-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get a W-9 Form Online in 1 Minute

.png)

Dmytro Serhiiev

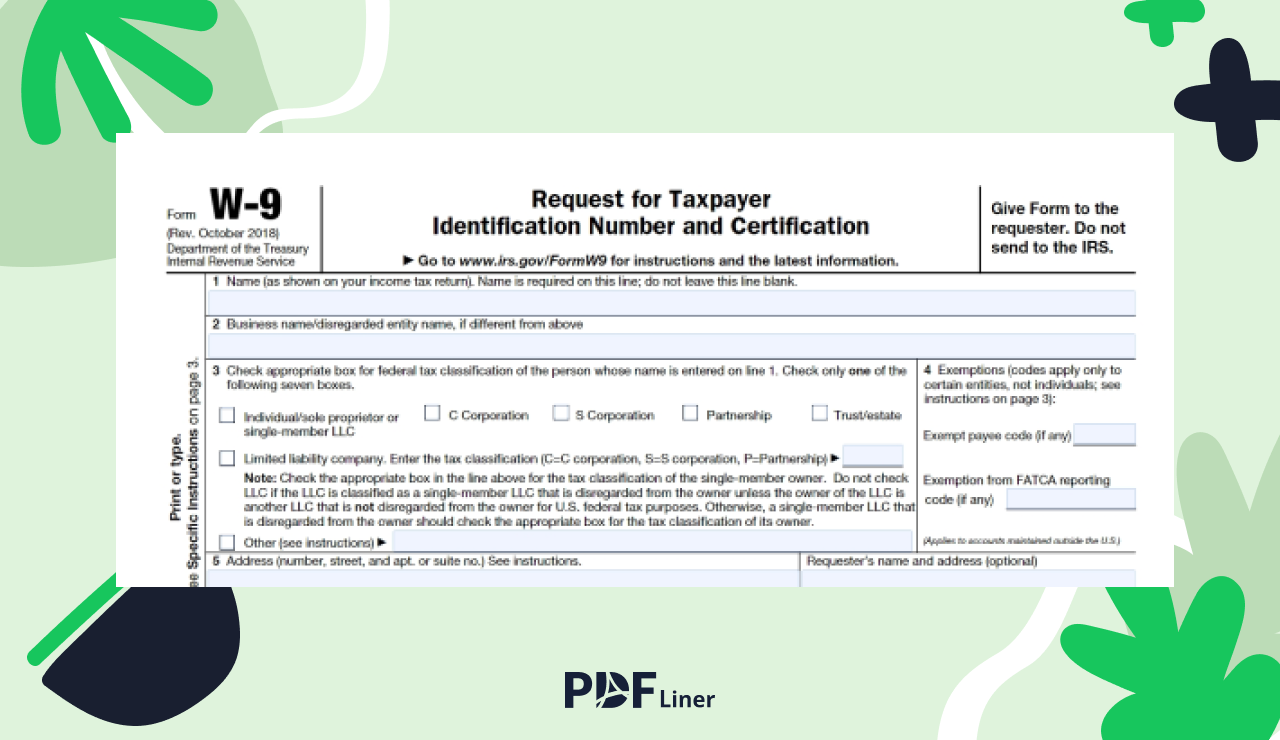

Another name for the W-9 form is a Request for Taxpayer Identification Number (TIN) and Certification. This document can be requested for employment or other income-generating goals. You can fill this form if you are either a U.S. citizen or resident alien. Some people think they need to apply for a W-9 form. However, there are two effortless ways to get it.

Get W-9 Online 65f013686d1834a70e07c82d

2 Simple Ways to Get a W-9 Form

For Business Owners

“How do I obtain a W-9 form?” – nowadays, you don’t need to go anywhere to get a document you require to send to the company further. You can also fill it out in online with easy instruments. The Form W-9 was created by the IRS – therefore, the first way you can get this document is to download it from the IRS official website.

Another way to get a W-9 form is to fill it out on the PDFLiner site. This multifunctional platform offers mostly all the possible PDF forms. What is more, you can fill them in the PDFLiner editor. It also allows you to sign the form you need online and send it to the company. Also, you can give access to the document to other users.

For Independant Contractors and Freelancers

If you've recently finished a job worth $600 and more your client will need to fill out a 1099 form. To complete it they will need your TIN. W-9 is the only legal way to request such tax information. Your client will most likey send you a fillable form or a link to the form that you'll need to fill out and send them back.

In case they didn't send you the form and just reqested it from you the methods would be the same as for business owners. Look for the free fillable W-9 at the IRS website or fill it out, send and store it as template here at PDFLiner.

Though the W-9 form is uncomplicated to fill out, it still requires some attention to detail. If you want to know how to fill out the W-9 form, PDFLiner offers a comprehensive step-by-step guide on this theme.

FAQ

If you wonder who needs to complete a W-9, you will find the answer here.

What is Form W-9?

The W-9 form is a Request for Taxpayer Identification Number (TIN) and Certification. You may need it when you get employment or in some other income-generating cases.

Who gets a W-9?

U.S. citizens can fill in the IRS form W-9. It is created for employers and other entities.

Who needs to fill out a W-9?

In most cases, the entity asks for the W-9 if you become employed or start a business.

Do I have to pay taxes if I fill out a W-9?

It depends on the type of company you give the W-9 form to. This document is usually used to create a version of the 1099 form.

Where can I get a W-9 form?

You may download it either on the IRS website or the PDFLiner platform.