-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out a W-4: Comprehensive Manual

.png)

Dmytro Serhiiev

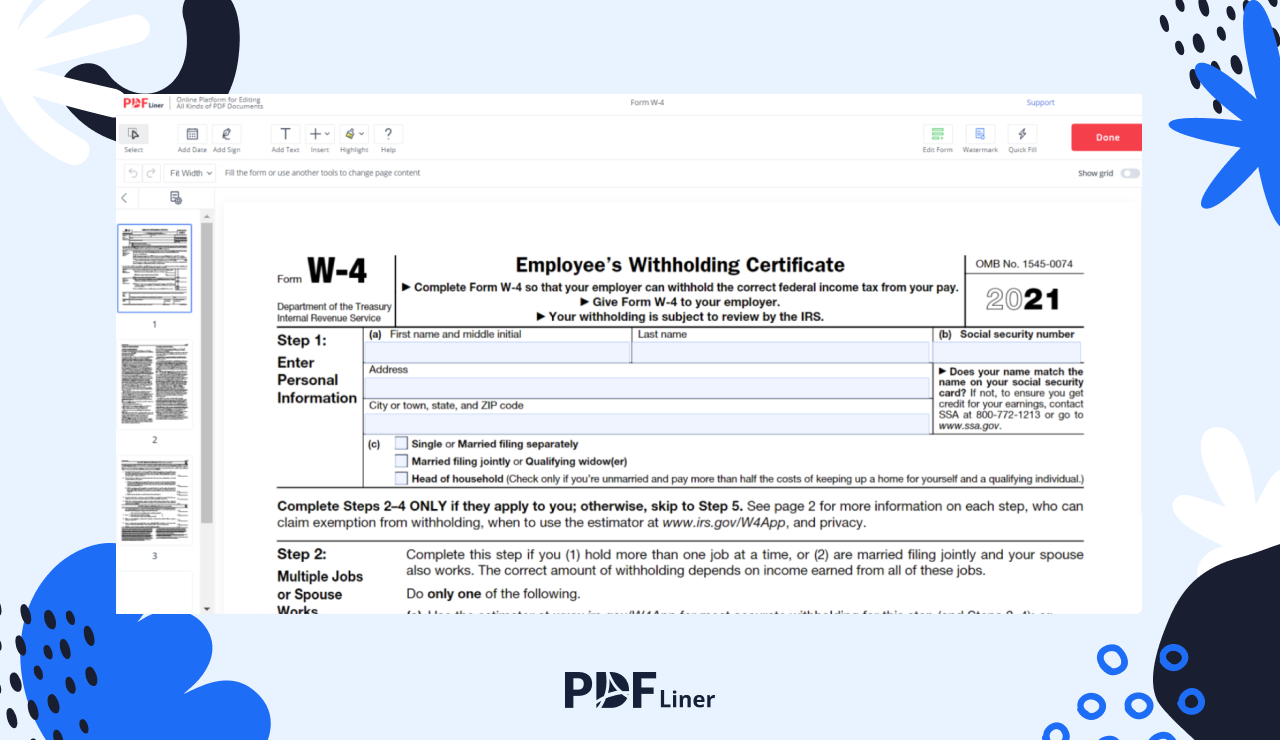

There are several tax forms that every taxpayer must fill out regularly. Among such documents is W-4. Correct filling and timely submission of this paper to an employer will save you from tax debts or large overpayments. This article explains how to fill out an employee's withholding allowance certificate using PDFLiner tools.

What Is a W-4

.png)

With this document, you can notify your employer about the amount to be withheld from your paycheck to pay taxes. The official name of this paper is Employee's Withholding Allowance Certificate. This form is mandatory for businesses that have employees on an annual basis. Also, filling out a W-4 is obligatory for you if your financial or personal condition as an employee has somehow changed. It will allow your employer to withhold the correct amount for federal tax payments. If you don't know how to get Form W-4, check out our article on the subject.

How to Fill Out a W-4 Form

The current document format has five main sections to fill out. On the PDFLiner platform, you will find all the necessary tools to work with this kind of form. Follow our step-by-step guide to quickly fill out the W-4 Form for a new job.

Step 1: Fill in the first block with your personal information: last name, first name, address, SSN, and marital status. If you have a simple tax situation (one job, no dependents, etc.), skip to Step 5. In all other cases, you need to fill in the other boxes.

.png)

Step 2: Completing the second section is obligatory for those with multiple jobs and persons with a W-4 married filing jointly status. Note that although this form is rather short, it has three instruction sheets and annexes. Depending on the current situation, choose the option that suits you:

- Fill in the table placed on the third page;

- Use the tax estimator on the official IRS website. This option is recommended for those who have more than three jobs, or the annual income from at least one of the jobs exceeds $120 000;

- Just put a tick in the appropriate box if you only work in two jobs with approximately the same pay rate.

You should complete further lines of W-4 if single with two jobs. Pick one of your positions, the one where you get the highest salary.

Step 3: For a complete description of your financial situation, enter W-4 dependents in this paragraph. The IRS has developed a tiered qualification system for persons who fall under the term "dependent." However, in short, it means your kids under 17 and other people to whom you provide financial support in the amount of more than 50% throughout the year. You can also take into account tuition fees, foreign taxes, and more. Based on this information, you may claim tax credits.

Step 4: The fourth block is called "Other Adjustments" and is optional. Check out the W-4 examples if you need help filling the file out. It might seem odd to someone that you should specify extra withholdings which you would like to be additionally deducted from you. However, it can be a logical step if you get too large tax credits based on the data from the previous point. In this case, you might find yourself in debt to the tax office. To avoid it, complete this step.

.png)

Step 5: Recheck the completed form for errors and sign it. You should leave the item that follows blank as it is for your employer to fill out.Please note that if you do not complete this document and submit it on time, your employer will withhold the highest tax rate from your paycheck.

.png)

How to Sign Form W-4

The signature on the new employment tax form guarantees that you are familiar with its contents, were in your right mind when filling it out, and confirm the document's validity. For it, PDFLiner also has a simple and handy tool. You can electronically sign papers if you have an e-signature, take a photo of it, or sign a file manually using your mouse or touchpad. Also, you can enter your first and last name in the corresponding line, and our platform will automatically turn them into a handwritten signature. For more information on how to sign forms, you can refer to our specific article.

How Form W-4 Has Changed

In 2020, the tax office revised some documents and released them in a new format. The changes also affected Form W-4. It was done to simplify the process of filling out an already rather complicated document. Now, instead of seven steps, taxpayers need to complete only five. In the new version, the opportunity to request various personal allowances was lost. So, for example, if you were single, married, or had one job, you were eligible for claiming 2 on W-4. In total, you could request three or more allowances. This item is missing in the new version of the form.

FAQ

After reading our W-4 for dummies guide, you can check out the answers to frequently asked questions.

What is an allowance on W-4?

W-4 allowances give an employee the opportunity to reduce the amount of tax collected depending on their personal situation.

Is the new W-4 better?

The purpose of the new W 4 Form was to simplify the filling out and paying taxes process. The 2020 version is really simpler and shorter.

What do you put on W-4 for no taxes taken out?

The old format allowed for zero federal taxes at the expense of allowances. It is impossible to do it now.

How to use a W-4 to owe nothing on a tax return?

You can avoid debt by completing the W-4 Form annually and revise it whenever your personal or financial situation changes.