-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get a 1040-X Form: Claim Additional Deductions Correctly

.png)

Dmytro Serhiiev

Many taxpayers have to use this document; however, not all of them know how to get a 1040-X form quickly and fast. This form is also known as an amended US individual income tax return. The 1040-X amended return document was created to correct the information in 1040, 1040-NR, 1040-EZ, 1040-NR-EZ, and 1040-A forms. It allowed making some changes after the deadline, even if it was already adjusted by the IRS. Taxpayers can also use IRS form 1040-X to claim the carryback because of the unused credit or credit case.

How to Get a 1040-X Form

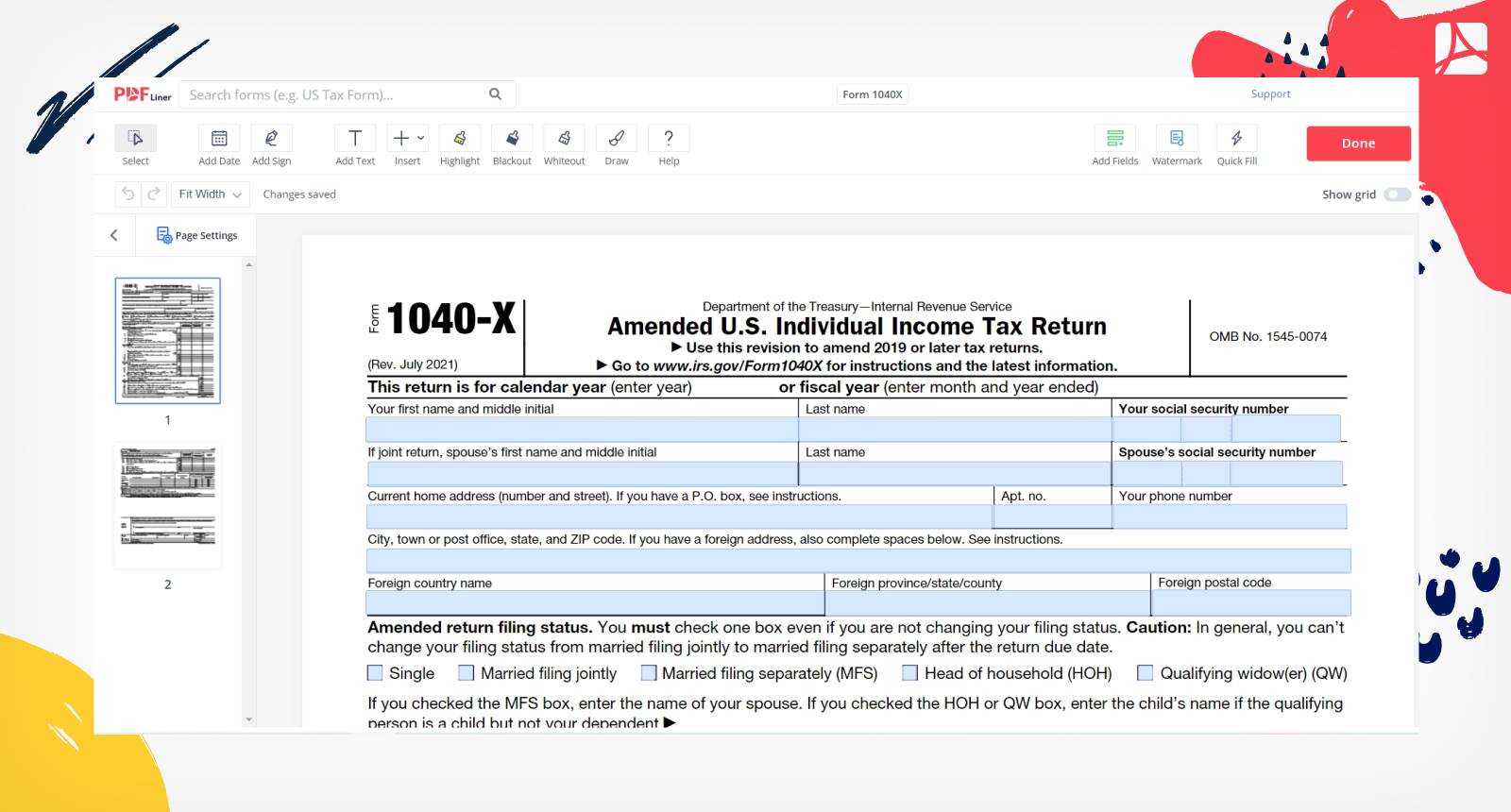

This amendment taxes form is available on the IRS page. You can download or e-file 1040-X online directly on the Internal Revenue Service website. To do this, search for the form you need and open it. There is another simple way to get this document, which is to tap the name of the form right on this page of the PDFLiner site. If you want to know how to fill out Form 1040-X in detail, you can read the guide available here. Both methods are easy to work with.

You don’t need to register anywhere. All you need is to open the form and download it or fill it online. Both services provide this option. Moreover, PDFLiner and IRS form 1040-X instructions are user-friendly. Yet, PDFLiner has a step-by-step guide for beginners. Before you start completing the form, make sure you have the original that you want to fix. It is recommended to save a copy of form 1040-X in your documents.

1040-X Form 65cb6b37911ce9829a00d11a

FAQ

Here are the most popular questions from taxpayers. Read them to understand amended tax returns better.

Is it bad to amend your tax return?

It is not bad. Moreover, it is your primal right. Though it might not be a usual procedure for many taxpayers, the IRS will not contradict you in any way. The IRS is not interested in paying more taxes than you have to or underpaying them. In the end, you will still have to fix the problem. It is better to do this right after you notice the mistake.

Does 1040-X have to be mailed?

So, can you e-file a 1040-X? The answer is yes. E-filing is available, but for those taxpayers who send the original returns electronically. Until 2019, it was impossible to send the form this way. You may still use the regular mail.

Where to mail 1040-X?

If you want to send the form electronically, visit the IRS website and send it online. In case you want to do it in a classic way, check the address of the local post department. You might have to find the address on the form.

Should I amend my tax return for a small amount?

Yes, you can do it. If the original return does not match with the tax bill by a small amount, you have to fill the form as soon as possible.

File Taxes Online at No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Download 1040-X 65cb6b37911ce9829a00d11a