-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get a 990-EZ Fillable PDF

.png)

Dmytro Serhiiev

If you are responsible for tax returns in your nonprofit or tax-exempt organization, you need to deal with the non-profit tax form 990-EZ. This form is to be filed once a year, and, unlike other forms, it can be made public. Given that it doesn’t necessarily remain between your organization and the IRS, it deserves more attention than similar forms for commercial organizations or self-employed individuals.

How to Get a 990-EZ Form

There are two ways how to get a 990-EZ form for your organization.

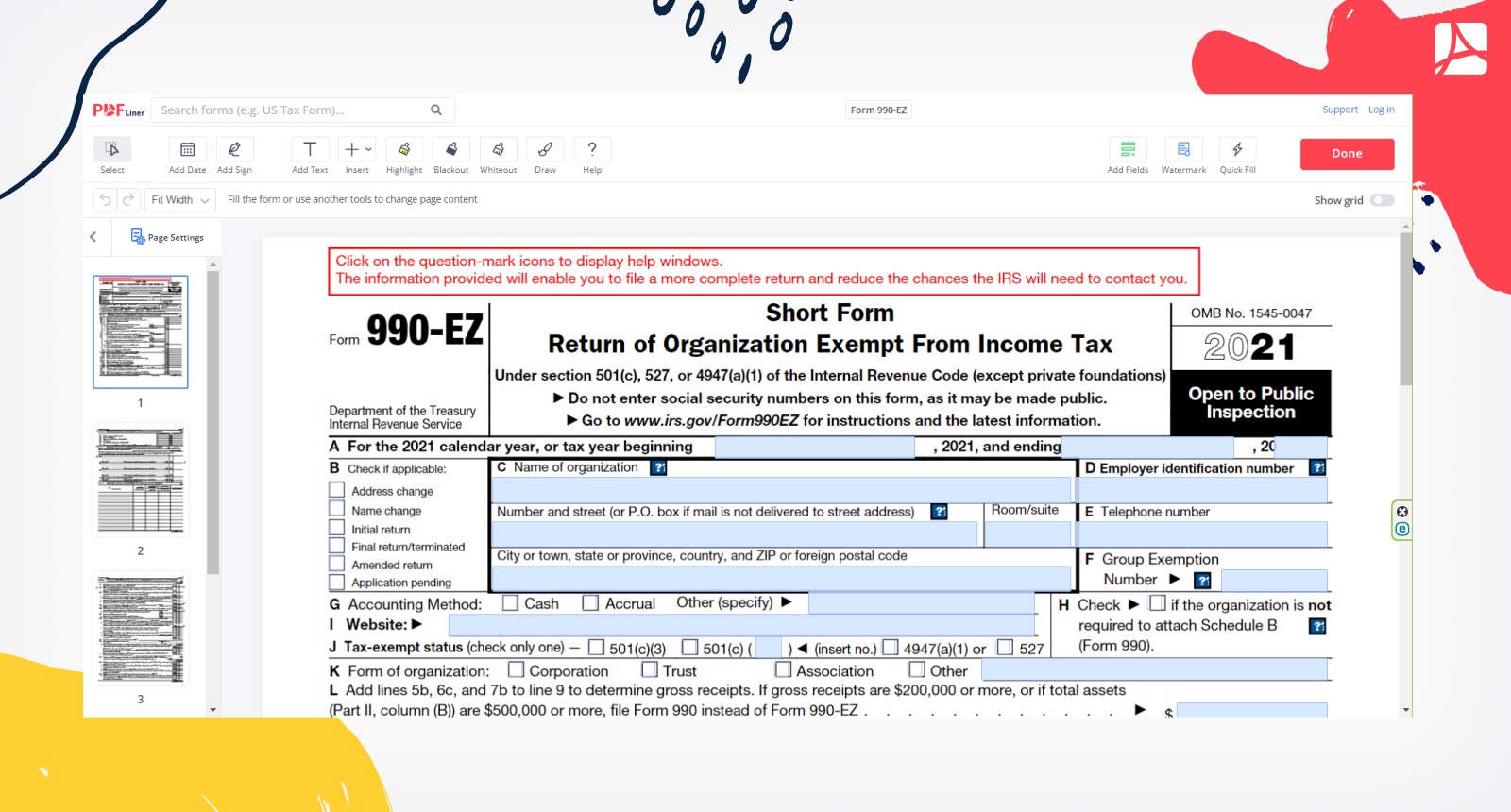

Get it on PDFliner

The advantage of this method is that you can easily fill out, sign, and file a 990-EZ form from the web editor. Along with the form itself, there are instructions on where and when to file 990-EZ, how to fill out the most problematic lines and boxes, and what to pay attention to.

Form 990-EZ 663cc4d84dfddd213d0f67c7

Get it on the IRS official site

The advantage is that it’s always the freshest. But the official instructions by IRS are often too detailed and almost unreadable. In addition, you need to download the PDF file, fill it, and then file it.

Along with separate instructions on how to fill out a 990-EZ, there are built-in tips and hints in the online version of the form on PDFliner. So this way is less official but more efficient.

FAQ

What is Form 990-EZ?

It’s a form that describes the financial affairs of nonprofit or tax-exempt organizations. The 990-EZ tax form is a bit simplified 990, EZ being for “easy”.

Who can file 990-EZ?

This form is meant for nonprofits and tax-exempt organizations whose gross receipt during the year is between $50,000 and $200,000, and total assets are less than $500,000. If the receipt goes beyond 990 EZ requirements, the organization needs 990-N (if below) or 990 (if above).

Can I file 990-EZ online?

Yes, you can. PDFliner has all the necessary tools to fill out, sign, and file Form 990-EZ online, as well as all the necessary schedules.

What happens if I don't file my 990-EZ?

If your organization fails to file its 990-EZ (or another sort of 990, if the gross receipt of your organization varies) for three years in a row, it will lose its tax-exempt status. Don’t forget that for many nonprofits their 990-EZ is the only source of information for the public as well as for the IRS.

Go Paperless with PDFLiner

Fill out, edit, sign and share any document online and save the planet