-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Schedule K-1 Form 1065 for Beginners

.png)

Dmytro Serhiiev

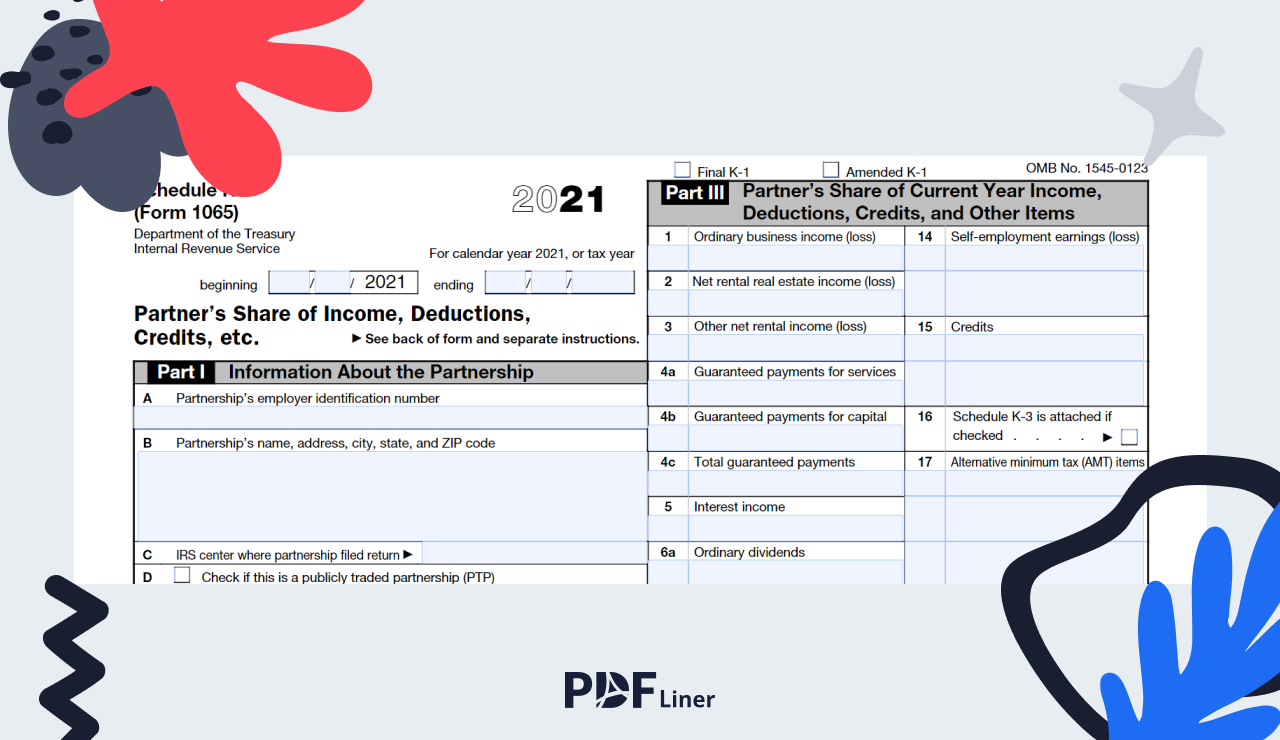

Looking for how to fill out Schedule K-1? K-1 is a part of Form 1065. It provides information about the share of partnership income, any credits, and deductions. The IRS requires a copy of the document sent to them annually. Form 1065 is also known as the document on US Return of Partnership Income.

What Is a Schedule K-1

The form was created by the IRS to get the information about your taxes. The IRS Schedule K-1 Form 1065 provides the information for the investment in the interests of the partnership. It reports the partner’s share in the business, including the losses, earnings, credits, and deductions. Each partner files a K-1 tax form separately. It has a similar purpose with Form 1099 that informs the IRS about interest or dividends from the securities or sale of securities income. It is widely used by S corporations’ shareholders. Companies that have less than 100 stockholders can use K-1 to report the earnings.

The partnership is usually out of the income tax policy, but individual and limited partners can be taxed on their own share. The schedule is part of IRS 1065 forms, on the return of income from the partnership. If you want to know more about how to get Form 1065 and complete it easily, you can read the detailed guide in another article on our blog.

Who Should File Schedule K-1 (Form 1065)

Many taxpayers struggle with questions of how to understand the K-1 form and who can file it. The US tax code allows pass-through taxation, shifting liability from the partnership or other entity to individuals interested in it. Schedule K-1 can be filled by all partners of the business. Filling the form allows the partnership to regulate the share in the business, calculate the income and spending. The information is sent together with Form 1065 by individuals.

Basically, you should learn how to file Schedule K-1 if you are:

- Part of the partnership;

- Included in the limited partnership;

- Part of the LLC that decided to be taxed as a partnership;

- Included in the limited liability partnership;

- Part of S Corporation’s shareholders with less than 100 stockholders all taxed as partnerships.

How to Fill Out Schedule K-1 (Form 1065)

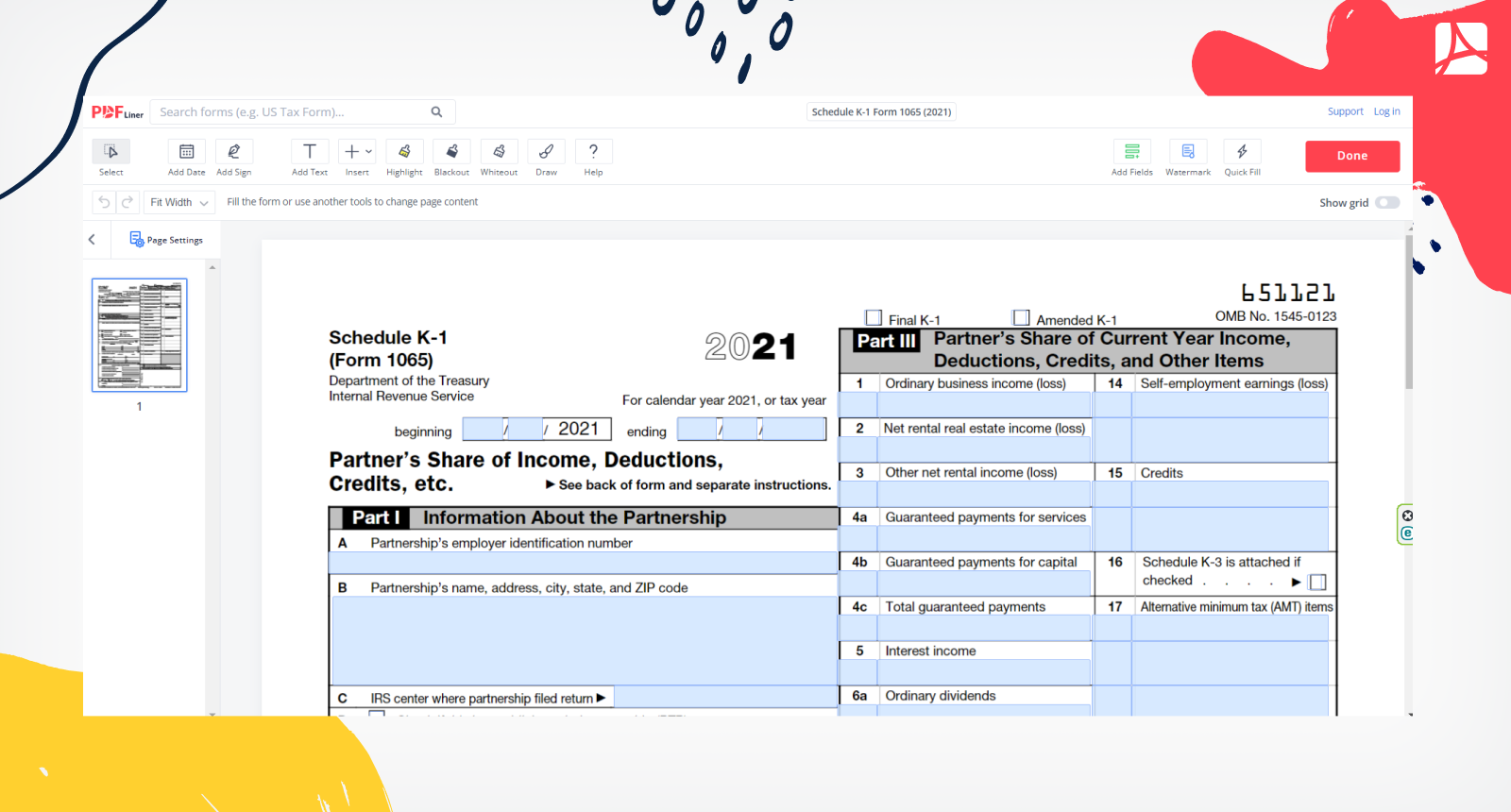

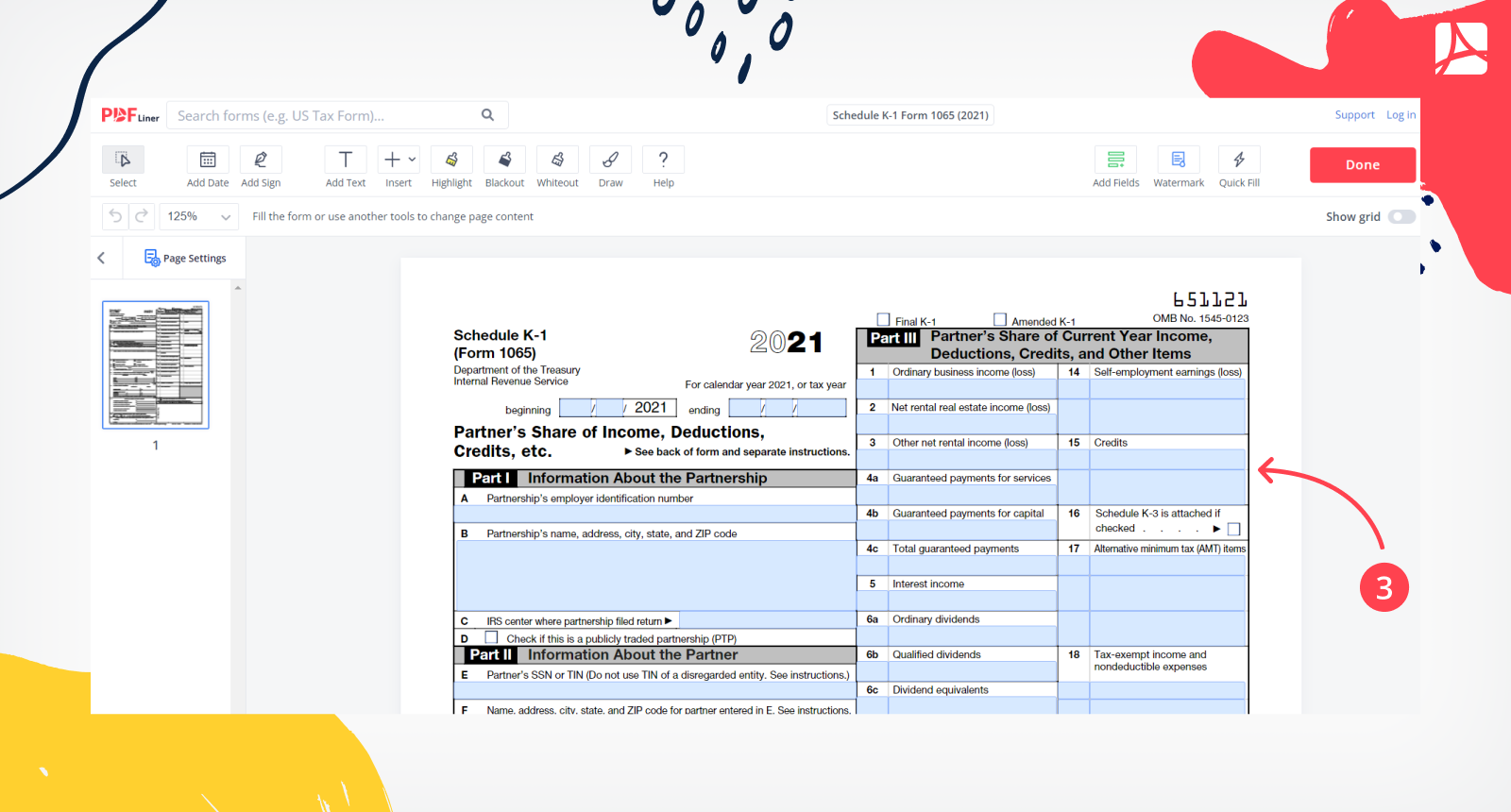

To complete the document quickly, follow Schedule K-1 Form 1065 instructions. You can either search for the form on the IRS website or open it in one simple move here, on PDFLiner. There are numerous advantages PDFLiner provides, including quick access to the form, a detailed guide, and an ability to create e-signature in several easy moves. No matter which option you choose, you have to provide the next data in this 1-page document:

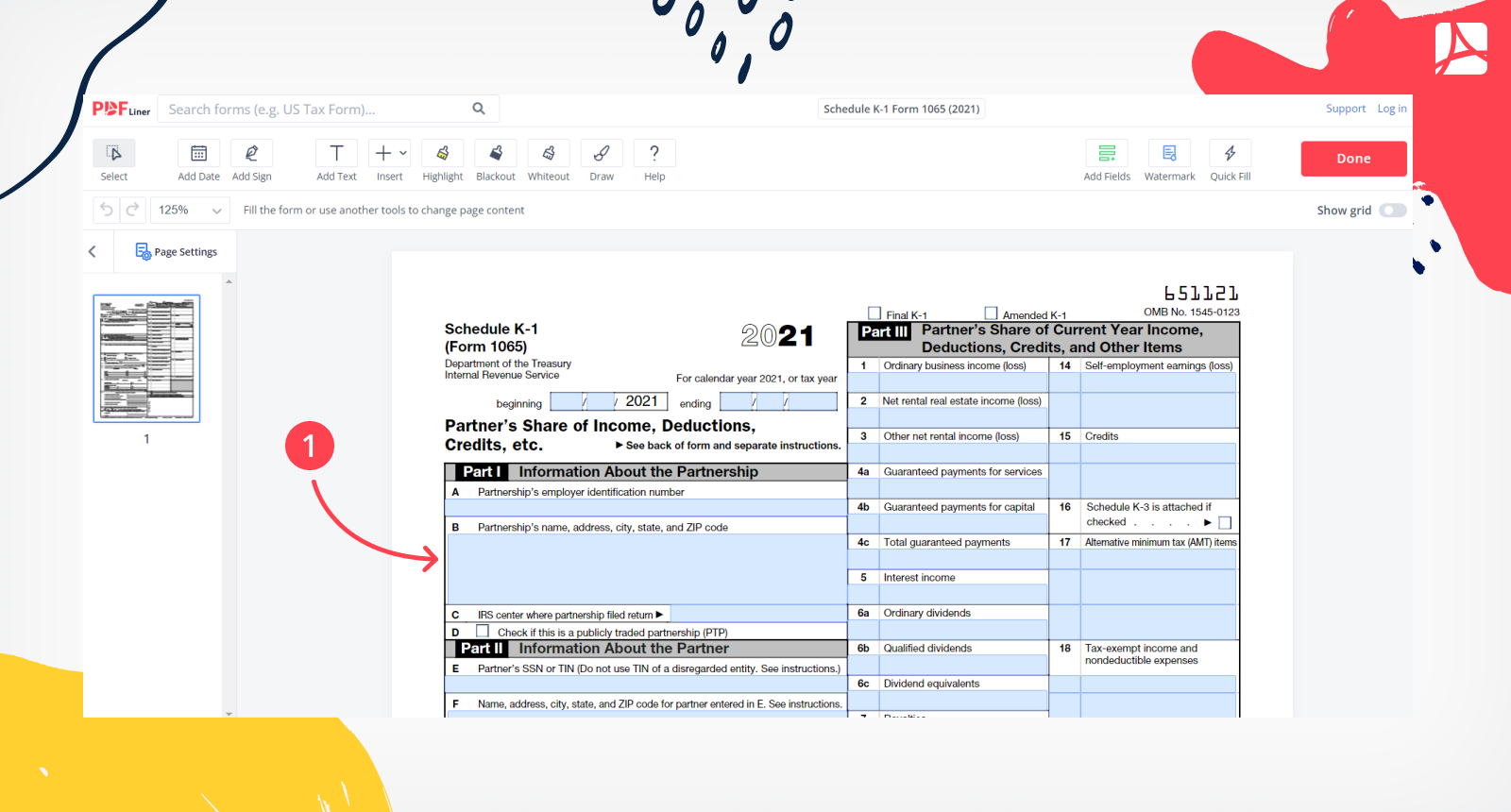

Step 1: Fill Part 1 with information about your partnership. It must include the employer’s ID number, partnership’s name, address, ZIP code, and IRS center with the return filed. You have to put the tick in the box D if you have the PTP;

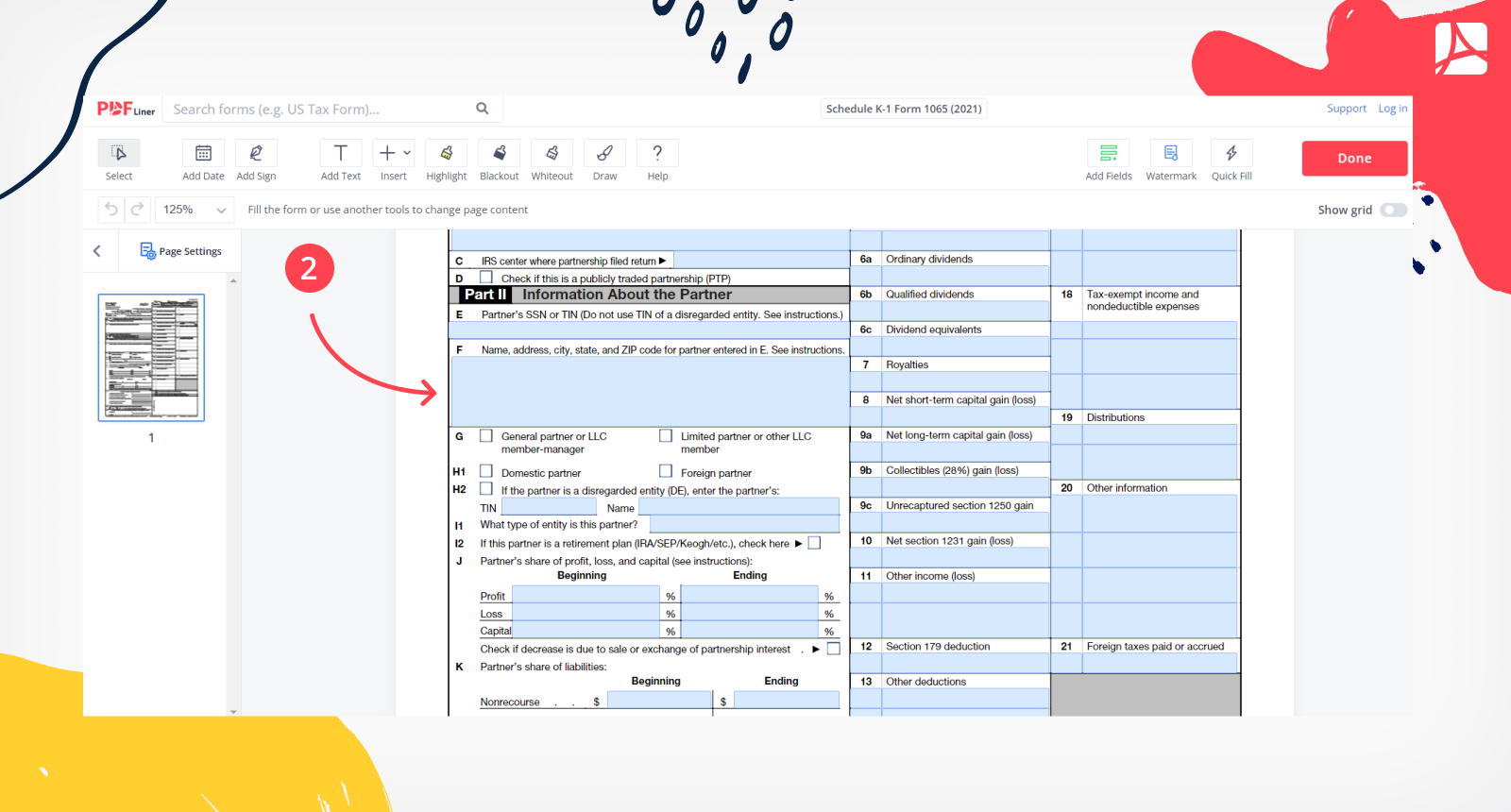

Step 2: Part 2 is about the partner. Include the SSN or TIN of the partner, name, and address. Pick your specific case and type of entity. Write down the partner’s share of profit, loss, and capital in the beginning and in the end. Include the partner’s share of liabilities and capital account analysis with the beginning capital account, the one that is contributed during the year, net income or loss for the year, and ending capital.

Put a tick in the box about the state of the contributed property. In section N, include the information on the share of net unrecognized section 704 gain or loss. Write down the numbers at the beginning and the ending;

Step 3: Part 3 is about the share of the partner of the current year's deductions, income, and credits. Include the information on the ordinary business income or loss, net rental real estate income/loss, and rental income/loss. Write down a guaranteed payment for capital and services and totally guaranteed payments. Include the interest income and information about the dividends, calculated royalties, net long and short term gain, collectibles, side income, deductions, earnings as self-employed, credits, and distributions;

Step 4: Leave the last section clear. It is intended for the IRS officials only.

If you are not sure how to fill the form, you can check the Schedule K-1 example. There are also instructions provided in the form. At the beginning of the form, including the calendar year, PDFLiner provides Form 1065 Schedule K-1 instructions that are clear and understandable. If you have doubts about the information you need to include, learn the recommendations and double-check the data that you write down.

Make sure all the numbers are correct. If you put some numbers incorrectly, usually the IRS notices it and sends the form back. If you notice it once you send the form, contact the IRS.

Fill Out Schedule K-1 657c2fc091734e26ef01a06e

How to File Schedule K-1 (Form 1065)

There is a K-1 deadline. The Schedule is usually filed together with Form 1065 until March 15. There is an exception to this rule. You may use Form 7004 and ask for an extension of the date. In this case, the IRS may grant you a 6-month delay. Meanwhile, March 15 is the deadline for the partnership to send Schedule K-1 to every partner in it. After that, partners may start filing a personal return. They will have 1 month for it.

Once the Schedule is filled, you have to attach it to Form 1065. You don’t need to send the paper version of it. If you use PDFLiner, there’s no need to download the form to complete it. Fill it with all the information you want to provide, double-check everything, and send it to the IRS online.

FAQ

Read the most popular questions about Schedule K-1. You might find the information helpful.

When are Schedule K-1 dues?

Schedule K-1 must be filled due to March 15. You should attach it to Form 1065. If you need more time, contact the IRS for a 6-month delay.

Where to file Schedule K-1?

You have to file the Schedule K-1 to the IRS. The easiest way is to submit the form electronically to the service, using their Free File program. Yet, you can file the form in an old-fashioned way, using standard mail. In this case, you have to find the address of the closest IRS department to you. Check out the official website for this data.

How to read a Schedule K-1?

There is a detailed guide on Schedule K-1 above. You can use it to fill the form step-by-step. Open the form in PDFLiner to see all the sections you need to complete highlighted. The document is understandable and clear. The instructions are provided here as well as on the IRS website.

Can I file my taxes without my K-1?

Yes, you can file the taxes without the K-1 form. Moreover, Schedule K-1 is helpful to a limited number of people. If you don’t have to file Form 1065, you don’t need to fill the attachment.

How is K-1 income taxed?

You have to provide information on your trusts, estates, earnings, and losses. The tax is calculated based on this data and the information from the 1065 form. The Schedule is filled by each partner on their income individually.

Go Paperless with PDFLiner

Fill out, edit, sign and share any document online and save the planet

Schedule K-1 Form 1065 657c2fc091734e26ef01a06e