-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out the 8962 Form: Reduce Your Monthly Premium Taxes

Liza Zdrazhevska

Many people are now registered in a premium health plan offered by the Health Insurance MarketPlace. If you’re one of them, you should know how to fill out the 8962 form and calculate your premium taxes. As a result, you can get credit for your needs. Here you will find the instructions on how to fill out form 8962.

8962 Form Online 657c6309996d2af9c80a2596

How to Get 8962 Form

As has been noted before, the Health Insurance Marketplace customers usually should know how to fill out premium tax credit form 8962. But not everyone needs to complete this document. Only if you receive the advance payments of premium tax, you have to discover how to fill out 8962.

There is no need to ask someone for the form 8962 — you may download it on the IRS websites or find it on our site. In both cases, you won’t pay for this. All you should do is to read how to complete form 8962 step by step and then send it to the service.

8962 Form 657c6309996d2af9c80a2596

How to Fill Out Form 8962: Step by Step

Some answers in the 8962 form can be obvious, but others may require a detailed explanation.

Follow our instructions, and you will see how to fill out the IRS form 8962 in the right way.

Step 1: Find and download the 8962 form

The premium tax form has only two pages, and it is free for everyone. You can download it on our website. Don’t worry — the document we offer doesn’t differ from the one that you can find on the IRS site.

Step 2: Start with your name and social security number

On top of the document, you will find a line where you should put your name. It should be the same that you can find at the top of your return. Then, indicate the social security number. You need to check it at least twice because you won’t have an opportunity to change it when the form is already sent.

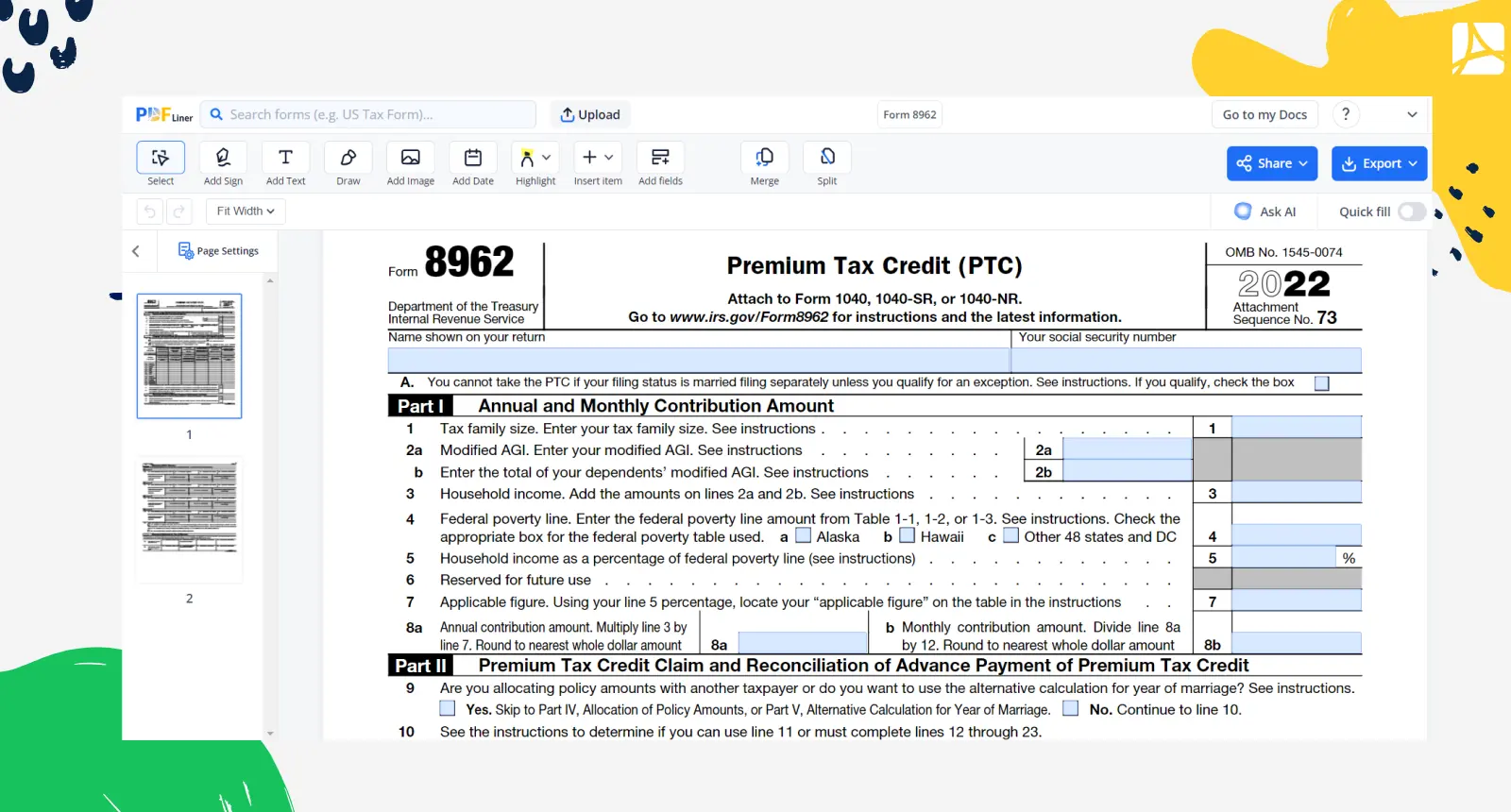

Step 3: Fill in Part I

To fill in this part, you need a 1040 and 1040A forms. Here you will find the family tax, modified AGI, and household income (the sum of the 2a and 2b lines) — put them into the first three lines. Next, fill the federal poverty. You should also check the box for the federal poverty table you use.

Line 6 depends on the percent amount you fill in line 5. If it is 401%, you should choose the yes box. After you find and indicate the applicable figure in the 7 line, go and calculate the 8a and 8b. There are comments near them. Don’t forget to round your result to the nearest whole dollar amount.

Step 4: Continue with Part II

This part starts with two questions — you should select the relevant box for you in each one. Due to your answers, you will skip this part or continue to the particular line. All the main instructions are written in the form.

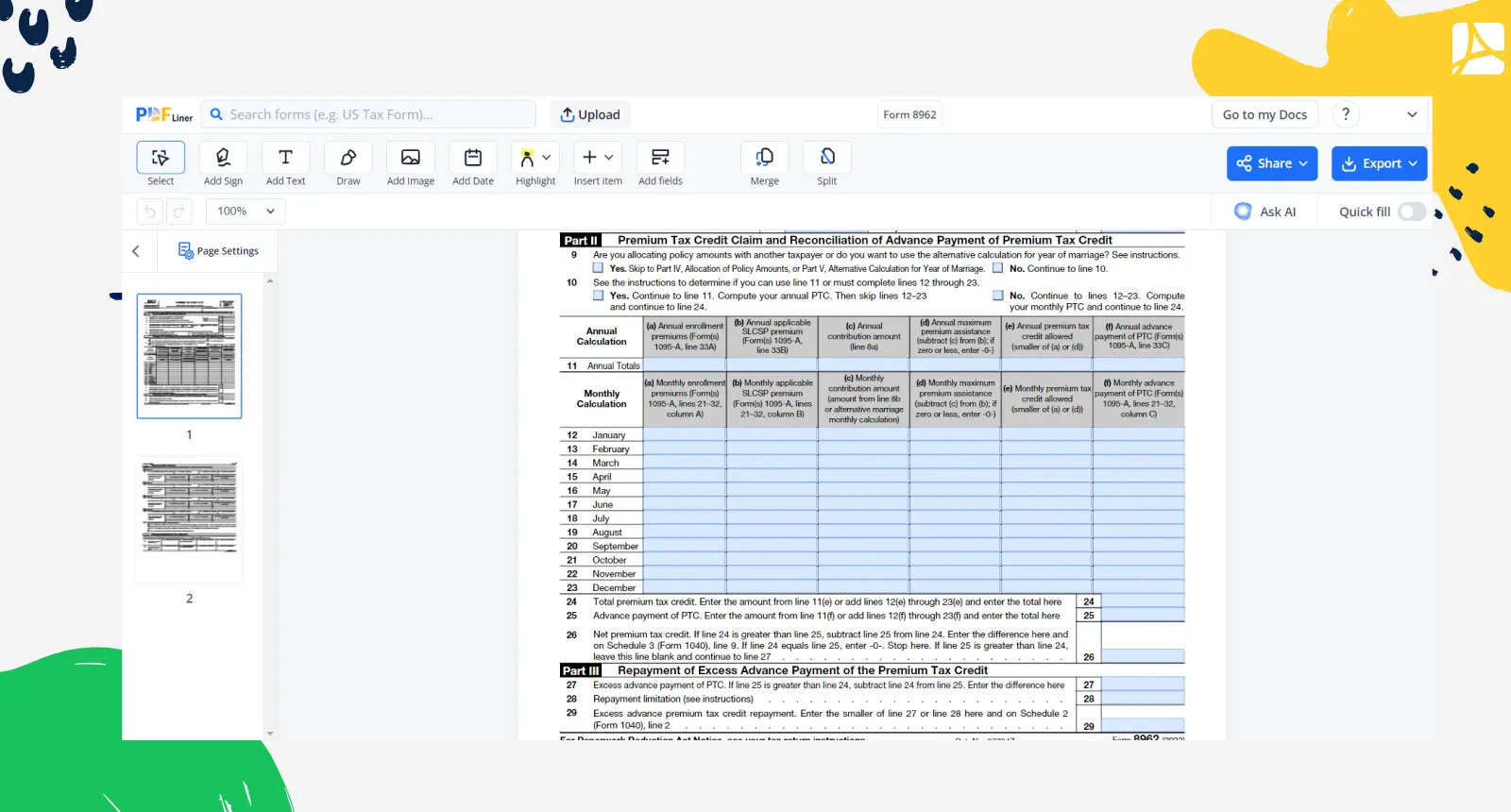

Line 11 requires the annual totals, which you will find mostly in the 1095 form. It is a small table that consists of one column and six lines. But below it is a bigger one. Here you should put the monthly calculation — don’t forget to fill in the total credit in the 24−26 lines.

Step 5: Finish the Part III

In part III, you need to analyze the data you have put in part II. The 27 line has the difference between 24 and 25. The next two questions require the information from the 1040 form mostly. You should consider that not everyone will have the 27 line filled.

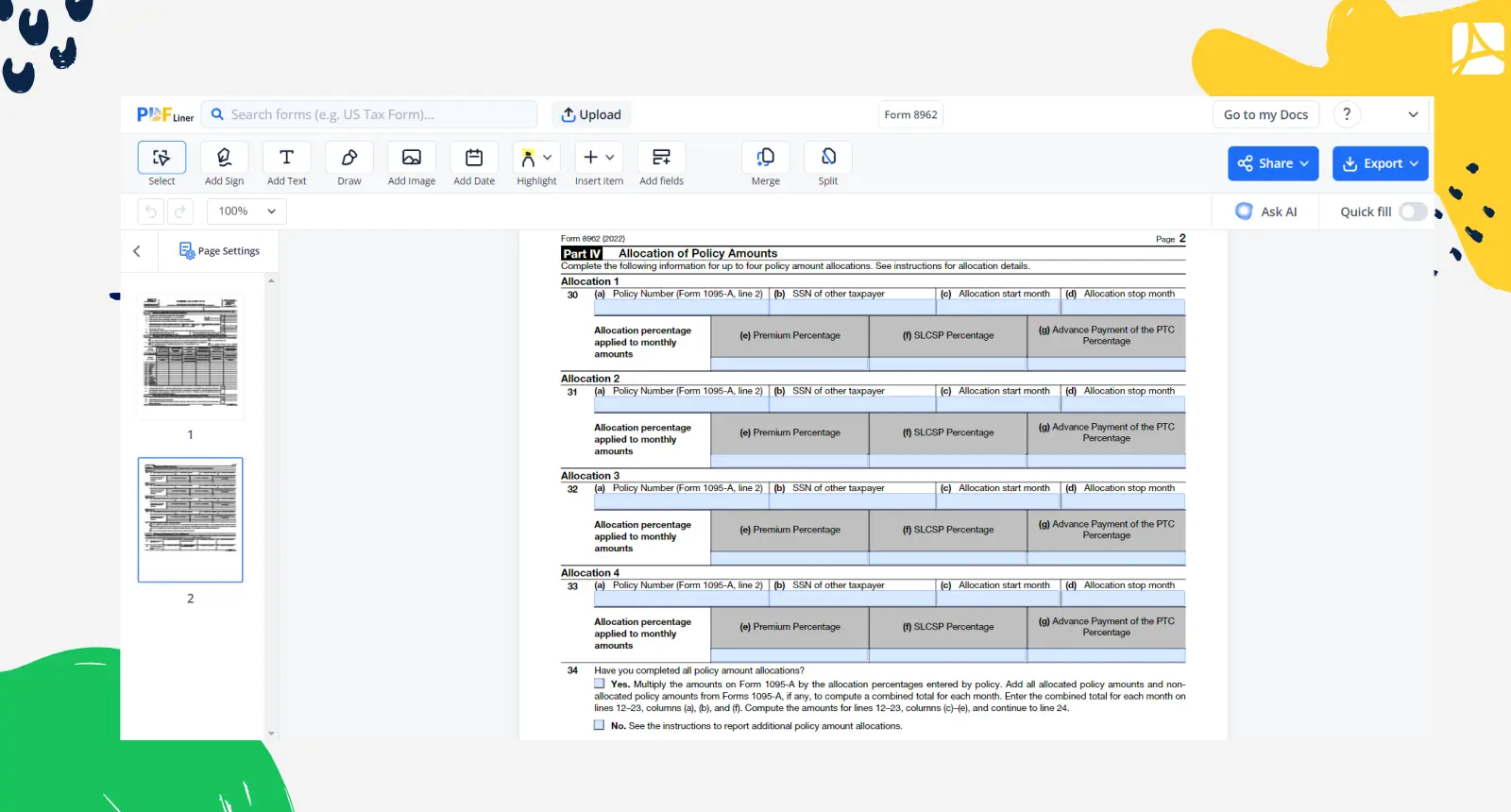

Step 6: End with Parts IV and V

To fill in the IV part, you will use the 1095 form. All the calculations should be written in the percentage form. There are two diverse tables for each line. So, be attentive not to miss a number — but some columns may be empty for you, and it is ok.

With part 5, our guide on how to complete the 8962 form ends. Here are two lines that include the alternative entries for the year of marriage. There is a table for you and your spouse. After you have finished all the parts, check the whole document again.

Fill Out 8962 657c6309996d2af9c80a2596

How to Fill Out 8962 Form: Quick Instructions

The form 8962 consists of five parts. Other forms like 1095 and 1040 that you have filled before will help you to know how to fill out tax form 8962. You will take a lot of data from other documents. You will see the comment near the line if you need another form.

Some parts include the calculations you should do. Usually, it’s a difference between two lines or just a number in percent — so, there is nothing difficult. You just need to be attentive when you put in the information and don’t miss the lines. However, some tables may be empty.

Printable 8962 657c6309996d2af9c80a2596

How to Send Form 8962 to IRS

When you finish the 8962 form, and you don’t know how to submit form 8962, you should visit an IRS website. Here you will find the e-mail. Also, they usually mention if you need to send only the 8962 document, or you need to attach a 1040 form. Sometimes, they may require other papers.

If there are missing lines or some mistakes in the form, the service will send you a message back. Don’t worry if there is no reply for several days. The IRS has a lot of requests, so they may ask you to wait until they read your e-mail. But they will definitely do this.

FAQ

If you still have questions about how to find form 8962 or how to fill out form 8962 online, here you will get the answers you need.

How to fill out form 8962 with 1095-A?

Several lines require the data from the 1095-A form. Usually, you will see what information you need to take from the other document and which line you can find it in the instructions. There is nothing complicated in this process. Just copy some numbers or calculations from 1095-A to 8962.

How to get form 8962 in TurboTax?

You can download it on our website or the IRS website and then start working with it in the TurboTax. Or register and find the form you need there. You may always contact us if you don’t know how to fill out form 8962 TurboTax.

How to fill out form 8962: married filing jointly?

Yes, it’s a specific instruction for this form. You also register in the Health Insurance MarketPlace together, so you don’t need to ask for the credit using two forms.

How long to get a refund after faxing form 8962?

It all depends on how you have filled the document and how large credit you can get. If everything is alright, you may wait for one week to three-four weeks. But it’s the best variant; we can’t guarantee you such a result.

How to fill out form 8962 with dependents?

You should fill the form 8962 jointly. Also, you need to consider that if someone is claimed as a dependant, they can’t ask for premium taxes in another document.