-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get a W-4 Form for Your Job

.png)

Dmytro Serhiiev

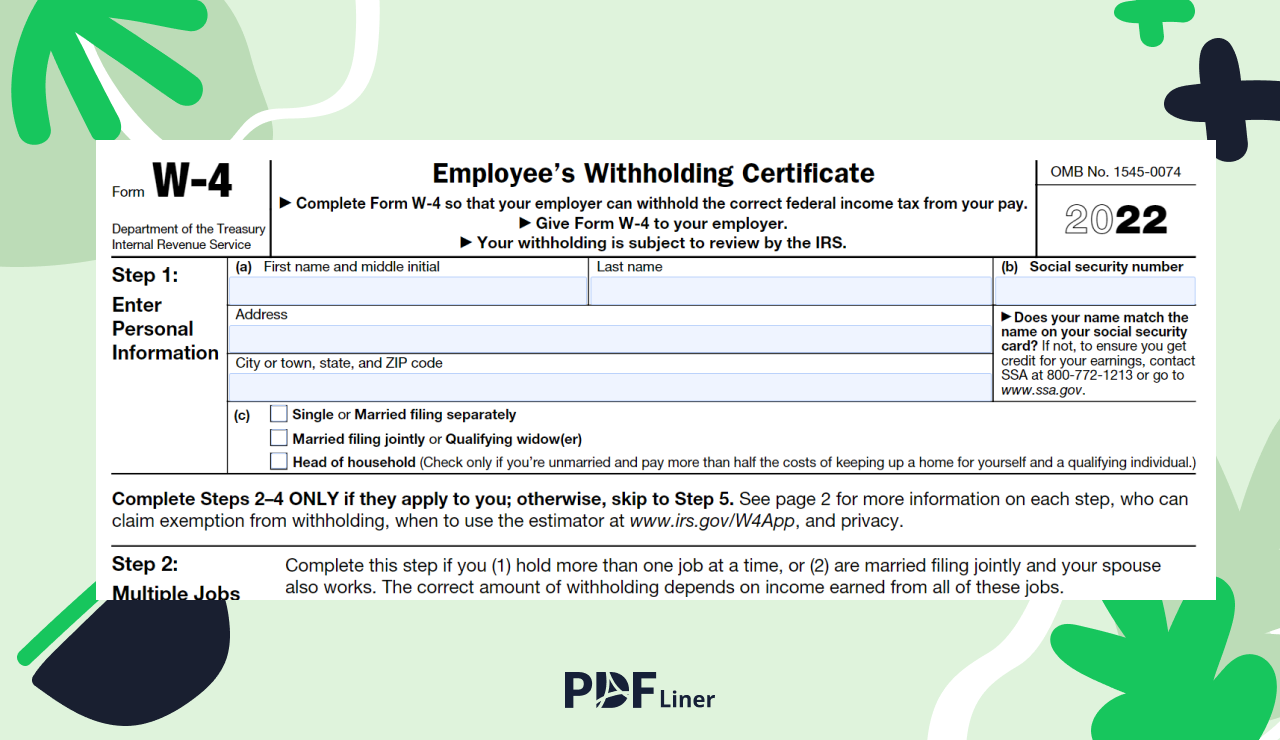

Whether you have just started a new job or faced changes in your financial or tax status, the IRS Form W-4, titled Employee's Withholding Certificate, is part and parcel of legalizing your situation. What is a W-4? It is a tax form you use to inform your employer of the amount to be withheld from your paycheck as federal tax. That is, failing to furnish a duly filled out W-4 might bring about exaggerated taxes or even legal trouble. Here is a concise and simple guide on how to get a copy of W-4 the easiest way.

How to Get a W-4 form

.png)

There are three main strategies for obtaining a fillable W-4.

Firstly, PDFLiner offers its users a wide range of IRS and other tax reporting forms in PDF format, all with the necessary data fields ready to be filled with your information. These can be found under PDF Forms. You can access the W-4 PDF directly and start filling it out on PDFLiner straightaway. There is a straightforward guide on how to fill out a W-4 form on the website.

Secondly, your employer is supposed to provide you with a copy of the IRS Employee's Withholding Certificate when you start working for them. If this is the case, it is likely to be partly filled out.

Finally, the form itself along with the official W-4 instructions can be found in the respective section of the IRS website. This approach won’t save you much time as you still need to open the form using PDF software for editing, but it’s a valid way of obtaining a copy.

Form W4 65c09d3b9580e4a026001f42

FAQ

In this section, we briefly answer common questions concerning W-4.

What is the purpose of the W-4 form?

This form is used to let employers know how much tax is to be withheld from their employee’s paycheck based on their income and dependents.

What are W-4 allowances?

Allowances were previously used to reduce the amount to be withheld. Currently, though, this is done based on dependents and/or the deductions worksheet.

Do employers send W-4 to the IRS?

Not unless they are expressly directed to for the purpose of review. Otherwise, the form serves the sole purpose of informing the employer.

Who should fill out a W-4?

The form is to be filled out by employees starting a new job who don’t have one on their file with the employer yet. Changes to the employee’s financial status that affect the amount to be withheld from their remuneration are another reason to re-submit W-4.