-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 1040 in 2024 and Send to the IRS

This guide includes comprehensive information on how to fill out the 1040 form and its main variations. Every adult individual in the US should be acquainted with the relevant information on how to get the 1040 form and fill it out correctly, as it’s an obligatory annual federal tax form.

Read on and save the article to the bookmarks.

Fill Out Form 1040 656f2839815ba38085013bdd

What Is a 1040 Form

Form 1040 (also called the US Individual Tax Return) is designed by the Internal Revenue Service (IRS) to let you report your annual gross income. You have to use it to report the full amount of money you made and to figure out how much of the amount remains taxable after deductions and credits. After completing the form accurately, you will know how much tax you have to pay and the exact size of the refund you will receive.

The form is applicable even if you have multiple sources of income as an independent contractor or a freelancer. For reporting sole proprietorship income, you will have to attach Form 1040 Schedule C to state income or loss from the business.

If you’re an employee, receive income from investments, or qualify for general filing statuses, it’s obligatory to file the form. If you don’t meet any of the statuses, but receive income from self-employment ($400 and more), you must learn how to file the 1040 form.

Fillable Form 1040 656f2839815ba38085013bdd

How to Fill Out a 1040 Form: Short Guide

First of all, you should know how to find form 1040. The latest version is currently available on our website and the official website of the IRS. How to get a copy of a 1040 form? Just download the form once you complete it from this website, and print it, or save it on a cloud.

How to fill out the 1040 form in 2024? You should gather all the tax docs you have first, including:

- 1099 forms;

- W-2 forms;

- Other documents on income and deductions.

Now, you have to enter your valid personal information (name, address, ZIP, etc.), then start reporting your income. If there are not enough lines for additional income sources, use one of the schedules, such as Schedule C for business income, or Schedule E for rental real estate, royalties, or partnership income.

You have to report all income from farming, unemployment compensation, alimony, gains or losses from business property sales, etc. Next, state itemized and standard deductions, calculate your tax liability, and sign the form to verify it.

How to Fill out Form 1040: Complete Guide

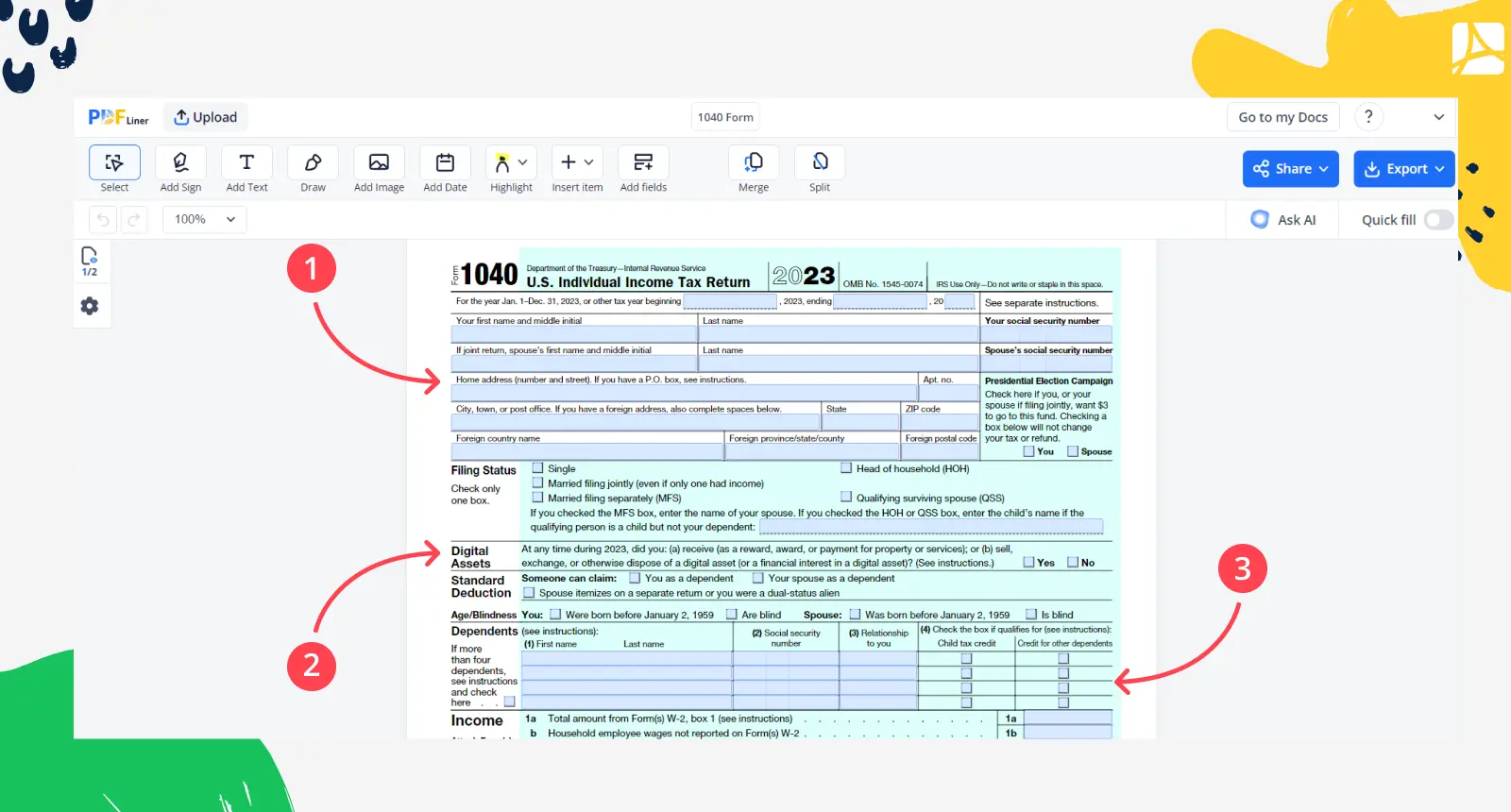

Now, when it comes to the detailed how to fill out 1040 instructions, let’s start with the fact that IRS form 1040 features two pages.

The first page is where you indicate the basic details about yourself, i.e. your name, where you live, SSN, and current filing status. If you’re submitting together with your partner (or have dependents), you will need to include their personal details, too. Furthermore, you will need to confirm that you, your partner, and your kids have full-year healthcare coverage or exemption.

New Section of Form 1040 2023: Digital Assets

In 2022 Tax Return IRS added a section where they ask if you have received or sold any digital assets during the year. Digital assets are any digital valuables that are recorded using Distributed Ledger Technology or any similar cryptography technology. For example, they include cryptocurrencies, such as Bitcoin or Ethereum, NFTs, and stablecoins.

If you answer "Yes" to the question in this section you should use Form 8949 to calculate your capital income and report that gain or loss on Schedule D (Form 1040).

List Your Dependents

In the Dependents block, list all the individuals whom you supported during the year. For example, you children under age 19 or 24 (for students) or your disabled relative.

Enter their names, SSN, and how they are related to you. Also mark if they quilify for a child tax credit or a credit for other dependents.

Fillable 1040 656f2839815ba38085013bdd

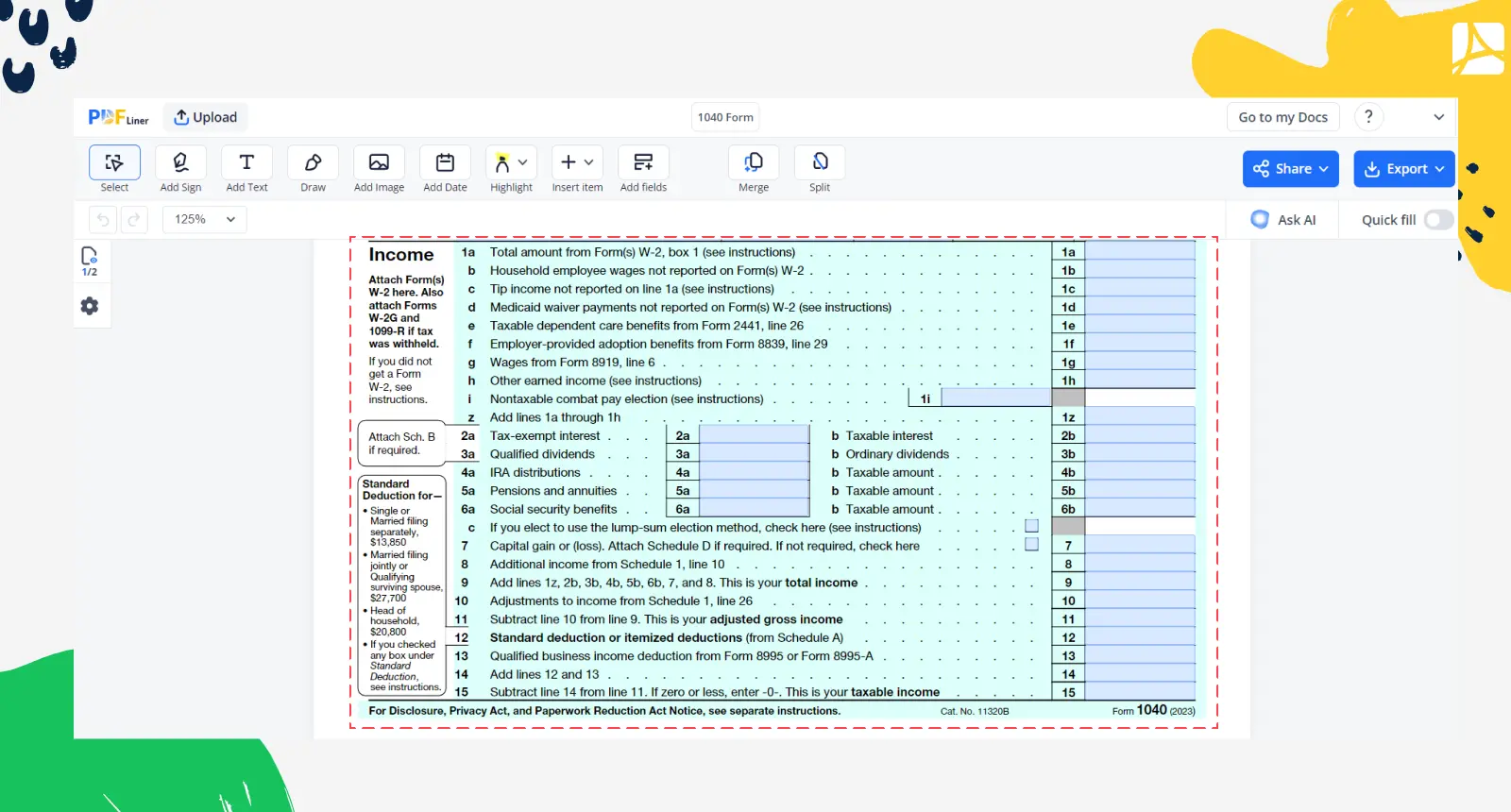

Specify Your Income

Now, let’s switch to the calculations of the 1040 form. From now on, things may get a bit challenging, calculation-wise. The first seven lines revolve around your earnings. If you have form W-2, then you will need to specify your income details from it. Also, attaching all your W-2 forms to form 1040 is a must.

After that, switch to specifying details on any dividends, pensions, IRA distributions, or Social Security benefits. All this important info will aid you in your AGI (adjusted gross income) calculation. The doc’s first page, lines 10 and 11, is all about your AGI.

Switch to AGI Calculation

After you’ve specified all of your earnings, introducing certain modifications is a must. These modifications are also referred to as above-the-line deductions (you have to withdraw them from your total earnings prior to calculating your AGI).

With regard to your AGI, it comes down to the income figure used by the government to figure out how much you owe in income tax.

In order to sort out these modifications, you should add other forms to your simple tax return. Form 1040 used to include a section that allowed filers to go through all of the available above-the-line deductions.

But because not all the taxpayers introduced these modifications, this section was deleted from the main part of the form and divided between Schedules 1 through 3.

Subtract line 10 (adjustments to income) from line 9 (total income) to calculate your AGI and enter the amount into the line 11.

Calculate Taxable Income

When you’ve finished making all the necessary modifications and calculated your AGI, focus on your taxable income. For starters, line 12 should include your standard deduction or the amount of your itemized deductions from Schedule A. In 2022 IRS increased the amount of a standard deduction, chose the one that fits your filing status.

If you’re dealing with a qualified business income deduction, then focus on line 13 of your document’s first page. You can find the amount in Forms 8995 and 8995-A.

To calculate taxable income, subtract line 14 (total deduction) from line 11 (AGI) and enter the amount into the line 15.

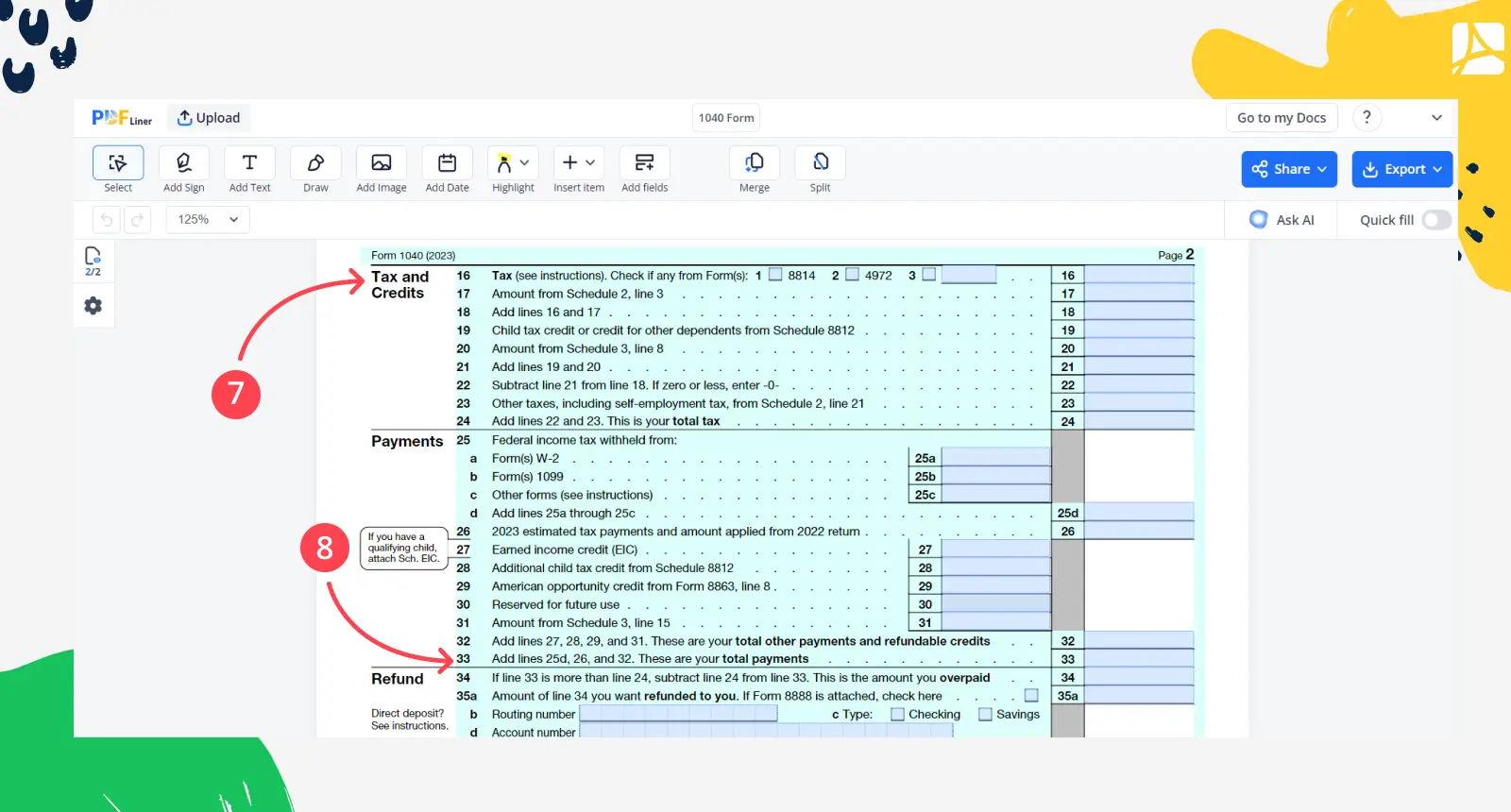

Calculate Your Total Tax

Lines 16 through 24 are a section where you can calculate your total tax. Calculate all your taxes and enter them into the line 16. If you are subject to an alternative minimum tax or excess advance premium tax calculate the amount in the Schedule 2 and enter it into the line 17. Line 19 is all about indicating the amount of your child’s tax credit. In case you’ve paid other taxes, make sure you add Schedule 2 to the 1040 form and enter the amount into the line 23.

Other lines of this block are used for calculation purposes. Calculate total tax in the line 24 by adding lines 22 to line 23.

Figure Out Total Payment

Payments section contains lines 25 through 33 and should be used to calculate your total payment. Line 25 is for entering the amount of the federal tax that’s already been withheld from your earnings shown in the Forms W-2, 1099 or other tax forms. Specify any amoumt of the estimated federal income tax payments you made in 2023 in the line 26. If you have Earned Income Credit, Additional Child Tax Credit or American Opportunity Credit enter it into the lines 27, 28 and 29.

Calculate your total payments in the line 33 by adding the lines 25d, 26 and 32.

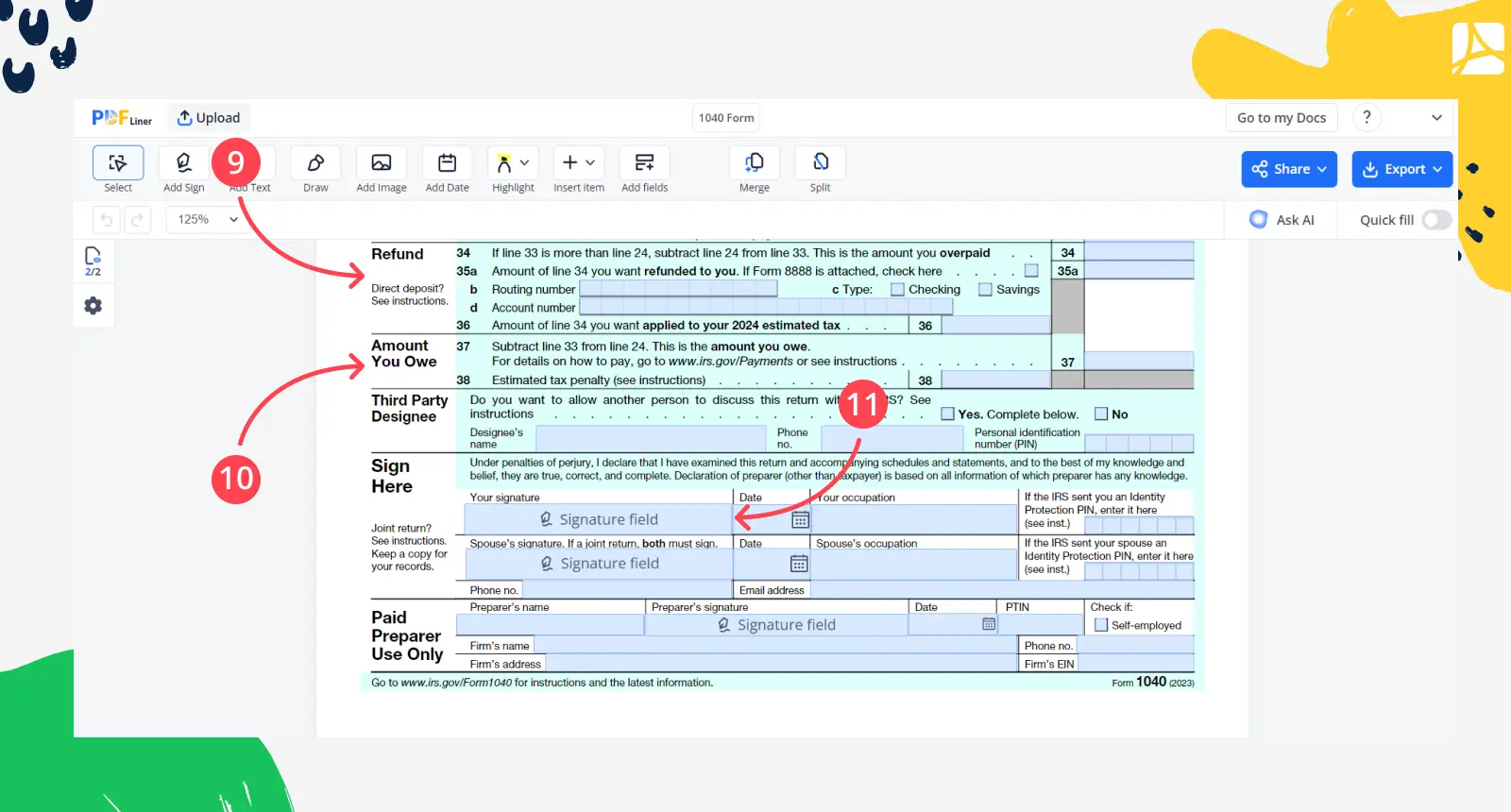

Proceed to the Refund Part

It’s time to switch to the next section of page 2 of your 1040 form, which is all about your refund. In case your total payments (see line 33) exceed the number on line 24 (your total tax), it means that you’ve paid more than necessary and now qualify for a refund. Line 34 is for the amount you’ll get when you subtract line 24 from line 33. Now’s the time to indicate the bank info (the account number) where it’s most convenient for you to receive your refund.

Identify How Much You Owe

If the amount of the taxes you’ve paid (see line nineteen) is less than the amount of the taxes you’ve owed (refer to line sixteen), it means that you owe some money to the government. That’s what the final part of form 1040 is all about. It’s referred to as ‘Amount You Owe'. Use line 37 to indicate the amount you owe. Line 38 is for adding penalties.

Sign Your Tax Return

Finally, the second page of form 1040 should include your signature and the details on what you do for a living. These fields should be filled in once you’ve completed the entire document. You can also send the completed document for signature to the other party.

Don’t forget that if you have doubts as to how to fill out tax return docs, form 1040 in particular, you can always turn for professional help. Remember that if you’re engaged in a form 1040 completion process with a bookkeeper, they also need to reveal their identity (and leave a signature) within the second page of the file.

What Are 1040 Form Variations

If you are interested in how to file the 1040EZ and 1040-A forms, as these two are known as shorter versions of the main tax return. We have to inform you that they are no longer used, and there’s no need to learn how to fill out the 1040EZ anymore.

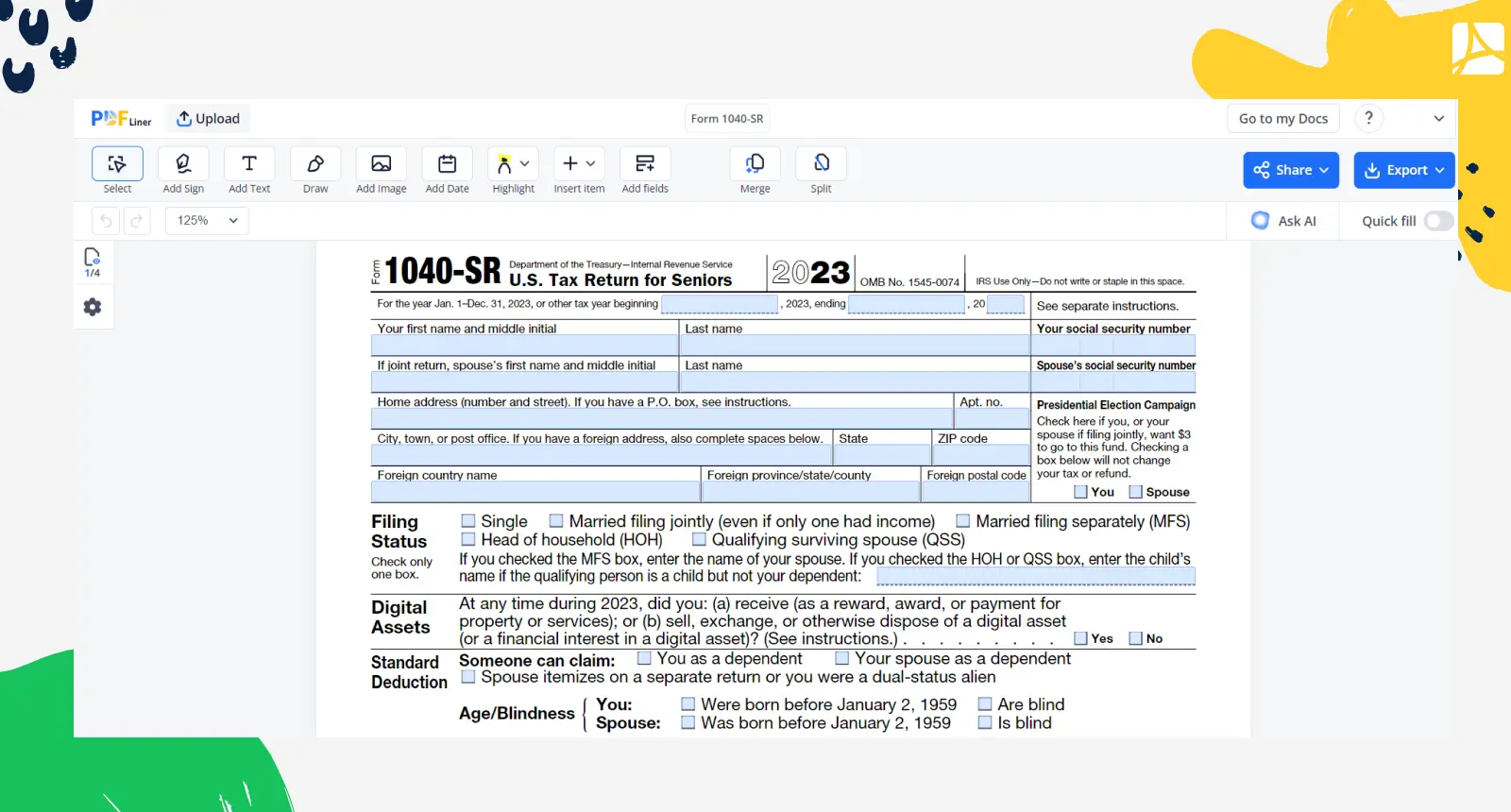

The IRS published a new type of 1040 in 2020, and the 2023 version is similar. It includes all the needed lines for reporting your gross income. At the same time, there’s still a separate version for taxpayers who are 65 years old and older. It’s called Form 1040-SR.

Fillable Form 1040-SR 6596d4d03f949ca16a0e25ca

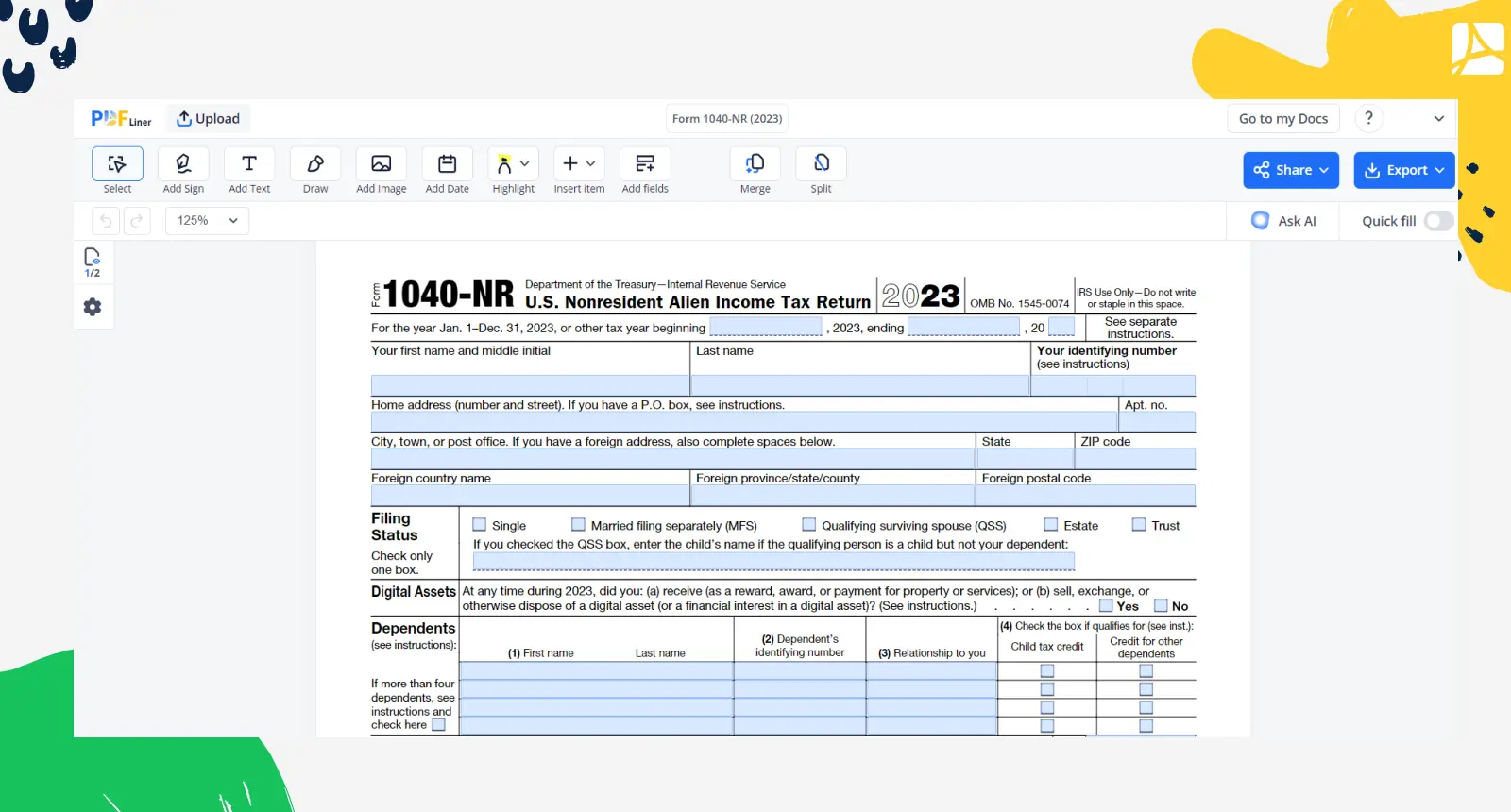

If you’re a nonresident alien who receives income in the US, you have to file 1040-NR. There’s also a variety of possible attachments called Schedules. In 2024, there are 13 active Schedules. Visit the IRS website to get acquainted with each of them if you see that the original form doesn’t cover your reporting needs. There you will also find first-hand information on how to fill out 1040 Schedule C and others.

Fillable Form 1040-NR 65a2731e9817d58d7701c9d5

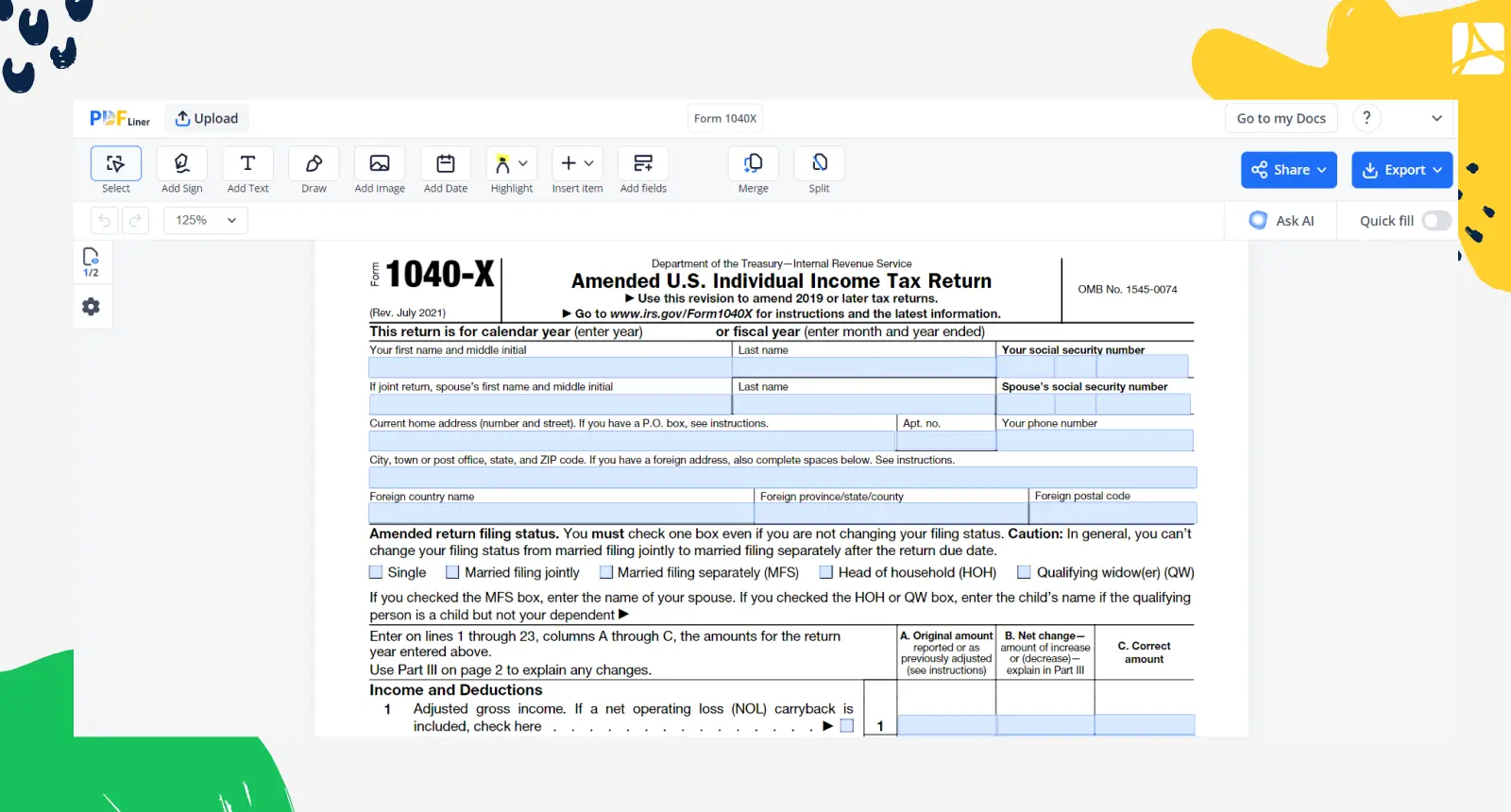

Looking for info on how to fill out 1040-X? You should know that you need this one only if you have to make amendments to one of the active 1040 versions. Currently, the IRS lets you use it for correcting forms 1040, 1040-A (discontinued), 1040-NR, and 1040-SR.

How to file the 1040-X? It must be filed within 3 years after 1040 was timely filed or within 2 years after you paid the tax. It takes around 16 weeks for the IRS to process it. You wouldn’t have questions on how to fill out form 1040-X if you’ve already filed 1040.

Fillable Form 1040-X 65cb6b37911ce9829a00d11a

How to File a 1040 Form

Now that you know how to get 1040 tax forms and how to fill out a 1040 tax form, learn how to file a 1040 form online and offline. You can file it by mail (look for that address on the IRS website), but the preferred way is to file it via email, as it lets you deliver the form to the IRS instantly. This way, you will also get your tax refund much faster.

For adjusted gross income below $ 66,000, use the IRS Free File. In other cases, use websites and software that feel most convenient to you. The 2024 deadline for the form to be filed is April 15. It's important not to miss the deadlinne to avoid being audited by IRS. You can request an extension if needed.

FAQ

How to fill out a 1040 form in 2024?

The 2024 procedure is similar to 2023 and described above. The form itself also includes detailed instructions for each line. Be attentive.

How to find adjusted gross income on the form 1040?

Instructions on how to find AGI on 1040 are quite simple. The current versions of the forms 1040 and 1040-SR include AGI on line 11. To determine the AGI, you have to subtract adjustments to income from your total gross income. As a result, your AGI will be equal to or less than your total income. Don’t forget to set the standard and itemized deductions apart, as AGI doesn’t include them.

How to fill out the 1040 form with W-2?

It’s important to remember how to attach W-2 to 1040 first. If you are mailing the form, you have to attach your W-2 to the front of 1040. If you’re filing online, you have to put order numbers on each page to have the document saved with pages in the right order. You will receive a filled W-2 from your employer. You have the right to request it if it’s not sent to you timely. Use the data from your W-2 to fill out your tax return.

How to get my 1040 online?

You can download the latest official version of this IRS form directly from our website, or fill it out online and download or print the complete form to mail it to the IRS or add a copy to your archive.

How to get a 1040 Form from the IRS?

You can download the most recent version of the form not only on our website but on the official website of the IRS as well. There’s no difference, but it’s up to you to choose the source.

How to find income tax on 1040?

In 2024 tax return form, the income tax should be calculated in the line 24. In order to do this, add lines 22 and 23.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable Form 1040 Online 656f2839815ba38085013bdd

.png)