-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

What Is a 1099-C, Tips for Beginners

What is a 1099-C form used for? You might already know it if you canceled debts recently. The form is widely used for debt cancellation, and it must be filed for each debtor you canceled at least $600 of debt. A 1099-C Cancellation of Debt form must be filed if the debt is forgiven as well.

Fillable 1099-C 61cc24e2ff28fd7905509862

What Is Form 1099-C?

The 1099-C tax form is also known as the Cancellation of Debt Form. If your taxable debt of $600 or over was canceled by the lender, they have to provide the form to the IRS. The lender sends the copy to the person who had a debt so that it could be used during the tax report period. If there is no category for your debt in the IRS, you may receive the debt forgiveness tax.

This IRS Forgiveness of Debt form is provided by lenders who can be either an applicable financial entity or federal government. Before you attach the form to your tax reports, make sure the data is correct.

What Is a 1099-C Form Used For?

To answer the question of what is a 1099-C form used for, think about the alternative name of the form. “Debt Cancellation” means exactly what it sounds like. If you have the debt that was canceled, your lender sends you this form. It is filled by the lender (a person or the company). You may also receive this form if the debt settlement started on your credit card went well, and the debt was forgiven. It is also considered debt cancellation. You don’t need the form if your debt that was canceled is less than $600.

The form can be sent to your email. If your students’ loans are forgiven, you have to provide this form to the IRS together with your tax reports. The same situation is with an apartment that goes through foreclosure and modified mortgage.

You can always find the form on the IRS official website or here, on PDFLiner. We believe that PDFLiner is a more comfortable place for you to work with forms since it allows you to edit the completed form. There are fillable sectors, so you know exactly where you have to write down the data and how many sectors you need to fill.

PDFLiner also allows you to create a signature right in the document and does not require unnecessary moves, like downloading. If you received the IRS Form 1099-C from the lender, you may add it to the PDFLiner’s storage and extract it whenever you need it for your tax reports.

Who Files Form 1099-C?

If you got the Form 1099-C meaning properly, you understand that it is filled by a lender. If you lend someone $600 but forgive the debt or cancel it for any reason, you have to complete the form as well. The form must be filed to the IRS and a debtor.

If you are a debtor, you can wait for the form from the lender who forgave or canceled the debt of $600 and more. If the sum is less than $600, you will not receive the form. Once it arrives, you have to attach the form to the annual tax report you send to the IRS. If you would like to know more about how to file Form 1099-C read another article on our blog.

Printable 1099-C 61cc24e2ff28fd7905509862

Instructions for 1099-C Form

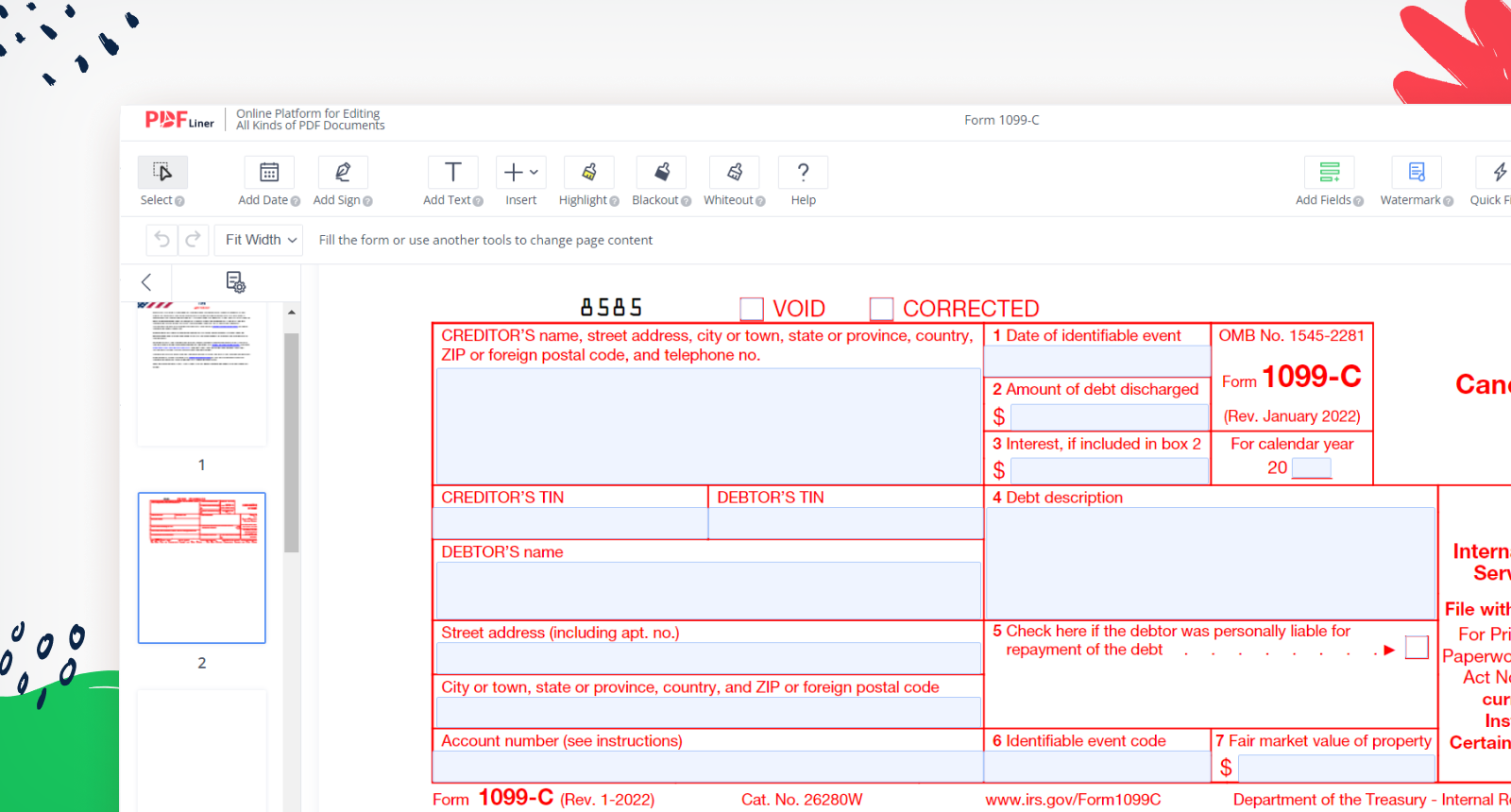

The form is not that complicated; it is only one page long. However, you need to make several copies for different institutions if you are a lender. If you don’t want to download the form and fill it out manually, you can use PDFLiner that provides a fillable online version of the form. Follow these simple 1099-C instructions:

- Include the current calendar year number in the specific box.

- Provide detailed information on the creditor, including the name, address with ZIP code, and phone number. If the address is foreign, you still have to provide the postal code.

- Write down TINs of creditor and debtor (first you need to request W-9 form to get the TIN).

- Provide the debtor’s name and address in separate boxes.

- Indicate the account number according to the IRS instructions.

- In section 1, provide the date of the event; the sum of debt should be noted in section 2, and section 3 contains data on interest.

- Section 4 is for debt description.

- Put a tick in the box if the debtor was liable for repayment in section 5.

- Section 6 is for the identifiable event code, and section 7 is for the property’s market value.

Copy A belongs to the IRS and must be filed together with Form 1096. Copy B is for the debtor, while copy C must stay with the creditor. After you complete these forms, you can send them online to all the parties required.

FAQ

Check out these most frequently asked questions on the form from users around the world. They might be helpful in your case.

What if I never received a 1099-C form?

If you know for sure that your debt was canceled, but you did not receive the form, you need to contact the creditor. Check out whether the canceled amount was $600 or more. The IRS considers the form your responsibility, and you have to provide it on time. If the lender does not want to provide the form or is unreachable, and you know the exact sum that was canceled, provide it in Form 1040.

What if my 1099-C form is incorrect?

If the form you received is incorrect, you have to reach the creditor. If you get the form for the debt you’ve paid, you also need to contact the company or person that sent you the form. Explain the problem and ask to file the corrected version of the form both to you and the IRS. If that didn’t work, contact the IRS directly and report the situation.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

1099-C Form in PDF 61cc24e2ff28fd7905509862

.png)