-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Form 990-EZ

.png)

Dmytro Serhiiev

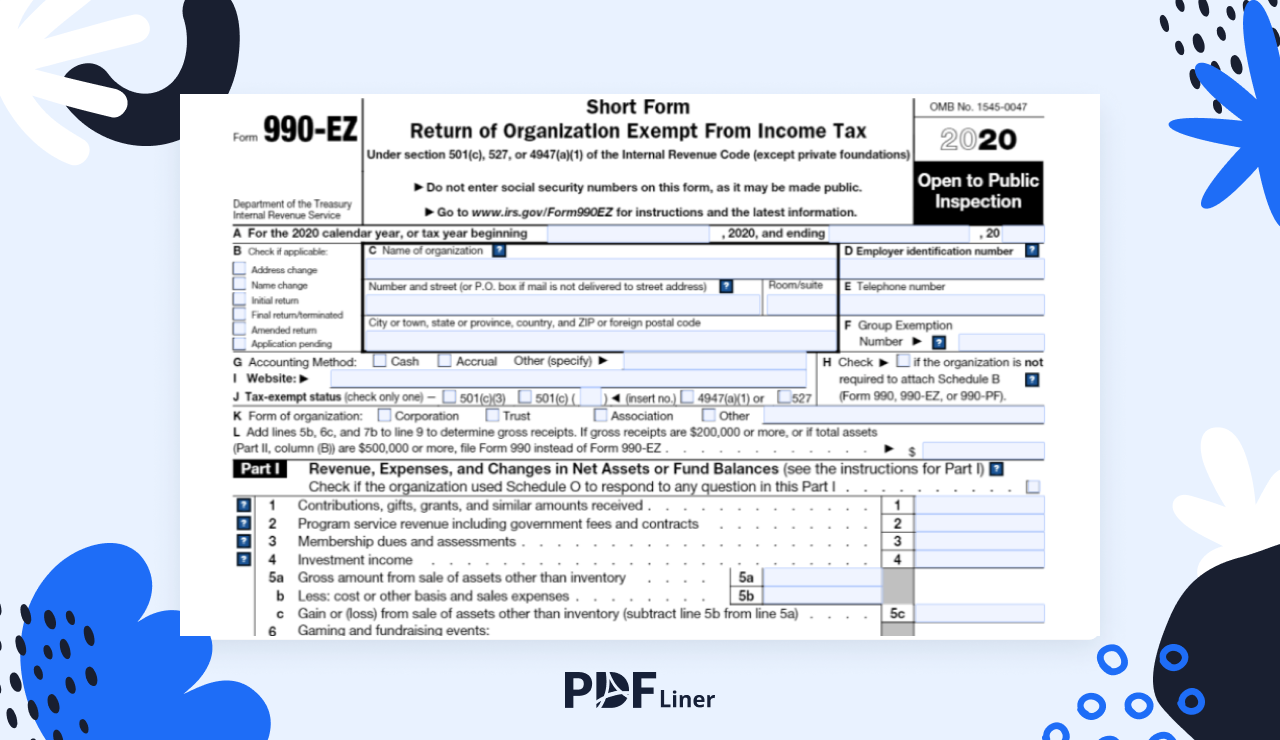

Form 990-EZ is a tax return form for nonprofit organizations. Though they are not supposed to actually pay taxes, they still file out their returns to prove transparency. This form is meant to inform the IRS about the financial, as well as political, and social activities of the organization.

What Is Form 990-EZ

IRS tax Form 990-EZ is a simplified form of the original Form 990. It is to be filled and filed out by nonprofits and tax-exempt organizations to provide financial details of their operations to the IRS. What makes Form 990-EZ even more important is that the details you share in it must be made available to the public, along with all related documents that prove or specify the numbers.

If your organization is one, you may wonder how to get Form 990-EZ for the current or previous year. You may find one of the PDFLiner, ready to be filled and filed out.

Who Can File Form 990-EZ

This form is meant for nonprofits or tax-exempt organizations. If your organization is not meant for making profits and does not act to make any, you can (and need to) file it.

In-person, it should be signed and filed by an officer of the organization (not necessarily the head, but someone whose position and responsibilities allow for this). In this case, this person’s e-signature is valid. It can also be filled by a paid preparer. If so, there is a special section for the paid preparer at the bottom of Page 4.

How to Fill Out Form 990-EZ

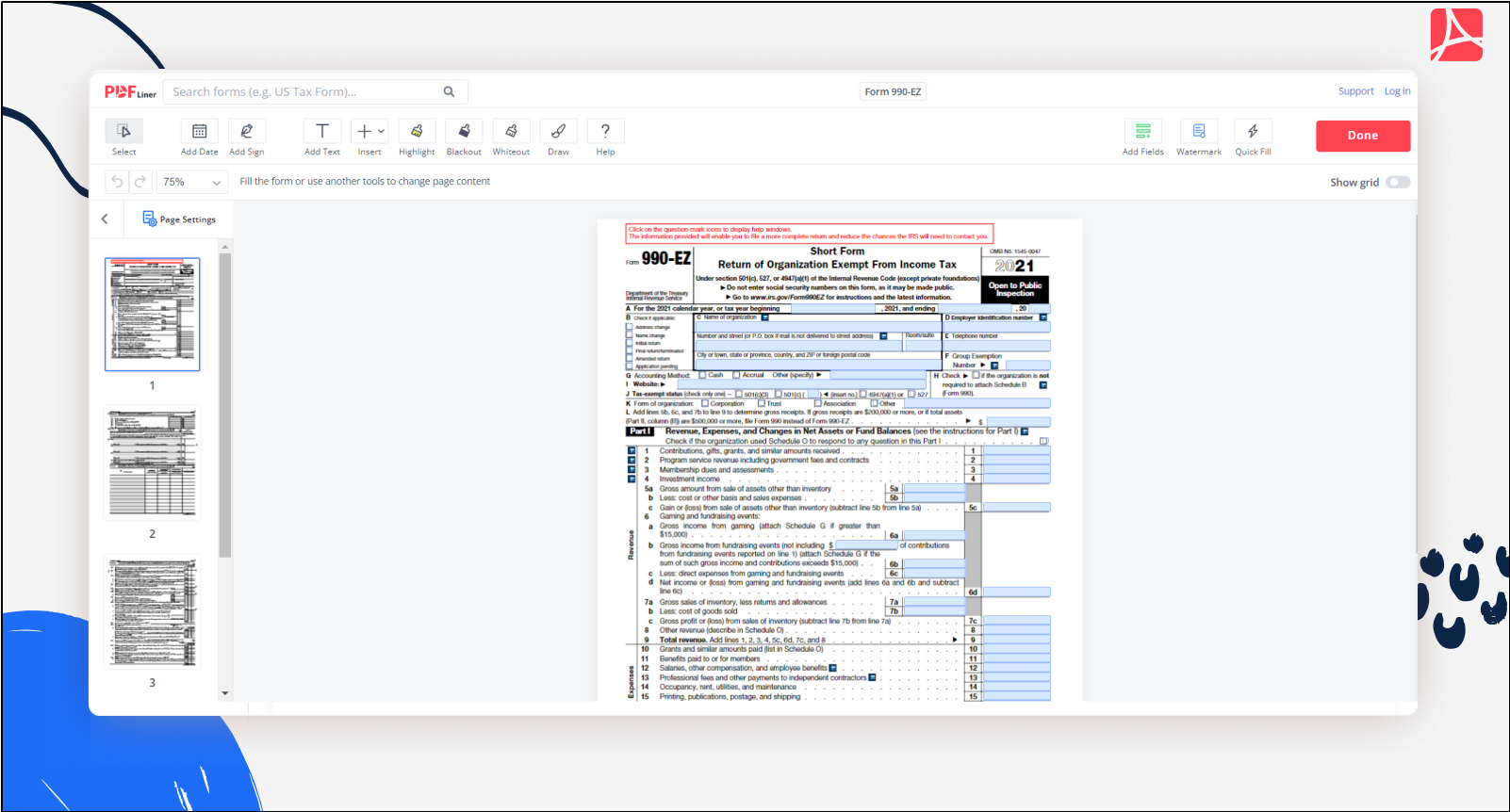

990-EZ requirements include access to the public. So, unlike other forms, it includes details that may interest mass media and other organizations as well as the IRS. It’s a four-page form, so let’s go from page to page. Skipping the most obvious lines, we’ll focus on potential problems.

Page 1

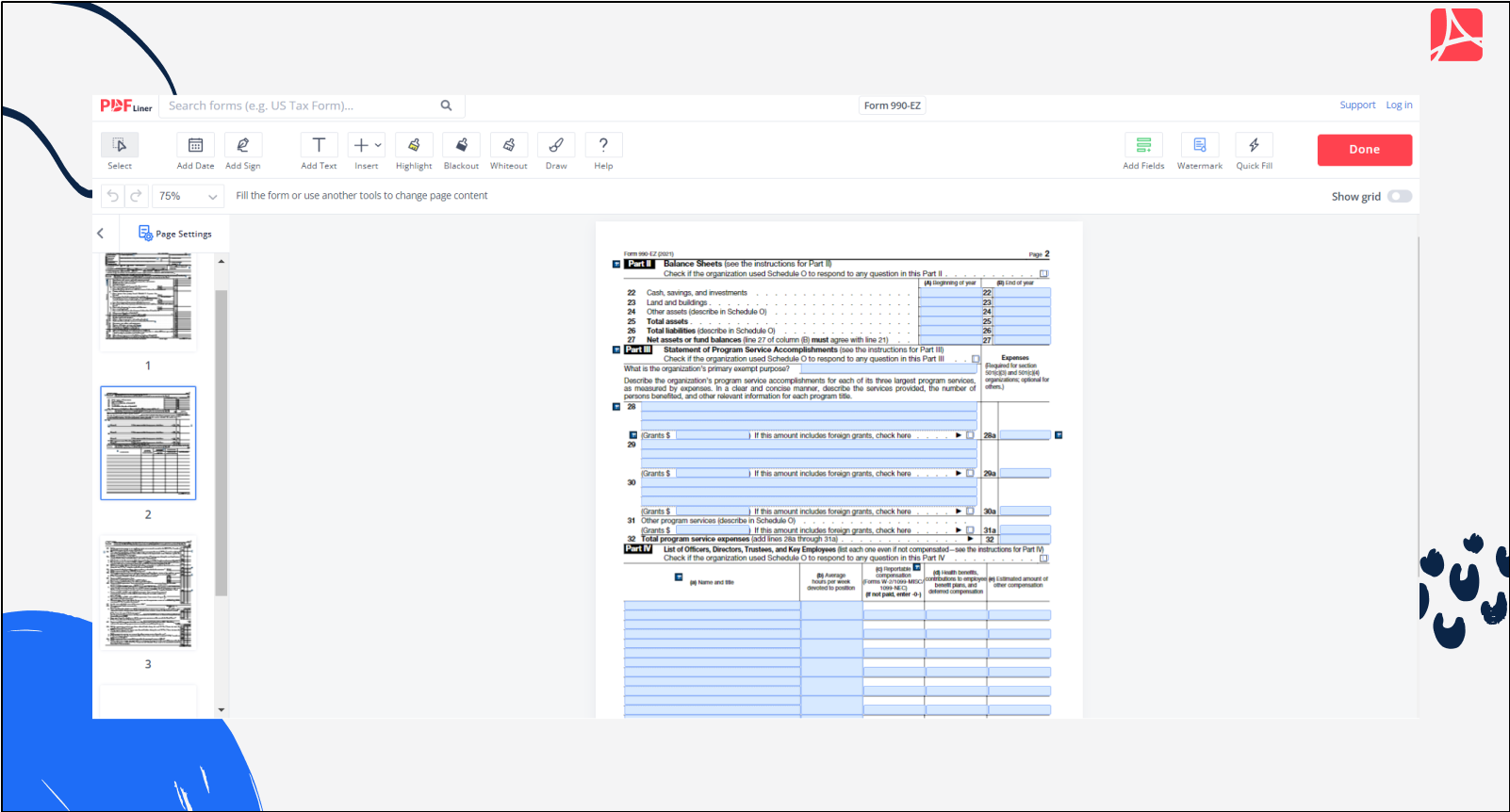

Page 2

1. In Box A, specify the year to which this form applies, not the current date.

2. In Box B, specify which of the organization’s requisites have changed since the last return.

3. In Box F, type in the 4-digit group exemption number for your organization if it has one.

4. In Box G, select your accounting method and apply it throughout the form and the schedules.

5. Don’t hurry to fill Box L. First, calculate your gross receipts.

6. In Part I, the lines are quite self-explanatory. If there are non-listed revenues or expenses, use Schedule O to list and describe them.

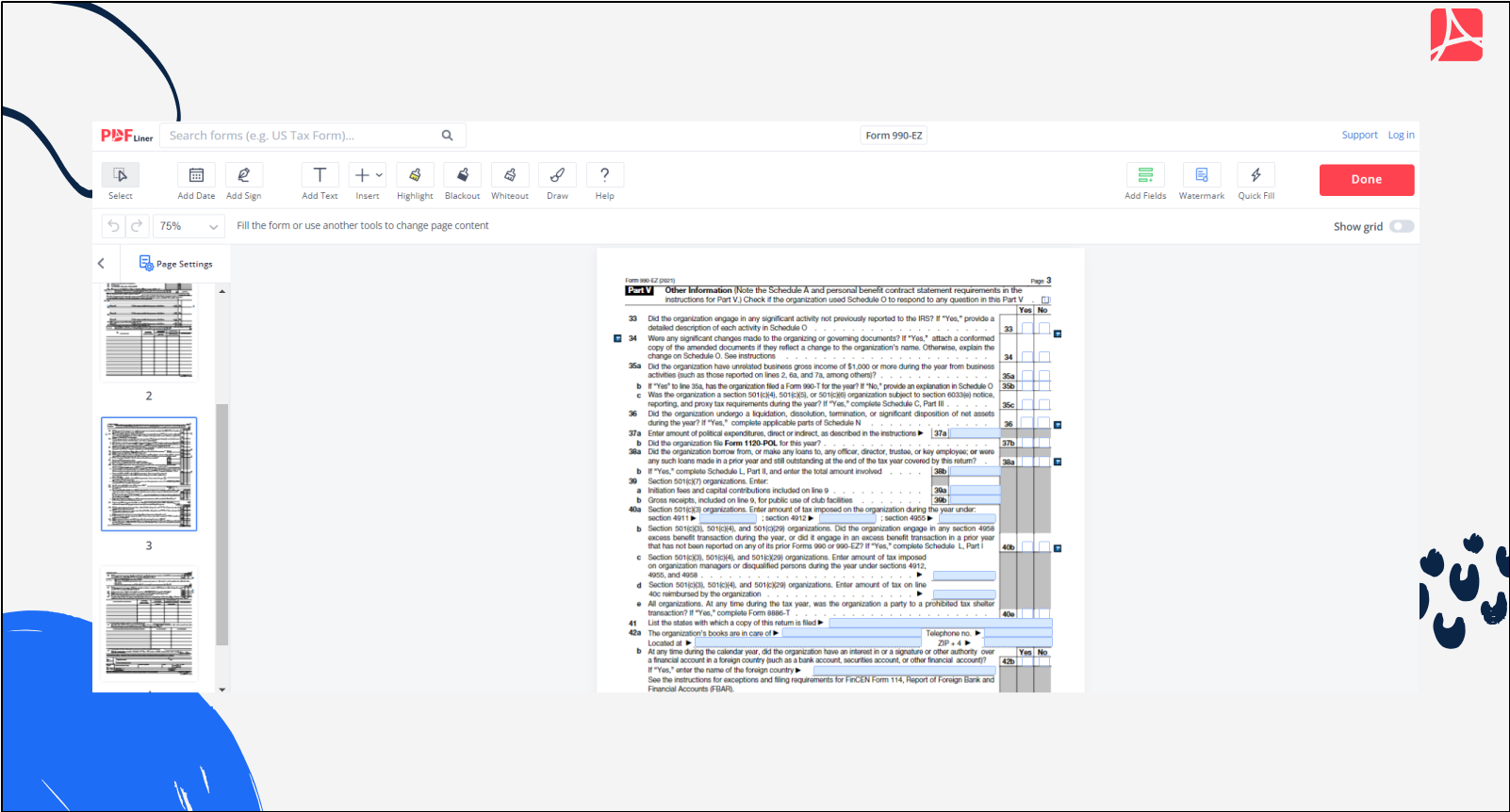

Page 3

This page mostly consists of questions with definite answers. Each “yes” would require an explanation in your Schedule O. It may also need Schedule L if it applies.

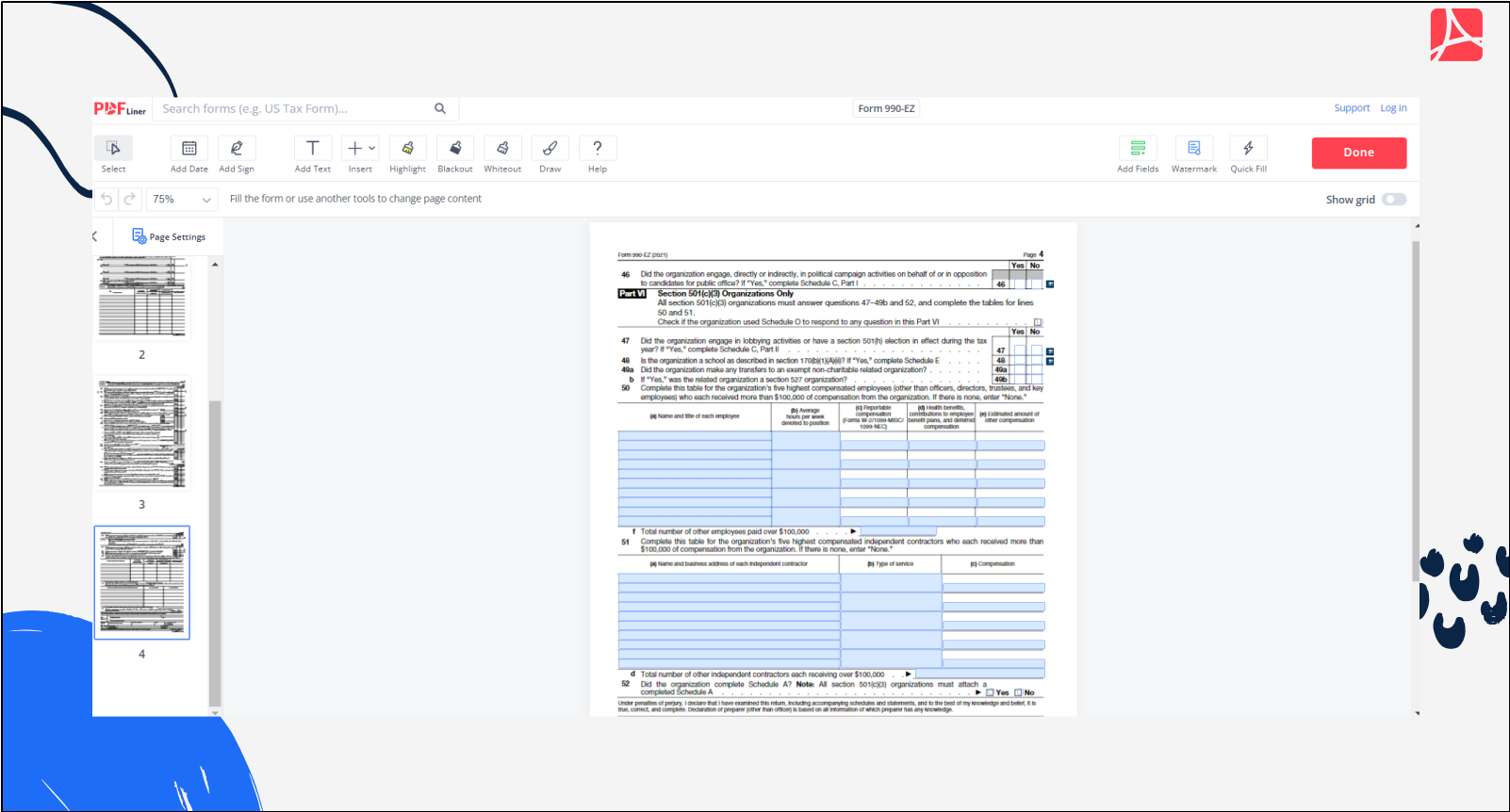

Page 4

1. Only fill Part VI if your organization is section 501(c)(3) – that is, purely religious, educational, scientific, charitable, supporting amateur sports, preventing cruelty, or testing for public safety.

2. Complete Lines 50 and 51 only if there have been employees or contractors who received over $100,000 over the year.

Schedules

The schedules mentioned in Form 990-EZ itself require more explanations than calculations. When filling them, you must be aware that they may be read by the public (and if your organization is popular, they will be read). So try to write your comments as comprehensively as possible and avoid ambiguities.

Along with the most mentioned Schedule O and Schedule L, there are six more schedules:

- Schedule A, Public Charity Status and Public Support

- Schedule B, Schedule of Contributors

- Schedule C, Political Campaign and Lobbying Activities

- Schedule E, Schools

- Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities

- Schedule N, Liquidation, Termination, Dissolution, or Significant Disposition of Assets

You only need to attach those that apply to your organization’s activities.

If you have any more questions about how to fill out form 990-EZ, on PDFliner you can find more detailed instructions integrated into the form. Just click on “?” signs throughout the form to see Form 990-EZ instructions for this specific line or box.

Fill Out 990-EZ Form 663cc4d84dfddd213d0f67c7

How to File Form 990-EZ

When it’s filled, where to file 990 EZ? If you do it on paper, you need to file it to the Internal Revenue Service Center, Ogden, no later than May 15 of the next financial year. But if you do it on PDFliner, all you have to do is sign and file it.

To sign your PDFliner version of the document, use the “Add Sign” feature that can be found in the left of the menu above the document.

FAQ

When is 990-EZ due?

In general, organizations need to efile 990-EZ before the 15th day of the 5th month of the next calendar year. It may shift a little; say, 990-EZ for 2020 was due to May 17, 2021. Form 990, 990-EZ, or 990-PF must be filed by the 15th day of the 5th month after the end of your organization's accounting period. Thus, for a calendar year taxpayer, Form 990, 990-EZ, or 990-PF is due May 15 of the following year.

Can Form 990-EZ be e-filed?

Of course, it can! If you do it on PDFLiner, it only takes an e-signature (though it would anyway) and a “Send” button. The required IRS email is already written in the requisites.

Where to mail Form 990-EZ?

On the IRS site, you are offered to use it in the web editor, so the filled form is automatically sent when submitted. The email is not exposed, thus. When you do it on PDFLiner, the result is the same, but you might find it more convenient for you.

What is the difference between 990-EZ and 990-N?

The letters “EZ” are for “easy”. Nevertheless, the “N” form is easier. 990-N is meant for organizations whose annual gross receipt is under $50,000, and it’s only available on the IRS site as an e-postcard. Filing 990-EZ is required for organizations whose annual gross receipt is between $50,000 and $200,000, and it can be done in other ways.

Go Paperless with PDFLiner

Fill out, edit, sign and share any document online and save the planet