-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Proven Tips on How to Maximize Your Tax Return

.png)

Dmytro Serhiiev

‘Why is my tax return so low?’ If that’s what’s been bothering you lately, you’ve come to the right place. The prospect of getting as big of a tax refund as you can is always appealing. With simple tax planning, a little research, and some far-sightedness, you can actually minimize your tax liability, pay no more than you owe this year, and ultimately score a higher tax refund.

You’ll discover how tax refunds work, explore some important deadline-related topics you should be aware of, as well as learn about some key ways to achieve tax success this year. Remember, though, that for a long-term effect, finding a reliable financial advisor might be your best bet. Meanwhile, read on and start making steps towards getting more money back in your pocket from the taxman.

Fillable Form 1040 656f2839815ba38085013bdd

5 Useful Tips to Boost Your Tax Refund

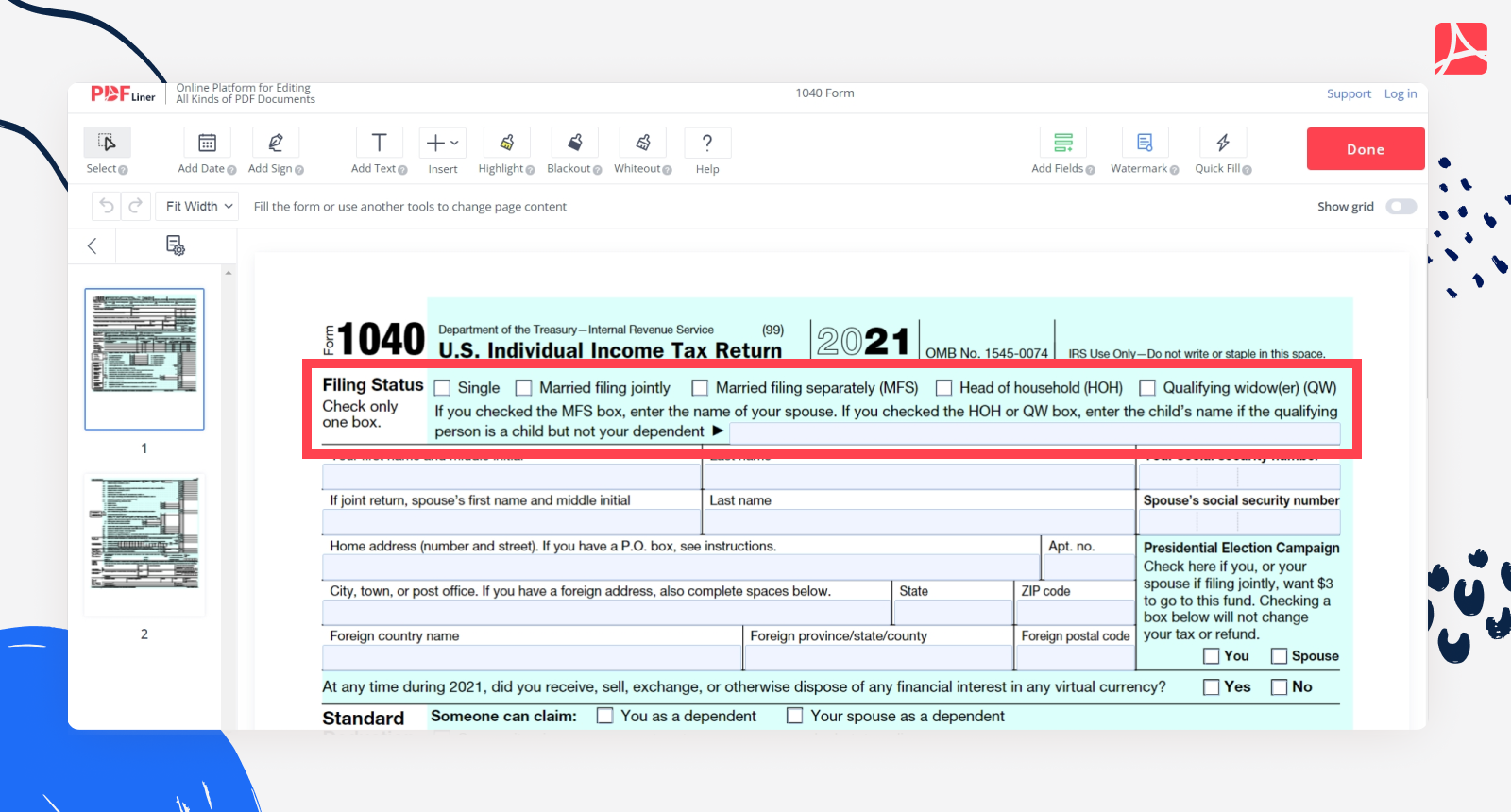

Refund-Boosting Tip #1. Re-Examine Your Filing Status

Your filing status can increase your tax return, irrespective of whether you’re single or married. If you’re married, joint filing is generally a good choice. Nevertheless, there are cases when you should file separately. For instance, if you or your spouse has lots of work- or health-related expenses, separate filing may lower your AGI (adjusted gross income) and increase your deduction amount.

Then again, if you file separately, you may end up ineligible for some important tax credits. Make thorough calculations well in advance to figure out which filing status gives you more perks. If doing all this math is not what you’re into, you can find a free tax refund calculator and make the most of its powers.

If you’re single, research if you’re eligible for Head of Household status. As a rule, that requires covering more than half of the expenses for your household for the year (including a qualifying dependent). Tax-wise, this implies a child or a dependent adult, e.g., an elderly parent. If you succeed in the filing as Head of Household, it could increase your refund significantly.

Refund-Boosting Tip #2. Elevate Your Tax Credit Savviness

Tax credits are usually a lot more effective than deductions when it comes to refund boosting. That’s because they reduce the amount of tax you owe to the Internal Revenue Service on a dollar-for-dollar basis. For instance, if you owe $7,000 in taxes and claim a $2,000 credit, you get $6,000 off your taxes. A lot of Americans miss out on some splendid possibilities when it’s about claiming tax credits.

The Child Dependent Care Credit, the Earned Income Tax Credit, as well as tax credits for education-related expenses, are among the most frequently claimed ones. Tax credits for energy-saving home improvements can also help you max out your refund. Whether you qualify for these and other tax credits depends on your earnings, filing status, and the eligibility of your dependents. With regard to tax credits associated with educational expenses, there are some extra rules concerning your eligibility and the best timing for claiming them.

If you pay taxes as digital nomad you might qalify for Foreign Earned Income Exclusion and housing deductions, which can significantly reduce your taxable income while living abroad. Always consult with a tax professional to understand the specific requirements and benefits associated with these provisions.

Fill out Tax Return 656f2839815ba38085013bdd

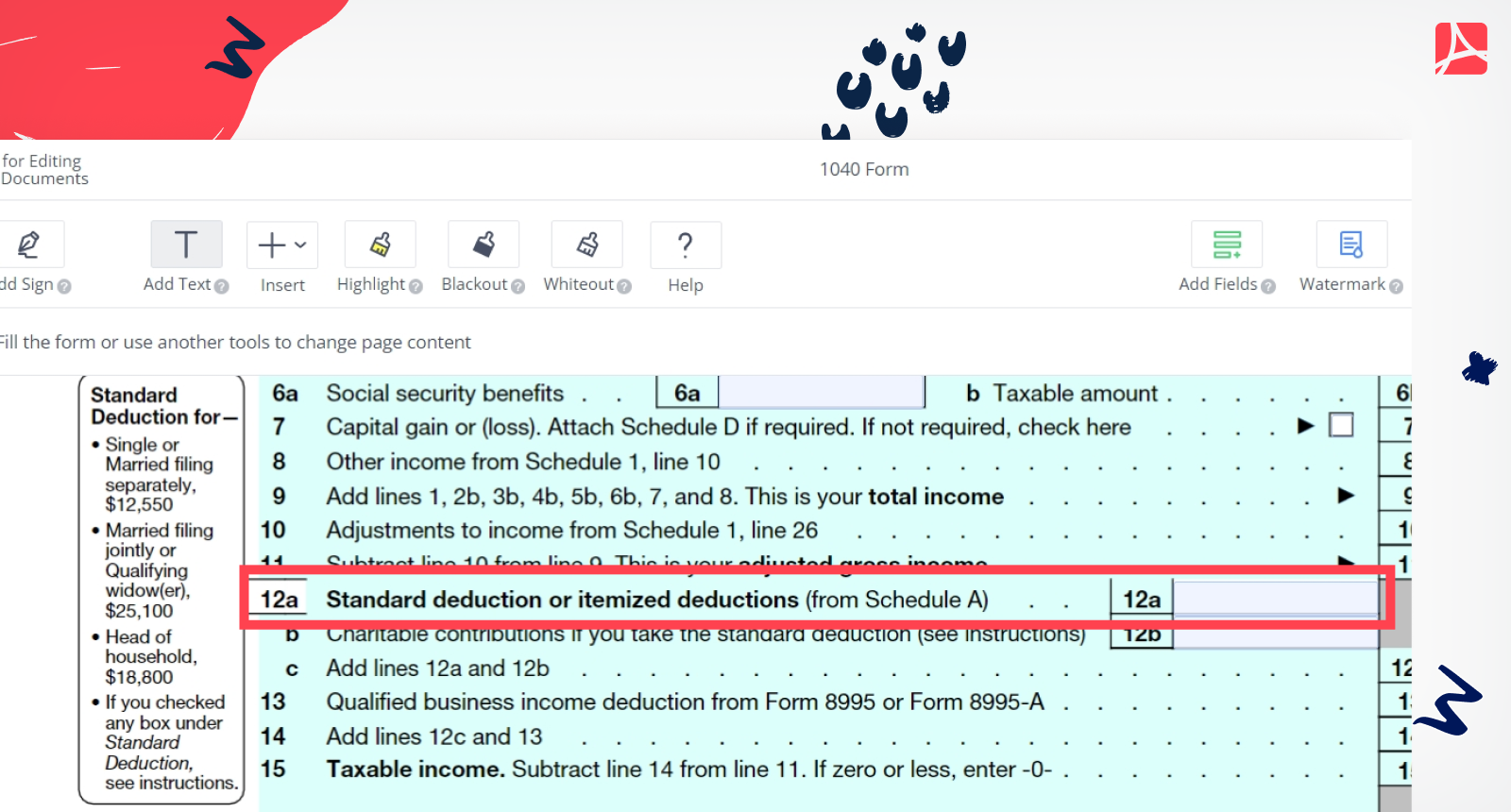

Refund-Boosting Tip #3. Make the Most of Deductions

When it comes to your tax return, credits usually boost your tax refund a lot more effectively than deductions. However, overlooking important write-offs, you’re eligible for would be simply unwise. So, instead of lowering the amount of tax you owe, deductions decrease the number of your taxable earnings.

When filing your taxes, you need to choose whether you should focus on taking the standard deduction or itemize. If you have a lot of deductible expenses (e.g., business, education, or home office-related), then itemizing is the best solution. The amount of each deductible expense varies. Making sure you can appropriate records to back up your claim is also vital.

Refund-Boosting Tip #4. Optimize Your IRA Contributions

Putting finances in your IRA is an excellent way of building your nest egg and scoring more tax bonuses. Just make sure you open or contribute to a traditional IRA for the previous tax year before the filing deadline. That way, you’ll feel more flexible when claiming the credit on your refund, filing early, and making use of your return for opening the account.

- Traditional IRA contributions can lower your taxable income. You can make the most of the heftiest contribution and, if you’re 50 years old or older, the catch-up provision can add to your IRA.

- Even though contributions to a Roth IRA are not deductible, they are eligible for the Saver’s Credit if you conform to certain income regulations.

- In case you’re self-employed, you must contribute to a specific self-employed retirement plan until October 15th (granted that you file an extension on time). In case you don’t, the usual yearly filing deadline should be the deadline for most contributions.

Refund-Boosting Tip #5. Use Timing to Get More Tax Return

If you keep tabs on your tax calendar, you’ll get another excellent answer to the ‘How to get a bigger tax refund?’ question. Focus on payments you can make within the current tax year for the purpose of reducing your taxable income. For instance, scheduling medical expenses for the last quarter of the year is sure to bolster your medical expense deduction potential. Or, by paying January’s mortgage bill before December 31, you will get the added interest for your mortgage interest deduction.

Printable 1040 Form 656f2839815ba38085013bdd

Best Way to File Taxes Online

Wondering how to get the most back on taxes? First and foremost, make sure you get your taxes out of the way as early as you can, for it’ll guarantee you less stress and a faster tax refund. One of the benefits of filing your taxes online is that there are some top-notch services that walk you through the whole process step by step, PDFLiner being one of them we have a complete guide on how to fill out and file your tax return.

Therefore, when e-filing your taxes, you get to identify any issues quickly and resolve them in the blink of an eye. Furthermore, submitting your tax forms online ensures greater accuracy, saves your money and allows you to receive the refund faster.

Here’s a brief outline of the steps you’ll need to take if you want to effectively e-file your taxes:

- keep tabs on your income;

- save all the needed records and files throughout the year;

- learn which credits and deductions you can claim;

- monitor your deadlines;

- choose the best service for e-filing your taxes.

Bottom Line

As you can see, there are some effective ways to maximize the tax return you receive back from the government. So, when fine-tuning this year’s tax-filing strategy, make sure you optimize your deductions, claims, and credits. Even your filing status makes a significant difference. However, we strongly recommend stick only to legal ways to avoid IRS audit. If you’re serious about the issue, no need to look for some sneaky ways to get more back on taxes.

Focus on finding the best platform for submitting your tax forms online instead. A solid tax service is sure to help you get every deduction and credit you’re eligible for. And it will guide you through the process, so you won’t feel confused as you sort out your refund.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fill Out 1040 Online 656f2839815ba38085013bdd

.png)