-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Details on How to File 1099-C Correctly

.png)

Dmytro Serhiiev

Read this helpful guide on how to file a 1099-C form. While the form is usually used by the creditor who forgives or cancels the debt of $600 or over, the debtor also needs to attach it to the tax report. The form is required by the IRS, so make sure you provide accurate data.

1099-C Form in PDF 61cc24e2ff28fd7905509862

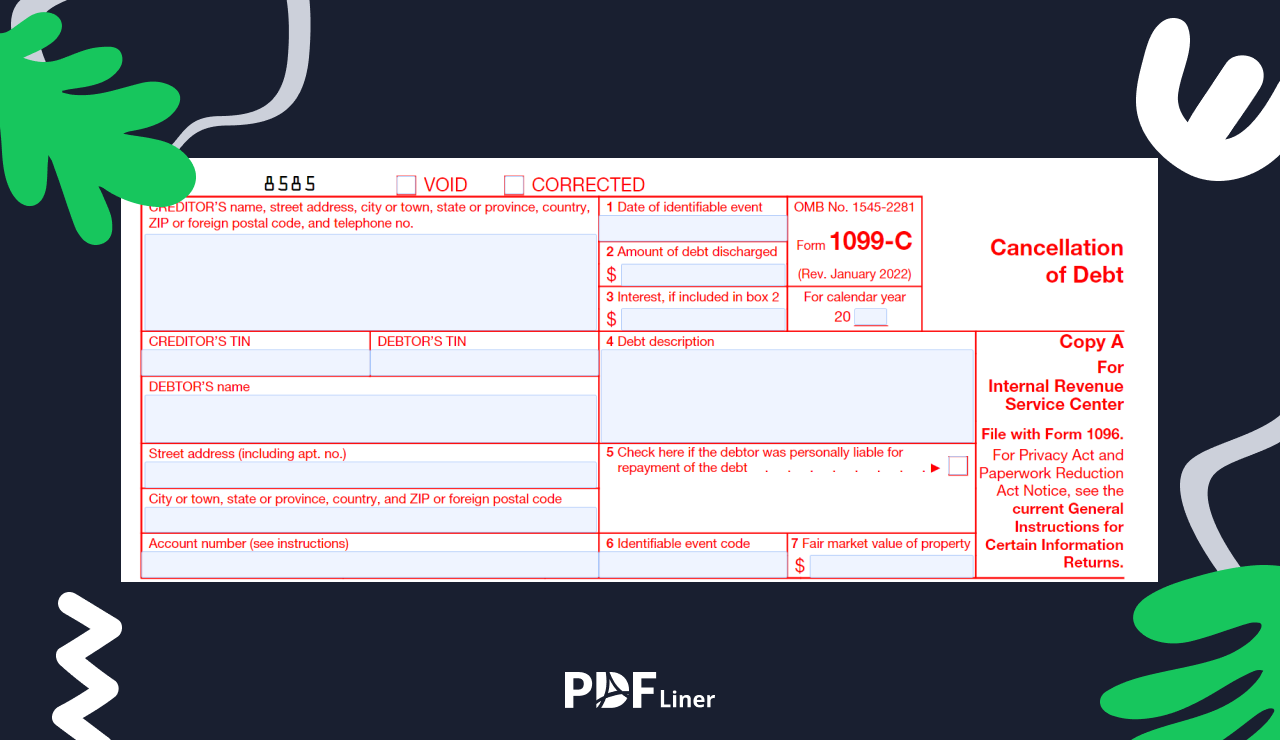

What Is Form 1099-C?

A 1099-C form is also known as the Debt Cancellation Form. It is filed for every debtor who got the debt canceled by the lender. The form is lately attached to the annual tax report by debtors. The form is not used if the amount of the canceled debt is less than $600. The debt can be either canceled or forgiven. The form must be filed by a creditor who can be either a financial entity or a company. If a creditor has several debtors, they must fill several IRS forms 1099-C for each debtor separately. One copy of the form is always sent to the IRS.

When and How to File a 1099-C Form?

Once you find out what is form 1099-C, you need to understand how to file it. Debtors receive the filled 1099-C form from lenders. After that they should use it to specify the amount from the form on their tax return and attach the form to it when filing tax return.

Lenders also should attach this form to Form 1096 and send it to the IRS by mail or electronically.

The most popular reasons for Form 1099-C filing:

- forgiven students loan;

- foreclosure of the house;

- modification of the mortgage.

The form is sent only when the debt is canceled or forgiven. The amount of debt must be $600 or more. You may expect to receive the form only if your debt was officially canceled or forgiven. If you paid the entire sum of your debt but received the form, you need to report the mistake.

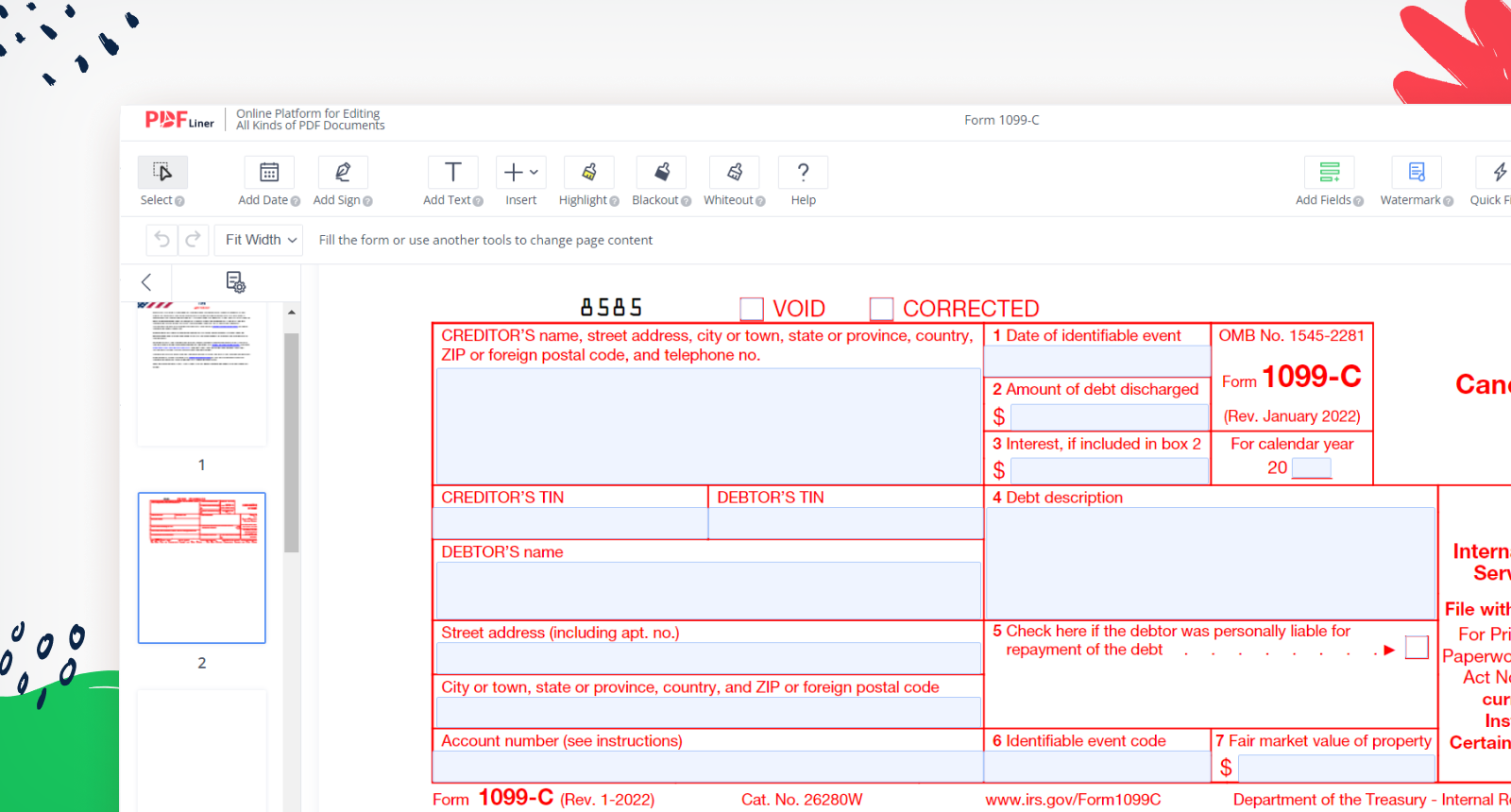

The fastest way to complete the form is using PDFLiner. You may also keep a copy of this form there and send it directly to the IRS or other party without downloading the template on your device.

If you are a debtor, you still need to file the form with your annual report on taxes to the IRS until January 31. You don’t have to edit the form, and it must be completed by the lender. If you did not receive the form in advance, you can include the numbers in Form 1040.

Form 1099-C Deadline and Important Dates

After you find out how to report a 1099-C form, learn the data on the deadlines. Debtors may expect the form no later than by January 31. The IRS also needs the form by the same date. If the creditor did not send the form up to this date, there will be a fee for the delay. With the IRS, it must be e-filed until March 31.

You can send the form by regular mail or online. Pay attention to the possible changes in the schedule. You have to check out the current due dates for tax forms every year. If the due date happens on any holiday or weekend, it is postponed till the next business day.

1099 C Template 61cc24e2ff28fd7905509862

FAQ

Read the most popular questions about filing a 1099-C form. Check out the answers as they might be helpful for you.

How to dispute a 1099-C form?

If you received the form on the debt you have already paid, you need to contact your creditor immediately and ask them to send the correct form to you and the IRS. If the creditor refuses, address the IRS officials and inform them about the situation.

How does Form 1099-C affect my taxes?

This form can lower your tax refund. You have to report the numbers that are counted as the taxable income in your tax return form. The debt that was canceled is also considered as income.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Fillable 1099-C 61cc24e2ff28fd7905509862