-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is 1099-A and How to Use It

If you are looking for what is a 1099-A, you might either have lent the money and acquired the interest in property that secures the debt or become a borrower. Meanwhile, you don’t even have to be in the lending money business to file the form. A 1099-A form is also known as Acquisition or Abandonment of Secured Property.

Fillable 1099-A 61cc1df14def9a61496963a5

What Is a 1099-A Form?

This document is widely used as an official statement for both parties on the foreclosure of a property. A lender has to send this form to a homeowner after the foreclosure was revealed. Meanwhile, the main copy must be sent to the IRS to notify them of the current situation. Thus, if you are wondering what to do with a 1099-A next, you should attach the form to the annual tax report you send to the IRS.

The form may be provided by the mortgage lender to the owner of the foreclosed apartment. The house can also be withdrawn if it stays abandoned. The IRS considers the action of foreclosure as the operation of selling property.

Printable 1099-A 61cc1df14def9a61496963a5

What Is a 1099-A Form Used For?

As all the types of 1099 the form is informational, making the foreclosure of a house a conducted deal. Both the lender and the homeowner who lost the house need this form for the upcoming tax report to the IRS. Consider it the document on the sold property you file to the IRS. This form allows you to calculate the loss or gain; however, you don’t have to include the selling price here or the cash you might receive after the deal is over. If you close the debt with this action, you have to report it using a separate form as well.

It is the lender's responsibility to send the form. If there were several borrowers for one property, the copies of this form must be sent to all of them separately. Every borrower has to include the information in their tax returns. A lender does not have to be in the lending money business to participate in the procedure and send the form. If the information that the property is abandoned is confirmed, the form must be sent to the IRS with the lender’s claims.

You can easily find the form on the IRS official website or PDFLiner’s platform. The first option offers numerous forms, so you have to be specific in the search bar. PDFLiner offers you a direct link to the form right on this page. We recommend using our service since here you can fill out the form online in a few minutes, while you need to download it from the IRS website to complete it.

When Is Form 1099-A Issued?

According to the official Form 1099-A instructions, you need to send the copies to the borrowers before January 31. You have to do it in the following year of the foreclosure procedure. The IRS copy must be sent by February 28. If you need a delay, you have to contact the IRS in advance and find out whether it is possible or not. The form must be sent before the borrower sends the tax report to the IRS since it can significantly change the amount of taxes that are paid. You can’t miss the 1099-A reporting and must send it before the deadline.

1099-A Form 61cc1df14def9a61496963a5

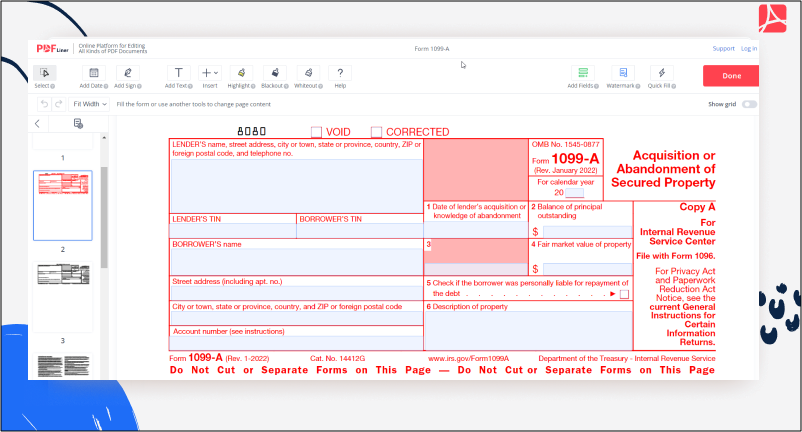

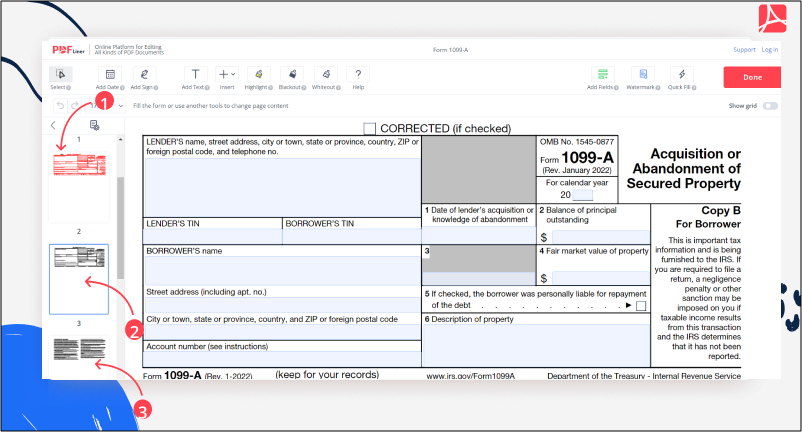

Instructions for 1099-A Form

Now you need to learn how to report 1099-A on the tax return properly. The form is not that big and does not require any specific knowledge from you. However, you have to follow the instructions provided by the IRS and PDFLiner. If you don’t want to waste your time downloading the form, filling it, and uploading it again, you can easily use PDFLiner and fill the template online. Follow the next steps:

- Write down the current year.

- Provide the lender’s name, address, and phone number.

- Write down the TINs of the lender and the borrower.

- Provide the information on the borrower, including their name and address.

- Write the account number by following the IRS instructions. Use a unique number to distinguish the account.

- Put the date of the lender’s acquisition in section 1.

- Section 2 is for the balance of the main outstanding.

- Leave section 3 blank, and indicate the value of property in section 4.

- Put a tick in section 5 if the borrower was liable for repayment.

- Describe the property in section 6.

There are three copies. You have to send copy A to the IRS together with Form 1096. Copy B is for the borrower. Copy C may be left for the lender.

FAQ

Read the most popular questions about the 1099-A form. They are often asked by Internet users, so the answers might be helpful for you.

How to file Form 1099-A?

You can file the form directly to the IRS by regular mail. However, if you don’t want to spend extra time filing the form or going to the post office, you can send it online. Visit the IRS website and send the form there.

What to do with a 1099-A form?

The form is required for your tax report. You have to keep one copy to yourself, send another copy to the IRS, and the third one goes to the borrower.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable 1099-A 61cc1df14def9a61496963a5

.png)