-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

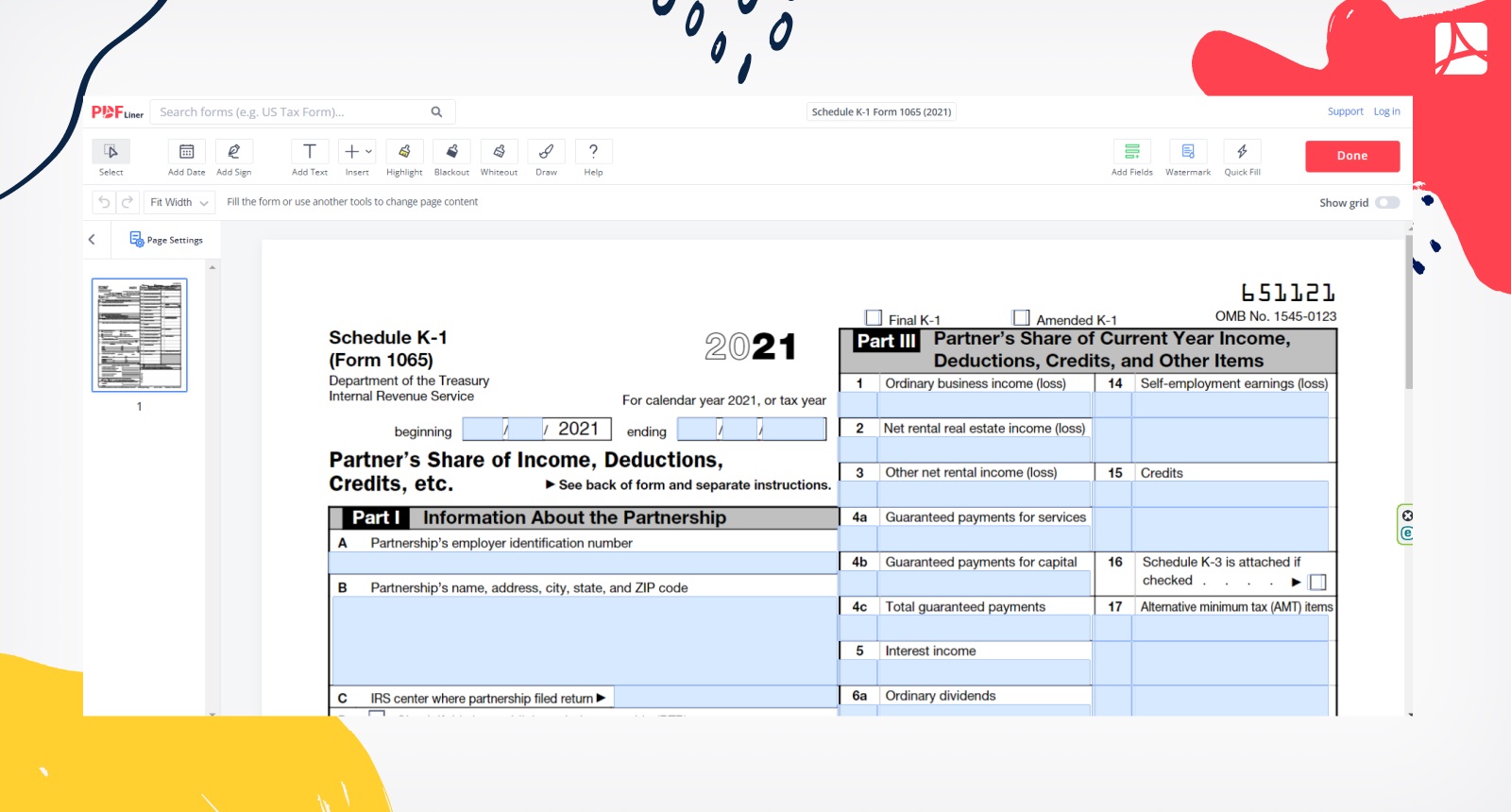

How to Get a Schedule K-1 Form 1065: Helpful Tips

If you still don’t know how to get a Schedule K-1, you come to the right place. Schedule K-1 is an attachment to Form 1065, Partnership Tax Return. It provides information on the Partner’s share of the income, credits, and deductions. Being a member of Partnership, you might find this document helpful since it allows you to calculate the amount of money both you and your partners spend/earn individually. Once you find out what is a Schedule K-1, you have to learn how to get it. This article contains the information you need to fill and send to the IRS.

How to Get a Schedule K-1 (Form 1065)

There are two ways to receive the IRS Schedule K-1. Both of them are effective and widely used by taxpayers. You can either download or fill online Schedule K-1 (Form 1065) by using:

- PDFLiner. Just tap the name of the form in the PDFLiner search bar, and it will open in a few seconds, or follow the link to open the form right away. You don’t need to download it since it can be completed online. All the sections are clear and highlighted. There is also an online editor that comes with the form and the option to create an e-signature if the form must be signed. After everything is done, send the form to the officials.

- IRS. Visit the official IRS website, find the form, open it, and download it. You can also use the Free File of the IRS and send the completed schedule through it.

In case you want to know more about how to fill out Schedule K-1, you can read the detailed guide on this website. The form is not challenging to complete. However, it is recommended to examine the Schedule K-1 instructions in advance.

Schedule K-1 Form 1065 657c2fc091734e26ef01a06e

FAQ

Here you will find popular questions about the K-1 tax form. Read them and fill the document with accurate data.

What is Schedule K-1?

The federal Schedule K-1 is a part of the 1065 form PDF. It is also known as Partner’s Share of Income. The form contains information on the earnings and spending of each partner of the business individually.

Do I have to file a Schedule K-1?

If you are a member of the partnership and want to receive the data on every member’s spending, you can file this schedule. Otherwise, you don’t have to file it. The IRS created the form for your convenience.

Can I file Schedule K-1 online?

You can do it either using PDFLiner or the IRS website. During the lockdown period, the IRS officials encourage taxpayers to use online services.

What happens if I don't file my K-1?

If the IRS notified you that they did not receive Schedule K-1, though you had sent it, contact them. If you don’t file this form in time, there might be fees for the delay. You may ask the IRS for a 6-months delay in advance. However, this form might be also requested by other partners.

Go Paperless with PDFLiner

Fill out, edit, sign and share any document online and save the planet

Schedule K-1 Form 1065 657c2fc091734e26ef01a06e

.png)