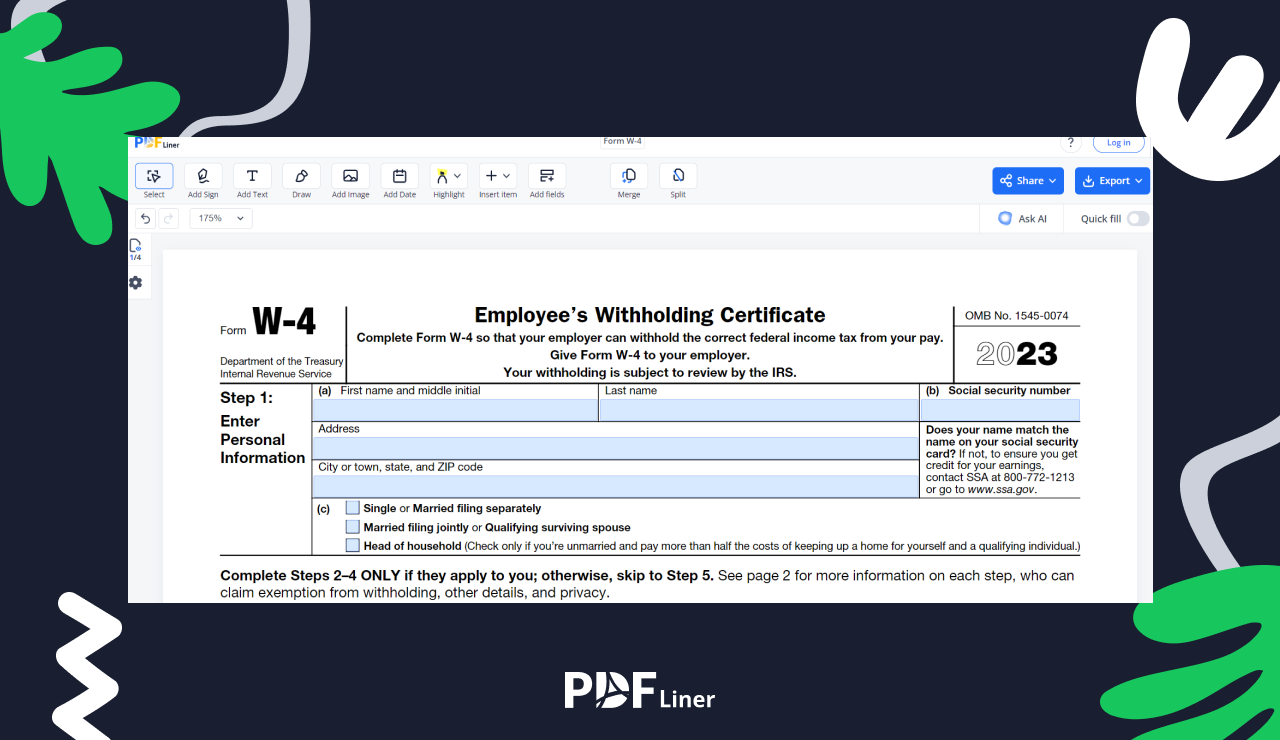

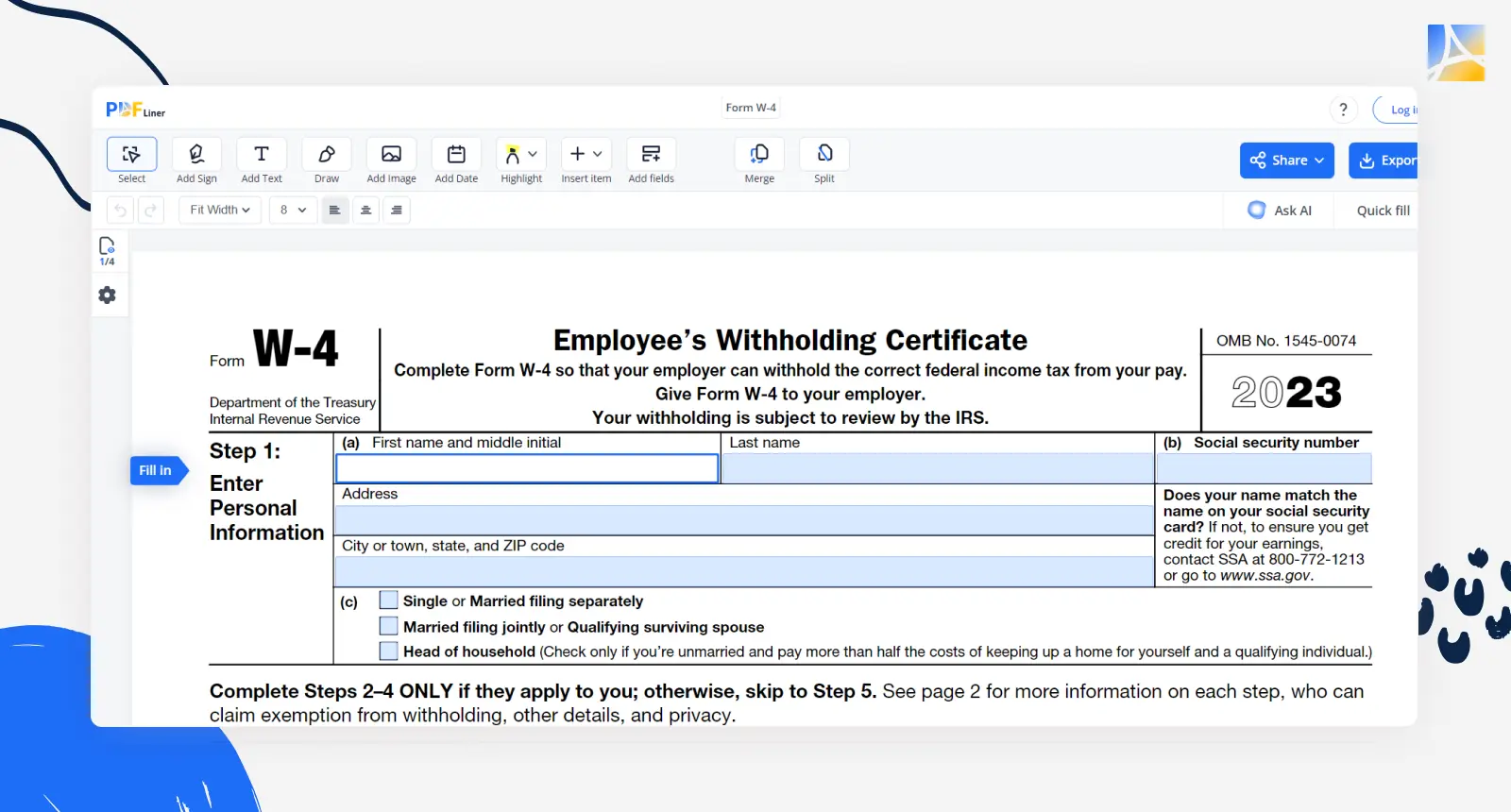

Filling out the W-4 form with PDFLiner

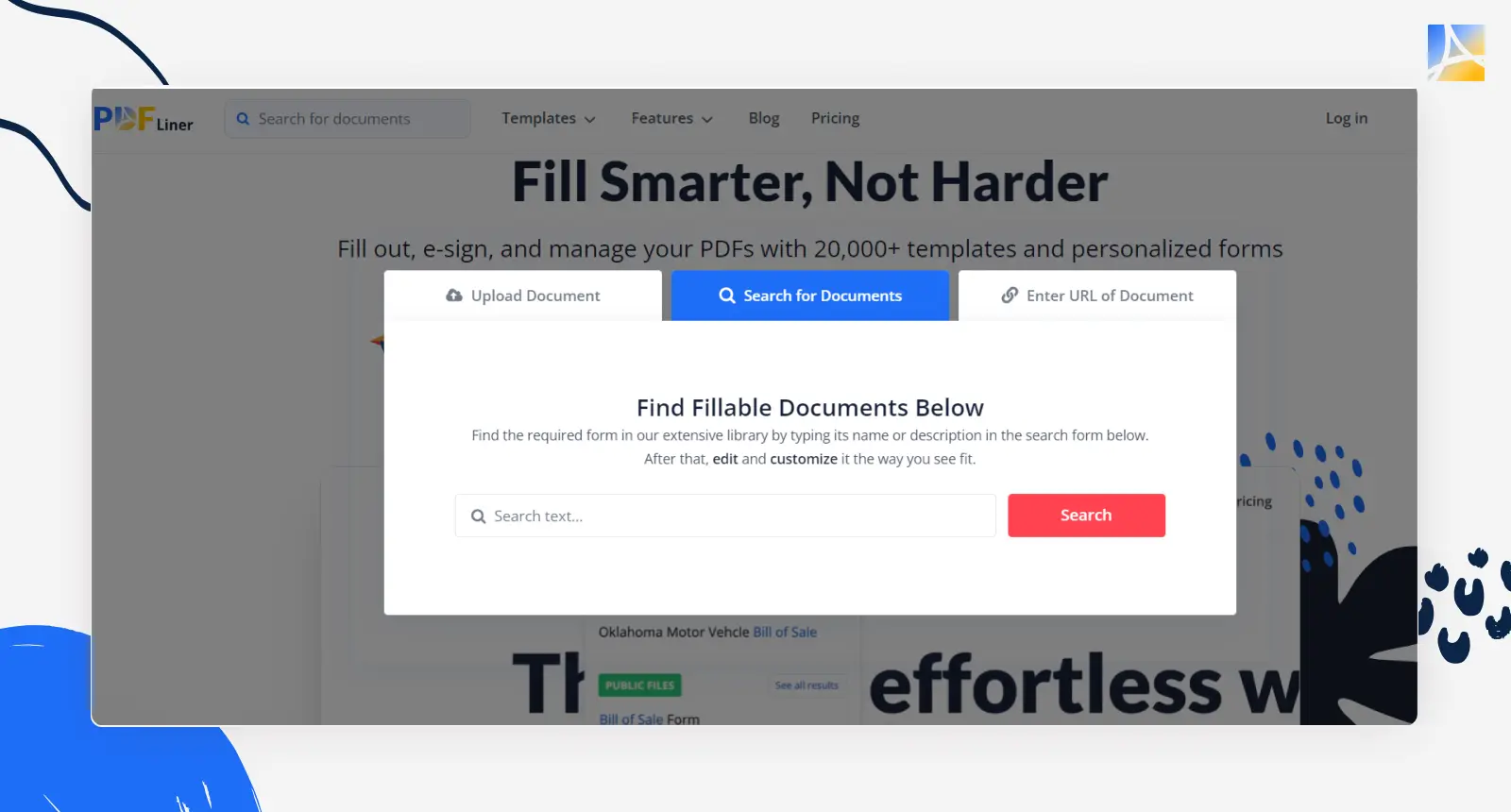

If your employer does not provide an online method or you prefer to fill out the form by yourself, services like PDFLiner are there to help. PDFLiner is an online platform that lets you fill out PDF forms directly in your browser. Here’s how you can use PDFLiner to update or fill out your W-4:

1. Access the form

Visit the PDFLiner’s website and search for the current W-4 form.

2. Enter your personal information

Fill in your details, such as your name, address, Social Security number, and tax-filing status.

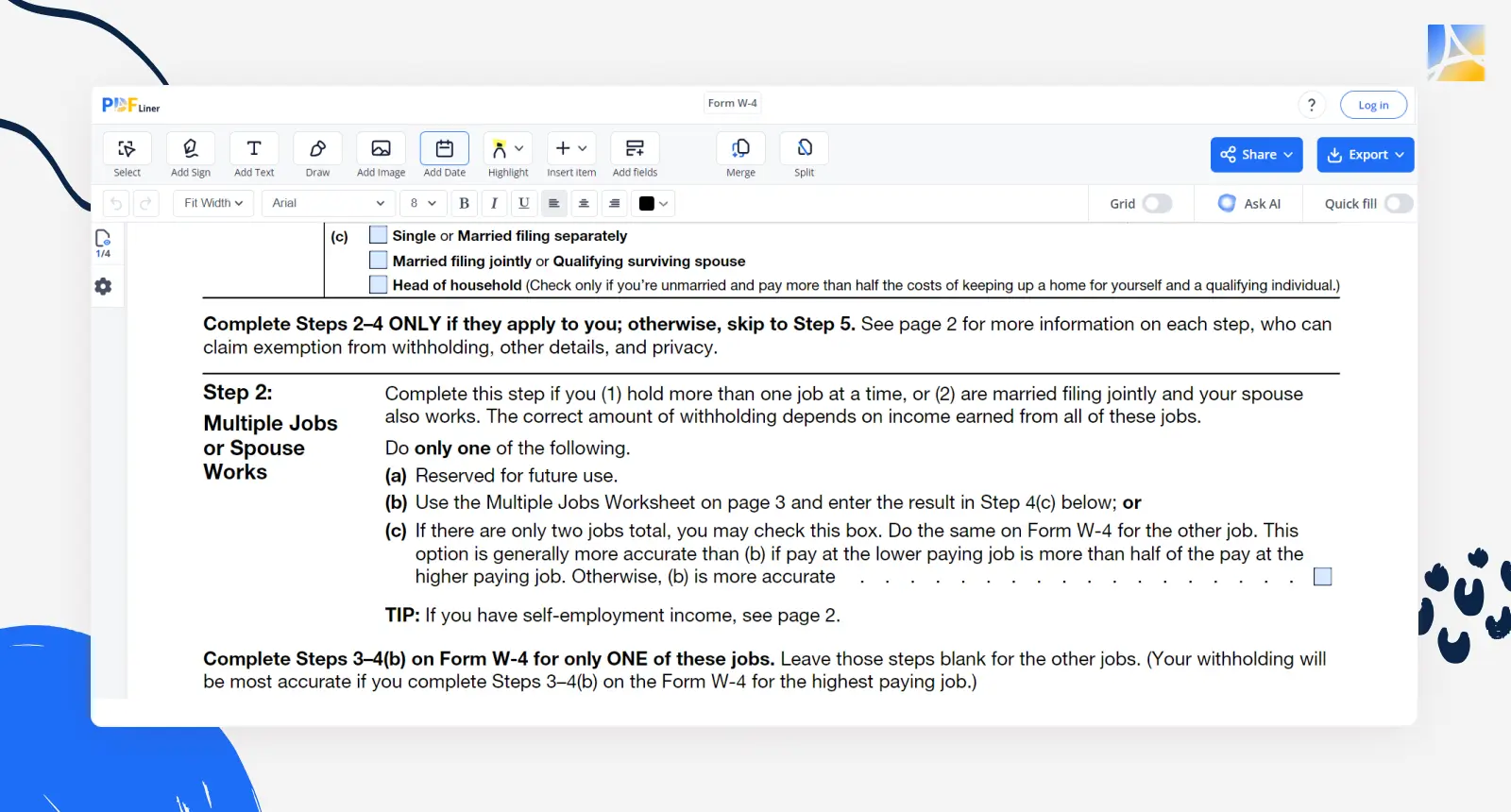

3. Multiple jobs or spouse works

If applicable, follow the instructions to account for multiple jobs or a working spouse.

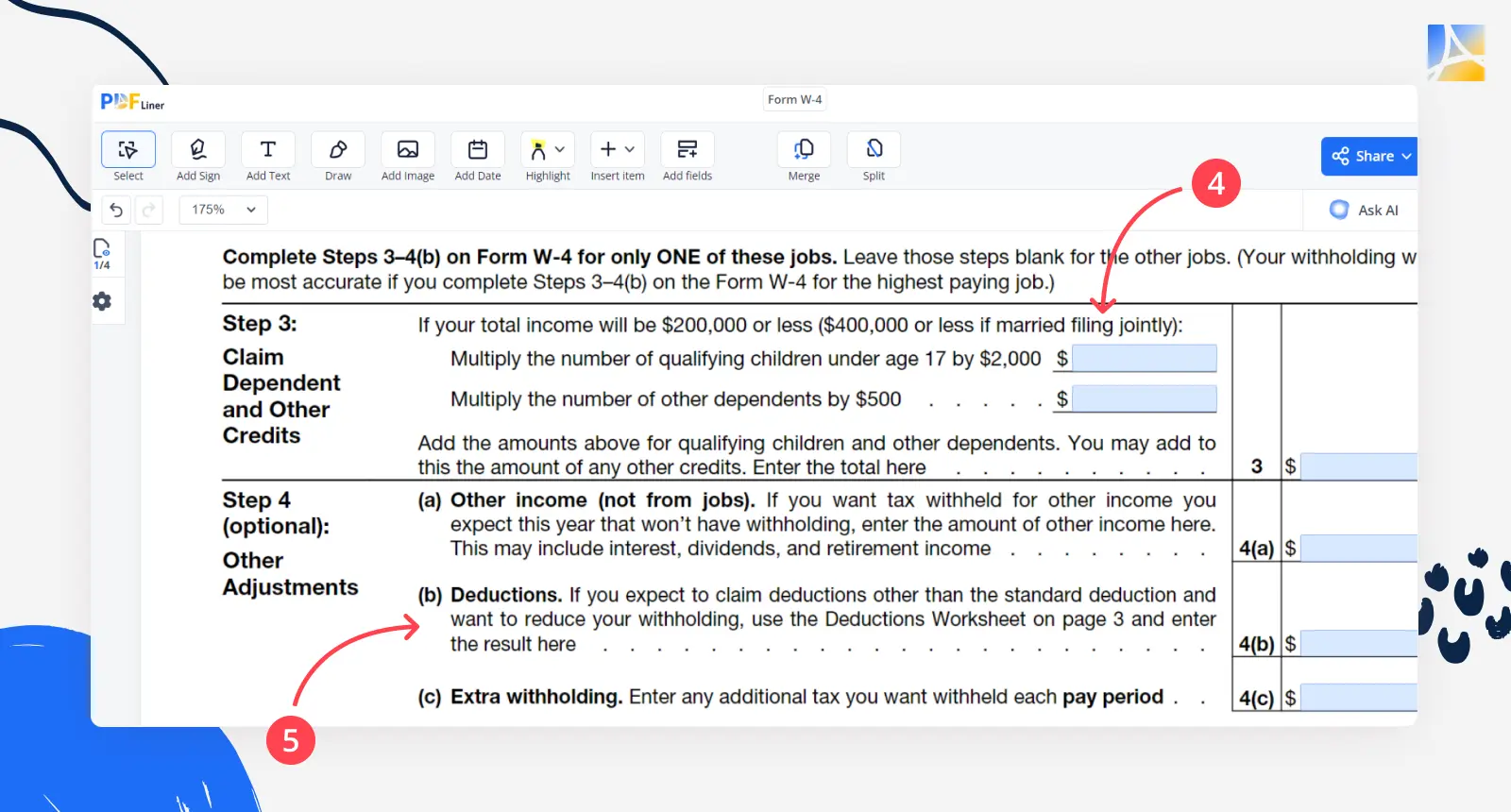

4. Claim dependents

For those with children or dependents, changing dependents on W-4 may be necessary to reflect your current family situation.

5. Other adjustments

To adjust how much tax is taken out of your paycheck, you might need to change exemptions on W-4.

6. Review

Before submitting, review all the information to ensure its accuracy.

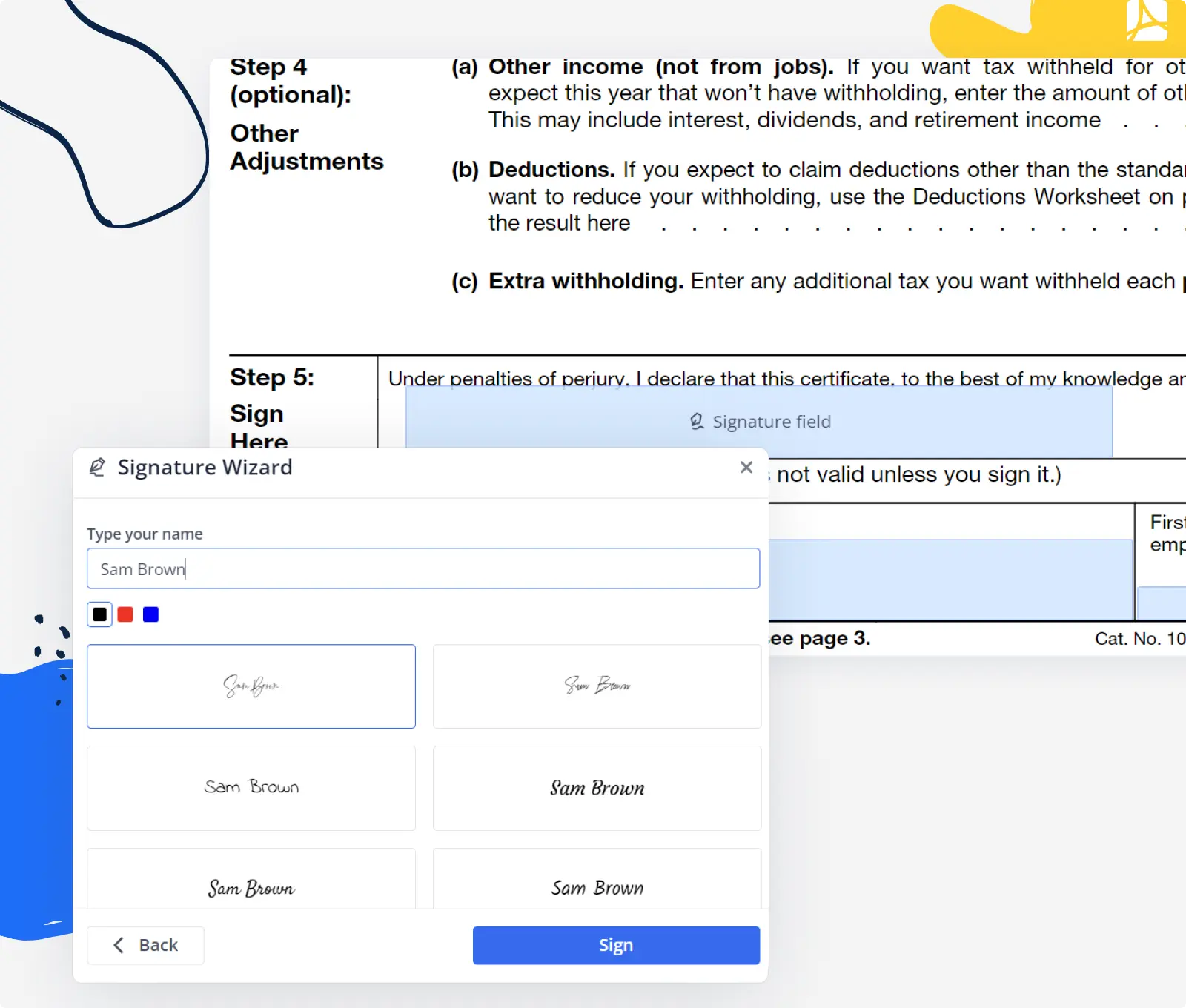

7. Sign the form

Use the electronic signature feature to sign your W-4 form.

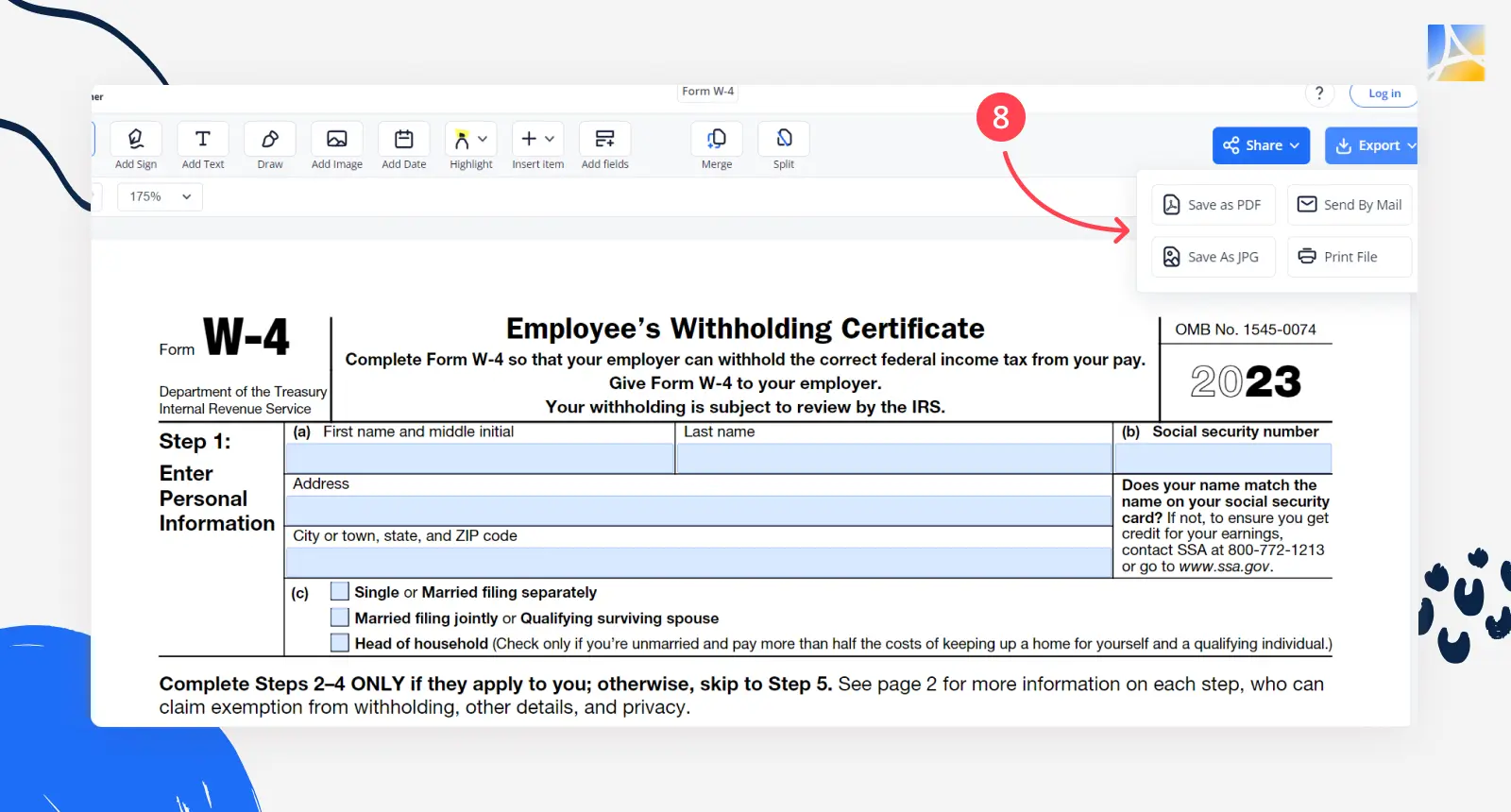

8. Download or print it out

After signing, you can download the completed form for your records or print it out if necessary.

Remember, while PDFLiner is a convenient tool, the responsibility for ensuring that all information is correct remains with you. Always double-check the details you enter against your records to avoid any potential issues with the IRS or your employer.

Submitting your updated W-4 to your employer

Once you update your W-4 form, you need to submit it to your employer so that they can actualize your payroll information. This is a critical step because if your employer does not receive the updated form, your withholdings will not be adjusted.

- Find out the preferred method of submission. Many employers will have a dedicated email address, an online portal, or a system through which you can securely submit documents. Use this method to ensure your W-4 reaches the payroll department directly.

- After submission, it's also a good idea to follow up with your HR or payroll department to confirm they've received and processed the form.

- If your employer requires a physical copy, you can print the form you filled out with PDFLiner and hand it to them personally or mail it to the appropriate department.

- Make sure to ask for confirmation that your updated W-4 has been received and that they will be adjusting your tax withholdings on your next paycheck.

- Keep a copy of your updated W-4 and any confirmation of receipt for your personal records.

Regularly updating your W-4 using online tools and ensuring that your employer processes these changes, such as changing allowances on W-4, can help you maintain your financial well-being and avoid any tax time surprises.

How to Have More Taxes Withheld

If you want to increase the amount of taxes withheld from your paycheck, you can make specific changes to your W-4. This may come in handy in case you had a large tax bill last year or you anticipate higher income that is not subject to withholding. Increasing your withholdings could lead to a smaller tax bill or even a refund when you file your taxes. Here are several tips on how to adjust your W-4 form for greater withholding:

- Decrease the number of dependents: If you claim fewer dependents on your W-4, more tax will be taken out of your paycheck. For instance, if you claimed two dependents last year, consider claiming one or none to have more tax withheld.

- Adjust your withholding on line 4(c): Use line 4(c) to request additional withholding. You can specify a dollar amount that you want withheld from each paycheck. This is a straightforward way to boost the taxes taken out throughout the year.

- Update your filing status: Make sure your filing status is accurate. For example, if you are married but withhold at a higher single rate, this will increase the amount of taxes withheld.

When you update your W-4 to have more taxes withheld, remember to reevaluate your situation each year. Your goal should be to have your withholding match your actual tax liability as closely as possible to avoid giving the government an interest-free loan.

How to Fill Out W-4 to Have Less Taxes Taken Out

Adjusting your W-4 to have less tax withheld from your paycheck means more money in your pocket throughout the year. This approach might suit you if you prefer not to overpay taxes and have access to your funds during the year. However, it's essential to be cautious to avoid a tax bill when you file your return.

Changes to consider on your W-4:

- Dependents: Increase the number of dependents if eligible, which reduces the amount of tax withheld.

- Deductions: If you expect to claim deductions larger than the standard deduction, increase the figure on line 4(b).

- Extra withholding: Decrease any additional amount you've asked to be withheld on line 4(c).

After making these adjustments, it's crucial to periodically check your paycheck to ensure the right amount of money is being withheld. Staying up-to-date on tax rules and consulting with a tax professional if you're unsure about changes can help prevent owing taxes at the end of the year. Make sure that your W-4 reflects your current financial situation accurately so that you're not caught off-guard with the onset of tax season.

How Often Should W-4 Forms Be Updated

Update your W-4 form whenever there are significant changes in your personal or financial life. This includes events like marriage, divorce, the birth of a child, or a change in income. While there's no legal requirement to update it annually, it's a good idea to review it each year to ensure the amount of tax being withheld matches your current tax situation. This proactive approach can help you avoid unexpected tax bills or penalties.

Using smart tax strategies can trim your tax bill and put more money back in your pocket. Use these tips, such as adjusting your W-4 or investing in a health savings account, and watch the savings add up. Stay informed and proactive about your tax situation, and you'll navigate tax season with confidence.

FAQ

In this section, we'll tackle some FAQs to clear up any remaining questions about reducing your taxable income.

Where can I find my W-4 form?

Your current W-4 form should be on file with your employer. Ask your human resources or payroll department for a copy. Alternatively, you can download a new form from the IRS website or fill it out here at PDFLiner.

Can I use an old W-4 form?

It's best to use the most current W-4 form to ensure you're considering the latest tax codes and withholding guidelines. Previous versions may not reflect current tax law changes.

When did the IRS change the W-4 form?

The IRS updated the W-4 form in 2020 to make it more straightforward and to accurately align withholdings with the tax law changes that took effect in 2018. This update was part of an effort to improve accuracy and transparency in the tax withholding process.

Is there a fillable W-4 form?

Yes, the IRS provides a fillable version of the W-4 form on their website. You can complete it electronically and print it out.

How to change dependents on W-4?

To change your dependents on the W-4 form, fill out section 3. Enter the number of dependents you can claim and calculate the credits accordingly. Then, submit the updated form to your employer.